![]()

CHAPTER 1

Outsourcing Strategies

Jeff Thomis and Smita Desai, Quintiles Ltd

Outsourcing is the contracting of any activity or service to a third party (McHugh, Merlin and Wheeler, 1995; Drtina, 1994). The effect of outsourcing on companies is often described as a form of ‘vertical disintegration’ (Eroglin, 1994; Walker and Weber, 1984).

Outsourcing of goods and services is not new. In the eighteenth and nineteenth centuries, contracting was commonplace in England and included a range of public and private services. However, during the twentieth century internalisation of activities within companies became the dominant trend. Two key factors contributed to this re-internalisation, namely direct government involvement in economic activity and development of production technologies that favoured large, vertically integrated organisations. However, the same factors that forced the initial retreat from outsourcing, ultimately led to its resurgence in the 1980s and 1990s.

It is now argued that in order to achieve a long-term competitive advantage, an enterprise should focus on its core competencies and outsource activities for which it has neither a critical strategic need nor the capabilities (Quinn 1992). However, the problems associated with identifying core competencies, and the dawning that proprietary technical knowledge may not be the central basis for obtaining market leadership, has led to a rethinking of the reasons for outsourcing (Domberger, 1998). Domberger (1998) has argued that a better basis on which to make an outsourcing decision is that of specialisation and hence relative efficiency, leading to improvement in overall competitiveness.

This chapter focuses on pharmaceutical R&D outsourcing and discusses clinical development outsourcing strategies, the challenges of assessing pharma core competencies, strategies for working with contract research organisations (CROs), and last but not least, preferred supplier relationships and strategic outsourcing, the hallmark of future drug development successes. Subjects such as resource planning, insourcing versus outsourcing, decision hierarchy and accountability, importance of geography and potential for offshore sourcing and niche providers are all discussed within this context. Current practices are highlighted and models and best practices suggested whereby improvements upon these practices may be made.

OUTSOURCING OF PHARMACEUTICAL R&D FOCUSING ON CLINICAL DEVELOPMENT

Outsourcing in the pharmaceutical industry has traditionally implied converting the fixed costs of resources and infrastructure assigned to execute development activities, into variable costs. It involved paying a sub-contractor to perform these activities, mostly on an ad hoc basis. Such sub-contractors were either contract research organisations (CROs) or contract manufacturing organisations (CMOs). During the process, pharmaceutical companies, however, have always strived to retain the intellectual property associated with in-house product development.

History of clinical development outsourcing

Outsourcing of pharmaceutical R&D began in the 1970s. Although rather little is known about the early history of clinical development outsourcing, it is conceivable that the first areas to be outsourced were back-door and very process-driven activities. One such activity is data management, and in the late 1970s, as demands from regulators increased, so did the need for robust data management processes and the capability for handling larger volumes of data. Not surprisingly then, that this period saw the execution of the first large cardiovascular outcome studies which required the collection of comparable large datasets.

The pharmaceutical industry responded to this increased resourcing need, and projects with lower priority became candidates for outsourcing. At the same time, the need for more proper statistical analyses created a market for statistical consulting which rapidly developed into a new outsourcing market. Dennis Gillings, a professor of statistics at the University of North Carolina, Chapel Hill, and founder, Chairman and CEO of Quintiles, undertook his first consultancy in statistics for a pharmaceutical customer in 1974 and went on to establish Quintiles, an organisation which initially specialised in data management and statistical services, in 1982. Such an initial scenario was confirmed in a CenterWatch survey of 15 pharmaceutical companies (1998) in which data collection/monitoring and statistical analysis were identified as the most commonly used services (77 per cent and 57 per cent, respectively) with respect to outsourced projects.

During the 1980s, in the US in particular, the regulatory environment began to change. The Food and Drug Administration (FDA) incorporated the principles of the Belmont Report into the Code of Federal Regulations, passed the Safe Medical Devices Act, the Orphan Drug Act, and became an agency of the Department of Health and Human Services. Pharmaceutical companies began to feel the burden of having to provide increasing amounts of data of regulatory quality in support of each new drug application, and this effectively triggered an increased demand for the outsourcing of some or all of these activities.

Outsourcing of clinical monitoring and site management had an even slower start. The late Hein Besselaar, founder of Besselaar, now part of Covance, and Joe von Rickenbach, CEO of Parexel, were some of the early pioneers in this area, but it is safe to say that initially CROs were seen as ‘body shops’ or ‘capacity for hire’ by the pharmaceutical industry. Indeed, it is only really in the last ten years with the maturation of the outsourcing process, that CRO staff are now beginning to be seen as specialists and adding value to the clinical development chain value.

Growing acceptance of outsourcing

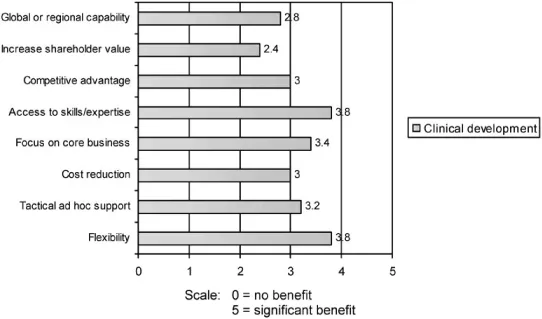

After a timid beginning, outsourcing is now well accepted and practised across the pharmaceutical industry. In a recent survey conducted among European-based pharmaceutical companies on behalf of Quintiles (Datamonitor 2003), access to superior skills/expertise, cost savings and increase in operational flexibility were identified as the top three outsourcing benefits, benefits shared with IT, financial and telecom industries (Figure 1.1). Similar levels of benefit are seen not only for the outsourcing of clinical development but also in the areas of product commercialisation and promotion.

Figure 1.1 Degree of benefit derived from outsourcing clinical development for specific business strategies

Most surveys conducted to-date continue to show that in the main, R&D and clinical development capacity shortfalls remain the principal motivation for outsourcing. Outsourcing is still largely conducted as a means by which the number of desired projects may continue to be carried out, without additional investment in in-house R&D, clinical development staff or infrastructure. Interestingly, 100 per cent of pharmaceutical industry respondents considered outsourcing important and 71 per cent stated that outsourcing will gain in importance in the next three years, a clear confirmation that the outsourcing process is maturing. However, cost, a fear of lack of quality and performance issues are still the main concerns with outsourcing.

Size of the outsourcing market

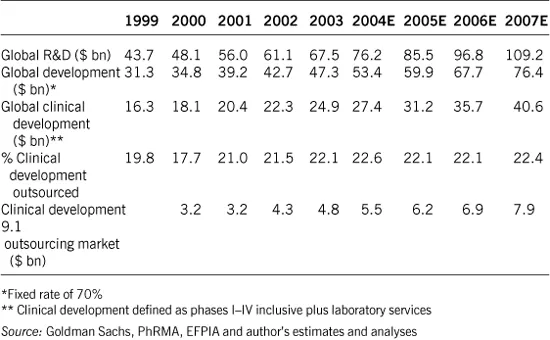

Although there is agreement that the CRO industry has seen unprecedented growth, reliable numbers are hard to obtain. Numbers of total R&D expenditure vary greatly between different reports, perhaps because some do not include biotech R&D expenditure (Table 1.1). In addition, outsourced penetration and how this divides between the various services (pre-clinical, phase I, II-III, IIIb-IV, central labs) is subject to a lot of interpretation.

Table 1.1 The global pharmaceutical R&D outsourcing market

One source estimates the global pharmaceutical and biotech R&D spend to be $76 bn in 2004, the development spend to be $53 bn and the outsourced market to be $11.4 bn (Goldman Sachs, 2004).

As would be expected given the fragmented nature of the CRO market and multiple definitions of outsourcing, analyst estimates of the size of the R&D and clinical outsourced development market vary. However, it is a recognisable trend that pharma companies are generally outsourcing a greater proportion of their clinical development work (Table 1.2).

Estimates of the overall penetration of outsourcing in clinical development was 21 per cent in 2004, with penetration of 95 per cent in central labs, 25 per cent in phase IIIb-IV, 16 per cent in phase I and 15 per cent in phase II-III.

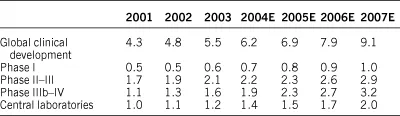

Table 1.2 Global clinical development outsourcing market ($ bn) by phase, 2001–2007

Outsourcing penetration is forecast to increase further, to an estimated 22.8 per cent in 2007 (Goldman Sachs, 2000, 2003), underscored by a favourable mix shift towards biotech, and growing economic justification for pharma to increase the percentage of their outsourced drug development.

The CRO industry has grown to meet the increasing demand, and it is currently estimated that the number of CROs worldwide has now reached over 1000 in spite of continued consolidation in recent years.

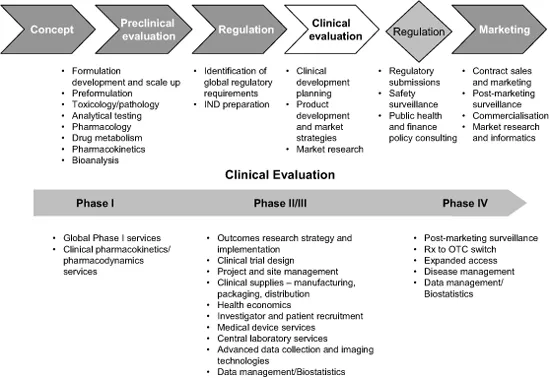

CROs now offer a wide range of services, from early development through clinical development and to late phase services. Some, such as Quintiles, are also able to provide services extending beyond drug development into drug commercialisation, as outlined in Figure 1.2.

Figure 1.2 Typical full service CRO services

In addition, the larger CROs are able to leverage their geographic coverage and their intellectual property to the strategic advantage of the pharmaceutical sector. Fluctuating drug development pipelines and high levels of product attrition still bedevil many pharma companies and with drug development costs still rising inexorably, many continue to search for more cost-effective and speedier solutions.

CROs which have a large global footprint are able to source and deliver large patient pools quickly, accessing these from research-naïve, yet populous, regions such as Central and Eastern Europe, Asia Pacific, India, China and Africa. They have been instrumental in driving training, accreditation, and increasing acceptance by regulatory authorities such as EMEA and FDA of data generated in these regions. In effect, they have paved the way for the inclusion of these regions into global medical R&D. Furthermore, many of the global CROs are leveraging the lower cost of the highly educated labour infrastructure in these regions to provide ‘back room’ services such as data entry and IT.

CROs are increasingly able to provide the pharma sector with significant strategic benefit, flexing their global footprints to achieve speedier, more cost-effective drug development. Some CROs are even taking this one step further facilitating risk mitigation during the drug development process, a topic we will return to later in this chapter.

OUTSOURCING STRATEGIES

Most pharmaceutical companies, irrespective of size, do not have a robust, strategically focused, outsourcing strategy. Portfolio management and headcount freezes continue to provide the rationale for outsourcing, sourced and fulfilled, mostly in an ad hoc manner.

Outsourcing continues to be viewed as an execution solution when the internal organisation cannot resource the study or project or when affiliates consider it of less importance for local business purposes.

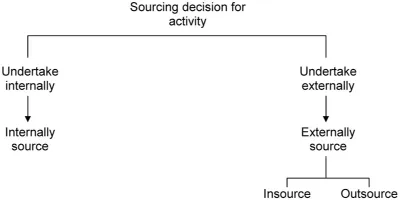

Outsourcing strategies can take different forms and shapes. The starting point, however, is the fundamental decision about whether to insource or outsource.

Decision hierarchy and accountability

The typical pharma clinical development decision tree for sourcing additional capacity is depicted in Figure 1.3.

The decision to either undertake a given clinical development activity internally or externally is, in most companies, a complex interaction between central R&D, local R&D or medical affairs, the central marketing department, affiliate companies and finance groups. Very often budgets for outsourced work, whether as a percentage of development spend or a dollar value, are agreed annually, and are driven by the need for short-term resources. Such a decision tree, and the budgetary process underpinning this sort of decision-making, is typical for tactical outsourcing.

Figure 1.3 Sourcing decision tree

The underlying characteristics of tactical outsourcing are that of a typical buyer-seller relationship for any kind of service or product. They are mostly controlled by a detailed scope of work and rigid contracts. They are mostly short-term in nature, although preferred provider agreements (PPAs) do often contain a promise for repeated work against the extraction of a volume discount or fixed and/or reduced hourly charge-out rates per resource category and definitions of hours spent on individual tasks. Value, in terms of how the CRO can deliver genuine added value rather than just vaguely defined values, such as therapeutic area expertise, tends not to be a consideration.

Accountability for tactical outsourcing, including PPAs, often lies with the outsourcing department, with or without tactical direction from corporate procurement and clinical development operational teams. Most companies have therefore set up cross-functional teams with clear roles and responsibilities, and with processes and practices for the selection of key suppliers in p...