- 200 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Risk and Financial Management in Construction

About this book

In today's climate the need for a closer understanding of the relationship between the two inter-related topics of risk management and finance on construction projects is becoming increasingly crucial to achieving the objectives of the investor, the end-user and the constructor and its supply chain, especially as interest in PFI and PPP arrangements continues to grow around the world. Risk and Financial Management in Construction shows the relationship between the Construction Project Manager's task of balancing time, cost and quality and the need to satisfy the client's requirements efficiently, effectively and professionally whilst at the same time contributing to the contractor's future sustainability. The book covers Risk Management describing the tools and methods to reduce the occurrence and consequences of risk, and the financial management of construction projects from raising funding, to contract strategy and through to estimating, budgeting and cost control. It includes a chapter covering international project risk, bringing together the issues of risk management, prime contracting, and PFI funding for construction projects undertaken away from the contractors main home market. Risk and Financial Management in Construction is aimed at those practising in, or studying to enter, the project management profession in providing a strategic and operational knowledge of these subjects allowing the reader easy access to the key points through a wide selection of models, checklists and easy to find lists in all of the key areas.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

At the moment all of our mobile-responsive ePub books are available to download via the app. Most of our PDFs are also available to download and we're working on making the final remaining ones downloadable now. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Risk and Financial Management in Construction by Simon A. Burtonshaw-Gunn in PDF and/or ePUB format, as well as other popular books in Business & Business General. We have over one million books available in our catalogue for you to explore.

Information

PART 1

Construction Risk

Management

CHAPTER 1

Risk Management in

Construction Projects

Risk Management and the Role of the Project Manager

Risk Management is a means of dealing with uncertainty – identifying sources of uncertainty and the risks associated with them, and then managing those risks such that negative outcomes are minimized (or avoided altogether), and any positive outcomes are capitalized upon. The need to manage uncertainty is inherent in most projects which require formal project management. In looking at risk management and the role of the project manager it should be noted that risk management cannot be owned by one individual on a project and that all team members must be ‘risk aware’ and participate in activities to improve a project’s position, through Action Plans, which are part of the main Project Plan. The two objectives for the deployment of the discipline of risk management are:

- To plan and take management action to achieve the aims of removing or reducing the likelihood and effects of risks before they occur and dealing with actual problems when they do; and

- To continuously monitor potential impacts of risks, review the associated action plans, and provide and manage adequate financial and schedule contingencies for risks should they occur.

To be fully effective, project managers need to recognize that risks exist and actively manage them; this should be viewed as an indication of good project management; not an admission of failure. By looking ahead at the potential events that may impact the project and putting actions in place to address them (where appropriate), project teams can proactively manage risks and increase the chances of successfully delivering the project within the time, cost and quality project requirements. Whilst, in the early days of project management, great emphasis was placed on managing cost and schedule adherence, in the 1980s companies recognized the need to integrate technical risk with cost, schedule and quality risks and thus risk management systems were developed to become a key project management discipline.

It should be noted that the project manager’s responsibility is not to make risks ‘disappear’ but to manage and communicate these through the implementation of a systematic risk management process. Often it is not possible for the project team to identify all risks as the unexpected may still occur, however these instances should be very rare and project staff should be familiar with dealing with other examples of risk occurrence and mitigation. All project staff will have some level of responsibility for internal control as part of their accountability for achieving both the project’s and their own objectives. Indeed this is even true of those above the direct project teams, as The Institute of Chartered Accountants report:

‘They, collectively, should have the necessary knowledge, skills, information and authority to establish, operate and monitor the system of internal control. This will require an understanding of the company, its objectives, the industries and markets in which it operates and the risks that it faces.’

Internal Control, Guidance for Directors on the Combined

Code on the Committee on Corporate Governance,

The Institute of Chartered Accountants

Code on the Committee on Corporate Governance,

The Institute of Chartered Accountants

Looking at risk management from the most senior level of the organization, from December 2000 all London Stock Exchange listed companies have been required to comply fully with the Turnbull Report on Corporate Governance which notes that:

‘Risk management is essential for reducing the probability that corporate objectives are jeopardised by unforeseen events. All that the company is trying to achieve can be affected by risk exposure. They should be proactively managed.’

Implementing Turnbull, A Boardroom Briefing

The Institute of Chartered Accountants

The Institute of Chartered Accountants

The Institute of Chartered Accountants also reported on the above that:

‘non compliance with the Turnbull guidance would result in an embarrassing disclosure in the annual report that could attract attention of the press, shareholder activists and institutional investors.’

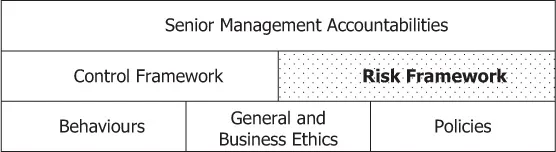

Given the importance of the above issues on corporate governance and its relationship to being able to demonstrate responsible risk management, many of the larger organizations in the UK embed risk management within their corporate governance model with a typical framework approach being shown in Figure 1.1. This framework of corporate governance illustrates the philosophy that effective controls start with the company’s executive in providing strong leadership with clear accountability. The purpose of the risk framework sets out the central philosophies for controlling the organization’s activities. These are then traditionally underpinned by requirements regarding behaviours, ethics and compliance with the organization’s policies.

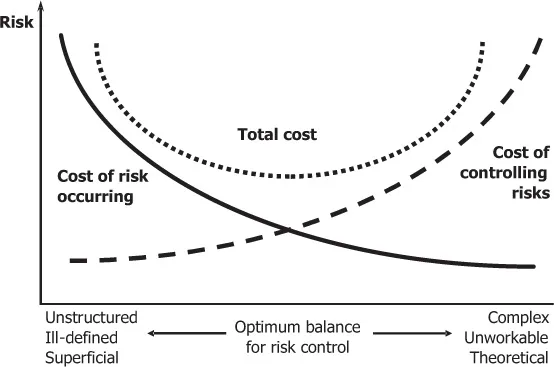

Another view of relating risk management to the role or culture of the company is illustrated in Figure 1.2, which shows a clear relationship between an organization’s objectives, risk and controls and its risk exposure. By proactively addressing risks correctly the project should cost less, be completed more quickly and produce products more likely to meet the client’s requirements.

Figure 1.1 Typical corporate governance model

Figure 1.2 Balancing risk and control

As such the test of an organization’s commitment to achieving effective risk management is the visible willingness to allocate budget or other resources to risk actions at each stage of the project. Although this may imply that all the actions are on the senior management of the organization, the responsibilities for risk management are far wider than this as both the project manager and project teams have direct project and governance responsibilities in adhering to the corporate risk requirements.

All organizations have a mixture of expressed or implied objectives. Risk management as a process for avoiding risk will actively support the achievement of those objectives, indeed when used well it can actively allow an organization to take on activities that have a higher level of risk (and therefore the opportunity to deliver a greater benefit), because the risks have been identified, are understood and are being actively managed. Risks can be managed through the operation of controls. However, even high levels of investment in control processes will not always eliminate all risk and any remaining risk becomes the organization’s ‘exposure’ to risk. This is also known as its net or residual risk.

Overview of the Risk Management Process

Individuals and organizations need to have an all-round approach to risk management; the most progressive risk management organizations achieve this by a uniform balance of tools, process, attitude and SQEP (suitability qualified, experienced/knowledgeable personnel). Risk management has evolved into a formal systematic process of identifying potential risk or uncertainties and developing, selecting and managing options for addressing the risks throughout the life of the project. Risk evaluation is a key element of the corporate system for managing business risks with its main focus on identifying risks, evaluating their severity and managing the process.

Whilst risk management may be a proactive approach it cannot control future events but will allow decisions to be made and actions taken if such identified risks become reality. An understanding of risk comes from a realistic understanding of what can go wrong, the likelihood of the event occurring and the consequences of such an occurrence. On the basis of such an understanding a number of actions are open to organizations to manage the risk and, to a large extent, such response will be a function of the probability and quantified consequences of the risk occurring.

To support this process there are a number of common descriptions of the risk management process steps but in general they all follow a similar basic approach of risk identification, risk quantification, risk response and risk control, as shown in Figure 1.3 which has a similar four step approach of risk identification, assessment, control and recovery.

Clearly all risks cannot be controlled but to ignore risks and the risk mitigation tools covered in the following chapters will undoubtedly lead to adverse consequences on a project. Such consequences of failing to deal effectively with risk can include loss of credibility and may include personal or organizational liability and fines. Other important consequences include significant cost overruns, inability to achieve desired the project technical objective(s), schedule delays, project de-scoping and ultimately project cancellation. All of which are likely to lead to unhappy clients and a significant reduction in future project opportunities with the same client.

Risk Management in the Project Lifecycle

Different risks occur at different times or stages in the project and no investment or even short-term production process can be planned without taking into account the associated risk during its lifecycle. In reality every project contains a component of risk which results in the necessity to assess and reduce the associated threats. On this premise, risk management is a continuous process which should be conducted at every stage of the project; from its emergence through to completion and operational use. It is important to eliminate risks as early as possible; for instance at the stage of analysis of the project value and at the cost analysis stage during the project implementation. The main objective is to identify the problem as well as its significance; together with any associated benefits with the risk management process. This identification can be documented as part of the ...

Table of contents

- Cover Page

- Title Page

- Copyright Page

- Contents

- Acknowledgements

- List of Figures

- Preface

- Introduction

- PART 1 Construction Risk Management

- PART 2 Financial Management

- References

- Glossary

- About the Author

- Index