The ROI of Pricing

Measuring the Impact and Making the Business Case

- 220 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

The ROI of Pricing

Measuring the Impact and Making the Business Case

About this book

As with executives and managers in so many other business functions, pricing specialists are being challenged more and more to substantiate the added value of their activities. Pricing is a core function of every business, and needs not only to contribute positively to short- and long-term results, but also to document its impact to the bottom line. A fundamental part of this is the pricing ROI calculations.

This book, edited by globally renowned thought leaders Andreas Hinterhuber and Stephan Liozu, is the first to outline contemporary theories and best practices of documenting pricing ROI. It provides proven methods, practices and theories on how to calculate the impact of pricing activities on performance. Marketing ROI is now a common concept: this collection proves to do the same for pricing.

Hinterhuber & Liozu introduce the concept of pricing ROI, documenting and quantifying the return on pricing activities and on the pricing function itself is of increasing relevance today and in the future – in times of budget constraints. 20 world class specialists explore the concept of pricing ROI under both a theoretical perspective and a managerial perspective to shed much-needed light on how to measure and increase pricing ROI.

This groundbreaking book will enlighten students and specialists of marketing and sales, pricing managers and executives alike.

Frequently asked questions

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Information

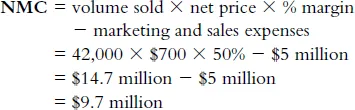

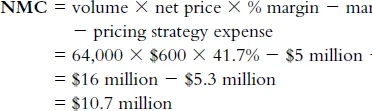

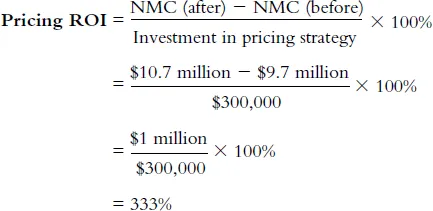

VALUE-BASED PRICING ROI

Value-based pricing and net marketing contribution

Value-based Pricing ROI

Investing in value-based pricing

Creating value

Communicating value

Delivering value

Table of contents

- Cover

- Half Title

- Title Page

- Copyright Page

- Table of Contents

- List of illustrations

- Notes on contributors

- Introduction: Pricing — from finance back to finance: the coming of age of pricing ROI

- 1 Value-based Pricing ROI

- 2 Cannibalization — five easy Pieces

- 3 Is there a long-term return on price promotions?

- 4 Pricing modelling as a strategic leverage for knowledge-intensive start-ups: an explorative case study in the luxury fashion industry

- 5 Making the business case for value-based pricing investments

- 6 Evaluating the impact of pricing actions to drive further actions

- 7 Using VOC to ensure product launch success: a case study showing how one firm prevented a launch misfire

- 8 The power and impact of quick wins

- 9 Illuminating value capture with return on pricing investment

- 10 Case study on break-even analysis

- 11 Allocating pricing resources with a more strategic ROI calculation

- 12 Making the case for value-based pricing software in B2B markets

- 13 Translating pricing-software-enabled capabilities to meaningful financial impacts: a holistic approach

- 14 Interview with a pricing leader: Robert Smith, Director of Corporate Pricing for Eastman Chemical

- 15 ROI and the impact of pricing: the state of the profession

- 16 Closing thoughts

- Index