- 288 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Property Asset Management

About this book

Property has unique characteristics, both as an investment and as an operational holding. A thorough understanding of this dual role is needed by professionals responsible for maximising a property's full potential. Property Asset Management emphasizes the need for a strategic plan in property management as well as for efficient day-to-day practice.

Tools to learn more effectively

Saving Books

Keyword Search

Annotating Text

Listen to it instead

Information

1 The role and responsibilities

of the property manager

| 1.1 | Property ownership |

| 1.2 | Land as a resource 1.2.1 Property as an investment 1.2.2 Demand for land and buildings 1.2.3 The available market |

| 1.3 | The providers of land and buildings 1.3.1 The main categories of Investors in property |

| 1.4 | The management task 1.4.1 The attributes and organisation of sound management 1.4.2 Management: a definition and some models 1.4.3 Approaches to management |

| 1.5 | Negligence and the property manager: general proposition 1.5.1 Level of knowledge inferred 1.5.2 Duty of care 1.5.3 Negligence claims 1.5.4 Some examples of negligence 1.5.5 Limitations 1.5.6 Relevant legislation23 |

| 1.6 | The future 1.6.1 Need for improved market intalligence 1.6.2 Expectations of oecuipers 1.6.3 Simplification for investors 1.6.4 other forms of investment in property |

| Further readings | |

This chapter introduces the uniqueness of each property interest and emphasises the difference between property and other forms of investment media, not least because of the nature of the relationship between landlord and tenant. It is emphasised that quality of management is an important contributor to performance: in this context the duties of managing agents are outlined as are their legal responsibilities.

1.1 PROPERTY OWNERSHIP

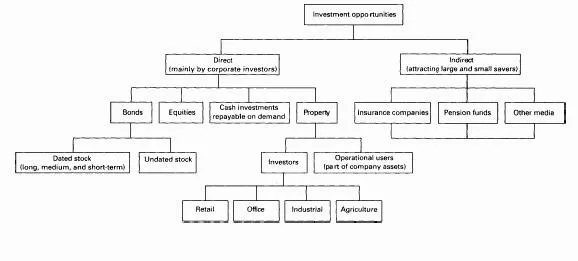

Ownership of property—land and buildings—with the express intention of letting to tenants, usually on fairly long-term contracts, is a wellestablished investment medium as an alternative or supplementary to stocks (being investments in government-backed borrowings referred to as ‘gilt-edged’ securities) and shares (being investments in the equity market where the return relies on the performance and policy of the company in which the shares are held). Properties are also acquired for operational purposes. The range of investment opportunities is shown in Figure 1.1.

1.2 LAND AS A RESOURCE

Of the principal factors of production—workforce, raw materials, machines, energy and property (land and buildings, also referred to as the fifth strategic resource in production decision theory)—the operational role of property is not well understood. The problem was first highlighted by a succession of reports by the National Audit Office and the Audit Commission for Local Authorities in England and Wales which exposed deficiencies in the management of property resources in the public sector and suggested ways in which greater efficiency could be achieved. The Audit Commission, for example, published A Management Overview and A Management Handbook together dealing with strategic issues and good practice in the management of local authority property (excluding housing). Arising from this initiative, local authorities now have a heightened awareness of the place of property and the need for total occupation costs and other information on which future decisions can be based. A similar initiative was undertaken at Reading University where a team of researchers carried out a detailed study of operational property in use by 230 of the largest public limited companies in the United Kingdom to find that typically, although the company’s property holding accounted for some 30% of its total asset value, it was often managed in a reactive way if at all and with incomplete records.

Figure1.1Range of investment opportunities.

These enquiries and the wide dissemination of their findings, together with the general state of business in recent years and the pressure on local authorities to cut costs have encouraged more thought on the part of both owners and occupiers of commercial buildings.

The receipt of a notice to quit, designed as a first stage in the grant of a new lease and only intended by the landlord as an opportunity to increase the rent, may now be the catalyst for a review both of the use of the premises and the organisation of the business in the course of considering whether the company wishes or needs to and if so can afford to continue to occupy the premises.

1.2.1 Property as an investment

There is no prospect of value growth in building society investments or many government securities. Equities and some gilts offer this combination, although the range and diversity makes comparison more difficult. Investors ideally aim for a positive or real interest annual return, an element of capital appreciation and a reasonable level of security. Yet in order to maximise returns it is essential to compare the total likely out-turn on the investment.

The effect of capital change is less certain since it exists only on paper until the asset is sold. It is this aspect more than any other that sets property apart from the majority of other investments and is referred to as illiquidity.

Investors in gilts and equities can make a judgement about the current value of their holdings and decide to sell in the knowledge that the transaction will take place without delay and on the terms agreed. The delay in implementing any property investment decision and the likelihood of market changes before it is effected tends to place property apart from other principal forms of investment. The investor will expect the relative illiquidity to carry an uncertainty premium as a trade-off.

Investors in gilts and equities can make a judgement about the current value of their holdings and decide to sell in the knowledge that the transaction will take place without delay and on the terms agreed. The delay in implementing any property investment decision and the likelihood of market changes before it is effected tends to place property apart from other principal forms of investment. The investor will expect the relative illiquidity to carry an uncertainty premium as a trade-off.

1.2.2 Demand for land and buildings

Banks, insurance companies, building societies and many of the leading retailers own their own operational premises where possible as a matter of policy. Manufacturers in the basic industries, especially where specialised processes use few conventional buildings, often have no option but to provide their own premises, developers not being prepared to finance such developments which often have no alternative use, suffer heavy wear and tear and are susceptible to technological change with a direct but uncertain effect on the remaining useful life of the unit.

Many of the remaining retailers, office users and manufacturers take a conscious decision to lease their premises, enabling available capital to be employed in the furtherance of their core business activities. The security offered to tenants by legislation provides real choice and has done much to promote the acceptability and popularity of leasehold interests among commercial users. At the same time, it restricts their exposure to risk of change and maintains their flexibility to relocate or relinquish if necessary for any reason.

Fashions and preferences change. Some of the largest retail chains which command sufficient capital to enable them to own many of their operational properties in preference to renting, have opted to become leaseholders, at least in some of their premises, releasing capital by selling blocks of property to property companies and others with the benefit of their covenant as the basis of a lease back. Recent examples include two of the more successful retailing groups, Dixons and Salisbury’s. Companies appreciate the option; relatively new and growing businesses will tend to look upon leased premises with favour as enabling them to expand at a faster rate than would be the case with freehold acquisitions.

The provision of premises for letting to these various users has become a major industry, almost entirely controlled by property companies, insurance companies, pension funds and similar institutions, which have vast investments in property. The majority of investments by such groups is in commercial (retail and offices) and industrial premises (factories, warehouses) with relatively small holdings in agricultural land and possibly residential property.

1.2.3 The available market

An important aspect of investment is diversification which may be achieved by investing across sectors and in several geographical areas. For the larger funds, the marketplace is global: even where there is some hesitation about investments around the world, there are many opportunities in Europe.

The wellbeing of the property market is inextricably linked to the economic performance of the country and its success in the European dimension. The deep structural changes of the 1980s are still working their way through the system and whichever political party is in power the result is likely to be further change and uncertainty. There is an urgent need to operate within the European community in a way which will ensure substantial benefits from the larger market to at least justify Britain’s substantial and increasing financial contribution. Property, whether held as an investment or used operationally, has an important part to play in this integration.

1.3 THE PROVIDERS OF LAND AND BUILDINGS

Property may be provided for the use of others by an investor; by a company for use in its business and to enable their operations to function and grow; and by various public bodies, local and national, mainly for their own operational use but including an element of investment property.

It is not possible to assess the capital value of property holdings with any precision although the result of a careful enquiry in 1989 put the value of UK holdings of commercial property at £250bn of which some 7% was held by the eight largest property companies. At about the same time another source placed the operational assets of the 29 largest United Kingdom companies at £58bn.

Almost all the significant holdings of property are held corporately, by pension funds, institutions, property companies and business firms, hospital authorities and similar groups.

Individuals usually invest in stocks and shares and indirectly in property through premium payments to insurance companies and contributions to private or company pension funds. These commercial organisations together with public and quasi-public undertakings have vast investment holdings. The quasi public ones include the Crown estate, the Civil estate, the Church commissioners and the Duchy of Cornwall.

The considerations of management will be determined to a large extent by the declared purpose of the organisation and the need to satisfy various interested parties—shareholders, policy holders, debenture holders, pension recipients, the Registrar of Friendly Societies, the Charity Commissioners among others—that the investment is being managed in an appropriate way.

1.3.1 The main categories of investors in property

Large and small contributions from individual and corporate sources provide the funds necessary for investment in the various investment media.

They may be deposited by individuals or their employers to provide pensions at some future date or to finance the redemption of a mortgage, personal savings, regular or spasmodic and often of relatively modest amounts, or by professional investors in larger amounts.

(a) The private sector

By far the largest concentrations of property are held corporately by pension funds, property companies and business firms.

Three examples give an example of the extent and spread of the holdings of larger corporate investors:

- One of the larger United Kingdom insurance funds is Scottish Widows which has investments in its Managed Pension Fund and Unit Linked Fund with a total value of some £1.25bn in the year ending March 1993. Approximately 7% of its life fund is invested in the property sector, principally in retail and industrial properties. Most management is carried on in-house although agents are engaged to search for and acquire suitable investment properties.

- The Liverpool Victoria Friendly Society has some £3.2bn invested assets, including £446m mainly in commercial property. A good deal of restructuring has taken place in the last few years to rebalance the portfolio and to improve the quality and lot size of the stock.

- The Grosvenor Estate is the largest privately owned investment fund in the United Kingdom. The nucleus of the estate has been in the family ownership for over 500 years, based on extensive land holdings in London and Chester. Fortuitously, the land in London was and remains in areas favoured for high-quality housing and premier shopping areas.

The trust has a sizeable subsidiary operation where substantial and prestigious assets are controlled.

(b) The public sector

Central government owns much of its older operational stock, mostly in the capital but with other substantial holdings, such as Crown post offices, in towns and cities throughout the country. There has been a tendency in recent times to enter the market and take leases of office blocks and other types of property.

In the past, local authorities have acquired vast amounts of land within their own area. For example, it has been estimated that Manchester and Sheffield each own approaching 50% of the land within...

Table of contents

- COVER PAGE

- TITLE PAGE

- COPYRIGHT PAGE

- PREFACE

- TABLE OF CASES

- TABLE OF STATUTES

- 1. THE ROLE AND RESPONSIBILITIES OF THE PROPERTY MANAGER

- 2. POLICY FORMATION AND IMPLEMENTATION

- 3. PROPERTY PERFORMANCE: EVALUATION AND PROJECTION

- 4. THE COMPUTERISED OFFICE

- 5. COSTS, EXPENSES AND OUTGOINGS ASSOCIATED WITH PROPERTY INTERESTS

- 6. ASPECTS OF OCCUPATION

- 7. BUSINESS TENANCIES

- 8. BUSINESS TENANCIES: RENT REVIEW AND THIRD PARTY PROCEEDINGS

- 9. RESIDENTIAL TENANCIES

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn how to download books offline

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 990+ topics, we’ve got you covered! Learn about our mission

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more about Read Aloud

Yes! You can use the Perlego app on both iOS and Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app

Yes, you can access Property Asset Management by D. Scarrett in PDF and/or ePUB format, as well as other popular books in Architettura & Pianificazione urbana e paesaggistica. We have over one million books available in our catalogue for you to explore.