1 | Introduction Challenges |

This chapter presents some examples that will be frequently referred to throughout the book to illustrate the presentation and discussion. The examples demonstrate some of the fundamental problems current risk analysis practice is facing. In later chapters, the problems will be rectified using recent developments in the field and science of risk analysis.

1.1 CLIMATE CHANGE RISK: CONCEPTS AND COMMUNICATION

Few global threats rival global climate change in scale and potential consequence. The principal international authority assessing climate risk is the Intergovernmental Panel on Climate Change (IPCC). Through repeated assessments, the IPCC has devoted considerable effort and interdisciplinary competence to articulating a common characterization of climate risk and uncertainties. The IPCC aims at informing governments and decision-makers at all levels about scientific knowledge on climate change issues. Their work is, to a large extent, about risk. The communication can be viewed as successful, in the sense that most governments are now taking serious action, in line with the main conclusions made by the IPCC.

However, the scientific quality of the risk assessments and characterizations made can be questioned and, hence, also the related risk communication. Strong criticism has been raised against the way risk is dealt with in the IPCC work. For example, in their review of the assessment and its foundation for the Fifth Assessment Reports published in 2013 and 2014, Aven and Renn (2015) argue that the IPCC work falls short of providing a theoretically and conceptually convincing foundation on the treatment of risk and uncertainties. The main reasons for their conclusions are: (i) the concept of risk is given a too narrow understanding, and (ii) the reports lack precision in delineating their concepts and methods.

The panel seems to have developed its approach from scratch without really consulting the scientific community and literature on risk analysis. For the IPCC, this community and literature have clearly not provided the authoritative guidance that could support it in forming its approach to risk. This demonstrates that the field and science of risk analysis is too weak to have an impact on important scientific work such as climate change research. The result is a poor IPCC conceptualization and treatment of risk and uncertainties.

For example, to characterize risk the IPCC uses the likelihood/probability concept, but an understandable interpretation is not provided. The IPCC states for instance that it is extremely likely – at least 95 per cent probability – that most of the global warming trend is a result of human activities (IPCC 2014a), without expressing what this important statement means; refer to Section 6.2.1.

In the 2007 IPCC reports (IPCC 2007, p. 64), risk was generally understood to be the product of the likelihood of an event and its consequences (the expected value), but this interpretation of risk is not used in the latest reports. The concept of expected values representing risk in situations such as climate change has proved to be inadequate, as emphasized by many analysts and researchers (Haimes 2015, Paté-Cornell 1999 and Aven 2012a); see also Chapter 4.

In later IPCC documents – see for example the Guidance note from 2010 (IPCC 2010) – this understanding of risk is replaced by a perspective where risk is a function of likelihood (probability) and consequences. However, strong arguments can be provided – see Chapter 4 – that this risk perspective is also inadequate for assessing climate change risk. The concept of risk in the IPCC works refers to likelihood/probability, but, with no interpretation of this concept, the concept of risk also becomes undefined and vague. Equally important, significant aspects of risk are not really incorporated, as will be thoroughly discussed in Chapter 4, see also Section 6.2.1. A key point is that probability is not a perfect tool for representing/describing uncertainties. One may, for example, assess that two different situations have probabilities equal to 0.2, but in one case the assignment is supported by a substantial amount of relevant data, whereas in the other by effectively no data at all. The likelihood judgement in itself does not reveal this discrepancy. When linking risk as a concept to a specific measuring device (likelihood, probability), special attention and care are warranted. The strength of the knowledge supporting the probabilities needs also to be highlighted, as well as the potential for surprises relative to this knowledge.

The IPCC reports also discuss knowledge strength, using the confidence concept summarizing judgements concerning evidence and agreement among experts. However, according to IPCC there is no link between the likelihood/probability judgements and the strength of knowledge judgements. Chapter 4 will show that there is in fact such a link and it is essential for understanding risk.

The recent IPCC reports also refer to risk as the “potential for consequences where something of value is at stake and where the outcome is uncertain, recognizing the diversity of values” (IPCC 2014a, p. 127). However, this broad understanding of risk is not followed up when it comes to the risk characterizations. Focus is on probabilities and expected values.

1.2 HOW TO DETERMINE THE BIGGEST GLOBAL RISKS?

How should we determine what are the most pressing global risks we face today? In its Global Risk Reports (WEF 2018), the World Economic Forum (WEF) provides an answer by presenting risk maps characterizing risk by impact and likelihood, using as input the result of a survey of experts and managers all over the world. If A symbolizes an event, like a natural disaster, water crisis or terrorist attack, the WEF approach presents values for the likelihood of A and its related impact. These values are averaged figures, based on the assignments made by the respondents. Five categories are used for both likelihood and impact. For the likelihood judgements, intervals are used (<20%, 21–40%, 41–60%, 61–80% and >80%), with reference to the event occurring in the next ten years. For the impact, only relative scores are used (minimal, minor, moderate, severe and catastrophic, with scores from 1 to 5, respectively).

This approach for characterizing risk raises several issues. First, the use of one impact value means that the respondents are forced to use a typical value or an expected value (the centre of gravity of their probability distribution for the impact, given the event occurring). This means that an important aspect of risk is not revealed: namely, that some events could have a much higher potential for extreme consequences than others. Secondly, the respondents will struggle with the probability assignments. It is a problem that the events considered are vaguely defined, with unclear links to the impact dimension. For example, a ‘terrorist attack’ could have a spectrum of consequences, some more severe than others, and, if one has in mind a ‘typical impact level’, the likelihood judgement would be completely different from that of the case where an extreme impact level was the reference point. In addition, there is no guidance provided on how to interpret the likelihood judgements, which could also add an element of arbitrariness to the assessment process. It is also reasonable to question the use of averages in the analysis. Would it not be informative to reveal other aspects of the score distribution than the mean? A high spread may say something about the knowledge supporting these judgements.

This leads us to the third main challenge of the WEF approach to characterizing global risk. The strength of the knowledge supporting the judgements is not presented. Two events could have the same position in the risk matrix but be completely different with respect to the strength of the knowledge supporting the judgements. In one case, strong phenomenological understanding and data could be available; in other cases, we could face complete ignorance. The placing in the risk matrix could, however, be the same.

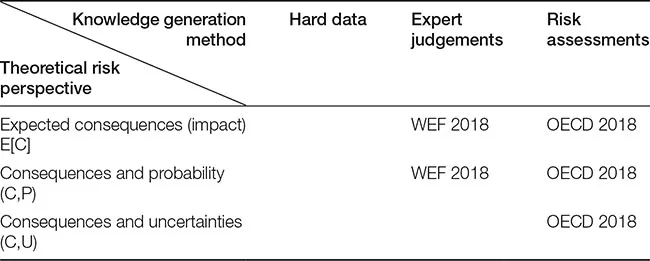

The WEF approach represents one way of characterizing global risk. Table 1.1 presents an overview of a set of existing theoretical perspectives for understanding risk, as well as methods for deriving the relevant knowledge supporting these perspectives, with the WEF approach placed. A distinction is made between three main categories of risk perspectives: risk viewed as expected consequences E[C], risk viewed as the pair: consequences and associated probability (C,P), and risk viewed as the pair: consequences and associated uncertainties (C,U). These will be explained and discussed in section 4.2. For the knowledge generation method, there is also a distinction between three categories. The first is based on hard data alone, the second on the use of expert judgements and the third on risk assessment, based on the modelling of phenomena and processes (as well as hard data and expert judgements). These methods for measuring or describing risk are discussed in more detail in section 4.2. The WEF approach is based on a mixture of the E[C] and (C,P) perspective and the use of expert judgements.

TABLE 1.1 Overview of how risk assessment studies depend on knowledge generation method and risk perspective

The WEF is the predominant study on global risk characterization. The approach used can also be applied on a national level; it is, however, more common to use risk assessment methods for this purpose; see for example OECD (2009), Pruyt and Wijnmalen (2010), Veland et al. (2013), Vlek (2013) and Mennen and van Tuyll (2015). OECD (2018) provides a summary of national risk assessments (NRAs) for 20 countries and represents an excellent basis for studying current practice of the methods used. The OECD report highlights that the NRAs are used to inform public policy and identify challenges that the countries need to address to reduce risks. These references demonstrate that, for national risk assessments, in practice, we find all three types of underlying risk perspectives, E[C], (C,P) and (C,U), as illustrated in Table 1.1.

In Chapters 4 and 5, we will look more closely into these approaches for characterizing global and national risks, with suggestions for improvements. To evaluate the quality of the approaches, two main aspects are highlighted: validity and uncertainties. Validity relates to the degree to which one actually measures or characterizes what one sets out to measure or characterize, here global or national risks. Uncertainties relate to potential deviations between unknown quantities and the related estimated, predicted or assigned associated quantities, for example the deviation between the actual damage costs and their prediction, or between an underlying presumed true frequentist probability and its estimate. Hence, uncertainty is an aspect of validity.

The above discussion has focused on global and national risk. However, the coming analysis is, to a large extent, general and also applicable to other settings where the aim is to characterize risk.

1.3 QUANTITATIVE RISK ASSESSMENT AS A TOOL FOR ACCURATELY ESTIMATING RISK

For more than 40 years, Quantitative Risk Assessment (QRA) – also referred to as Probabilistic Risk Assessment (PRA) – has been used as the basis for supporting risk-related decisions in industry, in particular in the nuclear and oil/gas industries; see reviews by Rechard (1999, 2000). Its first application to large technological systems (specifically, nuclear power plants) dates back to the early 1970s (NRC 1975), but the key analysis principles have not changed much.

The basic analysis principles used can be summarized as follows (Aven and Zio 2011): a QRA systemizes the knowledge and uncertainties about the phenomena studied by addressing three fundamental questions (Kaplan and Garrick 1981):

– What can happen? (i.e. What can go wrong?)

– If it does happen, what are the consequences?

– How likely is it that these events and scenarios will occur?

Following this line of thinking, risk is calculated by computing probabilities for the events, scenarios and related outcomes, and expressed through metrics like the probability that a specific person shall be killed due to an accident (individual risk), the expected number of fatalities in terms of indices, such as PLL (Potential Loss of Lives) and FAR (Fatal Accident Rate), and f-n curves expressing the expected number of accidents (frequency f) with at least n fatalities.

Some improved methods have been developed in recent years to allow for increased levels of detail and precision in the modelling of phenomena and processes, for example to better reflect human and organizational factors, as well as software dynamics; see, for example, Mohaghegh et al. (2009) and Zio (2009, 2018).

The QRAs have, to a large extent, been built on a scientific framing, which is in line with natural sciences and the so-called scientific method (refer to section 2.2). The basic idea is that the system or activity studied possesses an inherent risk, which the assessment seeks to estimate as accurately as possible, using models, observational data and expert judgements. For more sophisticated QRAs, specific uncertainty analyses are used to express the uncertainties about the ‘true’ values of the risk (Paté-Cornell 1996).

Although it is acknowledged that the risk assessment is a tool to inform decision-makers about risk (Apostolakis 2004), common use of the assessments has, to a large degree, been rather ‘mechanistic’ (refer to discussion in Aven and Vinnem 2007). For example, it is common to see decision rules based on the results of the risk estimations: if the calculated risk is above a pre-defined probabilistic limit, risk is judged unacceptable (or intolerable) and risk-reducing measures are required, whereas if the calculated risk is below the limit, it is concluded that no measure is required or, alternatively, that measures should be subject to a broader cost-benefit type of consideration, in line with the so-called ALARP principle (As Low As Reasonably Practicable) (Aven and Vinnem 2007).

O’Brien (2000) gives a number of examples illustrating the implications for risk management of this use of risk assessments, most related to toxic chemicals. Although rather extreme and some would argue somewhat biased, her message is clear: risk assessments generally serve the interests of business (i), as well as government agencies (ii) and many analysts (iii) (Aven 2011c):

i) Through risk assessments an industry gets significant legal protection for activities that may result in contaminating communities, workers, wildlife, and the environment with toxic chemicals. Through risk assessment, industry gets protection for filling streams with sediments, thinning the ozone layer, causing high cancer rates, avoiding cleaning up its own messes, and earth-damaging activities (O’Brien 2000, p. 102).

The use of risk assessments gives the industry a scientific aura. The risk assessments show that the activities are safe, and most of us would agree that it is rational to base our decision-making on science. However, the complexity of a risk assessment makes it difficult to understand its premises and assumptions if you are not an expert in the field. In a risk assessment, there is plenty of room for adjustments of the assumptions and methods to meet the risk acceptance criteria.

In the case of large uncertainties in the phenomena and processes studied, the industry may be tempted to take advantage of the fact that in our society safety and environment-affecting activities and substances are considered innocent until ‘proven guilty’. It takes several years to test, for example, whether a certain chemical causes cancer, and the uncertainties and choice of appropriate risk assessment premises and assumptions allow interminable haggling.

ii) Risk assessment processes allow governments to hide behind ‘rationality’ and ‘objectivity’, as they permit and allow hazardous activities that may harm people and the environment (O’Brien 2000, p. 106). The focus of the agencies is then more on whether a risk assessment has been carried out according to the rules than on whether it provides meaningful decision support.

iii) Risk analysts know that the assessments are often based on selective information, arbitrary assumptions and enormous uncertainties. Nonetheless, they accept that the assessments are used to conclude on risk acceptability.

This criticism of risk assessment is supported by a great deal of other research; see, for example, Reid (1992), Stirling (1998, 2007), Renn (1998b), Tickner and Kriebel (2006), Michaels (2008), Rae et al. (2014), Goerlandt et al. (2017) and Pasman et al (2017). Reid (1992) argues that the claims of objectivity in risk assessments are simplistic and unrealistic....