- 176 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

About this book

With the Solvency II deadline approaching, and full implementation expected from January 2016, affected entities are at varying states of readiness with embedding Solvency II into everyday practices becoming a major focus. Programme stakeholder communications needs to be robust to secure compliance and buy-in on both internal and external fronts. If your CEO fails to communicate to the markets your organization's ability to deliver on the EU Directive, or if a local Regulator finds that your Board has failed to embed a risk culture that is aligned with Solvency II, your ability to operate in the Solvency II world will be questioned. Solvency II: Stakeholder Communications and Change explains how to negate such risks. Gabrielle O'Donovan demonstrates how to approach stakeholder communications and change management in a structured and disciplined way, framed by the EU Directive's governance requirements. She demonstrates how to use a variety of tools and techniques to engage people with change and embed new ways of doing things. She reveals how to embed risk consciousness into your culture, helping you secure Solvency II approval and operate successfully in the Solvency II world. Based on the author's original research and the latest industry developments, Solvency II: Stakeholder Communications and Change is well-structured, readable and above all essential for all involved in Solvency II implementation.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Solvency II by Gabrielle O'Donovan in PDF and/or ePUB format, as well as other popular books in Business & Business General. We have over one million books available in our catalogue for you to explore.

Information

| CHAPTER 1 |

INTRODUCTION

The European insurance industry accounts for 33 per cent of the global market, making it the largest in the world. It is made up of a robust London market, the Continental Europe market, and the developing markets of Eastern Europe and Russia. Its business encompasses life insurance and general insurance, the former covering plans which relates to a person’s life with the latter covering motor, health, property and all other types of non-life related risks.

The industry employs nearly 1 million people directly, and another million are outsourced employees and contractors. In 2012, it invested more than €7,400 billion in the global economy, life insurers paid out around €646 billion in benefits while non-life insurers paid out almost €313 billion. Total gross written premiums for the whole European market amounted to €1,100 billion. According to Insurance Europe, the European insurance and reinsurance federation, the sector has the largest pool of investment funds in the European Union, with almost €8,400 billion invested in the global economy in 2012. This is equal to 58 per cent of the GDP of the EU.1

Each European Union (EU) member state has its own insurance regulator. However, EU regulation sets a harmonized prudential regime throughout the whole of the Union. This is supervised by the European Commission (EC).2

1.1 EU SOLVENCY REGIME CHANGE

1.1.1 Background

The original EU Solvency regime for the insurance industry was developed in the 1970s to provide a standard for monitoring the economic capital held. Solvency I defined the capital requirement by specifying simple, blanket Solvency margins. Over time, inadequacies in the regime became apparent:

• It was not risk sensitive and could require entities to carry too much, or not enough, capital.

• Different application was allowed by different EU member states, allowing for significant divergence across territories, hampering cross-border regulation and causing regulatory arbitrage.

• Insurance Solvency could not be judged based on information published.

• ‘Good’ behaviour was restricted.

• Financial conglomerates were not being regulated consistently.

• With accounting standards moving to a ‘Fair Value’ approach as part of the new International Financial Reporting Standards (IFRS), the need to improve consistency between published accounts and Solvency valuations gained momentum.

These issues led to the development of Solvency II.

1.1.2 The Solvency II Regime

Solvency II is a fundamental review of the capital adequacy regime for the European insurance industry.3 It’s a major EU Directive and applies to all EU-based insurers and reinsurance entities with gross premium incomes exceeding €5 million or gross technical provisions in excess of €25 million.4

The aim of Solvency II is to establish a revised set of EU-wide capital requirements and risk management standards which will replace current requirements. The objectives of the European industry for Solvency II are as follows:

1. To align capital requirements with the underlying risks of an insurance company.

2. To maintain strong, effective policyholder protection while achieving capital allocation.

3. To develop a proportionate, risk-based approach to supervision with appropriate treatment both for small companies and large, cross-border groups.

4. To provide incentives to insurers to adopt more sophisticated risk monitoring and risk management tools – this would include developing full and partial internal capital models and increased use of risk mitigation and risk transfer tools.

5. To achieve a harmonized approach to supervision across all EU markets – this will help to ensure there is a level playing field for all insurers and should provide a common standard of protection to all consumers regardless of the insurers’ legal form, size or location.

6. To increase competition within EU insurance markets and the global competitiveness of EU insurers – reducing or removing unnecessary regulatory constraints and adopting a coherent ‘lead supervisor’ approach for pan-European groups. This will provide more choice and a better deal for EU consumers, and also enable EU insurers to compete more effectively in global insurance markets, in line with the Lisbon agenda.5

Solvency II sets out new, strengthened EU-wide requirements on capital adequacy and risk management for insurers. When it comes into effect on 1 January 2016, it is expected to reap the following benefits:

• more protection for policyholders;

• reduced risk of market disruption;

• better risk-based capital assessment through the use of Internal Models and a closer link between capital and risk;

• best practice risk management and governance;

• a more informed and assured basis for decision-making;

• industry homogeneity and alignment.

Solvency II has been created in accordance with the Lamfalussy process which is an approach used by the European Union for the development of financial service industry regulations. Originally developed in March 2001, it is named after Alexandre Lamfalussy, the chair of the EU advisory committee which created it. The process is composed of four ‘levels’, each focusing on a specific stage of the implementation of legislation:

• Level 1: framework principles: developing a European legislative instrument (or Directive) that sets out core values and essential framework principles, including implementing powers for detailed measures at Level 2.

• Level 2: implementing measures: sector-specific committees and regulators developing more detailed implementing measures (prepared by the EC following advice from the Committee of European Insurance and Occupational Pensions Supervisors (CEIOPS))6 that are needed to operationalize the Level 1 framework legislation.

• Level 3: guidance: CEIOPS working on joint interpretation recommendations, consistent guidelines and common standards. CEIOPS also conducting peer reviews and comparing regulatory practice to ensure consistent implementation and application.

• Level 4: enforcement: more vigorous compliance and enforcement action by the Commission is underpinned by enhanced cooperation between member states, regulators and the private sector.

Ironically, the Lamfalussy process was established to fast track regulation implementation but, given how many years it is taking to implement Solvency II, one cannot help but wonder what the slow track process would look like.

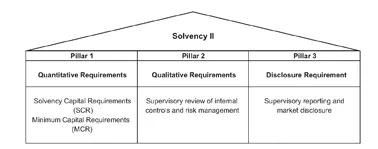

Although there is no reference to ‘pillars’ in the Directive, Solvency II has become synonymous with the ‘Three Pillar Approach’ adopted by CEIOPS to help frame the regulatory review process:

• Pillar 1 focuses on quantitative requirements such as valuing assets, liabilities and capital.

• Pillar 2 focuses on supervisory activities which provide qualitative review through the supervisory process including a focus upon the company’s internal risk management processes.

• Pillar 3 addresses supervisory reporting and public disclosure of financial and other information by insurance companies.

To use an everyday analogy, Pillar 1 is about checking out a car by its appearance, Pillar 2 is about checking under the bonnet for a closer examination while Pillar 3 is about allowing the neighbour around to inspect it.

Figure 1.1 The three pillars of Solvency II

Source: PricewaterhouseCoopers.

Recently, data management has emerged as the ‘hidden pillar’. With this approach, Solvency II sets out new Solvency Capital Requirements (SCR) and Minimum Capital Requirements (MCR). The SCR represents the normal target level of capital for an insurer while the MCR is the absolute minimum threshold whereby, should a company fall below this level, they will be forced to cease writing business.

The formulae used to calculate the SCR will include the risks outlined below, with correlations between each risk integrated into the calculations:

• Insurance and Reserve Risk – risk arising from insurance contracts. It relates to the uncertainty about the result of the insurer’s underwriting.

• Catastrophe Risk – related to potential losses associated with major catastrophes that have been insured against.

• Interest Risk – exists for all assets and liabilities of which the net asset value is sensitive to changes in the term structure of interest rates or interest rate volatility.

• Equity Risk – arises from ...

Table of contents

- Cover

- Half Title

- Dedication

- Title Page

- Copyright Page

- Table of Contents

- List of Figures

- List of Tables

- About the Author

- About this Book

- Forewords

- Acknowledgements

- Testimonials

- Glossary of Terms

- 1 Introduction

- 2 Industry Impact and Response

- 3 Framing the Stakeholder Challenge

- 4 The Solvency II ‘Culture Test’

- 5 Change Management

- 6 Stakeholder Analysis

- 7 The Stakeholder Communications Strategy

- 8 Communication Plans

- Appendices

- Bibliography

- Index