Wholly individual or indivisibly whole

INTRODUCTION

Western culture places a great deal of emphasis on the rights of the individual. The concept of freedom of expression and the right of self-determination are enshrined in the democratic political systems of North America and Western Europe. Indeed, they are so familiar to us that most of us do not give them a second thought. Nevertheless, single-minded concentration on the needs and desires of the individual has encouraged an arrogance that is at once both an asset and a liability. It is an asset because it has catapulted humankind on a voyage of discovery through the universe that is within each of us, but it is also a liability because it has encouraged us to place ourselves above the cosmos of which we are a part.

Many scientists and philosophers now believe that future progress will depend on our ability to recognize and accept that the independence of each individual is a relative condition rather than an absolute one. Humankind takes great pride in its control and direction of certain aspects of the environment, but it still remains true that ultimately we are all dependent on that environment in the crucial sense of being a part of it. In fact, one of the most exciting features of scientific research during the last 50 years is the recognition that there is a deep interrelatedness among natural phenomena. Quite simply, everything in nature depends on everything else.

THE RELATIONSHIPS IN NATURE

This finding has significant implications for the development of human knowledge, because it suggests that the most important aspect of the world is not the individual parts of nature so much as the relationships in nature: the relationships define the parts, and no single part can exist independently of other parts.1 Hence, it becomes possible to visualize the world in terms of multilevel structures that start at the subatomic level and then extend upwards in ever-increasing layers of complexity. As an example, electrons combine to form atoms, atoms combine to form molecules, molecules combine to form organs, organs combine to form organ systems, organ systems combine to form animals and humankind.

THE BREAK WITH TRADITION

These concepts have been explored in some detail in recent years,2 and have even given a strong impetus to a new discipline known as ‘systems theory’.3 However, the ideas are not yet widely understood. Part of the difficulty derives from the fact that systems theory marks a distinct break from the traditional analytical procedures that have been favoured ever since the pioneering work of Isaac Newton and René Descartes. These procedures presume that it is possible to understand all aspects of any complicated phenomenon by ‘reducing’ that phenomenon to its constituent parts.

The process of dividing nature into progressively smaller units (a process that is known as ‘reductionism’) works very well in the context of everyday life. Indeed, the fund of knowledge is actually enhanced as differentiation increases, and so the process is self-justifying. However, in the 1920s, physicists found that the process was totally inapplicable at the subatomic level.4 Specifically, it was found that electrons do not exist with certainty at definite places and do not behave predictably at definite times.5 In other words, there was a critical level where ‘certainties’ disappeared, and where the concept of basic ‘building blocks’ seemed to become invalid.

The practical solution to the problem was to step back and assign characteristics to electrons that accounted for both the uncertainty of the unobserved state of existence and for the certainty of the observed state. It was hypothesized that electrons had a dual nature: on the one hand, the behaviour of an individual electron could not be forecast with any degree of certainty; on the other hand, the behaviour of groups of electrons could be forecast with a high degree of certainty. In other words, the solution6 lay within the mathematics of probability theory, where a large number of uncertainties produce a certainty.7 Probability theory can, for example, determine with 100 per cent accuracy the half-life of any radioactive substance,8 despite the fact that the point in time when one particular radioactive atom will disintegrate is totally unpredictable.

THE CONCEPTUAL REVOLUTION

The search for basic building blocks in nature will undoubtedly persist.9 In the meantime, the revelations of the New Physics (as it is called despite the fact that it is nearly a century old) are generating major structural changes in the natural and social sciences.10 Each discipline, essentially, is having to absorb two related ideas:

- wholes’ are something greater than the simple arithmetic sum of their ‘parts’;

- each ‘part’ has a tendency to have both a separate identity and to belong to a greater whole.

THE PROBLEM OF MOTIVATION

In the social sciences, the changes are leading towards a revolution in our understanding of human behaviour. In economics, for example, the traditional approach has been to assume that human beings are essentially mechanistic in their behaviour patterns. This assumption is based partly on introspection and partly on research. First, even an elementary level of self-analysis reveals that a large part of our behaviour involves an automatic response to particular stimuli. Second, statistical analysis can also be used to show that groups of people tend to respond in a predictable way to given stimuli. It is, therefore, only a small step to infer that individual behaviour is definitely mechanistic and to use that inference as the basis for economics analysis and forecasting.

It is certainly true that a great deal of our behaviour is mechanistic. This is, in part, due to fundamental biological and ‘social’ drives that are common to many species that inhabit this planet. Indeed, anthropologists such as Desmond Morris11 have been able to identify a large number of parallels between human behaviour and that of animals. However, mechanistic behaviour is also due to a type of habit formation that is a particular feature of the human subconscious mind. The point is that, because individual histories differ, everyone’s habits are going to be different to some degree, no matter how small. This, of course, leaves an inconsistency between habitual personal behaviour and predictable group behaviour.

There is, however, a more telling criticism. This is that human beings have a type of awareness that specifically transcends automatic behaviour. As Fritz Schumacher12 observed, the structure of living organisms is a progression of increasing complexity and power: plants have life; animals have life and consciousness; people have life, consciousness and self-awareness. Self-awareness here means the ability to be conscious of one’s own existence,13 and it encourages each individual to choose between alternative responses to a given situation. Self-aware decisions are not forecastable by outsiders. Nor is there any reason to believe that one person’s decisions will be the same as anybody else’s. As a very simple example, if someone was given a windfall sum of money, it would be very difficult for another person to predict precisely how that money would be used: it could be saved, spent, lent, given away or even destroyed.

THE DUALISTIC NATURE OF MOTIVATION

Economists have tended to ignore the inconsistency between individual variety and group conformity for two reasons. First, it is often argued that the assumptions in a theory are less important than the conclusions of that theory.14 Although there are some circumstances where this may be true,15 it is by no means always correct. In particular, assumptions are all too often reflections of biased beliefs about the world. Second, and perhaps more importantly, economic theoreticians have tended to resist the idea that a paradox actually exists. The reason for this seems to be that it presents a very real threat to the logical structure of modern economic theory (this point is covered in more detail in Chapter 6).

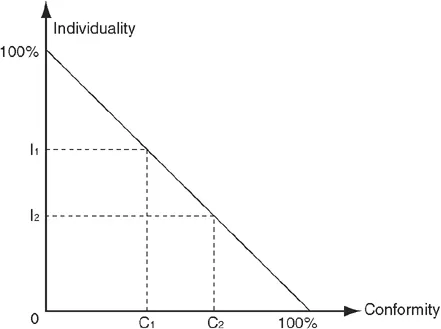

The solution to the dichotomy between individual variety and group conformity lies in the concept of a duality of characteristics, comparable to that used for subatomic phenomena. People have both the ability to be individuals and the tendency to belong to groups. The actual mix of the two characteristics varies over time depending on circumstances. Sometimes a person will be relatively individualistic, while at other times the same person will be relatively willing to conform to behavioural patterns pursued or imposed by others. Figure 1.1 shows this duality in a very simplified way. The locus of the link between the two axes representing individuality and conformity will vary from individual to individual but, in the simplest version, the mix will vary along a 45-degree line. Hence, the combination of individuality and conformity is different at I1/C1 than it is at I2/C2.16 The important difference between the two sets of circumstances is the degree to which a person accepts other people’s belief systems, thereby limiting their personal room for manoeuvre.

Figure 1.1 The combination of individuality and conformity

CONCLUSION

The idea that motivation has a dual nature represents a major breakthrough in our understanding of human behaviour. Eac...