- 252 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

About this book

Here is the first comprehensive and systematic explanation of the management system that drives the world's leading automaker. The development of JIT production at Toyota and the company's achievement of unprecedented levels of productivity were made possible by its supportive, integrated management system. This book reveals for the first time exac

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Toyota Management System by Yasuhiro Monden in PDF and/or ePUB format, as well as other popular books in Business & Human Resource Management. We have over one million books available in our catalogue for you to explore.

Information

CHAPTER ONE

______

Financial Management System

WHEN WE REFER to a company’s financial management system we mean the decision-making process related to the procurement and application of capital. This chapter examines Toyota’s financial management system.

Japan’s business environment has undergone great changes, both during the oil crises of the 1970s and during the yen’s steep climb against the dollar that began in the mid-1980s. These environmental changes have forced Japanese companies to become more dependent on capital from outside investors and more heavily burdened by interest obligations.

It sometimes happens that capital resources run dry, creating a life-or-death situation for the company. To avoid such predicaments, companies must build for themselves a financial structure that can withstand the kind of dramatic environmental changes that have occurred in recent years.

When the business environment is a favorable one, it is relatively easy for companies to procure both internal and external capital. The main purposes for such capital include funds for new plant investment, new product development, or for working capital. Any funds left over after serving these purposes usually are channeled toward safe and profitable investments in vehicles that lie outside the company’s main fields of business.

During an economic recession or depression, companies must move to protect their main business activities. At such times they are also wise to put the funds accumulated through their effective management of capital assets during the economic boom years into short-term, high-yield investments that provide safe alternatives to main business investments. In fact, companies always need such external investments as a source of capital that can be readily channeled toward new business opportunities.

The point of the strategy just described is to stop looking outside the company for capital procurement and to instead use funds produced by the company itself. When the need for funds is large, however, these internal fund-raising methods may not be enough, and the company may decide to turn to fund-raising methods such as issuing convertible corporate bonds or warrant bonds (certificates with preemptive rights), methods which are likely to change the nature of the company’s own capital assets. We refer to this type of financing as “equity financing,” or capital procurement through new stock issues.

While acknowledging that the type of financial operations described previously varies somewhat from company to company and industry to industry, we can say with certainty that all companies work with the same basic rules, policies, and know-how in managing their financial operations.

This chapter analyzes the financial data of Toyota Motor Corporation, known today for its debt-free management and for its top ranking as a company that stays “in the black.” These data cover the years 1974 to 1988. We will look at how Toyota has procured and managed its capital assets to support its automobile production and sales organizations. Specifically, we will study the rules, policies, and know-how behind Toyota’s financial management system and will identify the basic principles of its corporate financial operations.

SPECIAL FEATURES OF TOYOTA’S CAPITAL PROCUREMENT METHODS

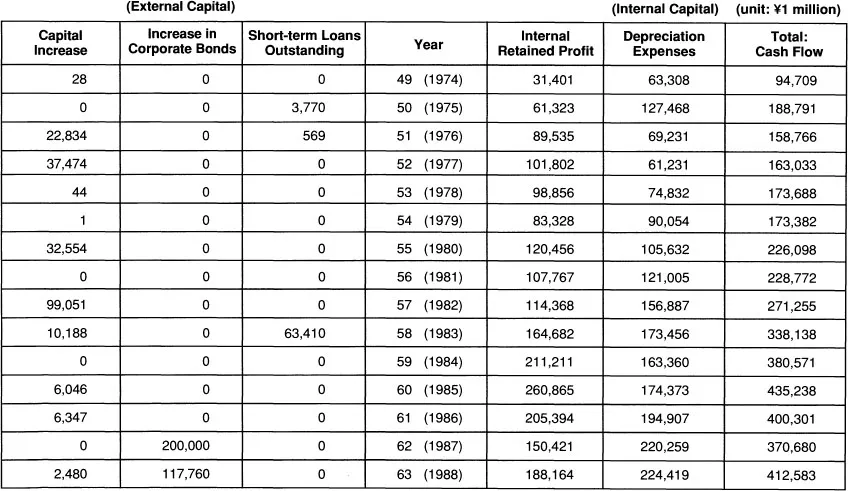

What are the special features of the capital procurement methods used by Toyota? Table 1-1 shows Toyota’s capital procurement trends over several years. As shown, Toyota clearly is oriented toward in-house capital procurement, for which it maintains vast amounts of retained profit and large depreciation expenses.

The retained profit reserves are what are left of the company’s net (after tax) profits for each business term after the company allots dividends (including interim dividends) to shareholders and pays executive bonuses. From business year 1974 (BY74) to BY85, such retained income generally expanded. However, in BY78, BY79, and BY81, such funds shrank slightly from the previous year’s level. The drop in BY78 was caused chiefly by the stricter controls on new-car exhaust emissions, the BY79 drop by the second oil crisis, and the BY81 drop by the Japanese auto industry’s adoption of voluntary export restrictions on passenger cars sold in the United States and Canada. The slight reductions that occurred from BY86 to BY88 came under the impact of the yen’s rapid appreciation against the U.S. dollar.

Depreciation expenses are the costs related to paying off the costs of depreciated items. As such, depreciation expenses are used to turn fixed assets into current assets or to recover invested capital. This makes depreciation expenses one of the resources for in-house capital procurement. Although depreciation expenses declined slightly from previous-year levels in BY76, BY77, and BY84, on the whole they grew during the period of BY74 to BY88. The declines in BY76 and BY77 were caused by Toyota’s curtailment of new plant investment in order to recover capital during the production slowdown that came in the wake of the first oil crisis.

Table 1-1. Capital Procurement Trends (1974-1988)

We refer to the sum of a company’s internal retained profits and depreciation expenses as the company’s “internal capital.” Analysts keep a close watch on the size of a company’s internal capital as the company deals with changes in the economic environment.

At Toyota, there has been relatively little capital procurement from outside sources (that is, external capital). In fact, Toyota showed absolutely no external capital in its business results for BY81 and BY82, which underscores just how little the company relies on outside sources of capital.

Looking at more specific categories, we see that Toyota showed annual increases in short-term loans in BY75, BY76, and BY83. The BY83 jump, however, was caused by the merger of Toyota Motor Company with Toyota Motor Sales Company, an upturn that was reversed in the next year. Therefore, in real terms Toyota has operated under “debt-free management” (without a “loans” account title) since BY77.

Although Toyota’s corporate bonds increased in BY87 and BY88, the corporate bonds issued in BY87 were U.S. dollar-based convertible bonds that were used primarily for meeting the funding needs of overseas projects such as the construction of assembly plants and other facilities in the United States. (As of 1992, one U.S. dollar equaled ¥ 130.) In BY88, ¥ 2.48 billion of these funds were converted to internal capital. Also in BY88, Toyota issued U.S. dollar-denominated warrant bonds which were also used for plant investments in the United States. Because Toyota’s results for BY88 were based on a business year that ended on June 30,1988, neither the BY88 balance sheet nor the schedule of bonds payable showed Toyota’s major bond issue of ¥ 30 billion in convertible bonds that took place on July 28, 1988, based on board decisions made on June 20 and July 11, 1988. Toyota issued these bonds to make use of the high yen and the voluntary car export curbs and as a manifestation of its U.S.-based projects that now covered activities ranging from capital procurement to automobile production and sales as operation of that capital.

Toyota shows a certain amount of fluctuation in its capital increases from year to year. Later in this chapter we will examine how capital operations (or meeting capital demand) relate to such increases. For the time being, please note which years have served as the main years for procuring new capital (such as BY77, during which Toyota raised ¥ 99 billion).

From what we have just observed, we can point to debt-free management and reliance on internal capital (especially retained profits) as the two primary special features of capital procurement at Toyota. These features did not change much even after 1986, when the yen’s sharp rise against the U.S. dollar began making its full impact felt. This is because convertible bonds, unlike other liabilities, are converted easily into internal capital. Also the issuing of warrant bonds is a capital procurement method that facilitates the augmentation of internal capital.

Another special feature of financial management at Toyota is the way the company sells off short-term bonds and sets short bond maturity periods of less than a year as a well-timed method to procure short-term funds. To analyze this method, we must approach it from both the capital procurement and capital application perspectives, and we will do so later in the chapter.

SPECIAL FEATURES OF CAPITAL APPLICATIONS (RESPONSES TO CAPITAL NEEDS) AT TOYOTA

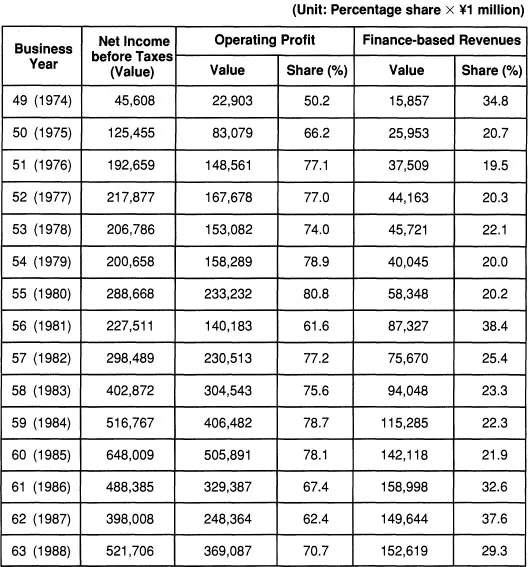

Previously, when we identified the two primary special features of capital procurement at Toyota, we noted the very strong emphasis Toyota puts on retained profits as an internal capital source. Table 1-2 shows the degrees to which operating profits from Toyota’s main business and its finance-based revenues (non-operating profits minus non-operating expenses) based on financial activities have contributed to its net income before taxes.

In studying Table 1-2, please note the following definitions:

1. Share of operating profits = operating profits ÷ net income before taxes

2. Share of finance-based revenues = (non-operating profits – non-operating expenses) ÷ net income before taxes

While the main business (operating profit) continues over the years to dominate Toyota’s net income before taxes, we still see a general rise in the share of finance-based (non-operating) revenues. This trend testifies to Toyota’s relative stability in turning out successful results in its main business even when dealing with a changing economic environment. That is why we see much larger shares of finance-based revenues during years when total income before taxes are relatively low. In this manner, Toyota has responded to short-term depressions affecting its main business activities by strengthening the support provided by its financial activities. From this, we come to understand how Toyota has managed to be so strongly resistant to recessions in the automobile industry.

In other words, Toyota’s strength in automobile manufacturing operations is backed up firmly by its skill in security portfolio investment.

Table 1-2. Shares of Operating Profits and Finance-based Revenues

Let us now look at the special features of Toyota’s capital operations. Table 1-3 lists various detailed data concerning Toyota’s capital operations. These data were compiled from annual securities reports for the period of BY82 to BY88, and all values are based on ledger balances, or book values, established immediately after June 30 — the end of each business year.

Table 1-3 lists Toyota’s capital applications in the following three categories. We will examine their special features in greater detail.

1. applications in tangible fixed assets

2. applications in security portfolio investment outside of the main business

3. applications in support of affiliated (keiretsu) companies

APPLICATIONS IN TANGIBLE FIXED ASSETS

These are Toyota’s investments in its main business. Most of these funds are used for plant investment. Between BY81 and BY87, the total funds in this category increased steadily until BY88, when tangible fixed assets dropped nearly ¥ 19 billion from their BY87 level. However, it probably will not be long before tangible fixed assets rise to reach the ¥ 1 trillion mark.

This type of main-business investment is needed to maintain a high level of production capacity and to help earn operating profits. As such, it is essential for the ongoing improvement of management and the development of the business. For automakers such as Toyota, main-business investment — especially plant investment for developing new car models — is the major investment theme for the company’s financial managers.

APPLICATIONS IN SECURITY PORTFOLIO INVESTMENT OUTSID...

Table of contents

- Cover

- Half Title

- Title Page

- Copyright Page

- Table of Contents

- Tables and Figures

- Original Publisher’s Message

- Preface

- Introduction • A Unified System of Business Management: The Pursuit of Effectiveness

- Chapter One • Financial Management System

- Chapter Two • Target Costing and Kaizen Costing in the Japanese Automobile Industry

- Chapter Three • Functional Management to Promote Companywide Coordination: Total Quality Control and Total Cost Management

- Chapter Four • Flat Organizational and Personnel Management

- Chapter Five • Sales Management System

- Chapter Six • New Product Development System

- Chapter Seven • Production Management System: Integration of SIS, CIM, and JIT

- Chapter Eight •International Production Strategies of Japanese Automakers

- Notes

- Bibliography

- About the Author

- Index