![]()

Chapter 1

Investment Valuation — Lending Purposes

This chapter examines an investment valuation undertaken for lending purposes. The surveyor has been instructed by the bank to report on the market value of the property, together with any factors affecting the suitability of the property for loan security. The report is contributed by Piers Cartwright-Taylor.

Introduction

I have chosen a case involving the valuation, for loan security purposes, of a freehold commercial property investment in Reading, Berkshire.

The client, a lending institution, was looking to use the subject property as security on a loan to their client, the borrower, who was in the process of acquiring the office building.

This particular valuation was chosen as there were a number of interesting lease terms and issues regarding the office market in Reading and the M4 corridor. It was also my first valuation carried out following the amendments to the RICS Appraisal and Valuation Standards, ie ‘Red Book’ in May 2003.

This report will discuss the valuation methodology and procedures followed in order to arrive at a value for the subject property. I will highlight some of the issues that I came across and the solutions to overcome these issues. Overall, the analysis will show how the valuation process has benefited my development as a general practice surveyor, and improved my knowledge of valuation techniques.

Valuation process

The following are the core elements that I identified in preparing this loan security valuation.

- Client’s instruction.

- Property inspection.

- Market investigation.

- Quality of building/obsolescence.

- Lease analysis.

- Statutory enquiries.

- Methodology.

- Valuation and report.

Before the instruction could be accepted it was important to determine whether it was appropriate for the company to take on the instruction.

Understanding the client’s requirement for loan security — key issue

The main objective is to provide the advice that is being requested. The bank’s client intended to purchase the property, which was an income producing office building. We were required to provide the Market Value, as defined in Practice Statement 3.2 of the Red Book, and Market Value on the special assumption that the property is vacant.

When acting for a bank the question of suitability for loan security is vital since the bank will rely on the valuation in a future default scenario.

In compliance with my firm’s ISO 9001 Quality Assurance procedures and Practice Statement 1.3 of the Red Book, it was important to establish whether any potential conflicts of interest existed. We found that my firm’s rating department was, at the time, instructed to act on behalf of the tenant in respect of a rating appeal. This involvement was bought to the attention of my manager and also the rating department. On this occasion it was decided that no conflict arose. The rationale given was that the valuation was for our client, the bank, which was a sufficiently separate entity from the occupier.

Once agreeing that my firm could meet the client’s requirements, the instruction was accepted in writing. Enclosed with the acceptance were duplicate copies of our conditions of engagement, drafted in line with Practice Statement 2 of the Red Book. This specified the purpose, basis and assumptions for the valuation, the name and qualifications of the valuer, the valuation date, time scale for reporting and the basis of fees.

Also, having regard to the RICS Rules of Conduct, I obtained the consent of the client and the lender to disclose the information outlined within this critical analysis. I have withheld their names in accordance with their instructions and for the purposes of confidentiality.

Property inspection

In accordance with Practice Statement 4, my supervisor and I inspected the property. The key factors noted are detailed below:

Location and situation

Reading is approximately 69 km (43 miles) west of central London in the Thames Valley, and benefits from good road communications. The property is situated on the northern side of Stevens Road, at its junction with London Street. Details on the location, situation, description and condition of the property are attached in Appendix IV (not reproduced here).

Description

The property comprised a detached office building arranged on basement, ground and six upper floors providing office accommodation on seven floors with ground floor and basement car parking. Photographs of the subject property are attached in Appendix V (not reproduced here).

Condition

The property showed few signs of disrepair. In any event, the lease is full repairing and the responsibility of repair rests with the tenant. This could be addressed by a schedule of dilapidations if need be.

Building obsolescence — key issue

Although the property was in a good state of repair, the age of the building was a letting would become increasingly difficult with more modern space available on thre-letting would become increasingly diffcult with more modern space available on the market. This is reaffirmed by the level of the rent achieved in 1988, which has remained virtually unchanged.

Measurement

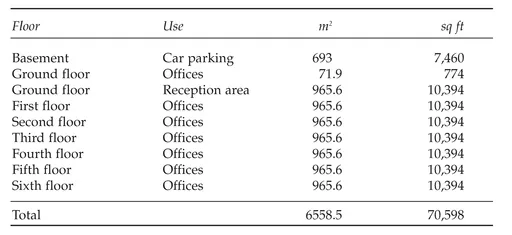

In conjunction with my supervisor, I measured the offices on a Net Internal Area (NIA) basis using a laser measuring device and in accordance with the RICS Code of Measuring Practice (5th ed). The building provided the following areas.

The property had perimeter air conditioning units that were not of a continuous nature. In accordance with the Code of Measuring Practice, wall-to-wall measurements were taken.

Lease analysis and security of tenure — key issue

We were instructed to value the freehold interest, but were not provided with a Report on Title. However, the bank advised us that the property was freehold. For the purposes of the valuation, it was assumed that that there were no unduly restrictive covenants affecting Title, and which would have an adverse effect on value. The valuation report stated this assumption, and that it should be verified by the client’s solicitors.

The property was subject to one occupational lease, producing a current rent of £1,145,000 pa. The lease had been granted in 1983 for a term of 25 years to a public company which had subsequently assigned the lease in 1995 to the Secretary of State. In 1996 a reversionary lease was granted to the Secretary of State for a period the period from 2008 to 2012. This meant that the question of privity of contract arose. Privity would apply to the original lease but not the reversionary lease since it is dated 1996, and is therefore covered by the provisions of the Landlord and Tenant (Covenants) Act 1995. A number of licences had been granted for alterations as the tenant was required to seek formal consent under the terms of the lease. A summary of key lease terms is attached in Appendix VI (not reproduced here).

Statutory enquiries

I undertook statutory enquiries to investigate whether there were any issues that may affect my opinion of value. Enquiries were made to Reading Borough Council and the Environment Agency in respect of:

- Planning.

- Highways.

- Rating.

- Environmental issues.

From my enquiries I was able to confirm that the property had consent for its existing use. I also found that neither the results of the planning nor highway searches revealed anything adverse to the client’s interest. I visited Reading Borough Council who confirmed that the register identifying contaminated land uses has now been discontinued, since it has not found it necessary to take action concerning contaminated land, and accordingly they were unable to assist with our enquiries. I was unable to obtain a conclusive answer with regard to the contamination issues without obtaining a specific search. However, on the basis that the property is a town centre location without any nearby contaminative uses, the likelihood of contamination would be limited.

It was concluded that if an environmental audit was undertaken, and it was discovered that the property was contaminated, the valuation would be affected. This assumption was noted in the report to the client.

Investigation of the Reading office market — key issue

From my own knowledge of the local market, I was aware that there was a large over supply of offices in the Reading market and along the M4 corridor. My task was to obtain market evidence that was comparable to the subject property. This involved identifying recent lettings, together with freehold investment sales within the locality. First, I had to identify recent lettings in the locality which would help determine the property’s Estimated Rental Value (ERV). Second, freehold investment sales would enable me to establish a yield that I could then apply in the valuation.

Collation of comparable evidence

I made inquiries with our agency department in respect of the Reading office market. I enquired as to whether they had recently let or acquired any properties on behalf of clients, or whether they were aware of any recent lettings or sales that may be suitable for comparable evidence. My initial thoughts were confirmed when I was told there was an oversupply of office space in the Reading market. I then searched for comparable evidence via external databases such as EGi and Focus.

Subsequently, I contacted agents who were active in the area, investigating any further evidence and the state of the Reading property market as a whole. These conversations gave me further information regarding the demand and supply for comparable property, including the duration of void periods and the level of letting incentives that were being offered.

Market conclusions

Rents in Reading town centre range from £15–£16 per sq ft for older second-hand accommodation to £24 per sq ft for modern recently completed developments. In the out of town markets, comprising Thames Valley Park and Green Park, and other smaller business parks, rents are typically around £26 per sq ft.

The office letting market is currently experiencing low levels of activity, although landlords are managing to maintain headline rents at high levels with the use of generous rent-free periods and other incentives. Due to long rent-free periods the headline rent being paid by a tenant can be misleading. When taking into account the overall rent payable over say, a five-year period the net effective market rent is much lower than the headline rent suggests. When analysing recent lettings I had regard to the level of rent-free periods granted, and calculated the net effective market rents. I enquired of my firm’s rent review department as to the current practice when analysing net effective rentals. I was advised that a notional three-month fitting out period should be deducted from the rent-free period granted. The resultant period should be analysed over five years to give the net effective rental. With a large oversupply of offices, landlords were offering competitive rentals.

The majority of lettings over the past 18 months within Reading have been of small suites, whereas a letting in excess of 20,000 sq ft would be regarded as a large transaction. The subject property provides over 70,000 sq ft of accommodation, and it is probable that, in the current market, a discount on market rent for the quantity of accommodation in the subject property would be required.

(Notes were made of letting boards when inspecting the property, identifying both local and non local agents.)

ERV

Based on the evidence, I considered that the current rental achievable for the subject property as a headline rent would lie in the region of £1,410,000 pa (£20 per sq ft), from which a rent-free period of some 12 months would need to be granted. Accounting also for three months’ fitting out allowance, this equates to a net effective rent of some £16 per sq ft, or £1,129,568 pa.

On this analysis, the property is shown to be marginally overrented against a passing rent of £1,145,000 pa (£16.25 per sq ft). Also, the rent review effective from March 2003 was not actioned by the vendor. On balance, it was concluded that the offices were effectively rack rented. A summary of the key comparable rental transactions is included in Appendix VII (not reproduced here).

Investment market evidence and establishing a yield

The value of commercial properties depends upon factors including security of income, unexpired term of the lease, whether there are any break provisions for a tenant, the covenant strength of the tenant and the location and condition of the building.

The subject property is let to a government organisation, and this is considered to be the strongest covenant available. Yields for prime office investments let to good covenants with unexpired lease terms of over 10–15 years in Reading were found to be in the region of 7%–7.25%. However, the subject property is an older office building, let with an unexpired lease term of nine years. This would therefore warrant a discount on prime yields.

From our investigations, it became apparent that recent investment sales of properties in the Reading area were attracting yields ranging from 7.25% to 8.1%. Countrywide recently built office buildings which were let to the...