- 312 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

About this book

Executives are under enormous pressure to meet stakeholder expectations regarding the prevention of fraud and corruption. However, the drive to demonstrate that they are complying with legislative requirements and high principles has, in many cases, overshadowed the need to deal with the problem itself. As a result, fraud and corruption remain a significant unmanaged source of risk for many organizations. Drawing on experiences across Europe, America and Australia, Iyer and Samociuk give you the tools to establish an effective and far-reaching anti-fraud and corruption programme. Included is a compendium of techniques for assessing the true risk of fraud and corruption, reducing those risks and using health checks to provide early warnings. Also included is The Tightrope, A Story of Fraud and Corruption...which takes the reader from first suspicions through crisis and finally recovery in a vivid and instructive style, covering the lessons in the main text. This new book is a must-read for all those responsible for the prevention of fraud and corruption, risk management, corporate compliance, corporate responsibility and governance.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Fraud and Corruption by Nigel Iyer,Martin Samociuk in PDF and/or ePUB format, as well as other popular books in Business & Business General. We have over one million books available in our catalogue for you to explore.

Information

CHAPTER 1 The Greatest Unmanaged Risk

Corporate fraud and corruption are arguably the greatest unmanaged commercial risks of the day. But are management taking fraud and corruption seriously enough by making prevention integral to their business strategies? Many executives would argue that they are, after having spent the last couple of decades implementing extensive corporate governance and control frameworks which are supposed to do just that. Furthermore, these frameworks are regularly reviewed by internal and external auditors, lawyers, risk managers, compliance officers, audit committees and non-executive directors.

However, in spite of tougher legislation and vociferous corporate rhetoric in recent years, not that much has changed in the world of fraud and corruption. Reports of major frauds and bribery scandals are just as prevalent now as they were twenty years ago.

Could this be your organisation?

An email arrives at head office alleging that certain directors have been buying personal items on the company’s account and that some of the marketing expenses are not genuine. Furthermore, people who have spoken up are being quietly dismissed. It’s not the first email of this kind and rumours to this effect have been circulating for a while. However, financial results in the region are strong and local management resents interference. The tone of the emails is increasingly angry and some of the claims about fraud and corruption are hard to believe.

You are one of seven recipients of this email. You are not directly responsible for the division concerned and it is easier to close your eyes to unsubstantiated claims by assuming that they cannot be true.

What you are unaware of is that if enough resources were actually dedicated to uncovering the whole truth then you would find that many of the allegations are in fact true and just the tip of an iceberg. In reality profits are declining, losses are being systematically hidden in the books, some managers have covert ownership in business partners via offshore companies, property frauds are taking place and bribes are being paid in violation of the code of conduct.

You may think that this sort of thing would never occur in your organisation, but are you sure? At first glance, any organisation may appear to have procedures and controls in place to prevent fraud and corruption, but when examined through the sharp eyes of a criminal, it quickly becomes evident that many different methods of fraud and corruption could easily succeed. And when you are in business, fraudsters, corrupt employees and corporate psychopaths are always looking to find a way round your controls if they can.

If you would like to find out if your organisation’s defences are in fact a paper tiger, and if you wish to prevent fraud and corruption, to detect cases as early as possible and to put the lost profits back then this book is most definitely for you.

Overkill in bureaucracy and legislation

In recent years there have been improvements in reporting requirements and a greater level of awareness, but a lot still has to be done to prevent the recurrence of fraud and corruption. Rather than making the prevention of fraud and corruption central to their management style, many executives still tend to rely on the belief that people are honest. During numerous workshops over the past twenty years, we have been repeatedly told by employees in both large and small organisations that despite all the focus on controls, they can easily spot ways to defraud the organisation. The reason they haven’t done it is because they are honest. Sadly, the spate of recent corporate collapses and the fact that investigators around the world continue to prosper shows that there are plenty of dishonest people around.

So much time and effort has gone into creating corporate responsibility agendas, defining corporate governance and internal controls frameworks, and implementing risk management strategies that very little time has been left to get to grips with the actual risks of fraud and corruption, the way criminals think and the methods that they use. Fraud and corruption differ from many other risks in that they are aggressively perpetrated against the company by intelligent people who are continuously looking, covertly, to identify and target new loopholes for new opportunities. That is why it comes as a distressing shock to management and employees alike when a fraudster or corrupt individual is uncovered; the honest people find it very difficult to believe that dishonest people will affect their organisation.

Extensive efforts have been made around the world to improve laws and definitions to ensure that legal processes are capable of adequately punishing fraudsters, corrupt employees and corporate psychopaths. Up until now we have not seen the same effort made by organisations in detecting attempts and preventing them succeeding in the first place.

Furthermore, the overkill in bureaucracy and legislation is something which international criminals understand only too well. Provided they can stay one step ahead by using the latest tools and technology and are able to move money around offshore destinations, they face very little prospect of being caught. Even if the money is traced and they are facing charges, they usually can afford lawyers who have the capability and resources to win the war of attrition against government prosecutors.

A way of making money is to stop losing it

Once the opportunity to stop losing huge sums of money is recognised at the board level, there are effective measures which can be put in place to prevent fraud and corruption. Even for multinational organisations, the solution to the problem has to come from within because there is little help from governments or regulators on an international level.

Tackling fraud and corruption on an international level is always difficult as it takes so long to get agreement as to how to go about it. Even agreement on the definition of fraud and corruption is nowhere near an international standard. There are dozens of definitions of fraud and corruption in use around the world.

This book is aimed at helping commercial organisations boost profits by increasing resistance to fraud and corruption. Therefore we have adopted the widest and simplest definitions and classifications of fraud and corruption along the lines of ‘any unethical act done by anyone, which diminishes the value of the organisation’.

For the definition of fraud, we are using:

• ‘an intentional act by one or more individuals among management, those charged with governance, employees, or third parties, involving the use of deception to obtain an unjust or illegal advantage’ (International Auditing and Assurance Standards Board, 2004).

For the definition of corruption we are using:

• ‘the abuse of public or private office for personal gain’ (which is adapted from a World Bank definition by Huther and Shah in 2000 and the simplest we could find to apply to the commercial sector).

Therefore for practical purposes and to cover as many forms of inappropriate commercial behaviour as possible our definition of fraud and corruption covers:

• any form of theft in the widest sense.

• deception in reporting

• corruption and bribery in the widest sense.

and any other form of dishonest or unethical activity which eats into profits or harms reputation or the organisational culture.

It still may take years to reach international agreement on the definitions of fraud and corruption and on what it costs organisations and economies. Rather than waiting for precise international definitions to materialise we propose that organisations start tackling the problems by gaining a better understanding of the fraud and corruption risks that they face and then developing a much greater level of resistance to them.

Whether you are an employee, a manager or an executive director it makes sense to pay more attention to the behavioural aspects of fraudsters, corrupt employees or corporate psychopaths, rather than being blinded by accounting, legal or procedural issues.

Even were you to look at the potential fraud and corruption risks in your own job function, you should be able to see that there are ways to bypass the controls. If you cannot, then we hope to open your eyes to the world of possibilities of committing fraud or indulging in corrupt behaviour which exist. It is only once you have recognised the potential, that you can do something to prevent fraud and corruption.

Our aim with this book is to provide the practical solutions which create value and improve resistance to fraud and corruption. The story, called the Tightrope, included in this book, is based on an amalgamation of real-life experiences. Many of the corporate issues raised by fraudsters, corrupt employees and corporate psychopaths are illustrated there.

CHAPTER 2 Fraud and Corruption Demystified

The true cost of fraud and corruption

There is a wealth of academic and empirical research which demonstrates the extent and effect of corporate fraud and corruption. For example, research by the Association of Certified Fraud Examiners (2002, 2004, 2006) in the US across a wide range of industries has repeatedly indicated that:

• fraud and corruption are widespread problems that affect practically every organisation

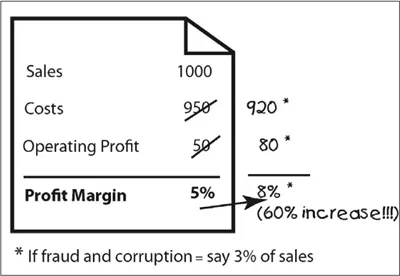

• the typical organisation loses 5 per cent of its annual revenues to fraud and corruption.

These US reports use the term occupational fraud and abuse to describe fraud and corruption stating that nearly half the incidents were detected by a tip-off rather than by active monitoring and control.

Corruption all over the world is a well-known and major problem. The word corruption features regularly in news bulletins and current affairs programmes. In some industries, for example construction, corruption can be found at every stage of the process, project and supply chain (Stansbury, 2005). It can involve major multinational companies, banks, government officials and trade unions

Recent national surveys on the cost of corruption tend to confirm the scale of the problem. In 2003 the World Bank Director for Global Governance, Daniel Kaufmann, said that a rough but conservative estimate of the cost of corruption to the global economy was 5 per cent of the world economy or about $1.5 trillion per year (Kaufmann, 2003).

However, the mounting piles of research, surveys and statistics are of little value in organisations if board executives and senior managers are reluctant to take fraud and corruption seriously.

Many senior executives believe either that their organisation is so much better than others that the likelihood of fraud and corruption is low, or alternatively that since there have not been many problems in the past then there cannot be any. They wait for a tip-off, and as a result, are often waiting whilst the damage is being done.

Once executives have experienced the effects of a major fraud or corruption scandal there is very little need to convince them to invest in preventing a reoccurrence. They also realise that their past inaction has led to significant losses. Because these losses eventually come off the bottom line, every dollar lost reduces net income by the same amount. If the profit margin of the organisation is say 10 per cent, then to recover the lost income requires 10 times the revenue to be generated. Hence to recover a $10 million loss requires $100 million of extra revenue.

In most cases the hidden indirect costs such as constraints on expansion and development, damage to reputation and employee morale greatly outweigh the direct costs.

Finally the costs of investigation are not to be taken lightly. If a case is complicated and involves the international movement of funds, then the investigation costs can be very complex. It is not unusual to spend $1 million on investigating a $10 million fraud. If it involves international money movement and offshore tax havens, this can cost from 30 per cent to 100 per cent of the amount lost.

Probably the single largest, and most ignored, cost element of fraud and corruption is the cost of all the on-going cases which have not been discovered and which are being carried by the organisation.

Figure 2.1 Hidden costs

Unfortunately, managers rarely set out to look for hidden costs (see Figure 2.1) caused by fraud and corruption and tend to ignore the warning signs.

Example

A multinational company recruited a new superstar to bring in fresh ideas to its management training schemes and gave him a free rein and a reasonable budget. The new manager immediately brought in some purportedly world-renowned management consultants. In order to be able to afford these consultants, it was necessary to displace (or make redundant) some of the employees in the training department.

It was subsequently discovered that the consultants (which were actually three front companies, all sharing the same remote farmhouse address) used low-paid sub-contractors to do the actual work. At least 80 per cent of the $2 million invoiced was discovered to be fictitious and the owner of the front companies had, amongst other things, settled the new internal training manager’s divorce payment as a reward for his cooperation. Worse still, he had been involved in a similar scheme in his previous job. In a post-mortem, it was estimated that at least 200 other senior managers had the same possibilities of abusing their budgets without this being detected by the routine internal controls. It was discovered later when a fraud and corruption health check was performed on major suppliers and their invoices that some simple tests would easily have detected this case and a number of similar incidents.

Given the speed at which business is done today, invoice approval and budgetary control are inadequate to prevent misuse of organisational funds. The average time taken by managers to check an invoice or payment instruction prior to approving it is about 15–45 seconds, with only a cursory glance if they believe that someone else has previously looked at it and given it the OK. Quite often, the person authorising the payment does not understand the underlying transactions which generated it. In spite of this, signatures and segregation of duties continue to be one of the main anti-fraud controls for many organisations. Fraudsters have realised that this opens up sizeable opportunities which can be exploited.

Example

A manager with a severe gambling problem used a ballpoint pen containing erasable ink to make out a spurious cheque to a genuine payee. He waited until his director had an office full of people before knocking on the door and r...

Table of contents

- Cover

- Half Title

- Title Page

- Copyright Page

- Table of Contents

- List of Figures

- List of Tables

- Acknowledgements

- Foreword

- 1 The Greatest Unmanaged Risk

- 2 Fraud and Corruption Demystified

- 3 Recognising and Respecting the Risk

- 4 Fraud and Corporate Risk Assessment

- 5 Upfront Prevention and Detection

- 6 Managing Incidents

- 7 Resistance – the Ultimate Goal

- Appendices

- References

- Index

- About the authors

- Novel