eBook - ePub

Building International Construction Alliances

Successful partnering for construction firms

- 142 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Building International Construction Alliances

Successful partnering for construction firms

About this book

Building International Construction Alliances is the first book to address the challenges of international cooperation between medium-sized construction firms. By presenting a case study of the historical evolution of Fratelli Dioguardi S.p.A. and Beacon Construction Company, and representative projects, Roberto Pietroforte offers the reader an understanding of

* the way successful firms adjust their strategic, organizational and operational settings to the changes in their market environments

* the importance and advantages of international cooperation among medium-sized construction firms

* the necessary analytical background for developing long-term collaboration.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

At the moment all of our mobile-responsive ePub books are available to download via the app. Most of our PDFs are also available to download and we're working on making the final remaining ones downloadable now. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Building International Construction Alliances by Roberto Pietroforte in PDF and/or ePUB format, as well as other popular books in Architecture & Architecture General. We have over one million books available in our catalogue for you to explore.

Information

1 Market opportunities and environments of the firms

The operational context of Beacon and Dioguardi is introduced in this chapter by describing the current business opportunities that result from the various functional phases of the building process, and the new challenges following changes in construction demand. The major characteristics and differences of the US and Italian construction industries and processes are also highlighted. The awareness of these differences is important for understanding the historical evolution of the firms to be analyzed in the following chapters.

The construction market: current opportunities

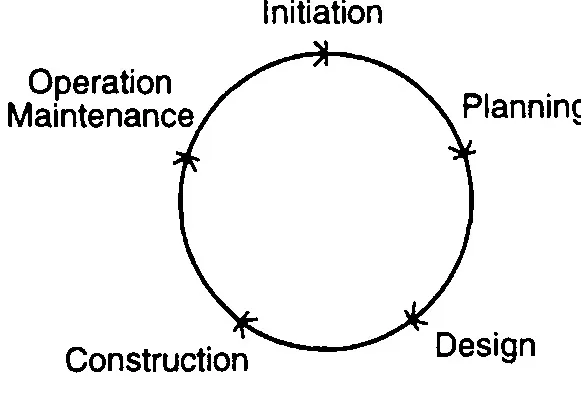

For explanatory purposes, the building delivery process—the environment of the construction market—is compared to a multiphased input-output cycle, as shown in Figure 1.1.

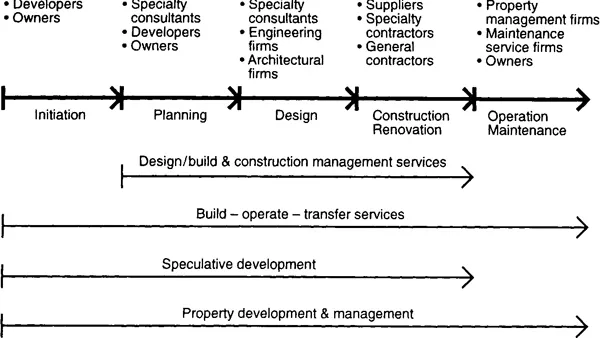

At each phase the value of the preceding input is accrued by embodying knowledge, capital and human resources in the output. The process is initiated with the perception of a need or investment opportunity that, later on, is followed by its transformation into a set of objectives and tasks for meeting these objectives, such as land acquisition, project scope definition, financing and a project delivery program. The design phase involves the transformation of objectives and plans into a set of graphic representations and construction specifications. Construction is the transformation of these documents into physical reality. Note that this phase may be characterized by the construction of a new building or the renovation of an existing one. After completion, the output of the building is the service to users and/or a stream of revenues for an investor. Over the years this output degrades or shrinks progressively, notwithstanding maintenance and upkeep interventions. Functional or economic obsolescence reaches a point when a new building or substantive renovation is needed. Roughly speaking, the process described above is broken down into five main phases: initiation (need/opportunity), planning, design, construction/renovation and operation/maintenance. With few exceptions the various activities of each phase are undertaken by independent firms, thus creating different market areas by phase and by specialties within each phase, as shown in Figure 1.2.

1.1 The cycle of the building delivery process.

1.2 Market segmentation by phases of the building delivery process.

Until not long ago, the general contracting business was identified with sales from construction and renovation operations only. Within this market, many specialties exist by type of project and construction technique. Competition is generally based on price for a given level of construction quality. Contracting firms consequently have developed a ‘production’ culture aimed at achieving production and operational efficiencies for competitive reasons. These objectives have induced some firms to integrate backward with their supply sector, e.g. materials, parts and machinery, in order to decrease input costs. Given the downstream positioning of the construction and renovation phase in the business cycle of the building process, contracting firms have little opportunity for influencing or creating the demand for their new projects without entering or controlling other phases. In this regard, some firms have moved upstream in the process by incorporating design/ engineering capabilities (e.g. through acquisition, in-house development or temporary associations) and/ or offering design/build services. Lastly, some firms have created new demand by being involved in real estate development, e.g. housing and commercial buildings, or more recently building-operate- transfer projects.

The construction market: future opportunities

This pattern has been changing. Macrochanges in the world economy at large, and the construction market in particular, are creating new opportunities for forging alliances between construction firms, particularly those of medium size.

Developments in information processing and telecommunication technologies, global procurement of materials and equipment, improved transportation infrastructures and internationalization of financial markets allow firms to enter new markets by operating worldwide. The collaboration with local firms is essential for understanding local markets, cultures and technologies without the need for significant investments, such as the opening of a local subsidiary, and for developing the awareness of the competitive requirements of the global economy.

At the same time the need for creative project financing (required by privatization programs and lack of public funds) and real estate and facilities operations and maintenance is expanding the traditional opportunities of the construction industry. Its market has been characterized by an increasing demand for broad management services to be offered early in the building process in addition to traditional construction services. The increasing complexity of projects with regard to both phasing and technology requires capabilities to cooperate with different specialized organizations and/or to deliver total and multidisciplinary services. These new challenges can be met if construction firms can develop technical and integrative management capabilities applicable to the entire building process, and a professional service attitude instead of a production-oriented culture. These capabilities should be supported by the increasing involvement of construction firms early in the development of new projects.

The scenario described above tends to favor large and integrated firms. Established cooperative and value-added linkages among small or medium-sized specialized firms, however, allow them to reach a competitive position, by having a superior organizational flexibility for project- and resource-transferring capabilities while maintaining efficiency of specialization and autonomous operating effectiveness. This organizational arrangement, in which independent specialized firms pool together their resources along the value-added chain of a product, has been described as ‘networks’ (Miles and Snow, 1986; Thorelli, 1986) in the manufacturing and services sectors, and in the case of the construction industry as ‘quasifirm’ (Eccles, 1981) or ‘macrofirm’ (Dioguardi, 1983).

The current environmental problems, the prospects for success of sustainable development, and the changing relationship between environment and mankind are other issues that foster domestic and international cooperation between firms and communities, because little is known about the management of the environment. In this regard, the construction industry as a whole needs to develop a stronger social role and cooperation and to improve its tarnished image as one of the main sources of environmental problems.

The environments of Dioguardi and Beacon

Dioguardi and Beacon operate in an industry that in the last 40 years has been losing importance vis-à-vis other sectors, such as services, in terms of contribution to their respective national economies. This pattern is typical of highly developed economies, such as those of the USA and Italy, with a shrinking new construction market and a growing maintenance and repair construction sector (Bon and Pietroforte, 1990, 1993; Pietroforte and Bon, 1995).

Construction is a mature industry, whose market is characterized by fierce competition among firms. The rules of competition are set predominantly by the client and the client’s consultants in the form of procurement and bidding approaches and contractual arrangements. The criteria according to which the demand for construction-related services are defined and communicated and their supply is controlled, strongly influence the behavior and culture of construction firms in the long run. These issues are reflected in the characteristics of the Italian and US construction markets to be discussed in the following pages. The value systems of the firms’ environments are different, although both share capitalistic features in their economies. Society in the USA is characterized by a thrust toward the enhancement of individual liberties, entrepreneurship and ethical values, while Italian society is characterized by an emphasis on social equality, public welfare and moral values. Some of these traits are reflected respectively in the personalities of the principal owners of Beacon and Dioguardi: Norman Leventhal, whose reputation builds upon his entrepreneurial achievements, and Gianfranco Dioguardi, whose reputation builds upon his social and cultural contributions.

The different value systems are also reflected in the labor market. The Italian context is characterized by rigid employment regulations, a significant employment role of the government, generous social benefits, and lack of job mobility. The US labor market, however, is characterized by more flexible employment regulations, a significant employment role of the private sector, and job mobility. These features are reflected in the US economy, which is generally more dynamic than in Italy.

Other important differences can be discerned in the business culture and procedures of the two countries. Italian corporations are generally characterized by long-term goals, continuity of employment, and less job specialization. US corporations are geared toward short-term goals and are characterized by a higher rate of employment turnover and job specialization. Business agreements in Italy tend to be based on general understandings and socialization with less reliance on contractual definitions, while in the USA business agreements are often completed with complex legal documents that often prevent the development of flexible procedures during their execution. Italian construction firms are more inclined to form alliances or joint ventures to build relatively small projects. Cooperation is also developed for complying with the requirements of the public building procurement system. US firms are less prone to long-term liaisons because of the fiercely competitive nature of their market. Italian construction firms, even those of modest dimensions, have a tradition of operating abroad because of the limited size of their national market.

The Italian construction market

The demand for construction services in Italy is dominated largely by public agencies, whose activities absorb 40% of the national economy. The state, in addition, strongly influences the housing sector, which accounts for 50% of construction demand, through grants and subsidized financing. The combination of public work, projects initiated by other state agencies (that are not classified as a public work) and subsidized housing, absorbs approximately 70% of the total fixed capital investments in construction. Over the years, the public sector has distributed construction work with the primary intent of maintaining full employment as opposed to developing efficiency in the industry.

In the 1960s and 1970s the bidding requirements of public projects, based only on competitive prices, have generally induced contractors to seek cost efficiencies rather than qualitative improvement or innovative proposals. The contractual separation of design and construction, in addition, has often negatively affected the quality and schedule performance of public building programs.

In order to overcome the problems of the traditional sequential project delivery process, in the last 15 years there has been a significant use of program management and design/build contracts, with emphasis on the duration and quality of the design/engineering characteristics of projects. This initiative, also aimed at improving the engineering and management capabilities of Italian contractors, achieved positive results, but at the same time has created abuse and scandals, given the lack of project documentation, resulting in time and cost overruns, and the frequent use of discretionary awarding procedures. The practice of subcontracting has been severely restricted by law in public projects, thus curtailing the growth of firms.

The Italian public procurement system is also characterized by approximately 15000 public or semi-public agencies, which can contract out projects by drawing state funds, but often without accountability to central authorities. Many of these agencies lack the technical personnel necessary to define precise project needs and control the quality performance of these projects. Over the years this situation, combined with obsolete regulations, has hindered the growth of the design profession, particularly in regard to specialization, diversification of services and roles within a building project. Public work is awarded on the basis of documentation that is generally less defined than in the USA, and there is a lack of standard written construction and material specifications (Garaventa and Pirovano, 1994). A 10% payment advance to contractors is normal practice in any project, immediately after the signing of a contract. Given the inefficient public procurement system, until recently Italian construction companies have been operating with profit margins significantly higher than those of other European and US companies.

The Italian construction sector, unlike that in the USA, is still characterized by labor-intensive operations: the large share of maintenance and repair projects (more than 50% of the total construction output), and the craft nature of the construction technologies used, e.g. masonry work, interior partitions, finishes, and plumbing systems. Because of their traditional craft orientation, Italian trades tend to be more versatile than US ones and less prone to jurisdictional disputes and strikes.

The public construction market is changing dramatically, given the recent scandals that have involved major contractors and politicians in charge of public posts. Increasing community scrutiny and lack of public funds will change the nature of the demand, with significant impact on the modus operandi of the market and the strategic orientation of firms.

The US construction market

In the USA the demand for public work plays a less important role in the market than in Italy (approximately 25% of the US total construction output). This results from the long-standing policy toward an economy regulated by market forces rather than by federal or state intervention. In the USA this orientation is reflected in a pervasive entrepreneurial culture, and the private ownership of many social services that are state-owned in Italy. In this context, private clients have a dominant role in shaping competition in the construction market. The private demand for construction services tends to be very sophisticated, particularly in regard to the definition of required performance and procedural criteria. Emphasis on time and cost control, and the clear allocation of responsibilities and risk, are typical examples.

The US project delivery cycle tends to be shorter than the Italian one, because of the tendency to overlap the design and construction phases, particularly in commercial projects, and also the use of a significant amount of prefabricated components at construction sites. It is more complex than its Italian counterpart from the organizational and procedural point of view as well. This last feature reflects the involvement of entities, such as financial institutions, insurance companies, equity investors, regulatory agencies and communities, which in Italy generally play a less important role in shaping the scope of a project. It also reflects the multitude of specialized contributions to the design and construction phases of a project, where several independent consulting firms and tens of contractors may need to be coordinated. The successful delivery of a project strongly depends on the management capabilities of the contractor and the close involvement of the client in the project team. Although the different interests of the parties involved in a project are generally solved with team-based approaches and the careful wording of contractual arrangements, liability issues are a major problem, with frequent lawsuits arising.

Over the years, the fragmentation of the process and the clients’ need for better control and flexibility have given rise to a new function, that of program and construction manager, in assisting the client in all phases of a project. This new type of demand is reflected in the progressive reorientation of innovative construction firms that started to offer broader process management services in addition to traditional construction services.

Conclusion

This chapter has outlined some of the opportunities offered by the changing nature of the construction market, characterized by an increasing need for broader management expertise and expanded services, beyond the traditional execution capabilities of construction firms. Small/medium-sized firms can take advantage of these opportunities by forming alliances based on complementarities and aimed at expanding their markets and capabilities. In addition, this ...

Table of contents

- Cover Page

- Title Page

- Copyright Page

- Foreword

- Preface

- Introduction

- 1: Market opportunities and environments of the firms

- 2: The historical evolution of Fratelli Dioguardi

- 3: The historical evolution of Beacon Construction

- 4: Comparative analysis of the firms

- 5: The operation of the firms: analysis of six projects

- 6: Cooperative strategies in international construction

- The alliance between Dioguardi and Beacon 7

- Appendix: The International Bridgehead Agreement

- References