![]()

p.1

1 Terminal impact

How to deal with strategic risks

When we think about business risk, most of us have a mental image of a polluted river or a company scandal. But while these are important, they’re rarely fatal. Poor strategy is responsible for most business failures. A survey by the Turnaround Society showed that the biggest cause of failure is management continuing with a strategy that’s no longer working (cited by 55% of experts).

Losing touch with the market and their customers was cited by 52% of respondents. Thirty per cent said that management underestimated changes in the market and did not adapt to them appropriately.

Being successful is a risk in itself. ‘When a company becomes dominant, its dominance precludes it from dominating the next thing,’ says Ben Thompson of Stratechery. ‘It’s almost like a natural law of business,’ he says.

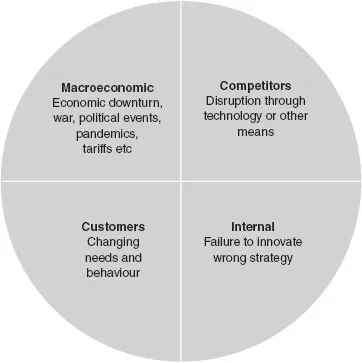

So while we need to manage everyday business risks, the strategic ones are more important. They can cause the organisation to run out of money, get closed down or be taken over. As shown in Figure 1.1, strategic risks come from four sources: politics and the economy, customers, competitors and internal failure.

1 Macroeconomic (political and economic) threats are the first strategic risk. A slow down by China could harm the automotive industry. A government intent on cutting costs could stifle consumer spending. Protectionist tariffs on steel or a commodity could choke off a flourishing export market.

Political and economic risk is one of those big external events that you can’t avoid, but how you respond to it will determine the organisation’s future. These risks can usually be spotted some time in advance, and businesses can do much to protect themselves.

2 Changes in customer behaviour. As we argue later in this chapter, it’s rarely that customers’ needs change. They usually just respond to a competitor giving them a better product. Being able to see customers’ evolving options especially at a time of changing technology, will allow the business to innovate and stay ahead.

That’s not to say we can ignore changing customer needs. Far from it. In the Strategic Uncertainty Risk Exercise (SURE) later in this chapter, we emphasise the need for continual experimentation to provide the customer with new opportunities that will provide competitive advantage.

p.2

3 Competitor activity is the third strategic risk. Business models that once seemed permanent have melted in the face of quite simple technology that has made life easier for consumers. Uber’s impact on taxi companies is one example, while Amazon’s effect on book shops is another.

4 Internal failure comes from failure to adapt or choosing the wrong strategic path. In turn, these stem from lethargy and exuberance respectively. Many organisations are the source of their own failure. Chapter 2 is devoted to stopping that from happening.

In this chapter we look at the kind of political and economic events that can capsize the business, followed by a review of technological and competitor threats.

Macroeconomic change: hostile political events

There are many political uncertainties. Will China remain stable? Could war break out in the Middle East? Will the EU break up? Will a military takeover occur in Africa?

Businesses often continue amid strife, not least because people always need to buy things. But sometimes politics can have major impacts. Governments can place politics above the economy. Russia’s income declined 34% between 2014 and 2015, but this had no effect on Russia’s decision to support Ukrainian separatists or its bombing of Syria in support of President Assad.

You need to be able to forecast the political stability of any country where you do business or are planning to. As Ian Bremen of Eurasia Group has pointed out in Harvard Business Review, a country’s economic facts – its income, growth and inflation – often obscure the political threats. A country can be wealthy, but be at risk of serious political upheaval. Analysing a country’s political stability and its potential exposure to shocks can provide a more accurate forecast than the economic data.

p.3

Jordan has a liberal state and is economically developed, but it lies in an unstable region, suffers massive immigration, is vulnerable to extremists and could be capsized by unrest.

With nations being interconnected, an upheaval in one country can cascade into another. A coup in Venezuela could cause problems in Colombia, which could affect Ecuador in turn.

Political problems are caused by irrational leaders, new laws, popular uprisings and military takeovers. These are especially found in emerging economies, many of whose leaders view politics as being just as important as economics. And the fact that emerging economies are attractive for their low labour costs should remind us that poverty and aspiration can be a cause of political instability.

Rigid political systems also give rise to instability. Because its ruling communist party can’t be voted out, China has no mechanism for change. Its people have economic freedom but not the right to express dissent. With a growing Chinese middle class getting more exposure to the internet, it remains to be seen how long the country’s political system can survive. Under pressure, its leaders may decide, as rulers so often do, on aggressive acts towards its neighbours.

Some countries are more capable of withstanding major shocks, while others aren’t. The United States is a prosperous and open society (albeit with great inequalities) which permits debate and is constantly changing. A fragile and impoverished state like Somalia is less able to withstand economic shocks.

A few countries such as North Korea have the ability to cause major upheavals, due to their military might. By contrast an implosion in South Sudan will have little impact on the world. On the other hand, a business with major investment in that country could lose it all.

Below is the first of our Mitigating Measures. Each of these checklists has actions you can take to mitigate the threat. Not every risk will be immediately applicable to every organisation. But each threat will affect some businesses, some of the time.

Mitigating Measures: responding to political events

Gain expertise in understanding your political risks, whether in-house or through outside experts.

Seek to measure the political stability and likelihood of shock in countries where you operate, especially emerging nations. Measures such as corruption, inequality and unemployment may be useful.

Get insurance against losses caused by political action.

Spread the risk by investing in more than one risky country. If in Latin America, you may choose to be in both Chile and Argentina, rather than deciding on one or the other.

Use public affairs consultants to keep abreast of the potential policy and regulatory implications of political events nearer to home.

p.4

Restrictive legislation

There are many kinds of restrictive legislation. The USA or Europe could introduce anti-dumping legislation, which could increase the cost of supplies. Local or national government could reduce the development of building land by restricting what can be built, or by imposing additional requirements for planning approval.

Safe within limits – but it’s got a bad name

Parabens, a family of chemicals, are widely used as preservatives in personal care, cosmetics and pharmaceuticals.

Following a review by the European Union’s Scientific Committee on Consumer Safety, several countries have considered restricting their use. This would have a negative effect on companies that manufactured them or used them as an ingredient. Among some consumers parabens is a dirty word, even though the EU has declared them safe as long as their concentration is kept within specific limits. But those who make ‘natural’ alternatives to parabens are not slow to raise alarms about the product.

It’s an example of how legislation can have a detrimental or even terminal effect on a business.

Protectionism

Protectionism makes life complicated for an individual business, increases costs, and runs the risk of retaliation, leading to a downturn in trade.

Germany has required foreign international hauliers to notify them of any movement within their territory, even when they are merely in transit, in order to check whether the drivers are complying with German law on minimum wages. Foreign haulage firms are obliged to complete a form on the planned route, time of entry into and exit from Germany, employees’ personal data and other information. They have to complete the form in German and send it by fax. This kind of activity complicates the life of businesses sending goods through Germany and massively increases the paperwork.

Mitigating Measures: restrictive legislation

Stay alert to the possibility of protectionist legislation, and seek to counter its introduction. Undertake measured lobbying and gain the support of legislators. Once legislation has been passed, review the steps you can take to limit its impact, such as lobbying for its repeal or reducing the scale of investment in that territory.

Get staff on to legislative working parties, or make representations to them.

Ensure that you have stocks of vital materials or components to tide you over in the short to medium term, giving you space to plan for longer-term action.

p.5

Killer legislation

When the UK government announced a plan to end the right to cash compensation for minor whiplash injuries, the stock market value of Australian law firm Slater & Gordon, which specialises in personal injury claims, fell 51%.

Any business model that could be wrecked by government legislation, and whose revenue costs the government money, rests on shaky grounds.

When the UK government cut its subsidies to renewable energy, the Mark Group failed, putting 1,000 employees out of work. Later two other companies called in the receivers. The worst case scenario by the government’s Department for Energy and Climate Change estimates that 18,700 jobs could ultimately go.

The same applies to US for-profit universities that relied on federal funds payi...