Chapter 1

The world of international finance

The globe is not a level playing field.

Anonymous

UNIQUE DIMENSIONS OF INTERNATIONAL FINANCE

While tradition dictates that we continue to refer to the subject matter in this book as international finance, the modifier ‘‘international’’ is becoming increasingly redundant: today, with fewer and fewer barriers to international trade and financial flows, and with communications technology directly linking every major financial center, all finance is becoming ‘‘international.’’ Indeed, not only are domestic financial markets increasingly internationally integrated, but the problems faced by companies and individuals in different lands are remarkably similar.

Even though most if not all finance must be viewed at the international level, there are special problems that arise from financial and trading relations between nations. These are the problems addressed in this book. Many of these problems are due to the use of different currencies used in different countries and the consequent need to exchange them. The rates of exchange between currencies – the amount of a currency received for another – have been set by a variety of arrangements, with the rates of exchange as well as the arrangements themselves subject to change. Movements in exchange rates between currencies can have profound effects on sales, costs, profits, asset and liability values, and individual well-being. Other special, uniquely international financial problems arise from the fact that there are political divisions as well as currency divisions between countries. In particular, the world is divided into nation-states that generally, but not always, correspond to the currency divisions: some nations share currencies, such as the euro that is the common currency for numerous European nations, and the Russian ruble that is still used by several former Soviet states. Political barriers provide additional opportunities and risks when engaging in overseas borrowing and investment. International finance has as its focus the problems managers face from these currency and country divisions and their associated opportunities and risks.

THE BENEFITS OF STUDYING INTERNATIONAL FINANCE

Knowledge of international finance can help a financial manager decide how international events will affect a firm and what steps can be taken to exploit positive developments and insulate the firm from harmful ones. Among the events that affect the firm and that must be managed are changes in exchange rates as well as interest rates, inflation rates, and asset values. These different changes are themselves related. For example, declining exchange rates tend to be associated with relatively high interest rates and inflation. Furthermore, some asset prices are positively affected by a declining currency, such as stock prices of export-oriented companies that are more profitable after devaluation. Other asset prices are negatively affected, such as stock prices of companies with foreign-currency denominated debt that lose when the company’s home currency declines: the company’s debt is increased in terms of domestic currency. These connections between exchange rates, asset and liability values, and so on mean that foreign exchange is not simply a risk that is added to other business risks. Instead, the amount of risk depends crucially on the way exchange rates and other financial prices are connected. For example, effects on investors when exchange rates change depend on whether asset values measured in foreign currency move in the same direction as the exchange rate, thereby reinforcing each other, or in opposite directions, thereby offsetting each other. Only by studying international finance can a manager understand matters such as these. International finance is not just finance with an extra cause of uncertainty. It is a legitimate subject of its own, with its own risks and ways of managing them.

There are other reasons to study international finance beyond learning about how exchange rates affect asset prices, profits, and other types of effects described earlier. Because of the integration of financial markets, events in distant lands, whether they involve changes in the prices of oil and gold, election results, the outbreak of war, or the establishment of peace, have effects that instantly reverberate around the Earth. The consequences of events in the stock markets and interest rates of one country immediately show up around the globe, which has become an increasingly integrated and interdependent financial environment. The links between money and capital markets have become so close as to make it futile to concentrate on any individual part.

In this book we are concerned with the problems faced by any firm whose performance is affected by the international environment. Our analysis is relevant to more than the giant multinational corporations (MNCs) that have received so much attention in the media. It is just as valid for a company with a domestic focus that happens to export a little of its output or to buy inputs from abroad. Indeed, even companies that operate only domestically but compete with firms producing abroad and selling in their local market are affected by international developments. For example, US clothing or appliance manufacturers with no overseas sales will find US sales and profit margins affected by exchange rates which influence the dollar prices of imported clothing and appliances. Similarly, bond investors holding their own government’s bonds, denominated in their own currency, and spending all their money at home, are affected by changes in exchange rates if exchange rates prompt changes in interest rates. Specifically, if governments increase interest rates to defend their currencies when their currencies fall in value on the foreign exchange markets, holders of domestic bonds will find their assets falling in value along with their currencies: bond prices fall when interest rates increase. It is difficult to think of any firm or individual that is not affected in some way or other by the international financial environment. Jobs, bond and stock prices, food prices, government revenues, and other important financial variables are all tied to exchange rates and other developments in the increasingly global financial environment.

THE GROWING IMPORTANCE OF INTERNATIONAL FINANCE

While we shall emphasize the managerial issues of international finance in this book, it is important to emphasize that the international flows of goods and capital that are the source of supply of and demand for currencies, and hence essential to the subject of international finance, are fundamental to our well-being. A strong currency, for example, ceteris paribus, improves a country’s standard of living: the currency buys more in world markets. Not only does a strong currency allow citizens to buy more imports, they can also buy more domestically produced products that are internationally traded because a country’s citizens have to compete with foreigners for their own country’s tradable products. The gain in standard of living from a rising currency is also evident when living standards are compared between nations. International rankings of living standards require conversions of local-currency incomes into a common measure, usually the US dollar. A rising currency moves a country up the ladder by making local incomes worth more dollars.

Citizens also gain from the efficient global allocation of capital: when capital is allocated to its best uses on a global scale, overall returns are higher and these extra returns can be shared among the global investors. Let us therefore pause to consider the evidence of the international movement of goods and capital. We shall also take a look at the sources of gains from the flows of goods and capital. We shall see that international finance is a subject of immense and growing importance.

The growth of international trade

International trade has a pervasive importance for our standard of living and our daily lives. In the department store we find cameras and electrical equipment from Japan and clothing from China and India .On the street we find automobiles from Germany, Japan, Korea, Sweden, and France using gasoline from Nigeria, Saudi Arabia, Great Britain, Mexico, and Kuwait. At home we drink tea from India, coffee from Brazil, whiskey from Scotland, beer from Germany, and wine from just about every country on Earth. We have become so used to enjoying these products from distant lands that it is easy to forget they are the result of complex international trading and financial linkages discussed in this book.

Record on the growth of trade

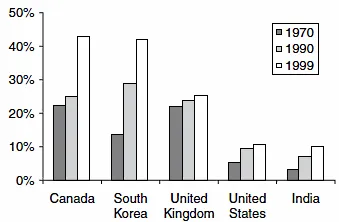

Peoples and nations have been trading from time immemorial. During the period since records have been kept the amount of this trade between nations has typically grown at a faster rate than has domestic commerce. For example, since 1950, world trade has grown by about 6 percent per annum, roughly twice that of world output over the same period. During the nineteenth century, international trade grew at such a tremendous rate that it increased by a factor of 25 times in the century leading up to the First World War. Even in the period since 1980, a mere moment in the long history of international trade, the value of trade between nations has tripled (see Table 1.1). Growth in the importance of trade in the form of the fraction of Gross Domestic Product (GDP) consisting of exports is shown for several countries in Figure 1.1.

Table 1.1 Aggregate international trade versus GDP

Figure 1.1 Percentage of GDP arising from exports

Note

Today, foreign markets represent a more important proportion of aggregate demand for the products of most countries than in the past. For example, the fraction of US GDP that is exported has almost doubled since 1970, while the fraction of South Korea’s GDP that is exported has almost tripled.

Source: National Account Statistics: Analysis of Main Aggregates, United Nations, New York, 2003.

Indeed, if anything, the published export figures understate the growth of world trade. This is suggested by the fact that when the world’s combined reported exports are compared to reported imports, global imports exceed exports. In the absence of extraterrestrial trade, this suggests a reporting error: when properly calculated, global imports must equal global exports. The mechanisms for reporting imports are generally better than those for reporting exports – governments keep track of imports for collection of duties and for safety and health reasons – and therefore it is likely that exports are understated rather than that imports are overstated. It is worth pausing to consider why international trade and the international financial activity associated with that trade have grown so rapidly in recent decades.

Reasons for the growing importance of international trade

The...