eBook - ePub

Financing Trade and International Supply Chains

Commerce Across Borders, Finance Across Frontiers

- 312 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Financing Trade and International Supply Chains

Commerce Across Borders, Finance Across Frontiers

About this book

The vast majority of international trade is supported by some form of trade financing: a specialized, sometimes complex form of financing that is poorly understood even by bankers and seasoned finance and treasury experts. Financing Trade and International Supply Chains takes the mystery out of trade and supply chain finance, providing a practical, straightforward overview of a discipline that is fundamental to the successful conduct of trade: trade that contributes to the creation of economic value, poverty reduction and international development, while increasing prosperity across the globe. The book suggests that every trade or supply chain finance solution, no matter how elaborate, addresses some combination of four elements: facilitation of secure and timely payment, effective mitigation of risk, provision of financing and liquidity, and facilitation of transactional and financial information flow. The book includes observations on the effective use of traditional mechanisms such as Documentary Letters of Credit, as well as an overview of emerging supply chain finance solutions and programs, critical to the financing of strategic suppliers and other members of complex supply chain ecosystems. The important role of export credit agencies and international financial institutions is explored, and innovations such as the Bank Payment Obligation are addressed in detail. Financing Trade and International Supply Chains is a valuable resource for practitioners, business executives, entrepreneurs and others involved in international commerce and trade. This book balances concept with practical insight, and can help protect the financial interests of companies pursuing opportunity in international markets.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Financing Trade and International Supply Chains by Alexander R. Malaket in PDF and/or ePUB format, as well as other popular books in Business & Business General. We have over one million books available in our catalogue for you to explore.

Information

1

International Trade: Where Does Financing Fit In?

International trade has been a driver of growth, economic prosperity and development since the dawn of business and commercial activity. The system around international commerce is far from ideal, and no objective observer would claim that trade, even when it is linked to international development, is conducted equitably, or that its mechanisms work well in all respects.

There are legitimate and important efforts to enhance the model under which global commerce is facilitated, supported and conducted, and even with that, it must be acknowledged that trade between nations has evolved well enough to allow for an enriching flow of goods and services across the globe. With that flow, comes economic value, growth, prosperity and improved standards of living for people across the world.

Trade is viewed as an effective tool in international development, and fair trade activities, meant to improve the distribution of revenue to producers in developing economies, is gaining traction. Trade has also been seen as an effective means of engaging nations to participate in the international community, and as an indirect means of mitigating or reducing threats to international peace and security.

In short, while there is undoubtedly room for significant improvement, trade is an important contributor to growth and development: so much so that robust trade was seen as one of only a few paths to recovery following the global financial and economic crisis that erupted in 2007. The solution to the imperfections around international trade and investment – from wealth distribution to carbon footprint issues and beyond – is to improve the system, its processes and some of the less than constructive underlying political dynamics.

The solution is not, as some have been suggesting, to retreat from international engagement. The damaging effects of protectionism and isolationism are well known, as are the benefits of trade that generate value for the parties and the nations involved, now less on a purely bilateral basis and increasingly, in the context of complex global supply chains and far-reaching networks of relationships.

Politics and ideology aside, and considering developments strictly in terms of the evolution of the international system in which trade operates, it is notable that the influence of emerging and developing economies is increasing significantly. There are active efforts to support the development of a next-generation model of globalization – perhaps a “kinder, gentler globalization” that recognizes the limitations of zero-sum models in international affairs, appreciates the long-term risk of inflated commodity prices and the need to raise the water level so that all ships can benefit.

The international system – including the system of international trade and investment – requires a way forward that is grounded in a more nuanced and finessed understanding of international affairs, including business, trade and investment.

There are promising indications of a continued and more positive evolution of the global system, including those elements related to trade and international business. Examples include:

• The EU-funded “Hub & Spokes” Program aimed at aiding developing economies in enhancing their capacity and capability to better negotiate trade agreements;

• The concerted global effort to assure adequate flows of trade finance through the G-20 and the World Bank’s International Finance Corporation (IFC) at the peak of the global financial crisis;

• The increasing awareness around fair trade, including an observable increase in consumer attention in this area;

• The development of the Equator Principles to guide the activities of export credit agencies (ECAs)in trade and project finance;

• The creation of institutions such as the Financial Stability Board, specifically mandated with a protection and oversight role relative to the global financial system;

• The recent, nearly global, focus on supporting the success of small businesses in international markets, on the basis of the importance of this segment to national economies;

• Continued focus on corporate social responsibility, including in international activities.

In business, the successful pursuit of opportunities in international markets, including the pursuit of import, export and investment activity, serves multiple purposes, such as increasing revenues and profitability, diversification of risk and facilitation of growth. International business and international trade, undertaken with care, is commercially very attractive and can be very lucrative for businesses of all sizes, from small or mid-sized entrepreneurial start-ups to large corporations.

In short, trade is extremely important, and creates a great deal of value. Trade benefits nations, enriches businesses and improves or enriches the lives of families all over the world.

The vast majority of world trade today is supported by some form of financing, which combines traditional and long-established instruments and mechanisms, as well as newer solutions or combinations of solutions, an understanding of which is important to any entrepreneur or executive with a mandate that covers international trade activities.

It is widely acknowledged among practitioners that 80–90 percent of global trade flows are supported by some form of trade or supply chain finance (SCF), according to various industry sources. Financing is important in all markets across the world and valuable to businesses of all sizes, from small businesses to large multinationals.

As a business owner, manager or executive, you may do everything absolutely right, but if you fail to understand – and manage – the financial dimensions of your international activities, your venture is likely to fail, and may even put your domestic operations at risk.

The good news is, although financing in the context of international trade (commonly called “trade finance”) is poorly understood, even by experienced bankers and financiers, it can be understood both at a strategic level, and in very practical, transactional terms, by entrepreneurs as well as non-financial business executives.

International Trade

International trade touches every country on the globe in some way. The average growth of trade flows has exceeded the growth of global productivity (as measured by Gross Domestic Product GDP) over most of the last four or five decades, until the global economic crisis of 2008, and has once again begun to overtake productivity growth rates as we come out of this ongoing crisis.

The fundamental importance of international commerce was brought sharply into focus by the global financial and economic crisis, in that trade has been – and continues to be – seen as the single most effective engine of recovery and growth, by political, business and academic leaders throughout the world.

Even as national self-interest prompted protectionist responses by some jurisdictions at the peak of the crisis, the overwhelming consensus was that robust and sustained trade was essential to recovery.

Figure 1.1 World exports 2011 – excerpt

Source: World Trade Organization, ITS 2012

The Geneva-based World Trade Organization (WTO) reported that total merchandise exports alone were worth close to US $18 trillion in 2011 as shown in Figure 1.1.

Success in international markets brings attractive revenues and returns, and may even lead to favourable changes in domestic business operations.

Analysis has shown that companies that succeed internationally often become significantly more efficient and competitive in their domestic operations as well.

International practices, lessons learned from trade and investment activities and the infusion of perspectives from international staff all contribute to enhancing domestic operations.

Growth rates and attractive profit margins, together with the opportunity to diversify markets, combine to argue strongly in favour of pursuing business in international markets.

The pursuit and conduct of business internationally involves a wider range of risk types, and a higher degree of risk overall, however, the potential returns and/or the opportunity to enhance competitiveness tends to counter-balance those risks, many of which can be effectively offset.

The additional risks and challenges encountered in the pursuit of international business opportunities can be wide-ranging, and should be understood by entrepreneurs and senior executives in large companies alike. They include:

• Country, political, economic and commercial risk in international markets;

• Longer and more expensive sales cycles, from feasibility assessments to multiple visits to the market during business development;

• Limited information about buyers or suppliers (counterparties) in international markets;

• Lack of credit history or credit data on potential partners, in markets where credit reporting is rudimentary or non-existent;

• Differing practices in financial reporting, ranging from differing accounting guidelines, to the absence of sound reporting practices, including access to audited financials;

• The conduct of business in and across a variety of legal jurisdictions, with the attendant cost, risk and complexity;

• Challenges and complexities related to cross-cultural interaction and engagement;

• Increased complexity related to transport and logistics;

• Increased risk of fraud;

• Risk of significant delay of payment or delivery of goods, or outright non-payment or non-delivery;

• Risk related to foreign exchange and currency volatility, and in some jurisdictions, difficulties in accessing foreign currency to pay for trade;

• Risk of default or outright failure of a bank in an international market.

International trade can generate great value and very attractive returns, but ought not to be pursued without careful consideration of, and planning for, the additional risks and complexities.

The benefits of engaging in international business, including trade and investment, can include significantly higher margins on sales, the ability to sell certain ancillary products that are not attractive to local consumers and may be desirable elsewhere, the opportunity to generate additional profitability through foreign exchange advantages, and the potential to reduce marginal costs of production by producing larger volumes destined for international markets. Investment in foreign markets can assist businesses in accessing technology or know-how, lower-cost labor pools and access to global supply chains and trading relationships that may not be in proximity to the home market.

The Trade and Investment Dynamic

Trade, historically, was a discrete activity, clearly distinguishable from investment. It was common for business and academic discussions to consider whether investment follows trade or trade follows investment.

Importers were engaged in importing, exporters focused on selling their products and services in international markets. Cross-border investment, likewise, was a separate area of activity.

More recently, supply chain and international sourcing activities have evolved in a manner which sees exporters frequently sourcing inputs to production from international markets. Investment activity, likewise, has become closely connected to international trade, no longer as clearly distinct from trade as once was the case.

The need for flexible financing solutions to meet the requirements of businesses engaged in import, export and international sourcing activities of all types, are more pronounced in this post-crisis environment. Banks, financial services organizations and others involved in trade and supply chain finance are increasingly aware of the interrelationship between import, export and investment activity, and are well-positioned to assist clients in these areas.

Trade and Supply Chain Finance

In addition to facilitating payment, and providing financing solutions for business partners, trade and supply chain finance can play a central role in effectively mitigating the risks related to international commerce. Trade finance is about much more than payment or financing, though clearly, the financing and liquidity element is particularly key in international transactions, where transaction timeframes can be long.

Figure 1.2 illustrates how settlement can take a significant amount of time, impacting cashflow and working capital. Financing options that assist in accessing liquidity, such as various trade and supply chain finance solutions, can be very valuable to businesses of all sizes, and that value is further enhanced when effective risk mitigation solutions are also included. The risk mitigation aspect is often a determining factor, without which a deal – or even a trading relationship – would probably not exist.

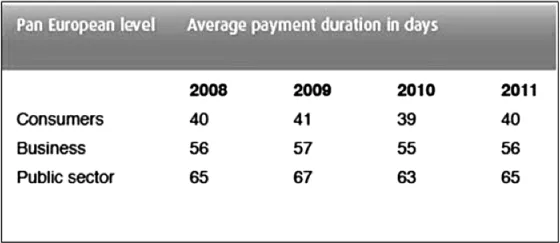

Figure 1.2 Average payment duration in days, Pan-European view

Source: Intrum Justitia, European Payment Index 2012

Payment timeframes and delays related to public sector transactions in Europe vary significantly from country to country. The issue was deemed sufficiently important to lead to the “Late Payment Directive,” which limits payment by public sector entities to 60 days – a significant reduction for some jurisdictions that averaged 120 days or longer, with delays averaging an additional 67 days, according to 2010 estimates from the European Economic and Social Committee.

The majority of global trade – estimates from various sources suggest 80 to 90 percent of trade – is supported and enabled in some way by trade and supply chain finance. Put another way, most business partnerships, and certainly, most cross-border or international supply chains, require some form of trade finance in order to function successfully. Large, cash-rich companies may benefit from financing solutions offered to their less established suppliers; small businesses across the globe are in need of financing and liquidity, particularly if they seek opportunity in international markets.

Financial intermediaries such as banks and others providing trade finance play a critical role in improving the risk profile of a transaction, in transferring risk between parties (and countries) and in establishing, in certain cases, a balanced protection of the interests of buyers and sellers, as will be explored in greater detail in subsequent chapters.

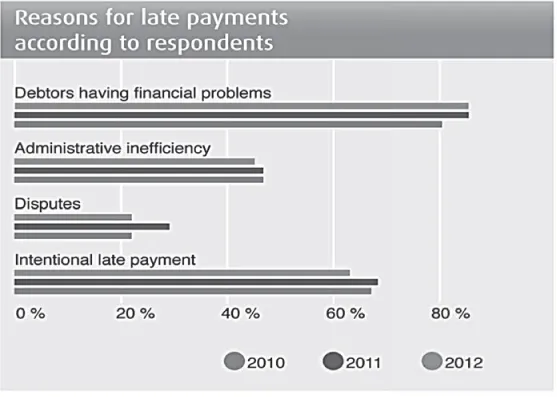

Figure 1.3 illustrates that a significant percentage of respondents to the 2012 European Payments Index survey identify international transactions as sources of late payment. International transactions can have material implications for cashflow and working capital, particularly in credit-constrained markets, and especially for cash-starved small businesses.

Figure 1.3 European payment index – reasons for late payment

Source: Intrum Justitia, European Payment Index 2012

The role of short-term credit and trade finance has been acknowledged as critical to the expansion of trade in the last century or longer, and has been described by a leading international institution as “providing fluidity and security” to the movement of goods and services. [Trade] finance, notes this same institution, is the “true life-line” of international trade.

The global economic crisis has demonstrated that financing is fundamentally necessary to the conduct of international trade. At the peak of the crisis, when liquidity in the market evaporated and certain types of trade finance became practically unavailable, the world saw a constriction of certain trade flows of about 40 percent in very shor...

Table of contents

- Cover

- Half Title

- Dedication

- Title Page

- Copyright Page

- Table of Contents

- List of Figures

- About the Author

- Foreword

- Acknowledgments

- Testimonials

- Chapter 1 Understanding Export Credit Agencies and International Financial Institutions

- Chapter 2 Country Risk: A Reality of Trade

- Chapter 3 Transparency and Information Flow in Finance: The End of Name-Lending?

- Chapter 4 Cost of Financing

- Chapter 5 Financing Trade: Selected Concepts and Traditional Solutions

- Chapter 6 Supply Chain Finance State of the Market: Coming of Age

- Chapter 7 Exporters: Choose Your Trade Bankers?

- Chapter 8 Discounting a Banker’s Acceptance

- Chapter 9 Export Credit Agencies, International Institutions and Non-Bank Providers

- Chapter 10 Flexibility of Financing: Small Business, Developing Markets

- Chapter 11 Fraud: A Different Type of Risk

- Chapter 12 Trade and Supply Chain Finance: A Case Study

- Chapter 13 Looking Ahead: Trade and Supply Chain Finance Tomorrow

- Appendix A: Selected Sources of Trade and Supply Chain Finance

- Appendix B Traditional Trade Finance: Industry Product Definitions – Global Trade Industry Council, BAFT-IFSA, February 2012

- Appendix C: Product Definitions for Open Account Trade Finance BAFT-IFSA, December, 2010

- Index