eBook - ePub

The NHS Budget Holder's Survival Guide

David Bailey

This is a test

- 96 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

The NHS Budget Holder's Survival Guide

David Bailey

Book details

Book preview

Table of contents

Citations

About This Book

This book takes the readers step by step through the key skills and knowledge, to enable them to take control of their budget. It is helpful for the reader to learn how to find out the rules governing their budget, why budgets overspend and underspend and how to make a bid for increased funding.

Frequently asked questions

How do I cancel my subscription?

Can/how do I download books?

At the moment all of our mobile-responsive ePub books are available to download via the app. Most of our PDFs are also available to download and we're working on making the final remaining ones downloadable now. Learn more here.

What is the difference between the pricing plans?

Both plans give you full access to the library and all of Perlego’s features. The only differences are the price and subscription period: With the annual plan you’ll save around 30% compared to 12 months on the monthly plan.

What is Perlego?

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Do you support text-to-speech?

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Is The NHS Budget Holder's Survival Guide an online PDF/ePUB?

Yes, you can access The NHS Budget Holder's Survival Guide by David Bailey in PDF and/or ePUB format, as well as other popular books in Medizin & Medizinische Theorie, Praxis & Referenz. We have over one million books available in our catalogue for you to explore.

Information

Part One

What are budgets?

Whose budget is it?

‘Just who does my department’s budget really belong to?’

Many managers have a clinical or professional background before being given management responsibilities. Many feel anxious or angry about financial responsibilities which have been imposed upon them.

However, it is very unlikely that anyone knows your department better than you. It is certain that no accountant does. You are given a budget each year to spend as you see fit, to benefit your patients, your service users and your staff. The point of devolving the responsibility for budgets is that the best person to make decisions about where the limited resources should be spent is you.

It is essential that you do not abdicate your budget management duties. Increase your budget management skills to complement your professional skills and begin to actively manage your budget.

Your department’s budget is entrusted to the department and it is up to the department manager to decide how the available resources should be spent. Better care and better services can be provided when the control of budgets is handed over to the people actually making the spending decisions.

The lines and individual amounts that are used on budget statements are not intended to limit you in buying the goods and services which you feel are in the best interests of your department. Just because there is not a specific budget for it, does not mean that you cannot buy it. It does, however, mean you cannot afford it without using your budget creatively and moving money around.

Producing budgets is a key managerial job, not just an accounting exercise. It is up to you to get involved in the continual business planning cycle. Many effective organisations have a ‘bottom up’ planning process which involves service managers in drawing up the action plans, in order to achieve the organisation’s broadly set objectives. How could accountants possibly set budgets for services without involving those spending the money?

In summary

Your department’s budget belongs to your department and the department manager is by far the most appropriate person to decide how best to spend it, to improve the service provided.

What are budgets?

‘What’s a budget then? Something yellow on a perch?’

Budgets are far more than just money. They are plans to match the resources required by a service to the objectives set for it. To have a successful budget it must be expressed in three very different ways:

• Money – in £’s

• Staffing – in Whole Time Equivalents

• Activity – in workload measures.

A budget should record the expected workload of your department, the staffing required to provide the service and the money to pay for the staff, equipment and materials that support the workload. These three elements need to be quantified and in balance with each other before you can have a successful budget. Budgets are meant to balance the inputs (the money, staffing, equipment and materials) with the outputs (the expected quantity and quality of activity carried out).

Measuring money

Money is the measure of value used in buying and selling goods and services. Financial budgets are measures of the expected amounts of money, both income and expenditure, which form the financial plans for the year. (See What do my reports mean? on page 35 for an explanation of income and expenditure.)

Measuring staffing

Staffing levels are measured in Whole Time Equivalents or WTE. The WTE is the level of staffing expressed in terms of whole time working. For nursing staff, 37.5 hours per week is 1.00 WTE and for administrative staff 37 hours per week is 1.00 WTE. A nurse working 20 hours per week would be 0.53 WTE (20/37.5). Two clerical staff, working 18.5 hours per week each, add up to 37 hours which is 1.00 WTE. Some areas use the name Manpower Equivalents, or MPE, and others Full Time Equivalents, or FTE, but both are identical to WTE.

Measuring activity

One major factor which will influence how much money you need is the workload of your department. There are many different ways of measuring levels of activity in the NHS. You need to make sure that the one which measures your department’s activity is:

• Relevant | The budgeted measure of your department’s activity must relate to the resources required to provide the service. For example the number of finished consultant episodes is not a good measure of the money required for long stay care of the elderly. In order to find a relevant measure of activity for your budget, you need one where any change in activity levels is mirrored by a change in your spending. |

• Accurate | Some measures of activity are unreliable, due to either the nature of the activity, or the way it is recorded. The total district nurse face to face contacts gives no information on the number or type of individual nursing activities undertaken. Also, the total of inpatient days gives no clue to the dependency levels of those patients, which may significantly affect their cost. Make sure your measure gives an accurate guide to the work actually taking place. |

• Controllable | Make sure you can control the measure of workload used for your service. If it is outside your control, why should you be given a budget for it? |

• Not volatile | Many activities are seasonal or random in their occurrence which makes them difficult to use as budgets. To have a budget you need predictability so you can make forecasts. |

It is important that any measure of activity for which you are given a budget or target is relevant to your budget, accurately measured, controllable by you and is not subject to unpredictable swings.

In summary

Budgets are plans designed to balance the money, staffing, equipment and materials required for the year, with the quantity and quality of activity expected. It is essential for you to ensure all these different elements are in balance.

What is the purpose of budgets?

‘What’s my budget going to be used for then?’

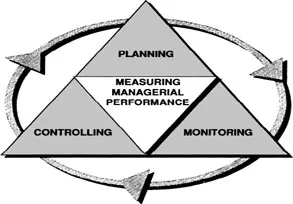

Your budget serves many different purposes. These include:

• Planning

• Monitoring

• Controlling

• Measuring your performance as a manager.

Often one budget is not sufficient for all the possible uses and several different budgets can be needed for the same area.

Planning

Budgets are needed for planning, to calculate the costs of new or changing services and ensure enough money is available to meet these demands. Accurate budget planning is critical to success. There are many examples of newly built facilities which have never been able to function as originally intended, due to incorrect running cost calculations. The kidney unit without a budget for drugs and the newly built ward with unsafe nursing levels are all problems caused by poor planning.

Monitoring

Budgets are monitored by comparing how much is actually spent (or how much income is received) to the budget on a monthly basis. Monitoring can tell you which of your assumptions in compiling the budget have proven wrong. It may be that your costs, your workload or your working practices have changed since your budget was set.

Controlling

Controlling your budget involves taking decisions to alter your spending. You must refer to your budget and change your spending appropriately, to ensure that what was planned actually happens. For example, if you find your dressings budget is overspending, you might switch to a cheaper type of dressing, review how appropriate each use of a more expensive dressing is, or train staff if there is wastage.

If circumstances have changed so much that the plan is no longer realistic, then the plan and therefore the budget should be changed.

Measuring the performance of managers

Budgets are needed as one measure of how well managers have performed. If you are a budget manager then your performance should be judged in part on how well you manage your budget. This is normally done on the basis of your total budget variance: how underspent or overspent your budget is.

However, many outside factors as well your decisions can cause variances. What is really needed to obtain a fair guide to your performance is a comparison between what your variance actually was and what it would have been if you had not controlled your budget.

Calculating what your variance would have been involves excluding all factors outside your control from the budget. For instance, it would not be right to base judgements about a budget manager on their total overspend if that overspend was due to a de...