eBook - ePub

Underwriting the Internet

How Technical Advances, Financial Engineering, and Entrepreneurial Genius are Building the Information Highway

- 312 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Underwriting the Internet

How Technical Advances, Financial Engineering, and Entrepreneurial Genius are Building the Information Highway

About this book

He covers the anti-trust case against Microsoft; the successes of eBay, Amazon, Yahoo, and Google; road-kills along the information highway such as the forgotten eToys; as well as the Enron implosion and other corporate scandals. After tracing this amazing story he concludes that the illegal practices and the ensuing USD7 trillion loss in equity markets slowed the Internet revolution but could not snuff it out, and with worldwide economic recovery e-business surges onward.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Underwriting the Internet by Leslie S. Hiraoka in PDF and/or ePUB format, as well as other popular books in Business & Knowledge Capital. We have over one million books available in our catalogue for you to explore.

Information

Chapter 1

Boom, Bust, and Recovery

The Internet Age, like most industrial epochs, was belatedly discovered by the hoi polloi because it arose so suddenly in the mid-1990s and revolved around not only arcane technology but atypical, almost maniacal financing. By 1999 the Nasdaq stock market that underwrote much of the dot-com (as in Amazon.com) phenomenon had surged to such frothy heights that an implosion was all but inevitable, even though media hypesters were cheering on a New Economy emerging from strong productivity gains that they predicted would keep the United States on an accelerating growth path. The vast wealth, created and lost in the blink of an eye, seared the ecstatic rise and agonizing collapse into the annals of business history and kept the Information Revolution, even with its momentary burnout, at the top of government and industry agendas into the new millennium. Already the instantaneous, low-cost communication network connects innumerable offices and homes, crossing oceans and national borders to encircle the globe. As a result, the loss of trillions of dollars in the stock market plunge is having only a transitory effect, with bankrupt e-commerce firms being replaced by a new generation of high-tech start-ups intent on succeeding in a more subdued environment.

The outlines of this resurgence are visible as software companies like Microsoft, Oracle, and SAP AG, the large German business-applications software company, continue their intense rivalry for network dominance. They are being joined by IBM, with its successful forays into software and services distributed over the World Wide Web. Cable operators are simultaneously increasing the carrying capacity of their online networks to allow faster electronic business transactions, transmission of information files, and multimedia interaction in real time. Networking moreover is still in its infancy, with innovators continuing to plan and implement new breakthroughs for the growing global system. Why did these activities continue to advance in the midst of a financial debacle? In retrospect, the Internet by the late 1990s had become such an accepted medium in communication, financial, and entertainment markets that the crash on Wall Street slowed but could not derail its forward momentum. Once clicked on, the World Wide Web permanently altered everyday life. Its use moreover was the latest manifestation of the Information Revolution in computing, software development, and networking, most of which were enabled by America's heralded technology that was used to vanquish fascism in World War II. Later technological breakthroughs also helped overcome a fierce industrial challenge from Japan and win a more menacing Cold War with the USSR.

The Internet's gestation period coincided with the Pax Americana following World War II and ensured that the government's meddling in the private sector would be minimized because of the absence of a pressing national security concern like global conflict. Hence the various stages of the Information Revolution, as listed on Table 1.1, could proceed and accelerate under free market conditions. Consumer demand, for example, ensured the rapid adoption of the personal computer, and with these ubiquitous terminals, users accessed cyberspace even as the U.S. Department of Defense was relinquishing control of its highly classified Arpanet communications network that began its evolution into the Internet. Entrepreneurs initiated projects to make use of the novel information superhighway spanning continents and oceans and developed the software and hardware that would connect the government-released Arpanet to private and foreign networks. Once the United States placed its wide area network in the public domain, other nations quickly connected their systems in order to keep abreast of the technology and to meet their own business and societal needs. The deregulation movement of the late 1990s also prompted a brisk innovation that burst forth in the free-for-all Internet milieu, with millions clicking on throughout the world to implement personal or business agendas or simply to "surf" the Net to see what the fuss was all about.

Various think tanks were similarly moved to monitor the Internet tidal wave, and the Paris-based Organization for Economic Cooperation and Development (OECD) reported on U.S. innovations in information technology (IT) and financial engineering even as the Nasdaq crash was causing the demise of innumerable dot-com start-ups.1 The industry's vicissitudes were also mirrored in the cover stories of Business Week magazine, with 'The Internet Age" appearing on newsstands on October 4, 1999, and 'The New Economy" issued on January 31,2000, both of which focused on productivity gains from the IT Revolution that would

Table 1.1

Stages in the Information Revolution

Stages in the Information Revolution

| Era | Period | Characteristics | Principal Firms |

| Main frame | 1964–1981 | Vertically integrated systems centered on large mainframe computers | IBM |

| PC | 1981–1994 | Distributed processing with personal computers widely available | IBM, Microsoft, Intel, Compaq, Dell |

| Dot com | 1995–2000 | IPO and venture capital financing of dot-com start-ups forms stock market bubble and ends in its crash | Netscape, Amazon.com, Yahoo!, eBay, Webvan, eToys, Excite@ Home |

| Internet | 1994– | Internet infrastructure developed in U.S. and extended worldwide; speeds communications and commercial transactions; increases productivity | AOL Time Warner, Cisco, Microsoft, Sun Microsystems, Oracle, SAP |

Source: Kenji Hanawa, “‘Information Technology Revolution’ Leads the U.S. Economic Expansion,” Sanwa Economic Letter, November 1999, exhibit 10. The Letter has ceased publication and was not copyrighted, and Japan’s Sanwa Bank changed its name after merging with another bank.

dampen if not eliminate the boom-and-bust nature of the business cycle. After the stock markets crashed, the magazine attempted a reevaluation with a backpedaling issue on March 26, 2001, on how it was "Rethinking the Internet."

Erratic Central Bank

Even more stunned with the startling reversal was the Federal Reserve Board of the nation's central bank, which under its chairman, Alan Greenspan, had steadfastly attempted to curb the "irrational exuberance" of the securities markets by raising short-term interest rates no less than six times in the absence of inflationary pressures. Sagging under the Fed's heavy-handedness, stock prices topped out in March 2000 and then precipitously fell, forcing a shaken Greenspan to reverse course in 2001 by dropping interest rates by several percentage points in a futile effort to stem losses amounting to trillions of dollars. Wall Street analysts were quick to blame the Fed chairman for doing "too little, too late." One irate columnist compared Greenspan to the central planners of the Soviet Union for practicing the black art of price-fixing in the manipulation of interest rates in, of all places, Wall Street, the bastion of U.S. capitalism.2 The "irrationally exuberant" remark was also a pompously obtuse expression characteristic of the central banker, which made him the target for all economic ills. Pundits quipped that a mutation of the mad cow pathogen wracking the English countryside had infected the Federal Reserve, giving it "mad Dow's disease" and a feverish desire to topple the Dow Jones industrial index.

The Fed's tight monetary policy, moreover, proved damaging when the sudden and prolonged slowdown caused the worst job loss—particularly affecting IT industries—in twenty years. Even as the economy revives, employers are reluctant to add to their payroll for fear that Greenspan will whiplash them again with another round of up-and-down interest rate moves. The Fed chief, after all, moved to end, in his words, "a once-in-a-generation frenzy of speculation,"3 only to make a U-turn when the central bank began to worry about a deflationary spiral of falling prices that crimped corporate profits and business investments. While overly concentrating on excessive stock market prices, the Fed failed to adequately monitor bank-lending practices, particularly in their structuring of over-the-counter derivatives with corporate borrowers. Use of these contracts—also called swaps, options, and futures—quintupled in value to $29 trillion, a development applauded by Greenspan because they allowed business to hedge adverse price and interest rate fluctuations. There was unfortunately a darker side to this topsy-turvy growth even as the central bank chairman was successfully leaning on the Commodity Futures Trading Commission to refrain from regulating the secretive transactions.4 Without the oversight, two of the nation's largest banks set up offshore entities that engaged in sham transactions with energy producers like the Enron Corporation to mislead investors and employees. This resulted in equity losses of $200 billion when the stock market crash eviscerated their stock holdings in the energy companies. The banks were forced to pay $300 million in fines and penalties in a settlement reached with the Securities and Exchange Commission and the Manhattan district attorney's office. Such deceptions were also involved in the bankruptcy of Enron, WorldCom, and Global Crossing, the transoceanic fiber-optic telecommunications carrier, wreaking havoc on the economy and on investor confidence and delaying economic recovery even after the Federal Reserve had shoved interest rates to near zero. As to why events had seemed to spin out of control, Greenspan, in testimony to the Senate Banking Committee, pointedly blamed corporate greed as well as fraudulent accounting practices:

At root was the rapid enlargement of stock market capitalizations in the latter part of the 1990s that arguably engendered an outsized increase in opportunities for avarice. An infectious greed seemed to grip much of our business community. Manifestations of lax corporate governance, in my judgment, are largely a symptom of a failed CEO....I was really deeply distressed to find that actions were being taken which very clearly indicated a lack of awareness of where the market value of accounting is.5

In his testimony, Greenspan failed to mention his trip to Dallas on November 13,2001—weeks prior to the Enron bankruptcy—to receive the Enron Prize for Distinguished Public Service from Ken Lay, who was soon to become the epitome of corporate greed. It was probably because the chairman was too burdened with the Fed's lack of success in stimulating the economy. The Bush administration subsequently proposed massive tax cuts that are resulting in record budget deficits and the possibility of more inflation and yes, higher interest rates. With the Fed seemingly stuck on a merry-go-round, is it any wonder that business investment and hiring remained sluggish in 2003, despite an economic recovery?

Internet Advances Stall

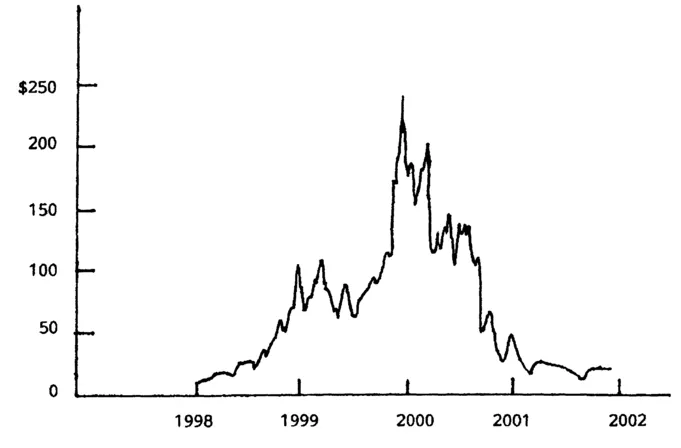

The capital markets crash and economic downturn undermined but failed to stop the Internet Revolution, which had been underwritten by generous financing from Wall Street. While much of the funds were misspent in an orgy of corporate greed, approximately $14 trillion generated during the 1990s was used to develop the Internet's commercial infrastructure and launch start-up firms that processed myriad interactions on the World Wide Web. A major participant in this exuberant period was the Internet portal company Yahoo! that was founded in California's Silicon Valley in 1994. Its youthful founders witnessed its share price soar to $240 a share to give the small firm a market capitalization value of $150 billion and an immediate presence in technical and marketing circles. And even though its stock promptly slid down the other side of the price curve as depicted on Figure 1.1, the company had accumulated sufficient resources and brand recognition to remain a permanent fixture on the Internet firmament. Such spikes were duplicated throughout the high-tech sector, leading to massive layoffs and corporate bankruptcies. Business slowed so quickly that it prompted John Chambers of Cisco Systems, another high-flying company, to proclaim: 'This may be the fastest any industry our size has ever decelerated," and he further characterized the adverse effects as being struck by a flood that comes every hundred years.6 Cisco, however, also had sufficient reserves and managerial talent to survive the cataclysm.

While the two companies can be categorized as Internet firms, each was in a separate part of the burgeoning business, with Yahoo! deriving most of its revenues from banner advertising on its Web pages and Cisco manufacturing routers and switches—principal hardware items that form the backbone of the network—in addition to selling its proprietary operating system software that controlled its computers. In the ensuing downturn, Yahoo! earnings tumbled into the red as major advertisers scaled back on Internet ads, finding them not as effective as those broadcast on television. The company discovered that TV viewers were willing to tolerate commercials while watching favorite programs, but Internet users easily ignored the static ads while selectively absorbing the information that had brought them to the screen. Another negative repercussion for both firms was the demise of numerous start-up firms that had been major advertisers for Yahoo! and buyers of Cisco's products and services. In 2000, firm failures began with one to two per month, reaching 16 and 20 in June and July. By November and December, monthly failures reached a "flood" stage of 46 and 40, respectively, with the year's total coming to 210. The torrid pace continued into 2001.7 By then, surviving firms were limping badly, and with equity prices plunging, there was no place to go for a quick capital infusion that could carry a cash-starved firm through what had become a very bleak period. The downward spiral fed on itself, with falling sales and earnings producing sell-offs in stock prices and finally layoffs and bankruptcies. The Wall Street plunge that began on March 20,2000, reached bear-market depths one year later when Standard & Poor's five-hundred-stock index dropped by 22.7 percent. A drop of 20 percent defines a bear market, and the attribution has been given to nine periods since the massive crash of 1929. That debacle saw a much smaller stock market fall a numbing 86.2 percent, reaching bottom in 1932. It furthermore precipitated the Great Depression, thus spreading a long-lasting pain over ensuing decades. The severe times, moreover, were exacerbated by a phlegmatic

Figure 1.1 Yahoo! Share Price

Source: "Going Down with the Dot-Coms," New York Times, March 11, 2001, section 3, p. 14.

Federal Reserve that adopted a tight monetary policy to purge equity markets of excessive speculation that had run rampant in the preceding Roaring Twenties. The central bank, at the time, did not know any better and consequently reverted to its traditionally conservative stance of administering bad medicine to a sick economy, unknowingly prolonging the Depression. In the current downturn the Fed has been impelled to move faster to combat recessionary forces, and it is pumping money into the economy to counteract the equity losses on Wall Street. Severe damage, however, has already been done, especially on the Nasdaq, where high-flying Internet issues like Cisco Systems and Yahoo! trade. That exchange fell a breathtaking 61.9 percent from March 2000 to March 2001, and wobbled near its lows for the following year and a half. Fortunately for American investors, other equity markets were not so wretchedly affected: The Dow Jones industrial average of big, blue-chip companies like IBM and GE fell only 13 percent in the same period. Nevertheless, the Internet bubble lured so many investors into high-tech stocks and out of more conservative issues that personal fortunes were severely impacted as investor favorites like Cisco and Oracle shares dropped by 75 percent, Intel by 60 percent, and Microsoft by 53 percent. Smaller firms were dumped by panicky individuals and mutual fund managers, with Yahoo! and JDS Uniphase, an optical networking newcomer, falling by 90 percent or more. In spite of the losses and ensuing layoffs, most of these enterprises remain viable businesses with sought-after products and frequently visited Web sites. They are hanging on in hopes of seeing better times, particularly as fiscal and monetary authorities move to stimulate economic activity with interest rate and income tax cuts. Others like Pets.com, eToys, Webvan, and Planet Rx (Internet seller of prescription drugs) were not so lucky. These e-commerce "shooting stars" burned through millions of dollars of venture capital and initial public offering (IPO) funds before crashing to earth without earning a dime for many of their investors. How could these supposedly knowledgeable individuals lose so much money that they had earned over many years of employment and even earmarked for retirement? 'This is the central paradox of the dot-com phenomena: that a set of inspiring ideas about how to use new technologies and build new kinds of organization got transmogrified into a destructive orgy of speculation, greed and envy."8

In retrospect, the greed and hubris of entrepreneurs, venture capitalists, Wall Street stock analysts, and investment bankers should not overshadow the accomplishments of the Internet Age that saw the massive development of the new medium's infrastructure, allowing the Net to be clicked on by growing millions of people and businesses in every minute of a given day. Trillions of dollars of equity wealth have disappeared, but the American economy has suffered through only a mild recession of two consecutive quarters of negative growth. Interest rate and income tax cuts to counteract the downturn were enacted, and the United States is experiencing few macroeconomic destabilizing forces such as inflation that could stymie growth. The equity losses have compelled the government to regulate the various excesses that inflated and burst the Internet bubble, but its often clumsy ways of implementing change will probably have minimal impact on an industry that is changing so swiftly. Moreover, the securities business already has procedures for determining if investors have legiti...

Table of contents

- Cover

- Half Title

- Title

- Copyright

- Dedication

- Contents

- List of Tables and Figures

- Preface

- 1. Boom, Bust, and Recovery

- 2. Arpanet and PC Prelude

- 3. The Information Superhighway

- 4. Dot-com Front-runners

- 5. Dot-com Roadkill

- 6. Microsoft Curbed

- 7. The Bubble Bursts

- 8. The Enron Debacle

- 9. The Telecom Crash

- 10. The Revolution Lives

- 11. Epilogue: Downloading Music and Doing No Evil

- Notes

- Bibliography

- Index