- 368 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Electronic Bill Presentment and Payment

About this book

Electronic bill presentment and payment (EBPP) is revolutionizing the billing process by offering online and real time presentment of bill content and payment choices. EBPP is the easy way of viewing billing status, remittance items, and presenting balances using a universal browser from any location. In contrast to paper-based bills, electronic bi

Trusted by 375,005 students

Access to over 1 million titles for a fair monthly price.

Study more efficiently using our study tools.

Information

Chapter 1: Introduction to EBPP

The following chapters examine electronic bill presentment and payment (EBPP) models, technologies, and solutions in greater detail. In some cases, it may be difficult to differentiate whether statements, bills, or invoices are presented. As far as possible, the following definitions are followed:

- Statement: an itemized listing of purchases, sales, and other activities for a specific account and a specific time period; differs from an invoice or bill in that it does not constitute a request for payment, although it typically specifies an amount due

- Bill: an itemized account of the separate cost of goods sold, services performed, or work done; an amount expended or owed; a request for payment

- Invoice: an itemized account of goods shipped, usually specifying the price and the terms of sale; a consignment of merchandise; a request for payment

Statistics for expected savings and additional predicted revenues are invaluable in justifying investments into EBPP processes and tools. Unfortunately, the numbers differ greatly by geographical area and by industry. Instead of offering hard numbers to the reader, the following important metrics are presented and recommended:

- Volume of Internet commerce in targeted areas

- Number of Internet users in targeted areas

- Number of households in targeted areas

- Number of online households in targeted areas

- Number of issuers of statements, bills, and invoices by industry and by geographical area

- Number of recurring bills in targeted areas

- Price of issuing and distributing paper-based statements, bills, and invoices by industries in targeted areas

- Percentage of issuers offering electronic presentment, electronic payment, or both

- Number of direct billers, consolidators, aggregators, and billing service providers in targeted areas

- Market share of B2B (business to business) and B2C (business to consumer) by industries in targeted areas

- Number of statements, bills, and invoices received monthly by average households and businesses

Market research can identify the right investment targets on behalf of issuers of statements, bills, and invoices.

1.1 Definition of Electronic Bill Presentment and Payment

EBPP is the term used to describe the capability of presenting bills to customers and supporting their payment by electronic means. EBPP helps to eliminate the costs associated with printing paper bills, reduces delivery delays, saves time for customer-service representatives, and provides a channel for bidirectional communication between service suppliers and their customers on a one-to-one basis. Customers (payers) benefit by simplifying management of bill payment.

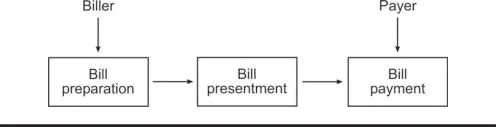

Figure 1.1 shows the basics of EBPP, including bill preparation, presentment, and payment. The potential impact of EBPP is significant when we consider that 20 billion bills are generated annually just in the U.S. at a cost of $2 to $5 in processing fees for each bill. The market opportunity for EBPP is particularly significant for solution providers.

While the term EBPP is used widely in the billing industry, there are also related terms frequently used by billers, consolidators, aggregators, distributors, and payers:

- IBPP (Internet bill presentment and payment)

- EBP (electronic bill presentment)

- OBPP (online bill presentment and payment)

- ED&EP (electronic delivery and electronic payment); electronic delivery is the Internet-based distribution and presentment of documents, which may or may not be payment related

- BIPS (bill and invoice presentment and settlement)

Figure 1.1 EBPP basic process.

The billing, invoicing, presentment, and settlement process is one of many direct interfaces between billers and payers. Other interfaces are call centers with customer service representatives (CSR), customer self-care solutions, and the sales force. In state-of-the-art applications, all can be considered as part of an integrated customer relationship management (CRM) package.

Independently from the targeted industry, EBPP or BIPS are part of a larger process from the perspective of suppliers, consisting of (Patel, 2002)

- Acceptance of an order

- Fulfillment of an order

- Settlement of an order

Automation has already been implemented for the first two process areas, leaving room for automation of the settlement process.

1.2 EBPP Service Types and Basic Business Models

Several service types can be considered as the basis for EBPP business models. The main types are:

- Biller-direct model, in which billers provide their bills on their personalized Web sites; electronic payment is assumed

- Consolidator model, in which billing service providers use one of several models allowing customers to access and process bills from multiple original billers:Thin client model

Thick client model

Customer consolidation model

Financial institution model - Consumer-centric aggregator model, in which billing service providers send their invoices to the aggregator site, rather than to the consumer, and are paid directly from the site; similar to direct-debit payments

- E-mail-based model, in which invoices containing rich-text graphics are sent to the consumer and then linked back to sites for online payment or detailed bill viewing

- Service-bureau model, which facilitates connections to large-scale consolidators, in particular for small and medium enterprises (SME)

- Portal model, which benefits from the portal’s established relationship with the user; the portal streamlines invoices from billers toward customers

- Alternative service provider (ASP) model, in which applications supplied by another provider may help to initiate a business relationship with minimal financial investment

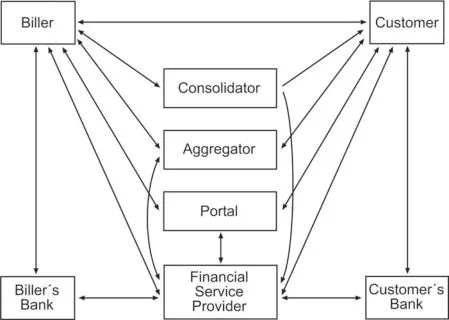

Figure 1.2 summarizes these service types and business models, indicating also the payments side via banks and financial service providers.

EBPP vendors can be categorized in one or more service types or allocated into general areas based on their business origins. These broad categories are:

- Special EBPP providers — companies that are completely focused on EBPP, e.g., CheckFree i-Solutions and Edocs

- Document and postal service outsourcers — companies that originally undertook bill and document processing in paper format and have now moved to EBP and EBPP, e.g., Pitney Bowes and DST Output

- Significant billing vendors — large billing vendors that offer various rating, billing, and related services and are interested in incorporating EBPP as part of their services, e.g., Daleen and Telesens

- Personal financial applications — consumer services related to the Internet for individual users, e.g., Yahoo, Quicken, and banking service providers, such as Corrilion, Digital Insight, MasterCard, and Visa

- Specialist telecom and utility providers — companies that offer a complete package bundled on a single site and that may expand into other services when EBPP makes further inroads, e.g., Servista and Essential.com

Figure 1.2 EBPP service types and business models.

1.3 EBPP Evolution Phases

EBPP is expected to be implemented in multiple phases. These phases are (Patel, 2002):

- Phase I: Print-to-Web, indicating the migration of existing printing structures to a Web presentation format

- Phase II: Adding value to EBPP by offering analysis, data mining, money savings, workflow support, and customer care

- Phase III: Revenue generation for the EBPP user — billers, consolidators, aggregators — by the maturing of previously implemented value-added services

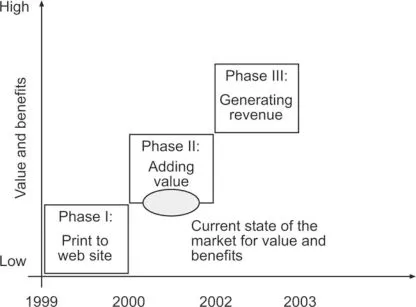

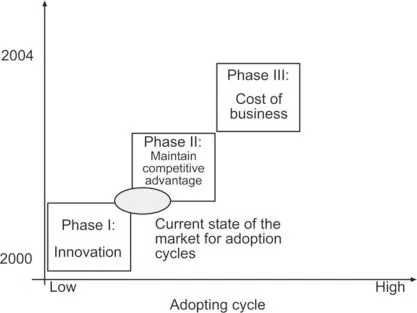

Figure 1.3 shows an estimated timeline for the increasing value of these three EBPP phases as each is implemented. Phase II currently dominates the majority of solutions. Figure 1.4 shows a timeline for the adoption cycle of the three EBPP phases (Patel, 2002):

- Phase I: Innovation

- Phase II: Maintain competitive advantage

- Phase III: Cost of business

As in Figure 1.3, Phase II in Figure 1.4 is the typical adoption average.

Figure 1.3 Evolution phases of EBPP.

Figure 1.4 Adoption cycles in the EBPP evolution.

1.4 EBPP Entities and Players

EBPP represents a complex relationship between participating entities. Interrelated workflows are the best tools to control this relationship. The following entities play a key role in EBPP:

- Billers: organizations that present bills directly to their customers. This entity provides goods and services that customers want to purchase. Billers can be individuals, businesses (e.g., telcos, utilities), or government agencies (e.g., tax authorities). Billers assemble the invoice and send it to the payers. EBPP replaces the traditional paper document by an electronic format.

- Biller service providers (BSP): special organizations that billers use to outsource their billing functions. It could be a vendor or service bureau that generates and delivers bills, statements, and orders of confirmations on behalf of other vendors. The BSP may also complete the cycle by accepting payment response and delivering corresponding automated clearinghouse (ACH) transactions to the biller or its designated bank.

- Consolidators: organizations that consolidate bills from various types of billers. This entity is responsible for invoice preparation, delivery, and tracking of invoice-related items. It serves as the central point for these functions and charges the biller for supporting these functions. Consolidation is usually consumer-centric. This entity is usually different from banks and billing service providers.

- Portals/distributors and exchanges: organizations that are responsible for distributing bills to customers. This entity is actually an aggregator that performs the function of aggregating invoices for a set of customers that frequently access a network where all their billers would like to present their invoices. Examples are the Web sites of Internet service providers (ISP) that could serve as the home site for invoices for certain consumer clusters.

- Payers: customers who are expected to view the presented bill and pay it electronically. This entity makes the final payment for goods and services. It could be an individual (e.g., consumer, household), another business, or a government organization. This entity receives the invoices for purchases in electronic format (EBP). Electronic bill payment takes this process further by enabling the payer to make the payment electronically, thereby eliminating the need for paper used for checks, money orders, and envelopes.

- Banks: financial organizations that offer electronic access to their customers’ accounts. Most noncash payment methods require this entity to play a principal role. With EBPP, banks are representing payers and billers. They complete the payment and posting functions, making sure that the billers receive the compensation for their goods and services by the payers once payments have been authorized. All processing takes place in back-offices by entities like clearinghouses and lockboxes, where payments are physically processed in financial institutions.

- Vendors: organizations that offer software and hardware to enable EBPP. This entity provides the necessary EBPP applications to all other entities. They are specialist providers, outsourcers, billing vendors, and special EBPP providers.

- Communications service providers: organizations that offer their infrastructure to the transaction processing service. This entity is responsible for the network, servers, server farms, and efficient storage management.

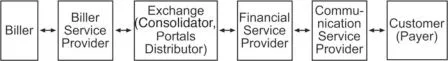

The relationships among these entities are complex, since a number of companies provide overlapping services, with some offering full coverage of EBPP phases, presenting different payment methods, and supporting dynamic alliances. Figure 1.5 shows the value chain with participating entities. It is a generic chain, and not all chain components are implemented in every case. Chapter 4 extends this chain by a control umbrella that collects and computes process-specific data.

Figure 1.5 Value-chain of the EBPP process.

Even within the same company, multiple stakeholders are responsible for various issues. Examples are (Schumacher, 2002):

- Operations for seamless functioning of hardware, software, and applications

- Treasury for supervising payments and payment metrics

- Market research to evaluate customer behavior

- Customer service to help customers and avoid customer churn

- Auditing to continuously evaluate the accuracy of bills and invoices

- Management to guide investment directions by evaluating the return on investment (ROI)

1.5 Who Is Using Electronic Bill Presentment and Payment?

The greatest interest to implement EBPP solutions within the billing environment is expected from telecoms, utilities, insurance companies, and from the banking sector. These businesses would benefit the most from the functions, qualities, and features of EBPP. Particular interest is predicted due to the overlapping nature of these four industry branches. Other industries might be interested in the future, including health care, government administration, manufacturing, wholesale, and retail. The adoption rate, however, is not yet too deep in these industry sectors.

In the case of telecom service providers and utilities, EBPP is attractive because of the level of detailed data that can be included in an online bill, e.g., call detail records and gas/electricity/water usage details, as well as the analytical and data-mining tools that EBPP can deliver. In the case of the banking industry, the driving force for EBPP is its proximity to the core business model of the financial industry. Most importantly, all of these businesses benefit by placing their recurring statement and billing cycles online because it reduces the need to print and deliver paper documents, a costly and resource-intensive activity.

1.5.1 Telecommunications Service Providers

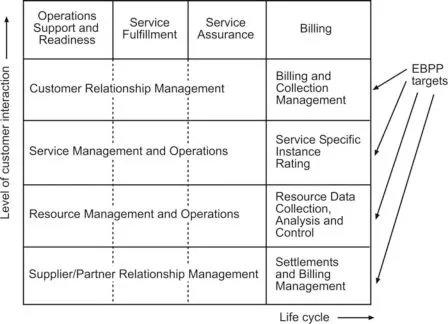

EBPP can be positioned in the operational service model of telecommunications service providers. Figure 1.6 shows the two principal dimensions of this service model: customer interaction and life cycle. As seen in Figure 1.6, the EBPP targets include all phases of billing that are assigned to the four principal processes:

- Customer relationship management

- Service management and operations

- Resource management and operations

- Supplier/partner relationship management

Figure 1.6 Operational service model of telecommunications service providers.

The relative importance of the telecom market in the EBPP business process is demonstrated by the fact that up to 80% (Phillips Group) of all recurring bills are produced by this market in the U.S. With as many as 50,000 recurring billers worldwide annually generating up to 20 billion bills in the U.S. marketplace and around 60 billion bills worldwide, the resource demand for this back-office function is considerable. If we add the degree of competition and the shake-up of legacy business models (e.g., price of bandwidth, licenses for third-generation wireless, usage-based rating models, etc.), any cost savings on the part of the telecommunications providers are relevant.

At this time, telecommunications service providers are one of the prime movers in the EBPP market, with most hoping to implement an online EBPP solution of some sort. Little planning and homogeneity is evident in these solutions, while the dilemma of which type of EBPP solution to implement is particularly marked. No particular business model is favored. Many providers are developing their own billing solutions for the future. In the meantime, they combine various EBPP models to bridge the time gap.

Originally, most service providers attempted to build their own EBPP solutions due to the fact that a midsize company would utilize up to 30 different internal legacy billing systems. Under these circumstances, the billing-direct business model was too complex. This is one of the main reasons that service providers outsource to specialist EBPP companies. EBPP vendors have recognized this trend and are aggressively marketing solutions. A particular issue arising from this development is the degree to which functionality can be extracted from legacy data delivered by mediation devices to the EBPP vendor. The more data that can be extracted from the legacy data, the greater is the front-end functionality that can be provided to the customer (payer). This demand has led to the development of powerful parsing capabilities and transparent open systems that can accept numerous industry standards and translation applications. The importance of XML and Java in this process should be reemphasized.

One problem is common to both telecommunicati...

Table of contents

- Cover Page

- Advanced and Emerging Communications Technologies Series

- Title Page

- Copyright Page

- Preface

- Acknowledgments

- The Author

- Chapter 1: Introduction to EBPP

- Chapter 2: The Billing Process

- Chapter 3: Business Models for EBPP

- Chapter 4: Value-Added Attributes of EBPP

- Chapter 5: Risks, Security, and Privacy with EBPP Business Models and Solutions

- Chapter 6: Documentation and Payment Standards for EBPP

- Chapter 7: EBPP Service Providers and Products

- Chapter 8: EBPP Operating Concepts

- Chapter 9: Case Studies of Successful EBPP Implementations

- Chapter 10: Summary and Trends of Designing, Implementing, and Operating EBPP Solutions

- Acronyms

- Bibliography

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn how to download books offline

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 990+ topics, we’ve got you covered! Learn about our mission

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more about Read Aloud

Yes! You can use the Perlego app on both iOS and Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app

Yes, you can access Electronic Bill Presentment and Payment by Kornel Terplan in PDF and/or ePUB format, as well as other popular books in Business & Information Management. We have over one million books available in our catalogue for you to explore.