- 224 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

About this book

For private business owners, managing a successful exit from their business is one of the most important events in their business lives. This book shows you how to do so with the minimum of fuss and maximum return. It is unique because the author writes from the owner's point of view, bringing together in one place all you need to know about planning this complex process. Exit Strategy Planning emphasises the need to place exit planning on a firm foundation, with taxation planning and business continuity planning providing the basis to ensure a smooth transition that will yield the maximum return. The first three parts of the book ('Laying the Foundations', 'Choosing your Exit Strategy' and 'Preparing and Implementing your Plans') present a best practice approach to this complex subject. Here the book highlights the importance of planning, often several years in advance, and explains the need to make the business 'investor ready' by identifying and removing impediments to sale. Part 3 culminates in a step-by-step guide to producing and implementing your Master Exit Strategy Plan. Following on from this the extensive appendices in Part 4 discuss in detail each of the exit options open to you (many of which you have probably never considered) and show how to choose the optimum exit route. Exit Strategy Planning is a book that will do more than save you time and money now and in the future; it will help you to maximise on what may well be a lifetime's investment.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Exit Strategy Planning by John Hawkey in PDF and/or ePUB format, as well as other popular books in Business & Business General. We have over one million books available in our catalogue for you to explore.

Information

PART 1

Laying the Foundations

CHAPTER 1

The Importance of Time and Timing

Why you might wish to exit

Many owners of private businesses will make the decision to exit their businesses because they have reached natural retirement age, or because they are ill, or because they have decided for personal reasons that they have just had enough. Others will make this decision because they see an opportunity to dispose of a business for a tidy profit, or because they wish to purchase another business, or because of events or influences outside their immediate control (for example, their business is failing).

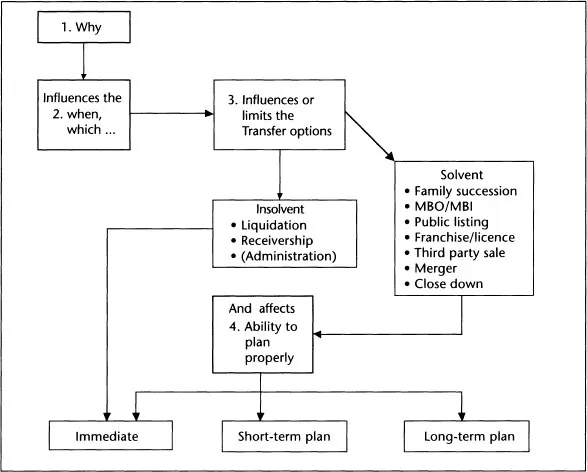

The reason for wishing to exit can help to clarify at least two other aspects of your exit strategy planning. The first is the important issue of how you will exit, while the second is the sometimes vital one of when you will exit. Figure 1.1 looks at the ‘Why?’ decisions and how they are likely to influence your exit outcomes.

How you might exit (the choice of exit options)

The reason for your exit could influence, or limit, the choice of exit options available to you. Where you are exiting immediately because of ill health, there is little time to plan properly for an exit through a management buyout (MBO), family succession, franchising or a public flotation route and you will, probably, sell through a trade sale or a close down. If your reason for exiting is that you feel the time has come to pass the business on to an heir, obviously your exit option is limited to a family succession. If you are planning to sell because you wish to partly retire by keeping a minority equity interest and a part-time job in your old business, this will, probably limit your options to a family succession or a third party sale (and, consequently, reduce the number of potential purchasers). If you need to exit your business because it is insolvent, your exit route will be through liquidation. In all these cases the limiting of the choice of exit option could reduce the price you receive from disposal.

When you will exit

The reason for your exit (or why you need to exit) can have a direct influence on when the exit will take place. The timing of your exit could be important for at least three reasons, namely:

• the state of the economy at the time

• the time you have to plan

• the impact of taxation.

Figure 1.1 Why, When and How do I Want to Exit my Business?

THE STATE OF THE ECONOMY

The general state of the economy and the health of your own particular industry sector will have an influence on your selling price, whatever your exit option (with, perhaps, the exception of a family succession). If, for example, you are disposing of your business because of ill health, or because you are desperate to retire, you will probably want to exit immediately. In this case you will have little opportunity to pick the best time to sell (in terms of the economic cycle).

Should you have to sell because of the death of a partner or shareholder (particularly where there is no shareholders’ agreement in place) you might have to act immediately with no time at all to plan. Here you will have to sell the business in whatever economic climate you find yourself.

When there is no pressure on you to dispose of your business and you set your own timetable, you should be able to choose a time to exit when the economic conditions are favourable for your industry and the economy generally.

TIME TO PLAN

The time you have to plan will have a crucial influence on the amount you can achieve through grooming your business for sale. Ideally, you should allow three to five years to implement most exit strategies (and longer for family successions), so that you are able to groom your business for disposal. However, circumstances beyond your control can sometimes dictate that you have to dispose of your business over a short period, or immediately. Where this is the case, and you do not already have an exit plan in place, you will have a very limited choice of exit option and very little time to achieve real improvements to the business structure and operations.

For all business owners, it is important to address immediately structural and continuity issues for your business. These can be considered as the beginning of your risk management planning and will give you some protection against events outside your control. If you are starting up a new business, you should ensure that you have advice on the most tax-effective business structure (with your eventual exit in mind) and, if you have partners or shareholders, you should put a shareholders’ agreement in place from the beginning. By doing this when the time comes to plan your exit you will already have the foundations in place!

With the foundations in place, if events go smoothly and you are able to plan your exit over a reasonable period (and you are able to be flexible with regard to the timing of your disposal), you will be in the prime position to reap the benefits of a three-to five-year plan. If things do not go smoothly and you have a more urgent need to get out, at least you should not be inhibited from selling by your partners or shareholders and you should be able to take advantage of the tax reliefs and allowances available. You might also still be able to devote at least a year to a short-term exit plan, which will give you some opportunity to groom your business for sale and, consequently, improve your exit price.

Planning ahead

Of course, there is no such thing as a perfect business and it is unlikely in practice that all your plans will be completely fulfilled by the time you sell your equity. However, this must still be your aim. One thing is certain: you will get much closer to perfection if you plan well ahead. Finding and training the right successor takes time; grooming a business takes time; paying back debt takes time; planning to minimize your taxation bill can take time; every worthwhile accomplishment in business takes time.

There are two very important rules of exit strategy planning that you should understand from the outset, which are as follows:

1. Plan well ahead.

2. Have a sense of urgency (but be thorough) in implementing your plans.

How long do I need to plan?

You need to decide whether you will embark on a short-, medium-or a long-term exit strategy plan. A short-term plan is anything under two years, a medium-term plan is between two and four years; and a long-term plan is for more than four years. The approach to planning in each case is different and can be best approached by considering which of the steps it will be possible to take in each one.

Any short-term exit strategy plan is a compromise. If you are unable or unwilling to delay your disposal for at least two years you will be limited in what you can do to improve the value and saleability of your business. In the event, what can be achieved in a short-term plan will depend on such things as the state of your business operations and what its impediments to sale are.

In summary, the limitations of a short term plan are as follows:

1. Your exit options will be limited, because some options take longer to accomplish than is possible in a short-term time frame.

2. The effects of restructuring to improve your taxation position can take several years, so you might not be able to do much here. You can attempt to put shareholders’/partners’ agreements in place, but this can be difficult where your co-owners have word that your are selling up shortly.

3. The extent of grooming of a successor and/or management could be very limited in the time available.

4. The ability to remove impediments to sale is limited in a short-term plan and you should refer to Chapter 6 for details of this.

5. Growth through acquisitions is possible but unlikely, whereas organic growth is virtually impossible. Success here will not only be dependent on time available; some businesses will never grow regardless of the time devoted to this task.

6. You should have ample time to undertake these preparations.

7. Integration of your plans might be difficult and will depend on how far ahead you have planned your personal finances.

8. The disposal itself should give you no problems.

(For a more detailed explanation of removal of impediments you should refer to Chapter 8 on short-term planning and Chapter 6 on impediments to sale.)

As to the medium-term plan, in two to four years you could achieve nearly all your exit strategy objectives, depending on the size of the business and, of course, on the extent of its problems.

Figure 1.3 on page 9 lists the important stages of planning your exit. With a mediumterm plan you should note the following:

• You should have few problems with steps 1 to 3.

• Step 4, the grooming of your successor, could be a problem, depending on the age and experience of your successor. This issue could be sufficient to force you, however reluctantly, to choose a longer time frame.

• Step 5, the successful removal of your impediments to sale, will depend on what they are. (Chapter 6 will provide you with more information on this.)

• Step 6 could be partially successful, though too many people underestimate the time it takes to turn around or grow a business. (Note also the comments under ‘the short-term plan’ above.)

• You should have no problems with step 7.

• Your success with step 8 will depend on how long you have planned this aspect of your personal affairs, while step 9 will be fine.

A planning period of over four years (long-term planning) is ideal for you to achieve all your exit strategy aims and your personal estate planning objectives. This is the planning time frame we recommend you adopt if at all possible. The exception to this could be the aim to grow your business to a target size where the target turns out to be overambitious, or the business is such that it cannot grow. Similarly, working on removing impediments to sale does not guarantee that they will be removed.

THE IMPACT OF TAXATION

This is an area which has huge implications for successful exit planning and, consequently, it is covered in detail in Appendix 1. However, if the reason for your exit limits the time you have available to plan, you could fail to gain the maximum relief from taxation that is now available to individuals who dispose, or transfer, businesses or business assets.

Figure 1.2 looks at the reasons for disposal and their influence on the time available to plan.

Questions to help you to decide your timetable

Even where you have the option of a long-term exit plan, you will wish to be convinced that such a plan has advantages for you compared with a short-term plan, or no plan at all. The following summary of questions you could ask will help clarify this issue for you. (Some of the issues raised here are covered in detail in later parts of the book.)

• Check the current market conditions for business disposals in general, and for your type of business in particular. A corporate broker, an accountant or a specialist corporate adviser could be good sources of information. (What you wish to know is whether or not there is currently a demand for your type of business and whether or not prices are good.)

• Try and obtain a consensus on the current trend of the economy. (For example, are things likely to be better or worse over the next three years?)

• Check with your accountant your likely tax position (see Appendix 1, ‘What about tax?’).

• Review your business’s operations. (Are there any obvious things in the business that currently depress its sale value or make it more difficult to sell? Can these be rectified and, if so, how long do you think it will take? You should refer to Chapter 6 ‘Impediments to sale’ for guidance here.)

• Check whether your fellow shareholders wish to sell and the position with your shareholders’/partnership agreements. (For example, at what price will minority shareholders sell? Are they compelled to sell when you sell? What prices are you compelled to pay them if you are forced to buy them out first? Is a delay prudent, or even essential, to sort this out?)

• Check whether your management will stay on after the sale? (For example, is there anything in your management agreements that covers this?)

You should review yo...

Table of contents

- Cover

- Half Title

- Title Page

- Copyright Page

- Table of Contents

- List of Figures

- List of Abbreviations

- Acknowledgements

- Introduction: The Story of Bill and Carol

- Part 1: Laying the Foundations

- Part 2: Choosing your Exit Strategy

- Part 3: Preparing and Implementing your Plans

- Part 4: Appendices

- Useful Web Sites

- Index