- 126 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Strategic Project Risk Appraisal and Management

About this book

Success in business depends on two broad management skills: 'doing the right thing' (choosing the right projects) and 'doing things right' (good project management). This book examines the challenges that managers face in assessing the likely risks and benefits that need to be taken into account when choosing projects. It then explores the strategic level risks that will need to be dealt with in managing those projects and suggests risk management strategies. In so doing, it makes a rare but important link between strategic level appraisal of project opportunities and project risk management. Many projects have similar characteristics that are common to a number of projects experienced by the same or other organizations. Elaine Harris shows how the use of a project typology can guide project risk management by identifying common risks shared by projects of each type. Her cutting edge research will help advanced project practitioners and researchers in projects and risk management to develop a risk management strategy that is better suited to the context of their projects and one that is flexible enough to develop and adapt once the project decision has been taken and the real-world of project management and delivery begins.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Strategic Project Risk Appraisal and Management by Elaine Harris in PDF and/or ePUB format, as well as other popular books in Business & Business General. We have over one million books available in our catalogue for you to explore.

Information

PART 1

BACKGROUND TO PROJECT RISK APPRAISAL

CHAPTER 1

CONTEXT FOR STRATEGIC PROJECT RISK APPRAISAL

Project risk appraisal should begin before the organization makes its decision about whether to undertake a project or if faced with several options, which alternative to choose. This chapter sets the scene for pre-decision project risk assessment, when there is more uncertainty than measurable risk. Timing is important here, so the first section of this chapter deals with the project appraisal process, identifying stages in a project’s development prior to the decision to commit to the project. This is before project management is assumed to begin.

Further sections explore the context in terms of decision-making behaviour and traditional approaches to project risk management. The last section develops the project typology that will be used in Part 2 to analyze the likely sources of risk affecting different types of project.

BACKGROUND TO THE PROJECT APRAISAL PROCESS

In early accounting literature, rooted in economics, project appraisal was seen as part of capital budgeting, defined as ‘the allocation of scarce resources between alternative uses so as to best obtain objectives ... over time’ (Bromwich, 1976). This covered decisions on the total amount of capital expenditure a firm should undertake and the financing of projects as well as the decisions about which specific investment projects to accept. The main methods of project appraisal recommended, internal rate of return and net present value, were based on discounted cash flow (DCF) techniques.

The term capital budgeting also implied that capital expenditure decisions might be routinized into the overall budgeting process, usually within an annual planning cycle. In the case of investment in assets such as manufacturing equipment in established firms, where life cycles and capacity requirements may have been relatively predictable, this assumption may have been reasonable. However, with the more rapid change and complexity involved in advanced technology and the emergence of new knowledge-based industries, a fundamental change in our thinking about investment in projects has become necessary.

A view that DCF techniques misplaced the emphasis of capital budgeting was expressed (King, 1975) and a broader view advocated with multiple steps in the decision-making process, from triggering, screening and definition to evaluation, transmission and decision. However, it took time for this view to become widely accepted. The need to focus business planning more externally on the competitive environment and the shortening of time available to identify and evaluate new opportunities is well documented in the strategy literature, where investment decisions are more about the formulation and implementation of strategy. Recent research is concerned with strategic alignment of projects (Langfield-smith, 2005).

Strategic investment decisions are still concerned with choosing ‘between alternative(s) ... so as to best obtain objectives’ (Bromwich, 1976), but involve a far broader consideration than the economics of the prospective project. Research in the 1980s and 1990s ‘focused on the fit between the use of DCF techniques for capital expenditure evaluation and specific contingencies of business strategy, external environment, information systems characteristics, reward systems structure, and degree of decentralization’ (Langfield-smith, 2005).

Strategic investment decisions (SID) are required to deliver a business strategy and allow an organization to meet its business and financial goals. The SID process starts with the identification of a project opportunity or a number of alternative opportunities that compete for the allocation of organizational resources (money, people and capital equipment).

There are two broad schools of thought on the funding of projects. One is that capital is limited so there is a competition amongst business units and projects for it, named capital rationing. This may be true in times of economic downturn, especially when there is less inter-bank lending activity. The second school of thought is that if a potential project is good enough, especially if it is likely to generate exceptional profits, that capital can always be raised to fund it. The experience of most managers is that the reality in their organizations lies somewhere in between. There is usually some sort of capital constraint and thus an element of competition for funds. The SID process is all about defining a project opportunity and working up a business case to present to the funding providers, either internally to a group board, or externally to investors, or both.

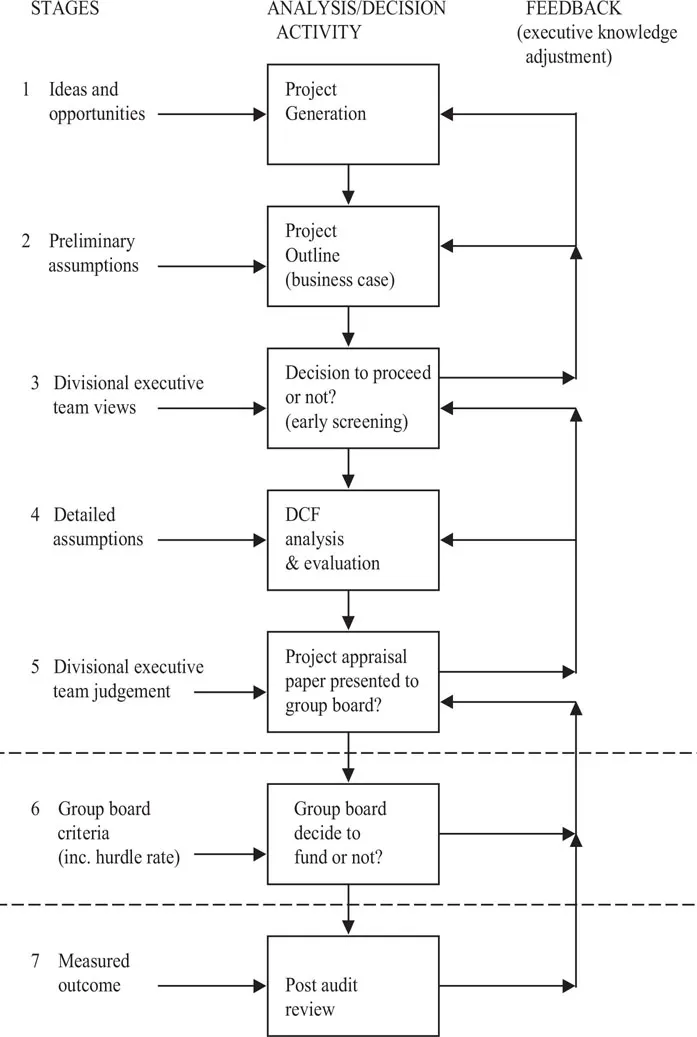

Figure 1.1 shows a typical SID process for business development-type projects in a large divisionalized company in the logistics industry, where each business unit is responsible for scanning the environment for potential projects, often in the form of invitations to tender (iTT) for new business or contract renewal. This process model was supported as more generally relevant in a recent survey (Emmanuel, Harris and Komakech, 2009) with two additional post-decision steps identified of project implementation and change management to extend the model.

These further stages are most relevant to project managers, fitting between the final decision point (stage 6) and the project review (stage 7).

However, what is generally the case in most organizations is that the managers involved are different at the different stages. At stages 1 and 2 the business development managers or marketers are most involved. At the evaluation stage (stage 4) the management accountants or financial managers are most involved. A range of experts may be consulted at stages 2 (technical) and 3 (stakeholders) and the full divisional board may be involved at stage 5, but often project managers do not become involved until the decision has been taken at stage 6 and responsibility is allocated to a project manager to form a team to implement the project. Thus the evaluation of risks and returns has already taken place. (How) is this knowledge transferred? Does the project manager see a copy of any early stage project risk assessment?

We will return to these questions in Chapter 10.

It is important to note here that whilst the model in Figure 1.1 is generally found to operate in a similar way in many organizations, not just in the logistics industry, the ideas for project opportunities can emanate from different parts of the organization. If the opportunity is to take over another business it may come from the firm’s bank or financial advisers or from a direct approach from the vendor at top management level. Likewise, the project may be formulated to comply with new legislation, so may emanate from the firm’s lawyers or if employment law, from the human resources department. The differences in the above model that may be found for projects of specific types are considered further in Part 2 of this book. For any type of project the potential involvement of multiple managers in the process brings decision-making behaviour and psychology in particular, into consideration.

DECISION-MAKING BEHAVIOUR

Simon (1947) was one of the earliest and most acclaimed researchers to write about the psychology of organizational decisions. He identified the problems of assuming economic rationality in a process reliant on human behaviour, and of the roles of authority and communication. Later editions added sections on information processing, organizational design and the selective perception of executives (Simon, 1976). However, many lessons from this work seem to have been neglected. This book aims to put such issues firmly back on the management agenda, as it is argued that they are even more relevant in the context of project management, governance and accountability in today’s corporate world.

Figure 1.1 Strategic investment appraisal process

Source: Harris (1999)

Kahneman and Tversky (1979) developed prospect theory, which also contradicted the economic rational model of decision-making. They found that people do not use probabilistic calculations to ascertain the economically optimal solutions, but that they exaggerate downside risks if they are risk averse and may exaggerate the chances of success when faced with upside risks, for example by buying a lottery ticket at low cost with little chance of a potentially high gain. This kind of behaviour is just one of the ‘heuristics’ found in the psychology of decision-making.

Tversky and Kahneman (1981) also found that people react differently to the same prospect if it is presented differently, known as the framing effect. Framing experiments focus on how the gains and losses of an option are presented from a zero or other reference point to give the decision-maker a different impression of the same set of cash flows. This work on the psychology of intuitive judgement has been extended to include many examples of heuristics and types of bias in decision-making (Gilovich, Griffin and Kahneman, 2002).

One of the newer examples is the ‘affect’ heuristic, which deals with the emotive or intuitive response to certain words or phrases used in describing or framing a prospect (Slovic...

Table of contents

- Cover Page

- Title Page

- Copyright Page

- Contents

- Acknowledgements

- List of Figures

- List of Tables

- Preface

- Introduction

- PART 1 Background to Project Risk Appraisal

- PART 2 Strategic Project Risk Case Illustrations

- PART 3 Project Risk Management Post-Decision

- References

- Index

- Fundamentals of Project Management and Advances in Project Management