![]()

PART I

Digital finance and financial services

![]()

1

INTRODUCTION

The term “finance” may refer to either the finance industry (generally speaking, banking, insurance, and real estate) and to the functions of finance (inclusive of accounting, business development, business intelligence, regulatory services, and more). In this text we address both contexts of finance, with an especially intense focus on digital considerations. By “digital” we mean online businesses (“Clicks”) as well as all manner of digital data types inclusive of text, numbers, sound, or images. If it can be included in an email as a message or attachment, then it is digital, or is capable of being converted to a digital rendering. In this chapter we set a foundation for the remainder of the text by providing a multi-dimensional blueprint of what digital finance may include.

So what exactly is meant by “digital finance”?

Firstly, “digital” is a reference to any kind of data that can be captured and expressed electronically, inclusive of numbers, text, images, and sounds. If it is something that can be sent via text or email, it is digital.

Secondly, “finance” refers to both the financial industry (banking, investments, insurance, and real estate) and to finance functions within any business (accounting, budgeting, acquisitions, cash and capital management, or whatever functions management decides to delegate).

The value proposition of this book is that it represents a blueprint for students of finance (whether in the classroom or workplace) to use in order to see how things digital are designed, and by extension, how new constructs can be cobbled together. Digital Finance provides a context and tools for navigating our increasingly digital world, with an enumeration of specific strategies for success. Among the topics covered in this practical, how-to text are the following:

- Valuing a start-up;

- Maximizing the integration of online (Clicks) and physical (Bricks) business channels;

- Opportunistically exploring new opportunities in the digital economy; and

- Harnessing big data for targeted applications.

With the breadth of topics covered, references for additional resources are often cited to encourage readers to take deeper dives into topics of special interest (with regular updates also provided at perrybeaumont.com), and an extensive glossary has been created to facilitate clear understandings of commonly used (and misused) industry terminology.

Theories underlying various concepts are also presented throughout the text. Rather than simply presenting ideas on a standalone basis, efforts are made to link observations to a grounding in foundational principles. Modern Portfolio Theory, the Capital Asset Pricing Model, and the Efficient Market Hypothesis are just a few of the frameworks evoked in order to provide insights, and references to recent advancements in accounting, economics, and finance are routinely explored as well.

In addition to providing a survey of current and prospective issues of significance, Digital Finance also unveils novel perspectives along with unique strategies. For example, the concept of tangencies is revealed for the first time, and the newly evolving realities of a fundamental shift in the dynamics of global market volatility are also unveiled. The concept of P*Q is also introduced as a rubric for evaluating a company at any stage of its life cycle.

Frameworks for thinking about digital finance could include the various business functions for which it might be applicable, the technologies internal to a company where it could be used, and consideration of the kinds of third parties providing digital finance solutions that could be helpful to a firm in some way.

Digital Finance seeks to elucidate, to educate, and ultimately to motivate readers to think creatively about our digital world; opportunities to capture, and risks to avoid.

***

Nearly every company has at least one person who handles one or more finance-related duty. For particularly small firms, the person handling finance-related functions might also have other responsibilities. The person overseeing basic accounting and payroll might be the owner of the company, or an individual who also processes new business orders.

In larger companies, finance departments may include accounting, payroll, money management, risk management, strategy, and legal. The person generally overseeing these larger departments is often designated the Chief Financial Officer. In some instances, larger finance teams are also involved in some aspect of a company’s operations, and occasionally finance and operations are merged into a single group.

For firms both large and small, the internet offers a variety of online tools and services to assist with finance duties, and these include the running of payroll, tax calculations and payments, expense management, employee benefits tracking, and more. The internet also facilitates various finance functions being outsourced altogether, as in the case of NowCFO.com and others.

In addition to the corporate functions of finance, there is also the finance industry.

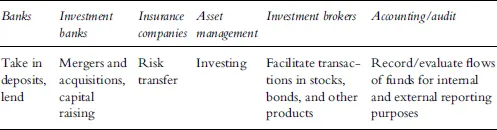

The finance industry encompasses products and services related to the flow of money, and Table 1.1 helps illustrate a few of the ways in which we can categorize various products and services.

TABLE 1.1 Finance industry products and services

In each of the examples cited in Table 1.1, there is a function related to the flow of money. Banks take inflows of money (deposits), and lend outflows (loans) at a rate of interest. Insurance companies take inflows of money (premiums) and pay outflows (claims) when there is an insured event. Investment brokers take inflows (investor cash) to purchase assets (stocks and bonds). Sometimes these products and services can cross lines. For example, insurance companies might seek to remove or reduce potential claim liabilities from their financial statements by bundling insurance policies together and selling them as asset-backed products via investment banks.

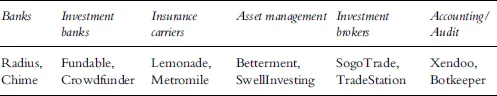

For each category exhibited in Table 1.1 there is a Click (online) equivalent, and these are presented in Table 1.2.

TABLE 1.2 Examples of online equivalents in financial services

For clarity, the fact that a Click solution is cited in Table 1.2 does not necessarily mean that it has identified a successful business model in relation to its Brick equivalent. As we will see in Chapter 2, “FinTech, InsurTech, PropTech, and RegTech,” some Clicks have yet to reach profitability.

***

One of the more exciting aspects of digital finance is how certain markets that were once viewed as being the last place one might expect to see new offerings are now often among the very first. With developing market economies, for example, the simple introduction of mobile phones has transformed business in dramatic ways. The ease of transferring money electronically has made for an explosion in the availability of credit to places and people looking to undertake new and innovative projects.

Companies involved with microfinance have seen a real transformation in the way business is done. Simply put, microfinance involves bringing financial resources to remote parts of the world where small investments can go a long way. A modest loan to a fisherman in Malaysia can facilitate payments toward the purchase of a boat, saving on costly lease payments. With monthly installments paid from fishing proceeds, the loan is eventually paid; this permits the fisherman to secure a second boat and creates the need for even more labor. Microfinance has been particularly successful with helping to launch ventures for women in developing countries, with some studies suggesting that it can go a long way to help reduce gender inequality in developing countries.1

It has been estimated that 2 billion people in developing markets lack access to a bank, and that 200 million small businesses have challenges with obtaining credit, estimated to an aggregate need of about $2.2 trillion.2 Further, mobile networks reach about 90% of people in emerging economies and nearly 80% of adults have a mobile phone subscription, and it is estimated that greater adoption and use of digital venues could increase the Gross Domestic Products (GDPs) of all emerging economies by 6% (or nearly $3.7 trillion) by the year 2025.3

The digitization of money not only facilitates its transfer from one source to another, but does so in a fashion that is relatively secure and which reduces concerns such as the need to watch money stockpiles, or the need for people to monitor cash reserves rather than engage in more active labor activities. Digitization also permits robust tracking of commercial flows, helping to identify areas that are active and underserved, or inactive and perhaps in need of financial resources. Transaction records maintained by financial institutions can also help government authorities with m...