eBook - ePub

Financial Services Marketing

An International Guide to Principles and Practice

Christine Ennew, Nigel Waite, Róisín Waite

This is a test

Share book

- 592 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Financial Services Marketing

An International Guide to Principles and Practice

Christine Ennew, Nigel Waite, Róisín Waite

Book details

Book preview

Table of contents

Citations

About This Book

Now in its 3rd edition, Financial Services Marketing offers a balanced and useful guide to the topic that is both conceptual and practical. The authors have drawn from extensive international experience to ensure that this text will resonate with users across the globe. This edition is complemented by numerous international references, examples and case studies featuring companies such as American Express, Direct Line, Barclays, NatWest RBS, Aviva and HSBC.

This fully updated and revised edition features:

-

- An expanded section on regulation which has international reach and addresses the post-Brexit world

-

- Greatly expanded coverage of digital marketing at both the strategic and tactical levels

-

- New material on how to improve a company's trustworthiness and safeguard a culture that is customer-focussed

-

- New examples, vignettes and case studies that showcase best practice from around the world

-

- B2B and B2C marketing

-

- Upgraded PowerPoint support on the companion website

Financial Services Marketing 3e will be hugely beneficial to academic students of marketing and finance, as well as essential reading to those industry-based and studying for professional qualifications.

Frequently asked questions

How do I cancel my subscription?

Can/how do I download books?

At the moment all of our mobile-responsive ePub books are available to download via the app. Most of our PDFs are also available to download and we're working on making the final remaining ones downloadable now. Learn more here.

What is the difference between the pricing plans?

Both plans give you full access to the library and all of Perlego’s features. The only differences are the price and subscription period: With the annual plan you’ll save around 30% compared to 12 months on the monthly plan.

What is Perlego?

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Do you support text-to-speech?

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Is Financial Services Marketing an online PDF/ePUB?

Yes, you can access Financial Services Marketing by Christine Ennew, Nigel Waite, Róisín Waite in PDF and/or ePUB format, as well as other popular books in Commerce & Commerce Général. We have over one million books available in our catalogue for you to explore.

Information

Part I

Context and strategy

1 The role, contribution and context of financial services

Learning objectives

At the end of this chapter you should be able to:

- Understand the economic and social significance of the financial services sector,

- Recognise the diverse ways in which financial services can impact on key aspects of everyday life,

- Appreciate the risks to the economy of failures in the regulation of financial services,

- Appreciate the need to market financial products and services in accordance with the spirit as well as the letter of regulation,

- Have an appreciation of the ways in which regulation is responding to the various financial crises that have occurred since 2007.

1.1 Introduction

Product and market context exert a significant influence on the nature and practice of marketing. Marketing activities that are effective for fast moving consumer goods may be wholly inappropriate when marketing fine art. What works in Canada may be ineffective in China. Accordingly an understanding of context is essential in order to understand the practice of marketing. Nowhere is this more evident than in the financial services sector where social, political, economic and institutional factors create a complex context in which financial services organisations (FSOs) and their customers interact. In recent years a development that has had profound implications for the marketing of financial services and the environment in which they operate is that of the digital revolution. The nature and impact of these various drivers of change vary from country to country and so it is vital that marketing practitioners have a sound appreciation of how they interact to create the marketing environment in their specific territory. All too often, discussions of marketing practice fail to recognise the importance of explaining and understanding these contextual influences. The purpose of this current chapter is to provide an overview of the context in which financial services are marketed and to explain the economic significance of the sector.

The following sections outline aspects of social and economic activity where the financial services sector has a key role to play and where its activities have significant implications for economic and social well-being. We begin with a discussion of the potential contribution of the sector to economic development in general. Subsequent sections go on to explore the role of the financial services sector in welfare provision, in income smoothing and in the management of risk. Section 1.6 explores the significance of financial exclusion and its potential impact on the welfare of the poorer groups in society. Section 1.7 reviews distinctive features of the financial services industry – namely the co-existence of mutual and joint stock companies. Section 1.8 provides an overview of the issues relating to the regulation of financial services and this topic is developed further in Section 1.9. Importantly, this final section discusses how the regulation of the financial services sector has been impacted upon by market failings since 2007 and the future direction of travel for this vital aspect of the marketing of financial services. Given the international scope of this text there is discussion of how regulation has been unfolding across Europe as well as the UK and details are given regarding regulatory arrangements across the globe from the USA to the Far East. Arguably, the UK has been in the vanguard of regulatory developments and due weight will be devoted accordingly. There has been a well-established trend regarding the convergence of a range of regulatory developments across jurisdictions as many of the underlying principles and challenges are relevant to countries throughout the world. For example, the six principles that underpin Treating Customers Fairly have been adopted in their entirety by the Financial Services Board of South Africa.

1.2 Economic development

Although economic and political theorists sometimes have widely differing views on the nature and value of economic development, there is a widely accepted view that controlled, managed economic development is, on the whole, a desirable means of furthering the well-being of humankind. Moreover, economic development that combines the positive aspects of the market economy (particularly innovation and resource efficiency) with the collectivist instincts and community focus of state legislatures is, arguably, most likely to serve the common good. In spite of the prolonged economic difficulties experienced globally since 2008, this combination continues to be the dominant framework for managing economic and social well-being. Having said that, there does seem to be growing concern regarding some of the unintended consequences of the phenomenon known as globalisation. Whilst this has been hugely beneficial in alleviating poverty in many developing nations, it has, in part, come at the cost of lost jobs and chronic economic stagnation in communities in developed nations. The outcome of the Presidential election in the USA in November 2016 has been influenced to a material degree by the impact of what is seen as the export of jobs in traditional manufacturing centres to developing countries. This trend has seen average wages in the USA scarcely any higher than they were in the 1970s. That is not to say that the concept of the market economy is under threat; it is more the case that aspects of its practical application are under review.

Economic development is being pursued by governments throughout the world, with varying degrees of success. Access to investment capital facilitates economic development, and a vibrant banking sector has a pivotal role to play in this regard. The liberalisation of financial services in the former communist countries of Eastern Europe has enabled inward investment to occur that has helped many of them to be successful in joining the European Union. Similarly, many of the rapidly developing economies of Asia are focusing attention on liberalisation of their financial sectors as an aid to economic growth and development. This is particularly in evidence in China where, according to The World Bank, over 400 million fewer people were living in extreme poverty in 2001 than 20 years previously. That progress has continued apace with The World Bank reporting that the percentage of the population subsisting at or below the poverty level of $1.90 per day fell from 6.5% in 2012 to just 1.9% by the close of 2013.

The global credit crunch of 2007/8 and the subsequent sovereign debt crisis, which at the time of writing remains unresolved, demonstrate beyond any doubt the interconnectedness of national economies and the financial systems that accompany them. Indeed, the term “too big to fail” came into common use in the aftermath of the collapse of Lehman Brothers in 2008 as national governments strived to avert economic catastrophe by saving financial institutions such as Royal Bank of Scotland, Lloyds Banking Group in the UK, Allied Irish Bank and Bank of Ireland in the Irish Republic. All in all these seismic events are a salutary warning of the magnitude of detriment that can arise from the collectively inappropriate behaviours of FSOs on a global scale.

A feature of particular note with regard to the current economic and financial backdrop is the role played by debt, both individual and governmental. John Greenwood, Chief Economist at asset management company Invesco, has taken a keen interest in how debt crises typically play out and impact on financial behaviour in both the private and public sectors. In Vignette 1.1 he presents his analysis and provides a commentary on what he terms the three phases of a debt crisis.

Vignette 1.1 The three phases of a debt crisis

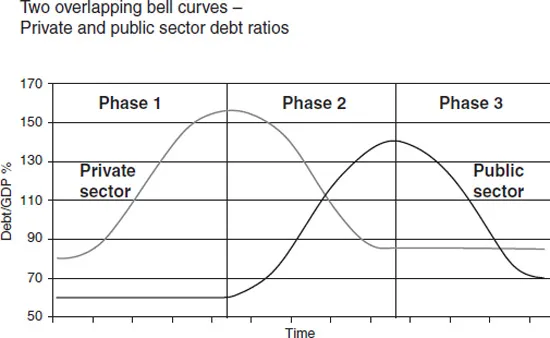

The process of ‘bubble and burst’, or the emergence of a credit bubble and its aftermath, may be visualised as two overlapping bell curves (as shown in Figure 1.1), where each curve measures leverage or a ratio of debt to income. The first bell curve represents the leveraging up of the private sector as it increases its ratio of debt to income (or GDP) during the bubble phase, followed by the deleveraging phase. The second bell curve represents the ratio of government debt to GDP which also follows the same pattern, though does not necessarily reach the same levels.

Figure 1.1 Three phases of a debt crisis

When the bubble bursts, the private sector typically tries to deleverage rapidly, reducing spending and repaying debt. But the onset of recession causes government revenues to decline abruptly, government budget deficits emerge and the ratio of government debt to GDP increases. In addition, as the recession intensifies the government may commit to additional fiscal stimulus measures, further expanding the public sector’s deficits and debt ratio. This explains why – in a modern economy – the government’s debt ratio typically starts to rise steeply at exactly the moment when the private sector begins to deleverage.

The chart above shows the three phase debt crisis model in concept. Figure 1.2 shows how it can work in practice, in this case with regard to experience in the USA.

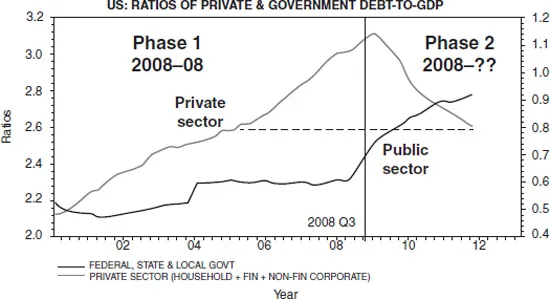

The chart below applies the concept to the actual data for the US since 2000.

US private sector debt – which includes the debt of the household sector, non-financial business sector and financial sector – peaked at 317% of GDP in 2008 Q4, marking the end of Phase 1. Since then the private sector has deleveraged, reducing its ratio to 241% as of 2016 Q2, a cumulative decline of 76 percentage points. This means that the private sector leverage ratio has returned to the level of 2002 Q1, unwinding two-thirds of the leverage built up since the start of 2000. Most of the deleveraging has been achieved by balance sheet repair in the financial sector (banks and shadow banks), with the household sector contributing to a smaller degree. In the UK there has been less deleveraging.

The US public sector debt ratio – which includes federal, state and local government debt – began rising in 2008 soon after the start of the US recession in 2007 Q4, as designated by the National Bureau of Economic Research. So far the government debt ratio has risen from 62.6% of GDP in 2008 Q2 to 101% in 2016 Q2. In other words, there has been no deleveraging by the US public sector. The same applies in the UK.

Figure 1.2 Trends in public and private sector debt in the USA

We cannot know in advance how much the US private sector will deleverage, but since interest rates are still very low, there may be more deleveraging ahead. I expect a period of up to two more years when US nominal GDP grows at 4–6% per annum but household and financial sector debts grow more slowly, contributing to a further reduction of the private sector debt-to-GDP ratio.

Source: John Greenwood, Chief Economist, Invesco; data from Macrobond.

However, what made the latest debt crisis so difficult to manage has been the combination of the steady accumulation of public and private debt in developed economies since the mid-1990s and the costs to governments of safeguarding their banking systems. The latter issue unfolded in the aftermath of the collapse of Lehman Brothers in 2008, and the subsequent costs and uncertainties surrounding the Eurozone sovereign debt crisis have added to the difficult economic backdrop. All of these developments interlock but, arguably, can be traced back to a range of inappropriate behaviours on the part of governments, financial institutions and, indeed, consumers. Too many governments have relied on debt to fund ambitious spending programmes and, in the case of the so-called Club-Med economies, took advantage of borrowing costs that were artificially low as a consequence of the way in which the convergence of Eurozone economies was contrived. Similarly, too many consumers in the developed world were dependent on debt to fund high consumption-driven lifestyles, and reckless borrowing has been encouraged by lending institutions in their headlong pursuit of growth.

The malign effects of gorging on debt are no more vividly in evidence than in Ireland where the decision to join the euro in 1999, and the consequent lowering in the cost of credit, fuelled an enormous property bubble, most notably in the commercial property sector. The perfect storm that brought the country’s economy to its knees was fuelled by the combination of erroneously cheap credit, the failure of lenders to operate appropriate standards of risk management, the inappropriate use of executive rewards which drove the wrong behaviours and downright greed.

This serves to illustrate the magnitude of effect that inappropriate financial behaviour can have at the level of the consumer, organisation and government. Too often there has been a failure to learn from the mistakes of the past; it is to be hoped that the currently pa...