![]()

Part 1

Accounting

![]()

1

What is Accounting?

Anne Britton

1. Introduction

Accounting is a necessary requirement for any business or organization be it a large multinational business such as BP or the society or club you belong to in your local community. It is essential for a business or organization to keep track of its resources. They need to know if they have any cash available, if they have made a profit/surplus or loss/deficit, if they can meet the future needs or requirements of the business, if they can possibly remain in existence, or if they should change their operations in any way. These requirements can be divided into the need for stewardship of resources and the need for decision making. It is also necessary that owners and other interested parties have information on the stewardship of resources and decisions taken or to be taken by a business or organization. For example you might wish to know the uses your subscription money paid to the local tennis club was put to and what changes are going to be made to the club in the future so that you can decide whether you should continue with your membership or not. In the same way a shareholder in BP will also wish to know how the resource of their share capital has been used, if a dividend will be paid now and in the future and how future decisions in BP could affect that dividend. Accounting is the language of business that we use to answer these types of question and, as with all languages, in order to understand it we need to learn its rules and vocabulary.

2. Accounting definitions

The most often quoted definition of accounting is that given by the committee of the American Accounting Association (AAA), ‘the process of identifying, measuring, and communicating economic information to permit informed judgements and decisions by users of the information’ (AAA, 1966: 1). Another definition is that given by the American Institute of Certified Public Accountants (AICPA), ‘the art of recording, classifying and summarizing, in a significant manner and in terms of money, transactions and events which are in part at least, of a financial character, and interpreting the results thereof’ (AICPA, 1953: Par. 5). In 1970 the AICPA defined accounting as, ‘a service activity. Its function is to provide quantitative information primarily financial in nature about economic entities that is intended to be useful in making economic decisions, in making resolved choices among alternative courses of action’ (AICPA, 1970: Par. 40).

From the above we can deduce that accounting is an art form, possibly a language as we have already stated, but not necessarily a science. If it is providing a service, we therefore have to determine to whom that service is given, that is, who are the users of accounting information. Accounting is about quantitative information generally and it should enable decisions to be made about the business or organization by users. If accounting is to facilitate decision making then we can also deduce that it must be core to any successful business. Accounting therefore needs both ‘an effective and efficient data handling and recording system and the ability to use that system to provide something useful to somebody’ (Alexander et al., 2009: 4).

3. Types of accounting compared

3.1 Accounting and book-keeping

We stated above that accounting needed an effective and efficient data handling and recording system. This is generally referred to as a book-keeping system. This system may be a manual system or it can be computerized. Book-keeping systems primarily perform the stewardship function of accounting and have been around for a number of years. Indeed, modern accounting is usually stated as commencing in 1494 when Luca Pacioli, a Franciscan friar, wrote about a system of double entry book-keeping in his book Summa de Arithmetica Geometria, Proportioni et Proportionalita. This text reflected the practices current at the time in Venice for recording the transactions of merchants. Book-keeping according to Pacioli was to give the trader information as to his assets and liabilities and to do this three books were required: a memorandum, a journal and a ledger. Pacioli also recorded the fact that all entries in the ledgers had to be double entries and thus for every debit there had to be a credit.

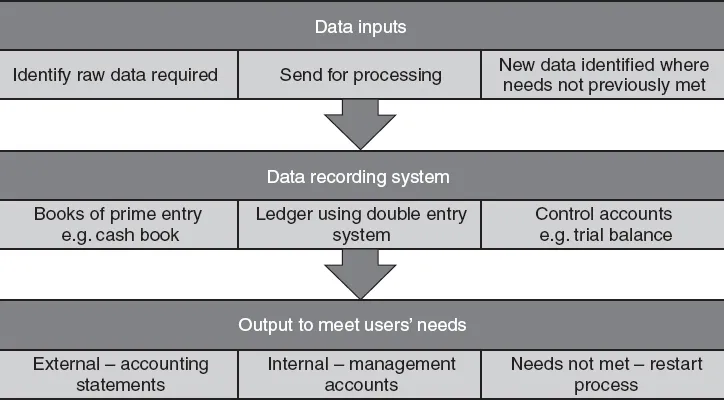

This all sounds quite simple but the book-keeping system and therefore its final output is highly dependent on what we choose to identify as our data inputs. This choice of data input is governed by what the user of such information wants to know. For example if a shareholder of a business wants to know what the business can be sold for then we need to feed into the recording system, the book-keeping system, information on the selling prices of resources held by the business not the historical price we paid for these resources. However, if a shareholder wants to know where cash raised from share issues has been spent, then we need to feed into the system historical cost of resources. Accounting therefore consists of data input decisions, a data recording system (book-keeping system) and the provision of useful information to users. Book-keeping can be seen as a subset of accounting when we identify the separate functions within the accounting process. The accounting process is shown in Figure 1.1.

3.1.1 Brief outline of the book-keeping process

The book-keeping process can be broken down into two sections: the initial recoding of transactions, and then the production of ledger accounts and a trial balance. All businesses need to record cash received and paid in some form of cash book and ensure that this is reconciled with any bank statement supplied. In addition details of sales and purchases will be made in what are generally known as day books: primarily a sales day book and a purchases day book. There may well be other day books for example to record sale returns. There is also a book of prime entry, known as the journal, where the few transactions that cannot be allocated to the cash or day books are entered. These are such items as adjustments to debtor balances or closing entries, for example inventory, so that end of period accounts can be drawn up for users. The day books and the cash book must be subject to controls and checks to ensure that only appropriate and correct entries are made in them as from these books the double entry ledgers will be constructed.

Figure 1.1 The accounting system

The double entry system codified by Pacioli is based on the accounting equation:

Assets = Capital + Liabilities

All transactions entered in the cash and day books are entered into the ledgers in accordance with this equation and to reflect that for every transaction there are two equal and opposite effects. For example the purchase of an item of equipment by cash will decrease the asset of cash and increase the asset of equipment.

A control used to check the accuracy of the double entry is the trial balance. This is a list of all the balances remaining in the ledgers at the end of a specific period and from which useful information can be summarized for users to meet their needs. At this point it is useful to identify who these users are and what their needs are.

3.1.2 Users and their needs

A comprehensive list of users of accounting information and their needs is provided by the International Accounting Standards Board in their Framework for the Preparation and Presentation of Financial Statements (IASB, 2001) paragraphs 9–11:

The users of financial statements include present and potential investors. Employees, lenders, suppliers and other trade creditors, customers, governments and their agencies and the public. They use financial statements in order to satisfy some of their different needs for information. These needs include the following:

| a. | Investors. The providers of risk capital and their advisors are concerned with the risk inherent in, and return provided by, their investments. They need information to help them determine whether they should buy, hold or sell. Shareholders are also interested in information which enables them to assess the ability of the entity to pay dividends. |

| b. | Employees. Employees and their representative groups are interested in information about the stability and profitability of their employers. They are also interested in information which enables them to assess the ability of the entity to provide remuneration, retirement benefits and employment opportunities. |

| c. | Lenders. Lenders are interested in information that enables them to determine whether their loans, and the interest attaching to them, will be paid when due. |

| d. | Suppliers and other trade creditors. Suppliers and other creditors are interested in information that enables them to determine whether amounts owing to them will be paid when due. Trade creditors are likely to be interested in an entity over a shorter period than lenders unless they are dependent upon the continuation of the entity as a major customer. |

| e. | Customers. Customers have an interest in information about the continuance of the entity, especially when they have a long-term involvement with, or are dependent on, the entity. |

| f. | Governments and their agencies. Governments and their agencies are interested in the allocation of resources and, therefore, the activities of entities. They also require information in order to regulate the activities of entities, determine taxation policies and as the basis for national income and similar statistics. |

| g. | Public. Entities affect members of the public in a variety of ways. For example, entities may make a substantial contribution to the local economy in many ways including the number of people they employ and their patronage of local suppliers. Financial statements may assist the public by providing information about the trends and recent developments in the prosperity of the entity and the range of its activities. |

While all of the information needs of these users cannot be met by financial statements, there are needs which are common to all users. As investors are providers of risk capital to the entity, the provision of financial statements that meet their needs will also meet most of the needs of other users that financial statements can satisfy.

The management of an entity has the primary responsibility for the preparation and presentation of the financial statements of the entity. Management is also interested in the information contained in the financial statements even though it has access to additional management and financial information that helps it carry out its planning, decision making and control responsibilities. Management has the ability to determine the form and content of such additional information in order to meet its own needs. The reporting of such information, however, is beyond the scope of this framework. Nevertheless, published financial statements are based on the information used by management about the financial position, performance and changes in financial position of the entity.

The IASB has begun a programme of updating the framework and the users as specified by the framework have now changed. A primary group of users has now been defined so that financial reports can be focused on them without having to take account of the needs of other more peripheral users. The primary group is identified as existing and potential investors, lenders and other creditors. In other words those users who provide or are considering providing resources to the entity. The 2010 Conceptual Framework for Financial Reporting (IASB, 2010: 46–7) in its basis for conclusions states:

| a. | Existing and potential investors, lenders and other creditors have the most critical need for the information in financial reports and many cannot require the entity to provide the information to them directly. |

| b. | The Board’s responsibilities require them to focus on the needs of participants in capital markets, which include not only existing investors but also potential investors and existing and potential lenders and other creditors. |

| c. | Information that meets the needs of the specified primary users is likely to meet the needs of users both in jurisdictions with a corporate governance model defined in the context of shareholders and those with a corporate governance model defined in the context of all types of stakeholders. |

3.2 Financial accounting and management accounting compared

Accounting is generally divided into two areas: financial accounting, and management accounting. Financial accounting is concerned with the provision of information to external users such as shareholders, creditors and customers, whereas management accounting is concerned with the provision of information to internal users, i.e. management, to enable them to make decisions about the future operations of the business. Both types of accounting consist of the functions we described above: identification of data input, a data recording system and the provision of useful information to the external or internal user. It is essential to note that the basic information for both financial and management accounting information is the same and both can use the same recording system.

The difference between the two is the purpose of the information:

• financial accounting provides information to external users on the overall per...