01

The development of the recruitment industry

The Americans may claim that they invented the recruitment industry. After extensive research, however, we believe that the UK founded the earliest recruitment consultancy.

The Industrial Revolution during the late 18th and early 19th centuries saw major changes in the need to recruit relatively large numbers of employees to work in mechanized agriculture, manufacturing and transportation. The manual labour-based economy of Great Britain began to be replaced by one dominated by industry and machine-based manufacture. Over a period of around 70 years the effects spread across Western Europe and then to North America. With this demand for skilled employees a ‘gang master’ approach of recruitment provision was emerging. As the British economy grew, with it came the emergence of a ‘middle class’ and, with childhood mortality dropping dramatically, a desire for education.

In 1873 Mr John Gabbitas and his business partner Mr Thring formed Gabbitas, the first recorded recruitment company. Launched to provide teaching staff, and still thriving today as Gabbitas Educational Consultants, it included Evelyn Waugh, W H Auden, H G Wells, Sir Edward Elgar and Sir John Betjeman amongst its candidates. Other recruitment companies followed, providing domestic as well as factory workers, with Alfred Marks forming his iconic recruitment brand in 1919. Europe was slow to follow suit but the American staffing sector pushed ahead, with Fred Winslow opening his Engineering Agency in 1893 and Katharine Felton responding to the construction industry’s problems in staffing building projects after the San Francisco earthquake in 1906. The end of the Second World War provided an opportunity for entrepreneurs to seek out the limited number of highly skilled, mainly male, individuals and match them with the huge demand for growth in both infrastructure and, of course, business. An industry was launched.

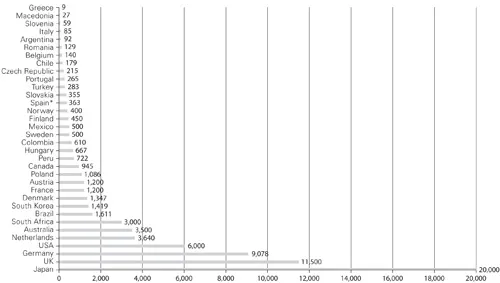

FIGURE 1.1 Number of private employment agencies

*figures for 2008; **ILO-Private employment agencies, temporary agency workers and their contribution to the labour market | 2009

SOURSE Ciett, 2011 report

The value of the recruitment industry

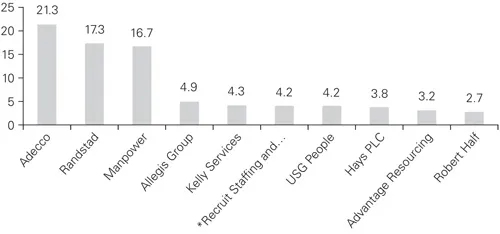

The global recruitment market is huge. In their 2011 report Ciett suggest that there are around 72,000 private recruitment companies, 169,000 individual branches employing 741,000 internal staff worldwide (see Figure 1.1). In 2009 the total global annual sales of the top 10 companies equated to 29 per cent of the world market (see Figure 1.2).

FIGURE 1.2 Top 10 staffing companies in billions of $

SOURSE Staffing Industry Analysts 2009 – www.staffingindustry.com

*Consolidated figures for Recruit Staffing and Staff Service

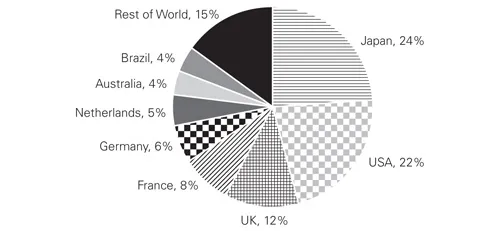

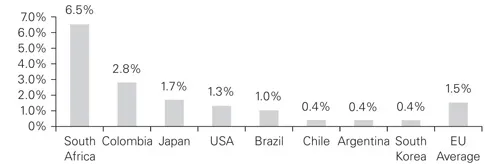

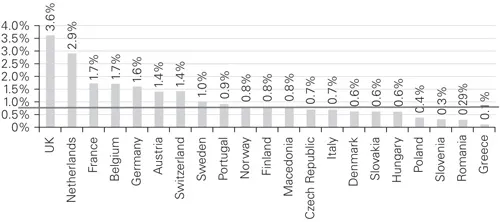

In 2009 Ciett found that there were 9 million full-time (or equivalent) temporary agency workers – a rise of over 3.8 million since 1999. Figures 1.3 and 1.4 respectively show the sales revenue splits per country and penetration rates outside Europe (2009) for agency work, while Figure 1.5 shows the penetration rates for agency work in Europe in 2009.

FIGURE 1.3 Agency work sales revenues split per country

SOURSE Ciett national

FIGURE 1.4 Agency work penetration rates outside Europe in 2009*

*Defined as the number of full-time equivalents – as supplied by Ciett National Federations – divided by the total active working populations – as published by the ILO

SOURSE Ciett, 2011 report

FIGURE 1.5 Agency work penetration rates in Europe in 2009*

*Defined as the number of full-time eqivalents – as supplied by Ciett National Federations – divided by the total active working population – as published by the ILO

SOURSE Ciett, 2011 report

European average penetration rate: 1.5%

Although the recessionary period has slowed the uptake of temporary workers in many countries, relaxing of restrictive legislation in many has created the platform for growth. And indeed, why not?

• Temporary agency work broadens the range of work solutions available to candidates, facilitating transitions in the labour market. It creates opportunities for workers to match lifestyle changes or indeed, personal constraints.

• The use of temporary agency work has been shown to contribute to reducing unemployment by creating a stepping stone to the labour market. According to Ciett 2010, 3 per cent of temporary workers registered as ‘unemployed’ before embarking on their temporary role compared to 15 per cent, 12 months afterwards.

• Higher temporary worker penetration has shown to reduce the level of undeclared (and therefore untaxed) work within a country.

• Recruitment firms often provide training to their temporary workers, which add to the work experience gained and upgrades the national skill set.

• Recruitment companies have been shown to pursue a diversity agenda ahead of the government. When employers have a narrow view of their ideal candidate, it has been recruiters that have widened the person specification beyond age, creed or gender, changing the client’s perspective of ‘square pegs’ and ‘round holes’. Temporary agency work also provides an opportunity to enter the labour market for potentially vulnerable groups, eg migrant workers, female returners or disabled candidates.

• Unions often worry that temporary work is a substitute for permanent job creation and therefore have a negative view of the concept. Yet research has shown (continual Research Capitation) that 80 per cent would not have existed if no agency solution were available.

• Generally temporary roles are created to meet peaks in demand or to fill in for absent permanent employees.

• Ciett found that the average profile of a temporary agency worker is:

– less than 30 years old (but ageing);

– working within service, manufacturing or public sector;

– motivated to temporary agency work by gaining work experience, to find a job or flexibility;

– satisfied with their position;

– do not want a permanent job.

• Recruiters have an extensive knowledge of local labour markets of special niche sectors.

• They advise on salaries, career paths or availability.

• They have access to extensive pools of both available workers and those passive candidates that do not apply to advertisements on job boards, are not turning up at job fairs and are not looking at corporate websites.

• They match the requirements of the client company to the needs of an individual and manage both expectations on each side of the recruitment process from start to completion.

• Recruiters select ‘the one’ from the thousands available and ensure that ‘the one’ recognizes the benefits of the opportunity.

The European recruitment market

Apart from the worldwide search companies, the majority of non-UK European recruitment businesses specialize in providing flexible workers. Around 2 per cent of the European workforce is temporary, with fairly mature markets found in Belgium, France, the Netherlands and, of course, the United Kingdom. Germany, Spain and Italy are consolidating and, with recent entrants into the EU, new geographical markets are emerging. As it did within the United Kingdom, the European market is developing from providing low-skilled, mainly young males towards office-based, mainly young and female staff. It is easy to predict that the market will evolve further up the value chain over time, as the UK market has.

Highly restrictive legislation has stunted the market growth potential of some countries, and it is certainly fair to suggest that there is a level of distrust about the motivation for organizations to utilize flexible workers; indeed, there is a view that everyone would really rather be in a secure permanent job. The recruitment industry is increasingly becoming recognized as a legitimate player in the flexibility/security debate (‘flexicurity’ is a hot topic in Brussels) and there is an overall trend for labour market deregulation. However there are still too many misconceptions about our industry, with severe image problems particularly in the Southern European countries.

The UK recruitment industry

The UK recruitment sector has a combined turnover of around £27 billion. The largest 100 UK businesses in the market turn over around £16 billion. Providing an exact figure of the number of UK recruitment companies is difficult, due to lack of licensing, low barriers to entry and substantial labour movement, especially amongst single-operator businesses. However evidence suggests that there are around 10,500 recruitment businesses in the UK. There are approximately 120,500 recruitment industry professionals with over 8,100 owners and senior directors working in around 19,000 offices. Approximately 1.6 million temporary workers are on assignment each day, with over 750,000 candidates being placed in permanent jobs by recruitment consultants, each year (Recruitment International, 2011).

The structure of the industry

As with any service-driven market, the UK recruitment industry has developed a structure around the business opportunities. Figure 1.6 gives an overview of the UK workforce and the types of recruitment business that supplies to each area, from both a permanent an...