Spatial Planning and Fiscal Impact Analysis

A Toolkit for Existing and Proposed Land Use

- 276 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

Spatial Planning and Fiscal Impact Analysis

A Toolkit for Existing and Proposed Land Use

About this book

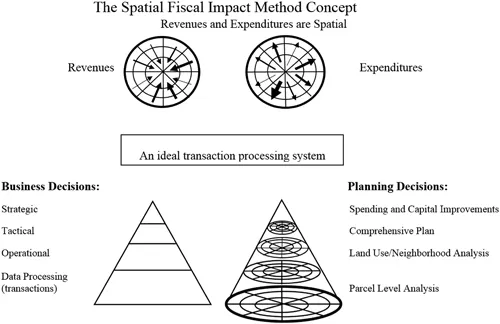

The Spatial Fiscal Impact Analysis Method is an innovative approach to measure fiscal impact and project the future costs of a proposed development, recognizing that all revenues and expenditures are spatially related. The Spatial Method focuses on estimating existing fiscal impacts of detailed land use categories by their location. It takes advantage of readily available data that reflect the flows of revenues and expenditures in a city, using the tools of Geographic Information Systems (GIS). The result is a comprehensive yet transparent database for measuring existing fiscal impacts and projecting the impacts of future development or redevelopment.

This book will provide readers with guidance as to how to conduct the Spatial Method in their own cities. The book will provide an overview of the history of fiscal analysis, and demonstrate the advantages of the Spatial Method to other methods, taking the reader step by step through the process, from analyzing city financial reports, determining and developing the factors that are needed to model the flows of revenues and expenditures, and then estimating fiscal impact at the parcel level. The result is a summary of detailed land use categories and neighborhoods that will be invaluable to city planners and public administration officials everywhere.

Frequently asked questions

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Information

Table of contents

- Cover

- Half-Title

- Title

- Copyright

- Contents

- List of Figures

- List of Tables

- About the Author

- Acknowledgements

- 1 Spatial Planning and Fiscal Impact Analysis Method

- 2 A Survey of Fiscal Impact Analysis Methods

- 3 A Comparison of the Spatial Fiscal Impact Method to Other Methods

- 4 Preliminary Financial Analysis

- 5 Compiling the Parcel_Factor Shapefile Attributes

- 6 Determining Fiscal Allocation Multipliers

- 7 Calculating Existing Fiscal Impact

- 8 Analyzing School Fiscal Impact

- 9 Projecting Fiscal Impact

- 10 Marginal Impacts and Sprawl

- 11 Working Toward an Enterprise Spatial Planning and Fiscal Impact Analysis System

- 12 Summary of the Spatial Planning and Fiscal Impact Analysis Method

- Appendix A: Creating an Address-Matching File for Parcels

- Appendix B: Allocating Public Safety Data to Parcels

- Appendix C: Determining Local Road Frontage for Parcels

- Appendix D: Reconciling Census Blocks with Parcels

- Appendix E: Using Census Data to Estimate Adult and School-Age Population by Parcel

- Appendix F: Modeling Fiscal Impact Using ArcGIS

- Index