eBook - ePub

Pharmaceutical Product Branding Strategies

Simulating Patient Flow and Portfolio Dynamics

- 312 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Pharmaceutical Product Branding Strategies

Simulating Patient Flow and Portfolio Dynamics

About this book

This updated Second Edition details how marketers, forecasters, and brand planners can achieve optimal success by building internally consistent simulation models to project future behavior of patients, physicians, and R&D processes. By introducing the reader to the complexities facing many pharmaceutical firms, specifically issues around cross-functional coordination and knowledge integration, this guide provides a framework for dynamic modeling of interest to several pharmaceutical markets, including epidemiology, market definitions, compliance/persistency, and revenue generation in the context of patient flows or movements.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Pharmaceutical Product Branding Strategies by Mark Paich,Corey Peck,Jason Valant in PDF and/or ePUB format, as well as other popular books in Business & Pharmaceutical, Biotechnology & Healthcare Industry. We have over one million books available in our catalogue for you to explore.

Information

1

Traditional Approaches to Brand Planning: The Disconnect Between Product Strategies and Commercial Evaluations

INTRODUCTION

This chapter will cover the following topics:

• Challenges facing the pharmaceutical industry

• Inadequate analytic methodologies in the pharmaceutical world

• Existing approach to strategic/Brand Planning

• Methodologies for commercial assessment

• Lack of integration between brand positioning and commercial assessment

• Risks associated with ineffective decision making

The American public has a love–hate relationship with pharmaceutical companies. On the one hand, we are avid consumers of the products they develop and distribute. More than 3.8 billion prescriptions were dispensed in the United States in 2007 (1), representing more than 10 “scripts” per year for each and every citizen in the country. According to one study, an astonishing 74% of the population is using at least one prescription medication at any given time (2). The aging of the population, the increase in conditions such as diabetes and obesity, and the creation of government programs such as Medicare Part D are all likely to further increase the dependence of Americans on pharmaceutical therapies.

Despite such a clear and widespread prescription usage, Americans continue to maintain an unfavorable perception of the pharmaceutical industry as a whole. According to Datamonitor, in 2005, less than 13% of consumers feel that the information provided by industry firms is more trustworthy than that provided by other organizations. Complaints on the part of consumers are on the rise and the resulting political pressures helped push through the Food and Drug Administration Amendments Act of 2007—a sweeping reform bill designed to address some major industry problems. And the election cycle of 2008 saw a number of candidates bashing “Big Pharma” (along with other targets such as “Big Oil” and “Big Insurance”) as one of the main reasons for skyrocketing health care costs.

The pharmaceutical industry is well aware of the conflicting opinions on the part of its customer base, but is facing internal challenges of its own. Many firms are attempting to change in response to evolving marketplace conditions that threaten the “blockbuster drug” business model of the 1990s. New compounds are increasingly difficult to discover and develop, and the regulatory approval process reflects this tightening of developmental pipelines. During 2005 to 2007, the Food and Drug Administration (FDA) approved only half the number of new compounds as it had only a decade before (3). And fewer than 10% of these newly approved compounds are expected to ultimately generate sales of even $350 million annually (4)—far below the $1 billion annual revenue benchmark usually reserved for “blockbuster” status. Five different blockbuster drugs went off-patent in 2006 and more such transitions loom large on the horizon; Lipitor (the world’s biggest selling pharmaceutical product) has only a few years of patent protection remaining (5). Price pressures, both from the public and private sectors, have made headlines nationwide—witness the plan in 2004 by the state of Illinois to import pharmaceuticals from Canada in order to cut costs. These situations have made the pharmaceutical industry as a whole seem vulnerable in the face of new challenges, new realities regarding drug development, new competition from biotechnology and the emerging world of genomics, and new expectations on the part of consumers and managed care providers.

The gloomy picture for the future of traditional pharmaceuticals, however, is being made brighter due to an emerging environment of new approaches to both analyze disease marketplaces and develop effective marketing strategies within them. Acceptance of new analytical techniques, associated computing power, and a wide variety of patient and physician data constitute a “perfect storm” of conditions to support a new paradigm for pharmaceutical marketers and executives alike. The need for a new approach has never been greater, and the results can often have huge impacts regarding the strategic decisions designed to create and maintain competitive advantage to the pharmaceutical industry.

These key business decisions have the potential to be supported by the wide availability of data relevant to pharmaceutical businesses, if only a coherent and consistent framework can be utilized to incorporate and leverage it. We like to tell our clients that data ≠ information ≠ knowledge ≠ wisdom. Only through careful examination of data, using cutting-edge analytical and simulation techniques, can the true power of the vast amount of industry-wide data be truly unleashed.

Extensive records regarding patient and physician behavior are now readily available from claims databases and third-party data providers, which in longitudinal form make it possible to track the dynamics of various patient segments and physician prescribing patterns over time. Extensive competitive intelligence makes product pipelines of industry players transparent to any analyst with an Internet connection. Masses of raw data are useless without an interpretive framework that synthesizes it into information that can generate learning and create the foundation for significant and sustained competitive advantage. And in the everchanging pharmaceutical world, the Dynamic Modeling framework is a highly effective organizing tool to capture, analyze, and ultimately leverage the complex dynamics driving industry behavior.

In our consulting practice over the last 15 years, we have assisted our clients in advancing their Brand Planning approaches and associated evaluations of commercial potential for New Chemical/Molecular Entities (NCEs or NMEs) or New Biologic Entities (NBEs) toward sophisticated methodologies that have been popular in other industries for years. Dynamic Modeling represents a cuttingedge approach for operationally defining the set of interrelationships that drive the behavior of pharmaceutical marketplaces.* This approach is based on established techniques from the world of operations research and system dynamics, and adds value in at least two distinct ways.

1. The Dynamic Modeling approach creates a means to test the linkages between cause and effect in various pharmaceutical settings. Such simulation-based models can be used to operationally define the expected outcomes of a set of strategic decisions, resulting in better strategic plans and a more complete understanding of the sets of key relationships governing them.

2. Dynamic models provide a useful operational input to the forecasting process by establishing a framework to integrate the knowledge bases that exist within a pharmaceutical firm’s functional divisions. The approach establishes practical boundaries on the realm of possible outcomes from a commercial assessment, providing a solid foundation for reasonability checks of the commercial potential for an NCE. As such, dynamic models provide another lens through which the future behavior of a disease marketplace, and the position of a particular compound within it, can be seen.

Before investigating the details regarding the Dynamic Modeling framework, however, it is useful to review the typical process for developing Brand Plans for an NCE, as well as highlight some deficiencies in the existing approaches of strategy development in the pharmaceutical world.

TYPICAL APPROACH FOR STRATEGIC/BRAND PLANNING IN PHARMACEUTICAL INDUSTRY

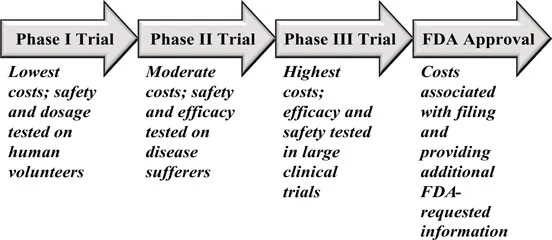

The pharmaceutical industry has been a large part of our consulting practice over the last decade, and many of our engagements are headed by marketers in charge of a particular developmental NCE.† These marketers often have the title of Brand Manager for a particular compound and are typically charged with developing a strategic plan for the NCE in late Phase II or early Phase III trials on its way to the approval by the Food and Drug Administration (FDA), as seen in Figure 1.

Results from the relatively inexpensive Phase I clinical trials force pharmaceutical firms to make critical decisions regarding the future of the NCE and the associated resources allocated to it. Sometime after the beginning with Phase II but often not until Phase III, senior executives will commission a Brand Plan to assess the technical and commercial potential of the new compound.* Brand Managers typically assemble a cross-functional team comprised of representatives from the firm’s marketing, clinical/medical, health outcomes, and forecasting departments† to evaluate the financial potential of the NCE. If the new compound is currently in Phase II, the evaluation process might also help decide on a testing plan for the subsequent clinical trials. For example, the strengths and weaknesses of currently available products often suggest a Phase III clinical trial design to demonstrate the superiority of the developmental drug.

The Brand Plan team is assembled to guide the compound through the development process toward the launch of the product—a complicated endeavor involving numerous milestones and a large investment of human/financial resources. However, from a marketing perspective a Brand Plan has two key objectives.

Key Components of a Brand Plan for an NCE

1. A set of product strategies for the short-term time horizon (1–3 years)

2. An early commercial assessment of the compound’s financial potential

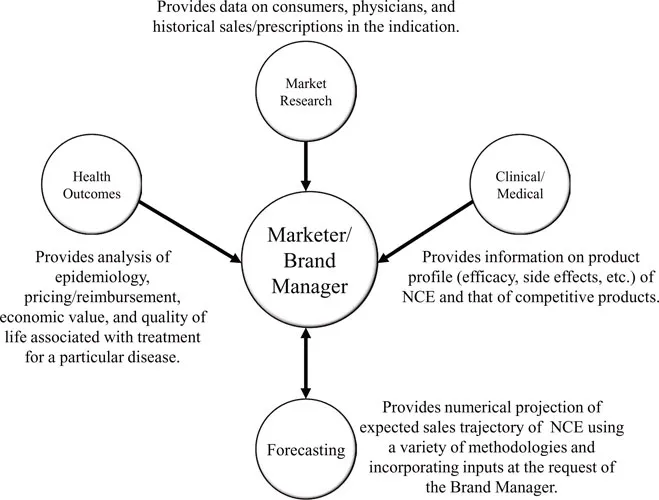

Pharmaceutical firms over the last decade have increasingly adopted the practice of cross-functional coordination in order to leverage various types of knowledge within the organization, and marketers often sit at a conceptual hub of company functions when it comes to early assessment of NCE market potential. In order to develop an effective Brand Plan, the Marketer/Brand Manager is often the “gravitational force” behind such cross-functional interactions, as depicted in Figure 2.

Clinical/Medical

Often physicians who previously practiced medicine in a specific disease area, Clinical/Medical experts are knowledgeable in the pros and cons of various currently available treatments and have the technical expertise to understand and evaluate the product profile of the NCE, especially as relates to understanding the design and results of clinical trials. Their knowledge of standard practice and corresponding treatment paradigms provides excellent background into how patients are viewed and subsequently treated by physicians. Clinical/Medical experts help place the NCE within a competitive market framework, often by working with the Marketer/Brand Manager to develop a Strengths, Weaknesses, Opportunities, and Threats (SWOT) analysis.

Health Outcomes

In order to assess the impact of a disease on individuals or the economy, Health Outcomes resources analyze marketplace factors such as epidemiology, the economic benefit of various forms of treatment, pricing and reimbursement, and lifestyle measures of the effect of a disease on quality of life metrics. Epidemiology is an increasingly important part of this analysis, and is based on evolving population demographics and changing prevalence, diagnosis, and treatment rates. Health outcomes personnel may provide information how the disease affects specific patient segments at the request of the Marketer/Brand Manager, but their primary contribution is the overall assessment of how a particular disease impacts the health of those suffering from it and lives of those around them.

Market Research

Market Researchers represent the “voice” of the marketplace and specialize in collecting, analyzing, and communicating information on the indication marketplace and individual existing treatment options within it. Market Researchers design primary market research studies to collect data on physician/consumer reactions to NCE product profile, pricing, packaging, etc., often using a conjoint analysis framework. They may also que...

Table of contents

- Cover

- Half Title

- Title Page

- Copyright Page

- Preface

- Acknowledgments

- Table of Contents

- 1. Traditional Approaches to Brand Planning: The Disconnect Between Product Strategies and Commercial Evaluations

- 2. Dynamic Modeling Approach to Brand Planning: Operationally Understanding Key Marketplace Dynamics

- 3. The Dynamic Modeling Language

- 4. Patient Flow Sector of the Standard Template Dynamic Model

- 5. Extensions of the Standard Template

- 6. Data for the Standard Template Dynamic Model

- 7. Specific Models of Patient Flow Dynamics

- 8. Dynamic Models of Doctor Adoption of Newly Released Pharmaceuticals

- 9. Agent-Based Modeling Approach

- 10. Treatment Attractiveness of Pharmaceutical Products

- 11. Integrating the Three Sectors of the Standard Template Dynamic Model

- 12. Strategy Testing Using Integrated Standard Template Model

- 13. Dynamic Modeling of First-Mover Advantage and Network Effects

- 14. Dynamic Modeling of New Marketplaces: Techniques for Dealing with Uncertainty

- 15. Integrating Standard Template Dynamic Models Across Indications

- 16. Dynamic Modeling of Pharmaceutical Pipeline Portfolio Issues

- Glossary

- Index