The Handbook of International Trade and Finance

The Complete Guide for International Sales, Finance, Shipping and Administration

- English

- ePUB (mobile friendly)

- Available on iOS & Android

The Handbook of International Trade and Finance

The Complete Guide for International Sales, Finance, Shipping and Administration

About this book

International trade, and its financing, is now a key component of many undergraduate and postgraduate qualifications. For anyone involved in international sales, finance, shipping and administration, or for those studying for academic or professional qualifications in international trade, The Handbook of International Trade and Finance offers an extensive and topical explanation of the key finance areas. This essential reference resource provides the information necessary to help you to reduce risks and improve cash flow, identify the most competitive finance alternatives, structure the best payment terms, and minimize finance and transaction costs.

This fully revised and updated 4th edition of The Handbook of International Trade and Finance also describes the negotiating process from the perspectives of both the buyer and the seller, providing valuable insight into the complete financing process, and covering key topics such as: trade risks and risk assessment; structured trade finance; methods and terms of payment; currency risk management and bonds, guarantees and standby letters of credit.

The Handbook of International Trade and Finance provides a complete and thorough assessment of all the issues involved in constructing, financing and completing a cross-border transaction, as an indispensable guide for anyone dealing with international trade. The new edition also includes a section on risk management, which plays an increasingly important role in international trade from currency fluctuations to political risk and natural disasters.

N.B. This covers the principles of international trade and finance that are common across the globe and is relevant to anyone wanting to understand the subject, wherever they are located. Specific national issues (such as the UK's Brexit decision) do not affect the content. Online supporting resources include PowerPoint lecture slides.

Frequently asked questions

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Information

02

Methods of payment

Different methods of payment

- cash in advance before delivery;

- letter of credit (L/C);

- documentary collection;

- bank transfer (based on open account trading terms);

- other payment or settlement procedures, such as barter or counter-trade.

- bank transfer (also often called bank remittance);

- cheque payment;

- documentary collection (also called bank collection);

- letter of credit (also called documentary credit).

| The role of commercial parties | The role of banks | ||||

| Method of payment | Seller’s obligations | Buyer’s obligations | Money transfer | Document handling | Payment guarantee |

| Bank transfer1 | Sending an invoice to the buyer after delivery | Arranging for payment according to the invoice | X | ||

| Payment by cheque1 | Same as above | Arranging for a cheque to be sent to the seller | X | ||

| Documentary collection | After delivery, having the agreed documents sent to the buyer’s bank | Pay/accept at the bank against the documents presented | X | X | |

| Letter of credit | After delivery, presenting conforming documents to the bank | To have the letter of credit issued according to contract | X | X | X |

Bank charges and other costs

- standard fees for specified services – normally charged at a flat rate;

- payment charges – normally charged at a flat fee or in some cases as a percentage of the amount paid;

- handling charges, ie for checking of documents – normally charged as a percentage on the underlying value of the transaction;

- risk commissions, ie the issuing of guarantees and confirmation of letters of credit – normally charged as a percentage of the amount at a rate according to the estimated risk and the period of time.

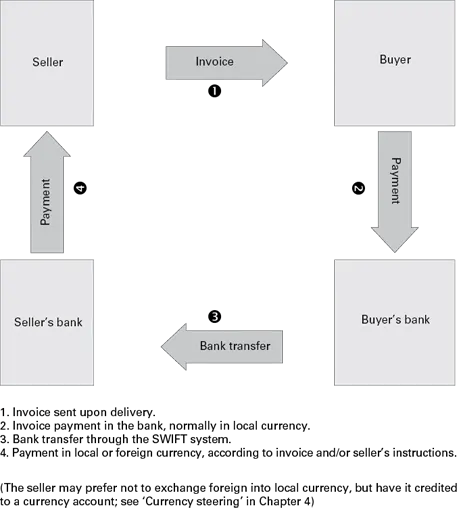

Bank transfer (bank remittance)

Payment structure follows the trade pattern

Table of contents

- Cover

- About this book

- Title Page

- Contents

- Preface

- Introduction

- 01 Trade risks and risk assessment

- 02 Methods of payment

- 03 Bonds, guarantees and standby letters of credit

- 04 Currency risk management

- 05 Export credit insurance

- 06 Trade finance

- 07 Structured trade finance

- 08 Terms of payment

- 09 The export quotation

- Appendix I: Electronic documents in international trade

- Appendix II: International transport documents

- Glossary of terms and abbreviations

- Index

- Copyright