- 520 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

eTourism case studies:

About this book

eTourism Case Studies bridges the gap in contemporary literature by carefully examining marketing and management issues of many international companies that have successfully implemented eTourism solutions.

Divided into six sections this book explores the newest developments in this field, introducing and discussing emerging trends, approaches, models and paradigms, providing visions for the future of eTourism and supporting discussion and elaboration with the help of thorough pedagogic aids.

With contributions from leading global experts both from the industry and academia, each case follows a rigid structure, with features such as bulleted summaries and review questions, as well as each section having its own thorough introduction and conclusion written by the editors, highlighting the key issues and theories.

This is the first book of its kind to bring together cases highlighting best practice and methods for exploiting ICT in the tourism industry, from international market leaders.

Tools to learn more effectively

Saving Books

Keyword Search

Annotating Text

Listen to it instead

Information

Part One

Hospitality

Introduction

In comparison to other tourism sectors, the hospitality industry was relatively late in starting to use information and communication technologies (ICT). The structure of the accommodation sector is extremely heterogeneous, ranging from tiny bed and breakfasts to large 5-star chain hotels. The location of the properties as well as the types of clientele determines the demands and requirements made on ICTs (Buhalis, 2003). A number of the factors set out in Table PI.1 are ultimately decisive for whether, and to what extent, ICTs are used in hotels (Camisón, 2000).

Table PI.1 Variables relevant for the features of the hotel trade

Factors | Examples |

Place | Urban/metropolitan/peripheral/alpine/rural |

Size | Small/medium/large |

Ownership relationships | Family/chain/franchise/state |

Price | Exclusive/expensive/affordable/cheap |

Activities | Sport/all-inclusive/club |

Services | Hotel/bed and breakfast/boarding house |

Guests’ travel reasons | Leisure/business/conference/incentive |

Transport links | Airport/motorway/railway |

Source: Buhalis (2003)

In particular it is the ownership, relationships and size of the business that determine the degree of technology used in hotel properties. Larger tourism enterprises and particularly hotel chains have more complex incompany processes and possibly distances in time and space to overcome, which require the use of advanced ICTs. At the same time, they also have the necessary financial resources in order to employ specialists and to be able to implement the corresponding applications (Egger, 2005). Thus, for instance, city hotels differ fundamentally from holiday hotels, and chain hotels differ decisively from small and medium-sized tourism enterprises (SMTEs).

Strategic Use of ICT for Hotels

Although the accommodation sector was for years regarded as ‘the most under-automated segment of the international travel industry’ (Buhalis, 2003) the rapid development of the Internet has led to most hospitality businesses, irrespective of their size, to engage actively with ICT. In many occasions computers were primarily introduced to facilitate the distribution function of hotels, as intermediaries would often refuse to collaborate with hotels that had no access to the Internet or were unable to receive emails or update their availability online. This push factor would bring a computer into the hotel environment which would then be used for the entire range of business functions and processes. There are many ways in which accommodation establishments can be supported by ICTs at both product and process level. These technologies promote the efficiency and effectiveness of operative processors, accompany strategic planning and are useful for the question of specialization and differentiation. They can be used within the company and between companies, support communication and coordination with all stakeholders. ICTs, for instance, can facilitate the administration and organization of the inventory, reduce distribution and communication costs, open new markets, permit the provision of up-to-date information and support flexibility in terms of pricing and product structure (O’Connor, 1999). In addition, they allow long-term customer relationships to be developed and support the creation of strategic partnerships. They encourage inter-organizational knowledge and know-how transfer and permit well-founded marketing research. The Carnival City study (Case 5), for instance, investigated the marketing strategy importance of ICT-assisted loyalty programmes and the contribution that the analysis of customer value can bring to an enterprise.

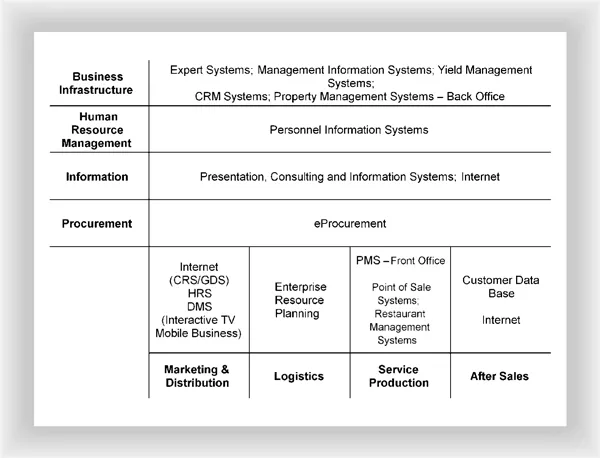

The internal and cross company structures in the hospitality industry are complex, and the requirements made of processassisting information technology is accordingly varied. Figure PI.1 by Mathies and Weiermair (2003) uses the value chain analysis to provide an overview of the technologies used in the hospitality industry. The most important are described above.

Figure PI.1 ICT in the hospitality industry

Source: Mathies and Weiermair (2003)

However, sometimes ICTs support not only individual corporate sectors but also central elements of the entire business model. The example of Omena hotels (Case 4) presents a premium budget- class hotel which challenges the traditional service concept and revenue models by fully exploiting the Internet and other forms of ICT in its operations. The hotel chain takes full advantage of technology to operate its properties with no staff on the premises. Although arguably this is detrimental to the customer service required, there is sufficient evidence from the success of the company to suggest that there is a market segment that would appreciate this type of business proposition.

The fact that today almost every hotel, irrespective of size, has its own website, is an impressive demonstration of the penetration of ICT amongst accommodation establishments. However, the use of this technology must be based on their business’s aims and strategies. The fact that there must be a strict coordination of all e-business activities with business operational and strategic management has not yet become sufficiently widespread. This problem is common particularly amongst SMTEs, that have not recognized the need for a coherent marketing strategy or who do not have the know-how required through their existing human resources.

In recent years, the tourism market has increased hugely in complexity, while at the same time the customer has acquired a new and stronger role that requires a change of paradigm in the understanding of the market. Whilst only a few years ago it was possible to speak of a customer-centric market, today a customer-driven market prevails, in which the consumer has the greatest market power. The development of Web 2.0 applications, such as Tripadvisor and HolidayCheck in the German market (Case 15), empower consumers to share reviews and to assess hotels publicly. In a recent article the Hotels magazine explained that consumer reviews on Tripadvisor are becoming more important that the official star ranking that hotels have. Hence if a hospitality company wishes to maintain its market share in the future, it will have to focus on both the distribution channels and also address the community/networking sites used by potential guests.

Distribution

While many SMTEs only upgraded technologically in the last few years, numerous hotel chains first began using ICTs as early as in the 1970s. In the past, the chain hotel industry identified the need to develop international distribution networks that give both customers and the trade the possibility of carrying out price and vacancy enquiries. The development of computer reservation systems (CRS) and global distribution systems (GDS) brought central reservation offices (CRO) of hotel chains to collaborate with Switch companies such as Pegasus to interconnect systems, display availability and rates and to allow reservations on a global scale (Buhalis, 2000; O’Connor, 1999).

Depending on the type of hotel, ICTs have revolutionized the distribution function. A typical business hotel can use a wide range of distribution channels, namely: direct sales (‘walk-in’), the hotel chain’s own CROs, its own website, marketing via online and offline travel agencies, online intermediaries, destination management systems (DMS), hotel representation and consortium groups or a GDS (O’Connor and Frew, 2000). Depending on the marketing channel selected, numerous intermediaries can be involved, who are ultimately also responsible for the amount of the marketing costs incurred. In order to serve different markets and address relevant target groups, it is necessary to differentiate in the handling of the individual marketing channels. The InterContinental Hotel group case study (Case 2) shows the significance of brand integrity and price parity as well as the need for coordinated channel management at the group level.

Internal Systems: Property Management System (PMS) and CRS

While larger hotels have implemented comprehensive software solutions in order to manage the inventory, hotel chains use group-wide systems that permit the control of the individual business operation and the management across the hotel chain. The InterContinental Hotel group case study (Case 2) shows in this context how the ‘Holidex Plus’ solution inter alia optimized capacity and inventory management.

Property management systems (PMS) such as Micros Fidelio Opera are in-house applications that support the central electronic structure of the hotel. They contain all the information about the units of a hotel such as number, price, category and status of rooms whilst managing customer reservations and billing processes. PMSs take on both front office and a number of back-office functions. They administer the booking and reservation processes and are used as an aid to decision-making in management functions through the production of comprehensive reports. The back-office applications include stock management, controlling, book-keeping, financial planning and wage payment. Front office applications simplify and enhance customer contact through customer relationship management and thus contribute to increased service quality. This includes reservations, check-in, room management and customer charging. In addition, PMS can also act as a hub between the different systems of a hotel, bringing all functions under one system (Egger, 2005). The case study of the Sino Group of Hotels (Case 3) shows the advantages that result through the joint use of a central PMS by a number of properties.

Buhalis (2003) identifies the most important functions of a hotel CRS and PMS:

- Improving capacity management and operations efficiency.

- Facilitating central room inventory control.

- Providing last room availability information.

- Offering yield management capability.

- Providing better database access for management purposes.

- Supporting extensive marketing, sales and operational reports.

- Facilitating marketing research and planning.

- Providing travel agency tracking and commission payment.

- Tracking frequent flyers and repeat hotel guests.

- Direct marketing and personalized services for repeat hotel guests.

- Enhancing handling of group bookings and frequent individual travellers (FITs).

External Systems

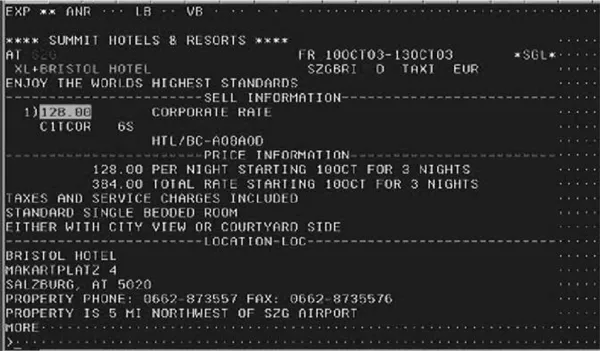

Direct marketing is often the preferred distribution option, because it is the least expensive and at the same time provides loyal clientele that engage directly with the hotel, rather than whoever happens to be on a distribution channel or cheaper than anyone else. In order to reach the markets needed, however, it is necessary to have access to intermediaries who have a much wider reach to the marketplace via a wide range of channels. In the pre-Internet era the developments in the field of GDS, which originally came from the airline sector, finally made the electronic link-up of CRS possible. From then on, chain hotels were able to participate in the global market by means of GDSs. The electronic marketing channel was gradually extended through the integration of PMS, CRS and GDS. The Switch companies described in further detail in Part Four, ICT Systems, were created in order to ensure interconnectivity and interoperability between the CRS and the GDS. The resulting advantages were reflected in increased efficiency and economy, a simplified controlling system and reduced personnel costs and time spent. The distribution of hotel services via GDS is, however, not without its problems. Firstly, the membership fees charged by the GDS and the costs per booking are too high for small enterprises. At the same time the GDS only permit a limited representation of the hotel and room information and they require considerable maintenance efforts. Figure PI.2 demonstrates the representation of the Bristol Hotel in Salzburg on the Amadeus system.

Figure PI.2 GDS listing of a hotel inquiry

Source: Amadeus

In the USA, roughly one half of all hotels are marketed online via GDS and CRS, however, this figure is only around 10% in Europe. The reason lies in the structure of the market. As already mentioned, the majority of businesses in Europe are SMTEs. GDS and CRS are ideal for marketing standardized products such as flight tickets or hire cars or large hotel chains that have standardized processes and procedures. However, if heterogeneous products such as rooms in European SMTEs are to be marketed, the systems very rapidly reach their limits (O’Connor, 1999). Leaving aside the excessive user charges, SMTEs do not have the brand names that could guarantee the quality of the service. Accordingly, the Internet is much more suited for the presentation of se...

Table of contents

- Cover Page

- Table Of Contents

- Half-Title Page

- Title Page

- Preface

- Preamble and Acknowledgements

- Introduction

- Hospitality

- InterContinental Hotel Group: Dealing with Online Intermediaries

- Intercontinental Hotel Group: Managing Inventory with HOLIDEX PLUS

- Sino Group of Hotels: Handling Multi-Property Operations

- Omena Hotels: Technology towards Operational Efficiency

- Carnival City: Valuating Guests in the Gaming Industry

- Hotel Sallerhof: Innovations in Interaction

- ‘Emmantina’ and ‘Palmyra Beach’ Hotels: Distribution for Independent Hotels

- Orbis on Line: Internet Distribution Strategies for a Regional Hotel Group

- Conclusion of Hospitality Section

- Intermediaries

- Lastminute.com: From Reservation System to Lifestyle Portal

- Wotif.com: Last Minute Selling of Distressed Accommodation Inventory

- A2Z Professional Travel Ltd: Online Travel Agency in Thailand

- ITWG: Increasing Intermediated Flows

- Incoming Partners: Integrating Operations

- Sidestep: Travel Meta-Search Engine

- Holidaycheck: Rendering Holiday Impressions

- TUI: Integrating Destination Information

- Cultuzz: Managing eBay as a Distribution Channel

- Conclusion of Intermediaries Section

- Destinations

- VisitBritain: Satisfying the Online Market Dynamics

- Spain.Info: Towards Stakeholder Network

- BonjourQuebec.com: A Vision, a Strategy, a Brand

- The Province of Rimini: Communicating with the Customer

- Tanzania: Extending eTourism Tools Utilization

- Tiscover: Destination Management System Pioneer

- Feratel Media Technologies: Providing DMS Technology

- Destimation.com: Online Solutions for Destination Management Companies

- Conclusion of Destination Section

- Transportation

- British Airways: Customer Enabled Interactivity

- Kulula.com: Low-Cost Carrier and ICTs

- Finnair: Innovating Interactivity

- Enterprise Rent-A-Car: Mainstreaming Distribution

- Lufthansa Systems: Dynamic Pricing

- Conclusion of Transportation Section

- Information Communication Technology Systems

- eCTRL Solutions: Trip@dvice Technology

- The Green Card (Targeta Verda): A Tourist Card for the Balearic Islands

- Checkeffect: Benchmarking e-Marketing Performance

- TAI (Day Trip Indicator): Measuring Value Added in the Tourism Sector

- Tourism Technology: Travel Wholesale Management System

- Digital Tourism Assistant: Enquiry Management Solution for Destinations

- Amadeus: Evolution of GDS

- Amadeus: Global Distribution System's New Paradigm

- Pegasus Solutions: Providing Interconnectivity

- Conclusions of ICT Systems

- Mobile Systems

- Rivertale: Mobile Services for Cruise Ships

- Lovo: The Mobile Lifestyle Assistant

- Aladdin: A Mobile Destination Management Solution for Incoming Agencies

- Conclusion to Mobile Systems Section

- Index

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn how to download books offline

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 990+ topics, we’ve got you covered! Learn about our mission

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more about Read Aloud

Yes! You can use the Perlego app on both iOS and Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app

Yes, you can access eTourism case studies: by Roman Egger, Dimitrios Buhalis, Roman Egger,Dimitrios Buhalis in PDF and/or ePUB format, as well as other popular books in Business & Hospitality, Travel & Tourism Industry. We have over one million books available in our catalogue for you to explore.