![]()

1

Responding to changing customer expectations

Understanding customer expectations and behaviors is hardly a new concept, given the insights it provides for developing and delivering innovative products and services. What is new, however, is the need to understand the speed and the areas in which customer behaviors and expectations are changing. Also, industry professionals need to keep up with new ways of engaging and interacting with customers in order to understand and respond to these changes. Not that long ago, many airlines thought that they knew what consumers wanted, and, based on that belief, they communicated their perceptions of value propositions to consumers in the traditional marketing seller-to-buyer direction, and with influence exerted by the seller through mass marketing.

Now, with the proliferation of new technologies and social networks, businesses must have two-way communications with segmented sets of consumers through their networks to learn about consumer values and to communicate their values to consumers. The focus of communication is now not just information on the features of a product, but also the experiential aspects, as these also influence behavior. From that context, airlines are beginning to have some control of consumer behavior through the provision of experience. In the long term, this will be helpful, since customers behave, to some extent, in response to their experience. If a consumer is frustrated with an airline, she will look for services offered by another airline, assuming she perceives differences among airlines. As such, leading airlines see that experience is becoming not only more important, but also necessary in engaging and interacting with consumers to receive input on the delivery of experience as perceived by the airline and as received by the passenger. As a result, airlines are transforming their business models.

As Raymond Kollau summarizes in his contribution to Chapter 7, today’s connected and empowered consumers’ expectations can be described by three attributes: on-demand, real-time, and end-to-end. As for businesses, whereas in the past they focused on internal operations with the objective of moving down on the economies of scale curve to reduce costs, now the focus is more on economies of scope and on increasing margin to become more competitive and more profitable.1

Super-connected travelers

It has become clear that in recent years, travelers’ expectations and demands have been changing rapidly, based partly on the products and services provided by leading businesses in a digitally connected world characterized by on-demand and sharing economies. In this super-competitive environment, sellers have been learning to fulfill buyers’ needs by delivering purchased goods more quickly, by making entertainment content available on mobile devices, and by providing a wealth of information. In broader terms:

- a Buyers are seeking smartly designed products and services with emphasis on authenticity, a seamless experience, and personalization.

- b Buyers are deploying digital methods to express and satisfy their needs, and they are using a wide array of social networking channels and apps.

- c Buyers want to shop more effectively, and they expect a product to be available anywhere.

- d Buyers are increasingly looking for content through digital devices, and they are shifting from “mobile first” to “mobile only.”

- e Buyers are moving beyond searching for products to seeking solutions to their problems, and they are beginning to have a short attention span.

- f Buyers are rapidly adopting the voice interface.

To complicate matters, businesses are dealing with multi-generational groups with more significant differences among them with respect to consumer expectations. For example, not long ago, the focus was on baby boomers, but now it is on millennials. This shift in focus is understandable, given that millennials are expected to compose up to 75 percent of the workforce by 2020. Therefore, designing products and services to meet this group’s expectations is important. However, other groups, such as people in their fifties (between the millennials and the baby boomers), should not be overlooked. This segment has a sizable base and significant spending power. By the time you read this, nearly 50 percent of the US adult population will be age 50 and older, and those people will control about 70 percent of the country’s disposable income.2 Although part of this wealth is in the hands of the baby boomers, much of it belongs to those in their fifties. And, although those in their fifties are quite familiar and comfortable with the use of technology, as consumers they are very likely to go for “value over luxury.” In the airline industry, this could imply new travel options, such as the use of low-fare carriers in long-haul markets and the use of alternative accommodations provided by Airbnb and many others.

An airline, of course, can dive deeper into an identified segment. For example, the millennials segment does not represent a homogenous group – there are wide variations within the group, just as in any other generation. Even among millennials, not everyone lives totally in the social media space – Facebook, Google, Instagram, WeChat, Snapchat, Twitter, and so on. In addition, not everyone is looking for visual content. The implication for airlines is that they need to be more careful about simplistic categorizations. Just as, in the past, the categorization of travelers into “business,” “leisure,” and “visiting friends and relatives” turned out to be too broad, the same is now true for millennials, fifty-somethings, and baby boomers. Similarly, just as economy, business, and first-class cabins were sufficient to meet the needs of most consumers, now consumers want more choices. These choices may not be in the physical products, but they need to be in the digital space.

In any case, the travel behavior of different groups has not stopped changing. Consider the implications for businesses of the change when consumers went from desktops to mobile devices, requiring a total re-design of web sites to fit the new, smaller format. Consumers have increasingly been making bookings through the mobile channel – a channel that is simple but effective. Going deeper, consumers are not just booking through the mobile channel; they are looking for improved user experiences, such as better control throughout the journey. Consumers are already starting to adopt wearable technologies, not to mention the use of voice interface. What are the implications of the widespread adoption of such technologies?

Consider another segment of travelers that is looking for packaged travel. For this segment, the need for the use of travel agents does not go away; rather, the need for such services is re-vitalized. A consumer might have been influenced through social media by reading about the experience a colleague had when bicycling in Iceland. How does this desire become part of the travel package? Consumers want to be able to select the components of the trip (air travel, hotel accommodations, ground transportation, and sightseeing) and the brands, not to mention the timings for the booking as well as service features. Whereas in the past, packages produced by travel suppliers may have created value in terms of lower prices, they did not provide convenience, flexibility, or, possibly, even the brands. As one example in terms of convenience and flexibility, a consumer may have flown on an acceptable day but might have desired to return on a different day when the airline had no service, requiring the use of a different airline, even if that airline had a lower brand value.

Corporate travelers

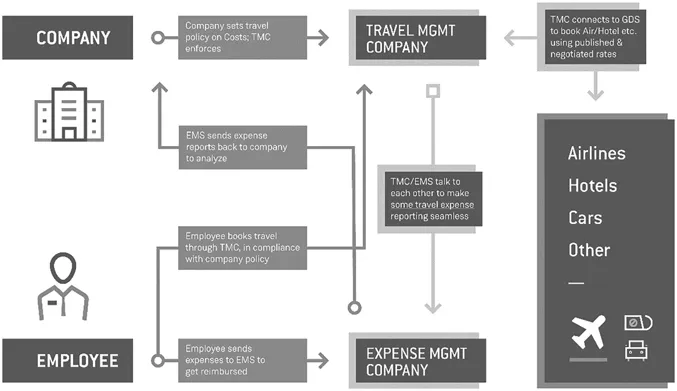

Consider another segment: corporate or business travelers. Before we discuss how the behavior of corporate travelers has been changing, it might be helpful to look at the past framework of corporate travel. Typically, travel managers at large corporations negotiated favorable rates with suppliers – airlines, hotels, and car-rental companies, for example. Travel suppliers provided significant discounts depending on the value of the travel generated. Why did suppliers offer lower rates to corporations? Corporate travel may represent 10 percent or less of the total number of passengers transported by an airline, but this small segment may represent in the neighborhood of 50 percent of the airline’s revenue. Travel managers also engaged travel-management companies (TMCs) to display content, access inventory, and make bookings via global distribution systems (GDSs) at rates negotiated by corporations with the suppliers. The TMCs also took care of travelers during their travel and, in some cases, managed the reporting of travel expenses for corporations. See Figure 1.1. Corporate travelers were expected to use the services of the preferred suppliers, and the TMCs tried to monitor travelers’ compliance with the corporate travel policies.

Figure 1.1 The typical current ecosystem of corporate travel (Note: EMS stands for expense-management system.)

Although the typical corporate travel framework worked reasonably well, a number of concerns have been raised in recent years. From the perspective of an airline, although this segment provided a large stream of revenue, it involved not just discounted rates but also significant distribution costs and less direct control over the customer’s experience, partly because of the lack of sufficient data on customers. On the part of frequent corporate travelers, many put themselves under tremendous stress. Their travel was in some cases painstaking, in other cases not particularly interesting, and they were required to comply with the corporate travel policies to control travel budgets. The situation was acceptable in that at least the travel took place in a relatively calm political environment. Now, corporate travelers are more connected (to social channels, for example), and they increasingly expect personalized services that maintain the productivity of the staff but make the trips more enjoyable. In other words, travelers want to satisfy their corporate objectives as well as their personal needs and life styles, and this is especially true of younger travelers.3 Personal considerations are particularly important to them when they are traveling in dangerous or politically unstable regions.

Although business travelers were hardly a homogeneous group before, diversity within this group has been increasing, calling for airlines to engage with individual customers and provide them much more personalized services. Increasing numbers of corporate travelers are willing to participate in the sharing economy and utilize apps to meet their needs. For example, many are beginning to use apps to acquire ground services, such as Uber, and to utilize unconventional accommodation facilities, such as Airbnb. In the case of air travel, they are now more likely to use services provided by lower-fare airlines – for example, Southwest and jetBlue in the US and Norwegian and easyJet in Europe.4 This trend is particularly evident in the younger generation of travelers. They want much more control over their travel experience and can use their mobile devices and apps to achieve this control. Sellers of travel services recognize the trend that corporate travelers are willing to consider alternative services and are beginning to re-configure their portfolios. Within the low-cost airline sector, eight low-cost carriers in Asia have formed the Value Alliance, discussed below in this chapter and in Chapter 6. Within the hospitality sector, the AccorHotels group has increased the number of partners to offer a much broader portfolio of products and services. See Figure 6.1 in Chapter 6.

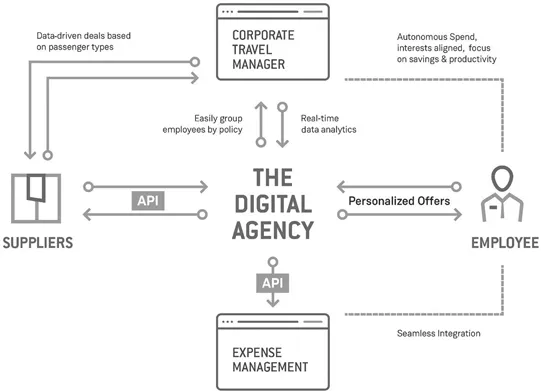

These changes mean that the management aspects of corporate travel managers are also changing. Managers must now meet not only the cost-related needs of the business, but also the greater needs of the business, such as staff retention. Each traveler is very different and must be treated differently. Now the travel manager needs to look at each traveler’s needs as well as the needs of the corporation – for example, the need to ensure compliance with corporate travel policies. Figure 1.2 shows a potential scenario of an ecosystem that has an embedded “Digital Agency” that connects corporate travelers with suppliers directly while providing a link between corporate travelers and travel managers on one side and expense-management systems on the other side. The needs of corporations and corporate travelers vary by corporation and by region. Corporations based in North America have different priorities relative to those based in Europe and those based in Asia. Even within a region, there may be vast differences.

Figure 1.2 One potential scenario for the ecosystem of corporate travel

The globalization of consumers

Consumers all over the world are becoming increasingly global. As such, consumer behaviors and expectations are being analyzed on a global basis. Let us consider consumers in Asia for a moment. Growth rates for products and services in Asia are expected to be very high, and there is increasing competition among Asian airlines and airports. Dianchun Li, in his contribution to Chapter 7, talks about the booming population and economy of the Pearl River Delta region of southeast Asia and how it has led to enormous growth in activity at two regional airports, Shenzhen (SZX) and Guangzhou Baiyun (CAN). Consequently, the big Hong Kong International Airport is facing stiff competition not just from new airports but also the rapidly expanding airports in the region.

Now let us consider consumers in Africa, where a middle-class segment is simply looking for reasonable schedules and fares in many markets. Consider passengers who need to fly between Algiers, in Algeria, and Doula, in Cameroon (about 2,300 miles). As of June 2017, there were no nonstop flights between these two cities. Royal Air Maroc offered a connecting flight at $544 (one way) that took 13 hours and 40 minutes, while Turkish Airlines offered a connecting flight at $699 that took 22 hours and 35 minutes. Compare that to flights between Manchester, in the UK, and Istanbul, in Turkey (about 2,100 miles). In this market, Turkish Airlines offered two daily nonstop flights taking 4 hours and 5 minutes, and British Airways offered connecting flights at $271 that took 7 hours and 40 minutes. Then there are middle-class segments (such as those in South Africa) in which technology-savvy consumers are looking for personalized services with self-service options. Airlines need to find ways of meeting the expectations of all segments – those traveling within Africa and those traveling in high-growth markets between Africa and the Middle East and between Africa and the Asia-Pacific region.

Technology is playing a big role in the evolution of consumer behavior all over the world. It is helping consumers shop faster, given that consumers worldwide “feel” that they are busier than the previous generations and need help making choices more efficiently with respect to tradeoffs between product features and price. Technology has also led consumers to expect a more seamless path to purchasing. As a result, the worldwide marketplace is becoming much more dynamic, but with significant variations by region. As Google describes it, consumers, at least in the affluent regions of the world, are living in the era of “micro-moments.” And Asia is becoming affluent at a rapid rate. In fact, it is estimated that 85 percent of the predicted growth in the middle class worldwide will come from Asia.5 The ramifications for airlines are enormous. For example, Trevor Spinks points out in Chapter 7 that group sales are much larger in Asia compared to North America and Europe, driven by the market growth in China.

What are some other reasons why consumers’ behaviors and expectations are changing all over the world? To start with, their environment is changing. Here are just a few examples.

- Changes are occurring within their culture. For example, more people are eating out during major holidays in the US. Dining out...