- 284 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

About this book

As Europe moves towards becoming a truly single European market, its contribution to global marketing grows. This topical text expands upon existing international marketing theory and synthesizes it with colourful examples of relevant international marketing practice. Topics covered include:

- marketing information systems

- marketing research

- product development

- pricing issues

- international promotion

- distribution channels.

With a strong theoretical framework, this informative text draws out the key issues within the developing European Union and the role it plays in marketing around the globe. Its excellent pedagogy (including case studies, summaries, text boxes and a website to run alongside), helps make it a valuable resource for academics and professionals alike.

Visit the Companion website at www.routledge.com/textbooks/0415314178

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access International Strategic Marketing by J.B. McCall,Marilyn Stone in PDF and/or ePUB format, as well as other popular books in Business & Business General. We have over one million books available in our catalogue for you to explore.

Information

Chapter 1

Introduction to international marketing

INTRODUCTION

This chapter will introduce you to the field of international marketing and, in particular, to the environment within which international marketing decisions are taken. It will demonstrate how it pervades nearly every aspect of our lives.

We are enmeshed as citizens, as individuals and as members of society, including that of organizations, in a network of global linkages that makes countries dependent more than ever on other countries and on other organizations. The so-called economic meltdown in South East Asia in 1997–8 made its effect severely felt as far away as Russia, Brazil and Japan, and to a lesser extent the rest of the world. Policy makers have less capability than formerly to deal effectively with the effects of the globalization of business. Markets have the power to dictate the destiny of countries. An example of this was the ejection of the UK and Italy from the Exchange Rate Mechanism (ERM) of the European Union (EU) in 1993 when the markets showed their lack of confidence in their currencies. The currencies fell outside the permitted deviation limits of the mechanism and were automatically excluded. There remains considerable authority on the part of governments to carry out actions in relation to interest and exchange rates. This is especially the case when they are not constrained by supranational legislation related to taxation, competition policy, direct influence on large projects deemed to be of national importance or co-operation with other governments. There is a host of other levers, often seen in the enactment of laws and any regulations made under them, by which legislators can create, if they are wise, a climate in which business can flourish to the benefit of all.

However, markets are themselves subject to the vagaries of changes in the environment. While the function of markets is to match segments of supply and demand by bringing together buyers wanting to exchange money for goods or services with sellers wanting to exchange goods and services for money, any events likely to influence supply or demand will affect the stability of markets. In a free market economy this will have implications for the allocation of resources among both buyers and sellers. The destruction of the twin towers of the World Trade Center in New York on 11 September 2001 is a classic example of an unpredictable occurrence affecting the market. It sent stock prices in stock exchanges throughout the world into a steep fall. They lost 20 per cent during the year 2002 alone. A long-term bear market underscored once more the dependence of such services as personal pensions on a stock market with a steady growth in share price. The collapse of share prices provided the lesson that international marketing takes place against a background of uncertainty which is in no way diminishing in the current climate.

Technology and communication have combined to provide an infrastructure in which information flows are immediate and facilitate the movement of funds around the world. The transfer of processes associated with production technology such as ordering, delivery documentation, invoicing and the payment of goods and services were not possible ten years ago. The development of these technologies, aided by the plummeting cost of computer memory, has given an added fillip to the globalization process. This, in turn, has created new organizational forms in which companies have to cross borders not only to access customers, but also to communicate with other parts of the organization, exposing personnel to new forces which they have to learn to handle. People in other cultures, whether as consumers, colleagues, partners, suppliers or legislators and functionaries, constitute groups which often think and act in different ways from their counterparts in the domestic market and indeed from each other. International marketing is distinguished from its domestic form by a high level of diversity.

LEARNING OBJECTIVES

The objectives of this chapter are to:

- introduce you to the field of international marketing;

- identify current issues in the economic, political/legal, socio-cultural and technological environment;

- underscore the implications of globalization for organizations;

- examine the organizational structures appropriate to the globalized market;

- derive some of the skills needed to communicate successfully across national borders.

When you have completed the chapter you should:

- be familiar with the nature of the global market place;

- recognize the inter-relationships between the various factors in the environment and identify their potential to affect marketing decisions;

- show understanding of organizational structures in the global environment;

- indicate awareness of the problems of communicating across cultures and give evidence of knowledge of some possible solutions;

- distinguish the special importance of the Internet within international marketing.

DEVELOPMENTS IN INTERNATIONAL EXPANSION

International trade goes back a long way. Even before the rise of the Roman Empire, the Phoenicians, from their base in the eastern Mediterranean, are believed to have explored the West African coast with a view to expanding their trading activities. Artefacts found in various sites in Italy, France, Spain and Britain bear witness to the trade that the Romans did with the Greek states and the Egyptians. Later, other traders like the Venetians connected with the trade routes to the East. By the Middle Ages, Europeans had set out to engage in the spice trade, which led to the keenest of competition for that trade between the British and the Dutch in the East Indies. Portuguese and, latterly, the British, Dutch, French, Swedes and others embarked on trading expeditions to the Guinea Coast of West Africa. At the same time, the Portuguese and Spaniards sought to find fresh sources of wealth in the New World which, in turn, led to the infamous slave trade as well as the development of the trade in sugar and tobacco. By the end of the industrial revolution and prior to the Great War of 1914–18, there was a truly international market. It differed from the global market of today in that there was greater emphasis on commodities being bought by the developed countries and manufactured products by the less developed countries. It reflected the comparative advantage possessed by nations although there were already companies involved in direct international investment. Today, there is a market where multinational corporations (MNCs) have transferred expertise to other, less industrialized, countries. These provide sources of cheap labour for manual skills as in Indonesia and Thailand, intellectual skills such as the computer software industry in India, and production expertise as in the example of the Republic of Korea. Bangalore, indeed, the centre of the Indian high-tech business, is becoming a fully fledged research and development centre to rival Silicon Valley in the US. In an economy where competitiveness is global, companies have to take advantage of resources available in organizations in other countries to retain competitive advantage whether in innovation, cost, quality or speed of production and delivery.

Some latter-day concepts in international expansion

Research suggests that firms expand into new markets based on their collective experience in other markets (Clark et al., 1997). This moves us on from earlier theories that a company will only export when a product reaches maturity and suggests that firms choose to internationalize in incremental stages following predictable paths. These were appropriate to their time. Today’s organizations operate in complex networks and internationalize to support their membership in their networks (McKiernan, 1992). Companies prosper if the network does. International marketing decision-making in MNCs operate as a network rather than through a headquarters–subsidiaries structure. In pursuit of the ideal network, the Japanese car manufacturer Mazda has encouraged its suppliers to forge global links by entering equity alliances with foreign component makers to enhance their international competitiveness. Similarly, Nissan, linked over the last few years with Renault, has been selling shares in its component groups to foreign and Japanese buyers and merging other parts makers to generate cash flow and streamline parts procurement to meet international standards in costs and technology.

In the ever-burgeoning services sector, the generally accepted view that all services are fragmented is changing. Service-dominant industries apart from separated services like films, books, patents and computer programs, have internationalized by developing economies of scale and scope (Segal-Horn, 1993). While they must stay close to the customer by the interactive nature of the delivery, they are more like product-dominant industries than had been believed. Cross-border mergers and alliances among lawyers, and more ambitious ones between firms of accountants and lawyers, have strengthened their international competitive position (Akroyd, 1999).

Globalization is driven by market, cost, government, competition and other factors (Yip, 1992) as well as by the motives of managers. Given the global strategic perspective, the corollary that it should be accompanied by a universal standardization is difficult to sustain as such a stance is product oriented and in defiance of the marketing concept. It is also apparent that different nationalities buy similar products for different reasons and different versions of a product for reasons of values, custom and preference as well as price. There are various models to assist in the decision about the extent of standardization and adaptation. In particular, differentiation and integration pressures are identified by Prahalad and Doz (1987) as critical to deciding whether a multi-domestic or global strategy should be pursued. They add a third dimension in ‘global strategic co-ordination’ which implies that a firm centralizes certain strategic resources while adapting where there is a need to do so. Such thinking has given rise to the saying ‘Think global, act local’.

COUNTRY RELATIONSHIPS WITHIN THE INTERNATIONAL ECONOMY

Within the global economy a number of trends can be observed which are not obvious if the markets are individually considered. Countries can no longer be self-contained even if they have the resources to exist as such.

Specialization

Countries specialize sometimes in different products but often in particular varieties of a product rather than the full range, usually because the greater the scale of activity, the lower the costs become and the more price competitive a company is likely to be. Some products are more susceptible to this process than others. Over the last twenty years or so average costs in research-intensive industries such as the microchip industry have tended to fall quickly. The electronics industry, like pharmaceuticals and agro-chemicals, is typified by high rates of product innovation shortening the product life cycle. Producers need to generate a high level of sales relatively quickly to recover their fixed research and development costs.

A second factor increasing the degree of specialization within a country is the size of the market, which is related to the returns to scale mentioned above. The large and wealthy economy of the US is often quoted as an example of the gains from the very ‘bigness’ of the domestic market. The abolition of tariffs within the EU, and the establishment of a single market, achieved a similar enlargement of the market which has encouraged firms to increase production plant size to reduce unit costs and has eliminated inefficient producers. The success of companies like Nestlé, the chocolate manufacturer, and the pharmaceutical company Sandoz, based in a small country like Switzerland, show that looking to other countries as markets can create market size.

A third factor influencing the way a country specializes lies in the decisions of MNCs about where to locate their production. MNCs can easily switch production from one location to another aided by developments in technology which will be discussed later. Ireland has become a favourite place to locate high-tech production and research as well as financial services because of the factors favourable to it. These include a good education system, the English language, low company taxation levels, a good infrastructure helped by substantial regional grants from the EU and its being a founder member of the single currency, the euro. It has become a net exporter of the products in which it has become an expert producer. Specialization means countries must trade with each other to obtain the benefits that it bestows.

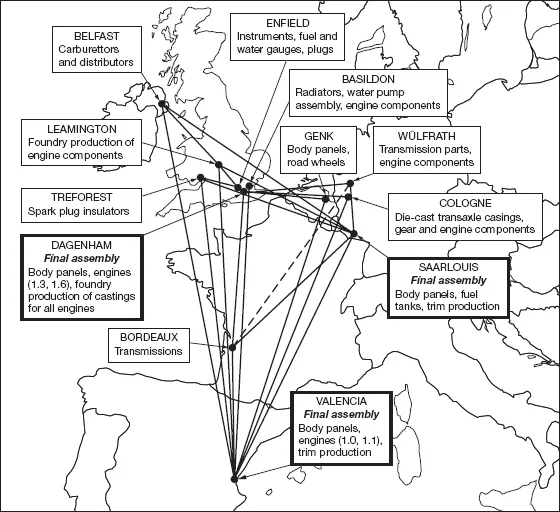

Specialized production in one country can be one part of an international product, other parts of which are produced in different countries and with final assembly in yet another location, raising the question of its place of origin (see Figure 1.1). While the places in which different parts of cars are made in different parts of Europe will change with new models, recent productivity comparisons and government incentives, the global organization of motor car production and the ease of changing patterns of production and assembly are evident. There is a coloured representation of Peter Dicken’s network on the Internet. Search on ‘Ford Fiesta production’ on Alta Vista.

Foreign direct investment (FDI)

FDI is investment undertaken by companies wanting to expand internationally. It may involve buying the necessary land, plant and buildings of an existing domestic company in a host country or setting up a green-field site there. At the other end of the scale it can mean setting up a local sales company with warehousing from which to attack a market from inside for the first time. Large acquisitions are more likely to be made when a country’s currency is weak. European and Japanese investment in the US peaked when the dollar dipped to a low level in the early 1990s. Due to the collapse of some East Asian currencies in the crisis of 1997–8, their values fell by up to 50 per cent making buying into the market a temptation for companies in countries less affected by the economic downturn.

Making such an FDI does not only involve a transfer of funds changed into the currency of the country receiving the investment. It has to be supported by other resources including transfer of technical and marketing skills and technology. It can be used as a substitute for alternative means of doing business like direct sales or, as is more likely, it can be used to complement trade.

Payments and the foreign exchange market

There is a complex web of international payments that links countries. Payment for goods and services is normally made through the banking system. The exporter’s bank balance is credited and the exporter’s bank settles with the importer’s bank. However, what the exporter gets in his own currency is not a fixed return. Exchange rates vary, determined largely by short-term rates of interest. This means that the exporter may have to ‘sell forward’, that is to be put in funds by the bank which will cover itself in the discount market and receive payment when it falls due. An appreciation of a currency makes exports more expensive to overseas buyers (and imports cheaper to domestic consumers). A depreciation has the opposite effect; the ...

Table of contents

- Front Cover

- International Strategic Marketing

- Title Page

- Copyright

- Contents

- List of figures

- List of tables

- List of boxes

- Authors’ biographies

- Preface

- List of abbreviations

- 1 Introduction to International Marketing

- 2 Framework for International Marketing

- 3 European Marketing

- 4 International Marketing Information Systems: Marketing Research

- 5 International Product Development

- 6 International Pricing

- 7 International Promotion

- 8 International Channels of Distribution

- 9 International Marketing Planning and Implementation

- Appendix: Answer Guide to Review Questions

- Index