Applying MBA Knowledge and Skills to Healthcare

- 156 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

Applying MBA Knowledge and Skills to Healthcare

About this book

Clinicians increasingly need a firm grasp of the fundamental principles of business management, finance and related subjects. Even so, business disciplines are still rarely taught during medical training, while busy practices and complicated accounting tasks mean that gaining business acumen 'on the job' is impractical for many. As a result, increasing numbers of clinicians learn the skills they need by taking an MBA (Masters in Business Administration). While an MBA may be the answer for some, the formidable costs and time commitment it demands leave many busy practitioners seeking more accessible options. This book provides a readable, tightly organised alternative - a primer on MBA principles and their practical application. Twelve compact, carefully structured modules cover the entire gamut of a business education, from basic finance and accounting principles, to strategic management methods and leadership theories. Unlike some similar texts, this book is designed to be light in tone, easy to read and digest, and thoroughly practical. Busy clinicians, academic surgeons, administrative physicians and other healthcare professionals will find this an invaluable resource in understanding the core principles of business management. Allied medical professionals, and nurses will also find it useful, as will interview candidates who increasingly face management questions as part of selection processes. 'An invaluable resource in understanding the core principles of business management, and in learning how to apply them. For busy clinicians, the value proposition is enormous in terms of the knowledge gained, versus the amount of reading required to capture what the authors have so capably managed to distill between the covers. The authors have done a remarkable task in capturing the latest concepts and thinking in the business management arena [and] the essence of an entire MBA education, and customise it for healthcare professionals. A delight.' From the Foreword by B Sonny Bal

Frequently asked questions

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Information

MODULE 1

Accounting and finance

Accounting

- ➤ Financial accounting – focuses on information for people outside the firm. These may include creditors and outside investors, who are not part of the day-to-day management of the company. Government agencies and the general public are external users that may be interested in accounting information.

- ➤ Management accounting – focuses on information for internal decision makers, such hospital administrators.

Finance

Company law requirements for financial accounts

- ➤ Directors’ report – Description by the directors of the performance of the business during the accounting period + various additional disclosures, particularly in relation to directors’ shareholdings, remuneration, etc.

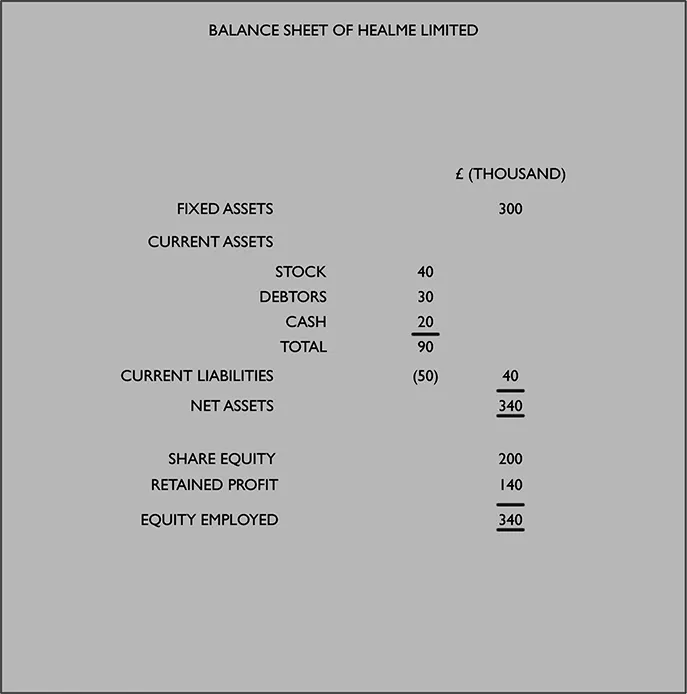

- ➤ Balance sheet – Statement of assets and liabilities at the end of the accounting period (a ‘snapshot’) of the business.

- ➤ Profit and loss account – Describing the trading performance of the business over the accounting period.

- ➤ Statement of total recognised gains and losses.

- ➤ Cash flow statement – Describing the cash inflows and outflows during the accounting period.

- ➤ Audit report.

- ➤ Notes to the accounts – Additional details that have to be disclosed to comply with Accounting Standards and the Companies Act.

- ➤ balance sheet

- ➤ profit and loss account

- ➤ cash flow statement.

The accounting formula

Assets

Equity

Liabilities

Balance sheet

Profit and loss account

Table of contents

- Cover

- Half Title

- Title Page

- Copyright

- Table of Contents

- Foreword

- About the authors

- List of abbreviations

- Introduction

- Module 1: Accounting and finance

- Module 2: Operations management

- Module 3: Marketing in healthcare

- Module 4: Strategic management for clinicians

- Module 5: Information technology (IT)

- Module 6: Human resource management

- Module 7: The clinical team

- Module 8: Clinical leaders

- Module 9: Managing clinicians’ performance

- Module 10: The learning and teaching clinician

- Module 11: Coping with change in the clinical environment

- Module 12: Innovation in medicine

- Glossary

- Index