eBook - ePub

Economic Instruments for Environmental Management

A Worldwide Compendium of Case Studies

- 216 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Economic Instruments for Environmental Management

A Worldwide Compendium of Case Studies

About this book

This volume presents the results of a three-year collaborative effort involving research institutions in Africa, Asia, Europe and Latin America. Case studies demonstrate the diversity of environmental problems to which a variety of economic instruments can be applied - air and water pollution, packaging, deforestation, over-grazing, wildlife. They also show what is needed for them to work successfully and the pitfalls to avoid in introducing them, providing guidance for future applications. Written to be accessible to non-economists, the book offers source material for students and academic economists, as well as for professionals working with economic instruments.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Economic Instruments for Environmental Management by Jennifer Rietbergen-McCracken,Hussein Abaza in PDF and/or ePUB format, as well as other popular books in Business & Business General. We have over one million books available in our catalogue for you to explore.

Information

PART III

EASTERN AND CENTRAL EUROPE CASE STUDIES

| 11 |

SULPHUR DIOXIDE EMISSION CHARGE IN POLAND | |

| |

BACKGROUND

In the early 1980s there was a general revival of the Polish national environmental policy, largely due to the impact of the Solidarity movement. Air pollution problems had a high profile because of their associated health risks and particular attention was paid to sulphur dioxide (SO2) emission because of the very obvious environmental damage caused by acid rain, especially in the forests in the southwestern part of Poland.

At the beginning of 1980, the Polish parliament replaced the rather inadequate Nature Protection Act with the first general Legal Act on Protection and Management of the Natural Environment, thus introducing an extended set of environmental charges that could be levied on polluters. These new charges were expected to play an important role in every area of environmental protection. The general act with its numerous amendments also established a complex regulatory environment for SO2 emission control and an SO2 charge appeared as a new policy instrument.

However, by the second half of the 1980s, it became clear that the new legislation was not bringing about sufficient changes. Poland’s sulphur dioxide emission levels declined by only 10 per cent over the period 1985—1989. In 1992 the SO2 emission per unit of GDP was still five times higher than that of Germany and about six times higher than the average for European OECD countries (OECD, 1995).

Studies had shown that poor air quality was a serious threat to human health in several cities during the early 1990s. Sulphur dioxide concentrations in cities like Chorzow or Krakow far exceeded ambient air quality standards and were several times higher than in German cities with comparable industrial activities. The national air quality monitoring data indicate that SO2 concentration violated air quality standards in about 15 of Poland’s 29 regions between 1990–1992 (OECD, 1995).3

The levels of both the export and import of sulphur dioxide pollution remained high throughout the eighties. By 1992, however, SO2 export was almost double the amount imported. Nordic countries, the major recipients of the unwanted export, exerted pressure on Poland and offered assistance in reducing the emission levels.

The major cause of Poland’s heavy SO2 pollution has been the heavy reliance on coal-fired power plants for electricity production: in 1992 public power production accounted for almost half of the country’s sulphur dioxide emissions. Public and private heating contributed 26.6 per cent, with a further 24 per cent coming from industrial power generation and industrial processes.

The 1991 National Environmental Policy (NEP) assigned a high priority to the need to reduce air pollution. One of the medium term objectives to be achieved by 2000 is a 30 per cent reduction of SO2 emission from its 1980 level. This will require a reduction in the annual emission from 4.2 million t/year in 1980 down to 2.9 million t/year by the year 2000. A significantly increased SO2 emission charge has been envisioned as an important policy tool to help reach this target.

EMISSION CHARGE

The sulphur dioxide charge is designed as a classic emission charge. It is a price to be paid by polluters for each unit of SO2 they release into the air. The aim of the charge is to create an economic incentive against excessive air pollution from fuel burning.

The SO2 charge is closely connected to the system of permits for enterprises that are point sources of air pollution. These permits specify the allowable emission of every regulated pollutant from every stack or other type of conveyance in the facility and all point sources are required to apply for and maintain these pollution permits. Theoretically, permissible levels are defined to meet the ambient air quality standards and since provincial authorities are responsible for meeting the national ambient air quality standards (which are specified by a ministerial decree), it is their environmental protection departments which set the allowable emission and discharge levels for each source.

To apply for a permit, each enterprise is required to conduct air dispersion modelling to determine the contribution of its facility’s emissions to ambient air quality. The model results are then reviewed and approved by an independent expert before the provincial authority decides whether or not to issue the permit. Considerable importance is attached to the results of the air dispersion modelling, particularly when the applicant’s emissions would contribute to violations of the ambient standard.

Polluters who have a valid permit must pay air pollution emission charges, including the SO2 emission charge. Those polluters whose emission exceeds the emission standards specified in their pollution permits must pay fines. Generally, the fine imposed is based on the difference between the permitted and the actual level of emission. The fine rate to be paid when emissions exceed permitted levels by more than 1kg is 10 times higher than the regular emission charge rate.

An important exception to this process is the treatment of larger combustion sources. In 1990, a ministerial decree introduced special, technology-based emission standards for SO2, nitrous oxide, and particulates, for major combustion sources with capacities greater than 200 kilowatts. Permitted emission levels for all of these large combustion sources were due to be determined according to the technological standards that were put in place in January 1998.

IMPLEMENTATION OF THE EMISSION CHARGE

All point sources which are required to obtain pollution permits for their operation are also liable for SO2 charge payment. The charge payment is calculated on the basis of self-reported SO2 emission. Provincial inspectorates are responsible for monitoring compliance with facility permits and verifying the accuracy of the pollution levels reported by the facilities.

In 1996, the SO2 emission charge rate was US$94/ton (or PLZ2400 per ton).4 Some sectors benefit from preferential rates or exemptions. For example, the charge rate for medicine manufacturers is ten times lower than the regular rate, and health and social care institutions, as well as educational and cultural organizations and prison management bodies, are completely exempt from the charge payment.

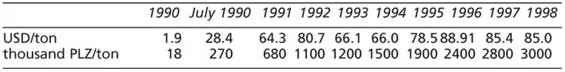

Table 11.1 shows the evolution of SO2 emission charge levels over the last seven years. The most dramatic increases occurred in July 1990 and January 1991 when the charge system was revised. The table shows a clearly increasing trend for the nominal rate, though when expressed in US$, the rate has fluctuated somewhat. The 1992 rates quoted in the table were set in January and, later that same year, the new incoming government reduced all rates for emission charges, including the SO2 rate, as a political response to strong protests from heavy industry against high charge rates. Surprisingly, these drastically lower charge rates also provoked strong protests from industry and the public. Those polluters who had already started abatement measures complained and revenues from pollution charges to the country’s environmental funds dropped to about 32 per cent below the planned level. On April 1, 1993, as a result of bitter criticism coming from the press and public debates, new rates revoked most of the changes and all rates were reestablished at the previous levels.

Table 11.1 Unit SO2 charge rates

Source: Sleszynski (1996)

An annual adjustment procedure is a regular element of the implementation of the charge. Slippage in charge rates due to inflation is largely avoided by adjusting nominal charge rates to account for predicted inflation in the next year. If actual inflation deviates significantly in either direction from predicted inflation, adjustments can be made in the following year.

Environmental charges are collected once a year by the provincial administration environmental protection departments, though a 1990 amendment to the general legal act allows provincial governors to request quarterly instalments from large enterprises.

Enterprises are able to treat environmental charges as normal business expenses and to deduct the amount of charges paid from their taxable income. Charges are thus treated as a normal production cost. An interesting provision allows enterprises to deduct the amount of the charges levied in the current year from the current year taxable income even if they are delinquent in making payments and don’t actually pay the charges until the next calendar year.

Annual revenue from collected SO2 emission charges is relatively high in comparison to revenues from other environmental charges. Table 11.2 shows the revenue collected between 1990–1994.

Table 11.2 Annual revenue from S...

Table of contents

- Cover

- Title Page

- Copyright Page

- Table of Contents

- List of Tables

- Preface

- Acknowledgements

- Introduction

- Africa Region Case Studies

- Asia Region Case Studies

- Eastern and Central Europe Region Case Studies

- Latin America Region Case Studies

- Glossary

- Index