- 232 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

A Short Guide to Contract Risk

About this book

Savvy managers no longer look at contracting processes and documents reactively but use them proactively to reach their business goals and minimize their risks. To succeed, these managers need a framework and A Short Guide to Contract Risk provides this. The foundation of identifying and managing contract risk is what the authors call Contract Literacy: a set of skills relevant for all who deal with contracts in their everyday business environment, ranging from general managers and CEOs to sales, procurement and project professionals and risk managers. Contracts play a major role in business success. Contracts govern companies' deals and relationships with their suppliers and customers. They impact future rights, cash flows, costs, earnings, and risks. A company's contract portfolio may be subject to greater losses than anyone realizes. Still the greatest risk in business is not taking any risks. Equipped with the concepts described in this book, business and risk managers can start to see contracts differently and to use them to find and achieve the right balance for business success and problem prevention. What makes this short guide from the authors of the acclaimed Proactive Law for Managers especially valuable, if not unique, is its down-to-earth managerial/legal approach. Using lean contracting, visualization and the tools introduced in this book, managers and lawyers can achieve legally sound contracts that function as managerial tools for well thought-out, realistic risk allocation in business deals and relationships.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access A Short Guide to Contract Risk by Helena Haapio,George J. Siedel in PDF and/or ePUB format, as well as other popular books in Derecho & Negocios en general. We have over one million books available in our catalogue for you to explore.

Information

1

Introduction

Why This Book and This Topic?

In today’s business environment, contracts are everywhere. Contracts govern companies’ deals and relationships with their suppliers and customers. They impact future rights, cash flows, costs, earnings, and risks. A company’s contract portfolio may be subject to greater losses than anyone realizes. Still the greatest risk in business is not taking any risks. Contracts should support sound risk-taking and help balance risk with reward. This book is designed to help business, project and risk managers, as well as contracts and legal professionals, find and achieve the right balance.

These managers and professionals find themselves preparing or reviewing contracts, requests for proposals and quotations. Whether involved in sales, procurement or projects, many handle contractual data and documents on a daily basis, but very few have received training in the area. Many lack the confidence that comes with mastering the topic. Lawyers are not trained in contracts either—they are trained in contract law. Apart from contract law, success with contracts and contract risk requires knowledge and skills in many other aspects: technical, financial, operational, and so on.

If contracts fail, a lot is at stake. In addition to potential financial loss, goodwill and reputation may be at risk. Contract disputes are expensive and consume time and resources that should be used for productive work. Yet contract failure and disputes are not inevitable: using the proactive approach emphasized in this book, problems can be prevented and the likelihood of successful business relationships can be increased. This book offers knowledge, skills and tools that can help in this venture. At the same time, the book seeks to enhance collaboration and communication between business, project, and risk managers on one side and contracts and legal professionals on the other, across functions and disciplines.

The foundation of identifying and managing contract risk is what we call contract literacy: a set of skills relevant for all who deal with contracts in their everyday business environment, ranging from general managers and CEOs to sales, procurement and project professionals and from risk managers to contracts and legal professionals. Equipped with the concepts in this book, companies can start to see contracts differently and to use them for business success, problem prevention, and risk mitigation. This book focuses on contract risk and contract opportunities, suggesting ways in which companies can manage both.

This book is not targeted toward any specific country or industry. Its core content and examples are chosen so that they are applicable to contracting within and across borders anywhere. While the book uses examples involving companies, its core contents are useful for public organizations as well. Our focus, however, is on business-to-business dealings, where the parties can “make their own law” through their contract, which also includes the freedom to choose the law that applies. The book focuses on general problems and general solutions and is not meant to supply direction on how to handle legal issues, or to provide or replace legal or other expert advice. Appropriate legal or other professional advice should always be obtained and relied upon before taking or omitting to take action in respect of any specific problem.

While the authors of this book are lawyers and we discuss a number of legal aspects related to contracts, we do not see contracts merely as legal tools. Contracts are not made for the legal department or future litigation; they are made for business, in order to reach business objectives. Among these objectives, winning in litigation hardly ever takes top priority. So we seek to take a balanced, down-to-earth, managerial–legal approach. Our goal is to enable shared understanding that leads to legally sound contracts, contracts that can be used as managerial tools for well thought-out, realistic risk allocation in business deals and relationships and that are implemented successfully in a way that meets the parties’ expectations.

This book is designed to help companies use their contracts and contracting processes proactively to achieve their business plans and to think through potential contingencies that may affect the outcomes of their projects, deals and relationships. The book demonstrates the increasing importance of contracts and the risks and opportunities they pose, illustrates the potential impact of exposure to contract risk, and outlines the key elements of effective risk management, along with ways to negotiate successful, risk-aware contracts.

Who “Owns” Contract Risks?

Today’s companies possess a wide range of contract-related and risk management-oriented skills and capabilities, yet these are often fragmented. It is not easy to transform the skills and knowledge of individuals to organization-level competence. Despite the obvious benefits of managing contract risk in a systematic way, challenges remain for someone wishing to change the ways a company sees and treats contracts and risk. One of the major challenges is the current “dual ownership” of contracting processes and documents. While contracting (as part of selling, purchasing, alliancing, networking, and so on) is a business process and business management is in charge of its outcomes, contracts often seem to fall into the sole domain of lawyers.

Who, then, is in charge of the contracts a company makes— or of the processes through which contracts are made, implemented and managed? Who is in charge of managing the risks related to them? Who is their “owner?” Is it wise when, first, the sales or account manager is in charge, then during negotiations the contracts or legal professionals take over, and after contract signing the project manager or the implementation team (along with the production or operations manager and eventually field or support services) take charge? When this happens, the right hand does not always know what the left hand is doing. Roles and responsibilities relating to obligations, tasks, costs, implementation, and risk may remain unclear and may cause confusion inside the company and among its customers, suppliers, and subcontractors. Buy-side contracts and warranties may not support sell-side contracts and warranties, and supply contracts may not be coordinated with insurance. Individual’s responsibilities and the extent of their authority are not always completely clear.

As the number of people who work with contracts grows, questions about how the contract portfolio is administered and used and how its risks are managed need to be addressed. If the company operates multiple facilities in different locations and countries and its business units are independent, the difficulties increase. The company is not always aware of the contracts made in the different business units and whether the units’ contract processes and documents are up to date. Information about aggregate liabilities or risks might not be available quickly. Purchasing power is hard to leverage if the units do not know that they are using common suppliers or the value of their total purchases. On the sell-side, payment terms, warranty periods, liabilities and other terms may vary significantly between the different business units and also between the different product and service groups within one unit.

On the business operations’ level, somebody must ensure that the interests of the different units, functions and professionals are aligned. Contracts must be easy to use and effective, and they must be legally valid. Risks must be reasonable in relation to the anticipated benefits, and the costs of contracting must not become excessive. Operations and resources need to be managed, and processes need to be repeatable. Healthy bureaucracy is needed—but at the same time, creativity, innovativeness, and flexibility are also important. The strengths of different professional groups must be merged and the various roles and responsibilities must be coordinated. While a matrix can help define the areas of responsibility of each group or function, somebody must be in charge of integrating the different areas.

Who then is this “somebody” who is in charge of integrating the various skill sets, actions, documents and interests related to contracts, risks, and their management? The answer varies from one organization and from one project to another. The sales, procurement, project, risk or contract manager can be in charge of a major part of the whole. However, business leaders and executives are ultimately responsible for business results. So ultimately the responsibility for business contracts and for organizing the management of contract risks will normally fall on the shoulders of business leaders and executives. In any case, their attitude towards contracts determines how the opportunities offered by contracts are used—or whether they are used at all.

Executive management can delegate the responsibility for contracts and for managing the related risk, as long as this is visible in the job description of the person(s) to whom it is delegated. Responsibility is connected to the question of authority and a common understanding is needed regarding both. What matters most is clarity for everybody involved.

A Fresh Perspective: A Proactive Approach

Savvy managers no longer look at contracting processes and documents reactively, but use them proactively to reach their business objectives. The proactive approach adopted in this book has two dimensions, both of which emphasize forward-looking action: a preventive dimension, seeking to prevent problems and disputes, and a promotive dimension, seeking to secure the respective actors’ success in reaching their goals. In the context of this book, this means using contracting processes and documents proactively to (1) decrease the possibility and impact of failure and negative events; (2) increase the possibility and impact of business success and positive events; and (3) enable sound risk-taking, which includes balancing risk with reward. Success requires attention to both risks and opportunities, along with their causes, likelihood, and effects. Contracts are known for being effective risk-allocation tools. However, legal and business priorities may differ. While this book discusses ways in which contracts can be used to allocate risk, we do not stop there. Success requires contract literacy of the organization and its supply chain—in fact, the entire extended enterprise. Armed with this contract literacy, those involved in the contracting process can move beyond allocating risk to managing risk. Moreover, they can use their contracting processes and documents to realize business benefits and manage opportunities for value creation.

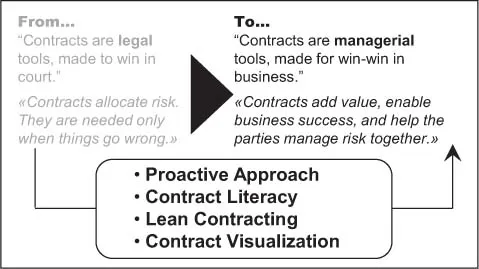

To reach their business objectives, companies seldom need legally “perfect” contracts; they need usable, practical contracts that achieve desired business goals and reasonable risk allocation at an acceptable cost. Contracts do not make things happen—people do. People need to know what their contracts require them to do, where, and when. Today’s complex contracts are seldom easy for their users in the field, mostly non-lawyers, to understand and to implement. If contract language and complexity overload readers’ cognitive abilities, contract implementation will fail. Such contracts—even if they are legally “perfect”—are far from good, operationally efficient contracts and fall short of their ultimate purpose. This is where a fresh perspective represented by what we call lean contracting and contract visualization enters the picture. Along with the proactive approach, this fresh perspective helps move from a “contracts are legal tools” attitude toward seeing contracts as managerial tools. At the same time, these approaches seek to change the view of contracts as risk allocation tools, made to win in court and needed only when things go wrong, to seeing contracts as value-adding devices and as enablers of business success that help the parties manage risk together. These aspects are presented in Figure 1.1.

Figure 1.1 A fresh perspective

For companies, the contract itself is not the goal; successful implementation is. So we take the view that the core of contract design should be securing the performance and business benefits the parties expect, not just a legal contract. Success in managing contract risks and opportunities often requires changing the ways corporate contracting works: from pre-contract to negotiation and signing and then to post-contract stages. This, in turn, requires the involvement of both business management and the legal department. Both need to see the need for change and must be willing and able to change their current ways of working.

How This Book is Organized

In Chapter 1, we have provided a brief introduction to the topic and have explained the sometimes challenging managerial–legal “dual ownership” of contracting processes and documents. We have also briefly introduced our approach to contracts, risks and opportunities: the proactive approach.

In Chapter 2, we present the big picture by asking why companies make contracts. After defining the core concepts used in this book, such as “contract,” “risk,” and “contract risk,” we discuss the business and legal objectives at risk and the promotive, preventive, and balancing power of contracts. We then introduce what we consider the foundation of identifying and managing contract risk: contract literacy.

Chapter 3 provides an overview of the sources of contract risk. It illustrates how contract wording or legal issues, while they are important when resolving legal disputes, are not the primary sources of contract risk. After introducing what we consider to be the true risk sources, we discuss current contract practices and how these must change.

Chapter 4 focuses on risks in negotiating the business contract, such as legal risks that arise in contract formation, the risk that negotiators will use negotiating strategies that cause them to overlook opportunities to create value that will benefit both sides, and the risks associated with a deal-maker mindset. The chapter also introduces lean contracting as a method that enables the development of contracts that are management as well as legal tools.

In Chapter 5, we cover risks inherent in a contract itself. We address performance concerns and legal concerns, along with the most frequent sources of claims and disputes. We discuss contract clauses and issues that are typically considered to be risky and how to respond to them through the use of exclusion and limitation clauses and other conventional contract risk allocation devices. While contract literacy recognizes the importance of being able to identify devices used to respond to risk, the chapter also illustrates how true risk management needs to go beyond them. Chapter 5 also illustrates, with examples, how what is left out of a contract— knowingly or unknowingly—can be at least as important as what is included.

Chapter 6 provides tools and techniques to secure systematic contract risk recognition and response. The chapter’s introduction of the contract risk management process and the contract risk and opportunity management plan is followed with examples of how you can apply them. In addition to the more traditional tools, the chapter introduces visualization as a new approach ...

Table of contents

- Cover Page

- Title Page

- Copyright Page

- Contents

- List of Figures

- List of Tables

- About the Authors

- Acknowledgments

- Foreword

- 1 Introduction

- 2 Contracts and Risk—the Big Picture

- 3 Sources of Contract Risk

- 4 Risks in Negotiating a Business Contract

- 5 Risky Terms and Issues in Contracts

- 6 Contract Risk Recognition and Response: Processes and Tools

- 7 Conclusion

- Index