- 304 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

About this book

How can you be sure you are buying the company you think you are? Are you sure it is as good as the seller says? How can you be certain unexpected costs and obligations will not suddenly appear once you are the owner and responsible for them? How best can you arm yourself for the negotiations? Have you worked out precisely what you are going to do with it once it is yours? How do you set the priorities for change to recoup the premium you have paid for it? The answer to all these questions, and many more, lies with effective due diligence. Due diligence is one of the most important but least well understood aspects of the acquisition process. It is not, as many believe, a chore to be left to the accountants and lawyers. To get the best from it, due diligence has to be properly planned and professionally managed. This book is a comprehensive manual on getting due diligence right. It is a uniquely comprehensive guide, covering all aspects of the process from financial, legal and commercial due diligence right through to environmental and intellectual property due diligence. There are also useful chapters on working with advisers and managing due diligence projects. It also includes a number of checklists to help ensure that the right questions are asked.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Due Diligence by Peter Howson in PDF and/or ePUB format, as well as other popular books in Business & Business General. We have over one million books available in our catalogue for you to explore.

Information

CHAPTER 1 Introduction

Who is this book for?

Due diligence is variously described as boring, expensive or time consuming and, more often than not, all three. To many it is a way of spending a lot of money to tell you what you already know. It is also incredibly time pressured. Sellers have absolutely nothing to gain by giving a buyer time to probe and question. The buyer, on the other hand, has to gather and digest an awful lot of information on a whole range of quite specialist topics in a very short time and often with less than perfect access to the sources of information. Despite what many may believe, this in practice makes due diligence not some clever financial modelling exercise or a fascinating legal challenge, but essentially an exercise in project management.

The secret is to be very focused. This book is aimed at helping the practitioner to focus. The practitioner is the person who is going to drive the due diligence process. By knowing what information is needed, where and how to get it, and how the various due diligence professionals, lawyers and accountants as well as management consultants, go about their work, due diligence becomes more manageable, much more fun and much more cost-effective. It allows acquirers to focus on what is important and therefore to make better decisions.

The book should also be helpful to the professional adviser. Even experienced advisers may find something new in the sections which follow covering disciplines other than their own. Advisers tend, unfortunately, to work exclusively on their own area of investigation without reference to any of the other advisers. Although one of the aims of this book is to change that, it is nonetheless true that even lawyers with many deals to their credit may not know much about what accountants and management consultants do and how they go about their work.

The acquisition process

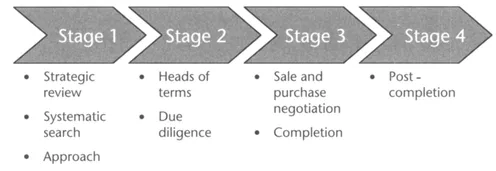

Due diligence is obviously only one part of an acquisition or investment exercise. In order to understand where it fits into the overall acquisition process, let us, for convenience, assume the process falls neatly into the four generic categories shown in Figure 1.1.

Stage one is about identifying an acquisition target and making an approach. This can only sensibly be done following a proper strategic review in which acquisition has been identified as a logical strategic tool. If an approach leads on to agreement to take things further, the deal enters the second stage. The two parties sketch out the broad terms of the deal and the buyer will begin due diligence. Successful due diligence leads to negotiation and, if all goes well, the deal completes. Then the buyer enters stage four, in many ways the most important stage of all, where the acquisition must be bedded in and made to pay its way. Each of the four stages is described in more detail below.

Figure 1.1 The acquisition process

Stage 1 Strategy, Search and Approach

Strategic review

It is a long time now since Barings advised Asda not to buy MFI. Asda did the deal anyway. Barings lost a client and a big fee. Standard corporate finance 'advice' has changed a lot since then. Now advice seems to be along the lines of 'Here is a good idea: we advise you to buy this business'. Acquisitions can and do happen as a result of banks hawking round ideas. They can also take place for a host of other not very good reasons. Often the chairman comes across a 'bargain', usually from one of his mates down at the golf club. Even today management may decide it would be a good idea to go on an acquisition spree to diversify shareholders' risk. Goodness knows why, when shareholders can do that better for themselves. At other times it is a case of the acquirer having a large cash pile to spend, management wanting a bigger empire, or, closely related, management persuading themselves that they can manage anything.

Acquisitions are very risky. All the academic research points to a failure rate well in excess of 50 per cent. Because of the risk, acquisitions should take place only after a thorough review of strategic objectives and then only after very careful consideration of the alternatives. They should be seen as a means of achieving strategic objectives - nothing more and nothing less. They will never be an antidote to poor performance in the core business or a means of management self-aggrandizement. Acquisitions are strategic tools, a means to a strategic end and given their very high failure rate, should be seen only as a last resort.

However, strategic reviews do often identify acquisition as the most logical way forward. If the strategic review has been carried out properly then the next step will be an organized, systematic search for acquisition targets.

Search

A systematic search for acquisitions often starts where the strategic review leaves off. The ideal targets have to be characterized. In turn this means creating a set of criteria for the types of company that should be looked at. A search will then seek to identify every company which meets those criteria, and to gather basic information about each one.

The potential targets will then be ranked according to their ability to meet strategic objectives and categorized according to whether they are strong contenders for purchase or merely fallback options. More detailed information will be put together on those companies which seem to be strong contenders, and a shortlist drawn up for approach.

Approach

Acquisition targets are like London buses. None come along for ages then all of a sudden there are three to choose from. Getting from first approach to a deal can take a long time. Approaching a company can produce extreme reactions. Some potential vendors will rejoice, thinking they are about to become rich, others may be deeply offended, others say 'no' when they mean 'yes' and yet others go away only to come back again. Reactions will vary according to the target's ownership, nationality, industry, and the personalities of those involved, but if a deal is to happen at some point both parties will perceive a mutual interest and decide to take preliminary discussions further.

Stage 2 The Preliminaries to Negotiation

Heads of terms

If an approach does lead to mutual interest, both parties will want to begin serious negotiations. Heads of Agreement/Heads of Terms/Letter of Intent is the document which records an agreement to negotiate the purchase of a business. It is a non-binding agreement (see page 20) which sets out the main points on which the parties to a transaction have agreed and the basis on which they are prepared to proceed.

As far as due diligence is concerned, the critical thing about signing Heads of Agreement is that there is a deal underway. Drawing up the document usually focuses the minds of both parties. The buyer will now have assured the seller of its seriousness, both parties will have decided that there is sufficient agreement between them to continue and both can draw comfort that the deal will go ahead because they can point to a document setting out the fundamental issues. Due diligence can therefore begin.

Due diligence

As explained in greater detail below and indeed in the rest of this book, due diligence assesses the deal from a commercial, financial and legal point of view. It is concerned with understanding more about the business being bought, confirming that the buying company is getting what it thinks it is buying, unearthing any risks in the deal, finding negotiating issues and helping to plan post-deal integration.

Skeletons found in due diligence should not normally break a deal but they will be negotiating points on the way, with luck, to agreement.

Stage 3 Negotiation and Agreement

Sale and purchase negotiation

With due diligence over, next comes the stage of finalizing the details of the deal. This is where everyone falls out, but eventually, after much posturing and horse-trading, negotiations are concluded, agreement is reached and the deal is signed. As mentioned above, due diligence feeds into the negotiations by identifying risks against which the buyer should negotiate some sort of protection. This could be through a price reduction or through a guarantee by the seller to compensate for any loss.

Completion

The due diligence is over, the terms of the deal are agreed, and completion is the process of actually signing the sale documents. For some strange reason there is an unwritten law that completion always happens at 4 o'clock in the morning, and usually at the weekend, even though all the participants struggle to avoid this!

Stage 4 Post-Completion – The Bit that Everyone Forgets

Of course the negotiating process is highly charged and extremely challenging. Not surprisingly a satisfactory conclusion, with the new acquisition in the bag, is often seen as an end in itself. Management are left exhausted and, after the thrill of the chase, too apathetic to manage the integration process.1 But, to paraphrase a well-known slogan, 'a deal is for life, not just for Christmas'. Once the deal is signed, the really hard work starts: that of making the return from the new acquisition justify the price paid. In the chase and excitement of the deal this phase is often overlooked. As is discussed in some detail below, due diligence should play a major role in shaping the post-completion plan. This leads on to the next topic, what should due diligence aim to achieve?

What is due diligence?

There is no dictionary definition of due diligence. There is no standard legal definition either. A lawyer would probably define it roughly as follows:

a process of enquiry and investigation made by a prospective purchaser in order to confirm that it is buying what it thinks it is buying.

Caveat emptor (buyer beware) is central to the whole acquisition process in Anglo-Saxon countries. Due diligence is the way buyers make sure they understand exactly what they are buying.

A dealmaker might go further. A dealmaker would say that due diligence is about reducing risk. There is no shortage of surveys which show how risky acquisitions are. As already noted, according to these surveys, at least half of all acquisitions fail. The true failure figure is probably more like three-quarters. The better the due diligence, the more buyers know about a target and therefore the more they know about the immediate risks they are taking on. As far as the dealmaker is concerned, therefore, due diligence allows an acquirer to:

- identify issues which feed into price negotiations, and hence reduce the risk of paying too much;

- de-risk the deal by identifying points against which legal protection should be sought.

In other words, the dealmaker sees due diligence as an aid to working out what contractual protection is required from the vendor and what risks the purchaser should avoid completely.

The problem with this thinking is that it sees the short-term issues specific to negotiations as being the same as those which in the end will dictate whether or not the deal will be a success. This may very well not be ...

Table of contents

- Cover

- Half Title

- Title

- Copyright

- Contents

- List of tables

- List of figures

- Preface

- 1 Introduction

- 2 How to structure a due diligence programme

- 3 Working with advisers

- 4 Financial due diligence

- 5 Legal due diligence

- 6 Commercial due diligence

- 7 Human Resources due diligence

- 8 Management due diligence

- 9 Pensions due diligence

- 10 Tax due diligence

- 11 Environmental due diligence

- 12 IT & production technology due diligence

- 13 Technology due diligence

- 14 Intellectual property due diligence

- 15 Antitrust due diligence

- 16 Insurance and risk management due diligence

- Appendix A

- Appendix B

- Notes

- Index