- 288 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

The Development of International Insurance

About this book

Despite their economic and social importance, there are relatively few book-length studies of national insurance industries. This collection of nine essays by a group of international experts redresses this balance; providing an extensive geographical and thematic spread, linked via an extensive introduction.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn how to download books offline

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 990+ topics, we’ve got you covered! Learn about our mission

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more about Read Aloud

Yes! You can use the Perlego app on both iOS and Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app

Yes, you can access The Development of International Insurance by Robin Pearson in PDF and/or ePUB format, as well as other popular books in Economia & Storia economica. We have over one million books available in our catalogue for you to explore.

Information

1 THE MARINE INSURANCE MARKET FOR BRITISH TEXTILE EXPORTS TO THE RIVER PLATE AND CHILE, c. 1810–50

Introduction

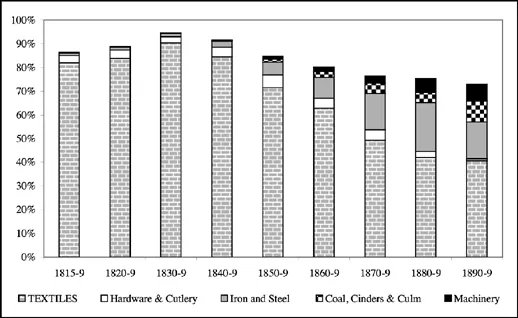

In the 1810s the River Plate and Chile gained independence after three centuries of Spanish dominion. From that point, British merchants opened for the very first time mercantile houses on the spot, marketing European manufactures in exchange for South American produce. During the first decades following independence, the main products imported by the new South American republics were textiles. These comprised over 80 per cent of British exports to the River Plate and Chile between 1815 and 1859 (see Figure 1.1).

Despite the predominance of textiles within British exports to these emergent markets, very little is known about the marketing chain of textile exports. This chapter sheds new light on this underexplored subject, by focusing on one aspect of this textile trade, namely, the marine insurance market in which British textile cargoes were insured before departing for the Southern Cone.1

This chapter relies heavily on the business correspondence of Huth & Co., a London-based mercantile house with branches in Liverpool, Valparaiso, Tacna, Arequipa and Lima, and which was very active in the marine insurance market. However, this firm was just one among over 250 British merchant houses trading with the Southern Cone during the first half of the nineteenth century. Therefore, further evidence was also obtained from other British houses involved in British textile exports to southern South America, namely Hodgson & Robinson (based in Buenos Aires), Hancock & Wylie (a Scottish house with branches at Bahia, Buenos Aires, Pernambuco and Rio de Janeiro), Dallas & Co. (also based in Buenos Aires) and Lupton & Co. (Leeds merchants exporting to the River Plate). Finally, the Chilean National Archives (Valparaiso Judicial Papers) and British Foreign Office correspondence with consuls in the Southern Cone also proved useful.

Figure 1.1: United Kingdom Exports to the Southern Cone, 1815–99: Shares of Main Product Categories (from declared value series).2

The chapter is in four sections. After this short introduction, attention is focused on the structure of the British marine insurance market from the eighteenth to the mid-nineteenth century. The second section examines the costs of marine insurance for British textile cargoes to Chile and the River Plate. The third explains the different marine insurance policies available for British exporters, as well as the complexities derived from them. The final section discusses the growth of British textile exports to the Southern Cone from the 1810s to the 1850s, and points to the drastic reduction in the cost of marine insurances as one of the many variables behind this positive British export trade performance.

Marine Insurance: The Structure of the Market

As noted above, very little is known about marine insurances for British exports to the Southern Cone during the first half of the nineteenth century, and indeed for exports to any Latin American outlet during this period.3 For this reason alone this chapter makes an important contribution to the field of insurance in history, particularly given that in the period 1815–49 Latin America received about a fifth of British exports.4 Furthermore, as this chapter demonstrates, there is little doubt that marine insurances played a crucial role in facilitating the expansion of British trade to the Americas after the 1810s, a fact previously ignored by the historiography on Anglo-Latin American trade. First, however, we need to establish the general context in which British marine insurance developed during this period.

In eighteenth-century Britain, marine insurance was in the hands of private individuals, above all, those who met at Lloyds coffee house. The first attempt to establish a marine assurance company was made in 1716 – the Public Assurance Office. Not surprisingly, there was great opposition from private underwriters, as well as from others interested in entering the market. When it appeared that the project had failed, a new scheme to create not one but two marine insurance companies was accepted, to silence the voices of those complaining about the inconvenience of having a single company monopoly.5 Thus, in 1720, two companies were finally chartered, under the names of the London Assurance Corporation and the Royal Exchange Assurance Corporation, considered to be the ‘first examples of corporate marine insurers in Europe’.6

For over 100 years, the British marine insurance market consisted of these two companies and the private underwriters operating mainly at Lloyd’s. By law, no other corporation could enter the market. However, in spite of having a corporate monopoly, the Royal Exchange and the London Assurance had a small share of the market. Though originally chartered to operate in marine insurance only, after a few years the two companies were also allowed to effect both fire and life insurance, which soon became the main part of their business. The lion’s share of the marine insurance market remained in the hands of Lloyd’s until the mid-nineteenth century; Lloyd’s became the foremost marine insurance centre in Europe.7 Indeed, in time, it became clear that the main beneficiary of the 1720 charter was Lloyd’s and, therefore, London. As stated by an 1810 British Parliamentary Committee, ‘this exclusive privilege … operates as monopoly, not merely to the companies, but to Lloyd’s Coffee-House’.8 Yet, in other British ports underwriters also operated. In 1802, for example, the Liverpool Underwriters’ Association was created.9 Private underwriters also signed policies at Bristol, Hull and Glasgow.10

The structure of the marine insurance market, thus, remained unchanged, despite the efforts made by the Globe Fire and Life Insurance Company from the late eighteenth century to enter the market. Freedom to establish new companies was not granted until 1824 when Nathan Rothschild’s Alliance Marine Insurance Company was created as part of the repeal of the 1720 Act. In the same year, another company entered the market, the Indemnity Mutual, followed by others in subsequent years, of which the most successful were the Marine Insurance Company (1836), the General Maritime (1839) and the Neptune (1839). Many more subsequently entered the market, though without much success. By the mid-nineteenth century, few of the new companies had survived (e.g. the Marine Insurance Company), and the market remained highly concentrated. It can safely be stated that not until the late 1850s and early 1860s did a ‘second generation’ of successful companies appear in the marine market.11

This, then, in brief, was the market in which British cargoes of textiles heading to the Southern Cone were insured. But who effected the policies? Most of the insurance for such exports were effected by the British-based merchants handling the goods, particularly when advances on consignments were given. In the words of the London mercantile house of Huth & Co. to their northern England agent procuring consignments on their behalf: ‘if we have to make advances, we must of course make ourselves the insurance’.12 Alternatively, ship-brokers were often entrusted with effecting marine insurance for exports to South America, for which a commission was charged to the exporter.

The papers of Huth & Co. provide a rich source of information in this respect. Huth & Co. were in the habit of using mainly private underwriters to effect their insurances. Among the most frequently used were S. Boddington, R. Davis, G. Pearce, R. Ramsay and Mr Cruikshank. Huth & Co. also used the services of the London Assurance Corporation and the Royal Exchange Assurance Corporation and, from 1824, occasionally used the Marine Insurance and the Indemnity Mutual Marine Assurance companies.13 In spite of having a Liverpool branch and most shipments leaving Britain from the Mersey, cargoes were insured by Huth at London. The standard brokerage commission charged by Huth & Co. to their textile suppliers for effecting marine insurances was 0.5 per cent of the invoice value of cargoes.14

Private underwriters took risks for as little as £50 for British textile cargoes to southern South America, which means that behind any given cargo there were a great number of individuals. The papers of a mixed Commission, established to investigate British claims against the government of the United Provinces of Rio de la Plata for losses suffered during a Brazilian blockade to the River Plate (1825–8) provide useful information in this respect.15 These claims reveal that underwriters at Lloyd’s in groups of up to 40 different ‘names’ might insure a single vessel, taking risks from £100 to £200 each.16 Alternatively, the insurance of cargoes was shared, one-third taken by one of the incorporated insurance companies, and two-thirds by underwriters at Lloyd’s.

In summary, when the market was highly concentrated in the hands of underwriters, who took little risk per ship, exporters needed to resort to a wide range of individuals to insure their cargoes. As a consequence, networks of contacts to guarantee the availability of as many underwriters as required were extremely important. The higher the risks in the shipments to distant markets, such as the Southern Cone, the lower the competition among underwriters. For exporters to Chile and the River Plate, the marine insurance market was very restricted and it was often difficult to obtain insurance, even for houses with the reputation of Huth & Co. It was not unusual for the pool of their underwriters to become exhausted. As stated to a Scottish supplier: ‘we had great trouble in effecting the insurance per Zoe even at 80/pc, most of our underwriters being quite full upon her’.17 Likewise, on another occasion the Liverpool branch was told that:

you are not conversant with the manner in which insurances are effected here … We have repeatedly explained to you that there are only one or two channels where we can place goods in tarpaulin @35 and that when they are full we are and shall be obliged to pay 40@, the premium that many of our competitors pay at all times. You must be aware that underwriters cannot be forced to take risks, and we need hardly add… that we take the utmost pains with every order entrusted to us.18

In spite of these difficulties, London remained the most important marine insurance market of Europe for exporters to the Southern Cone. Even textiles exported from France to Chile were insured in London, though the cargoes never entered a British port.19 Likewise, shipments from Antwerp to Valparaiso were also insured by Huth & Co. in London.20 Furthermore, not only was insurance of British exports entrusted to London but also insurance of remittances from the Southern Cone, either Chilean silver and copper or Buenos Aires tallow and hides. Insuring shipments of Southern Cone produce in London was a generalized practice among local houses, as there was no insurance market on the spot. Dallas & Co., for instance, British merchants at Buenos Aires, were in the habit of requesting that their associated house in London insure hides shipped in Buenos Aires for England.21 Likewise, David Campbell and George Faulkner (Hodgson’s connections at Liverpool and Manchester, respectively) were also in the habit of effecting insurances of produce shipped from the River Plate to England.22 Even cargoes of local produce shipped by British merchants in the Southern Cone to continental Europe and North America were insured in the London market.23

The Costs of Marine Insurance for British Textile Cargoes to the Southern Cone

Ocean freight rates for shipments from Liverpool to the River Plate during the 1810s–40s were most usually some 2 to 4 per cent of the invoice cost of cargoes, although moving within a wide range of between 1.5 and 6per cent, according to the quality (therefore prices) of the fabrics or garments being shipped.24 Likewise, packing costs were usually some 2 per cent of the invoice cost of cargoes, moving within a wide range of between 0.5 and 3.5 per cent, according to the quality of the packing used, as well as the price of the goods.25 As with shipping freights and packing costs, marine insurance charges could also be a substantial addition to operational costs for those exporting to the Southern Cone. As already observed by Platt and Reber, during the early stages of direct legal trade between Britain and Latin America, insurance rates as high as between 6 and 12 per cent on the invoice value of cargoes were frequently seen, particularly duri...

Table of contents

- Cover

- Half Title

- Title Page

- Copyright Page

- Table of Contents

- Preface

- List of Figures and Tables

- List of Contributors

- Introduction: Towards an International History of Insurance

- Part I: Non-Life Insurance

- Part II: Life, Health and Social Insurance

- Notes

- Works Cited

- Index