Empirical Development Economics

- 434 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

Empirical Development Economics

About this book

Understanding why so many people across the world are so poor is one of the central intellectual challenges of our time. This book provides the tools and data that will enable students, researchers and professionals to address that issue.

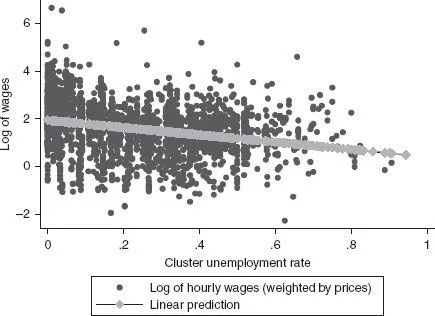

Empirical Development Economics has been designed as a hands-on teaching tool to investigate the causes of poverty. The book begins by introducing the quantitative approach to development economics. Each section uses data to illustrate key policy issues. Part One focuses on the basics of understanding the role of education, technology and institutions in determining why incomes differ so much across individuals and countries. In Part Two, the focus is on techniques to address a number of topics in development, including how firms invest, how households decide how much to spend on their children's education, whether microcredit helps the poor, whether food aid works, who gets private schooling and whether property rights enhance investment.

A distinctive feature of the book is its presentation of a range of approaches to studying development questions. Development economics has undergone a major change in focus over the last decade with the rise of experimental methods to address development issues; this book shows how these methods relate to more traditional ones.

Please visit the book's website at www.empiricalde.com for online supplements including Stata files and solutions to the exercises.

Information

Table of contents

- Cover Page

- Half Title page

- Series Page

- Title Page

- Copyright Page

- Contents

- List of figures

- List of tables

- Notes on Authors

- Preface

- How to use this book

- Part I Linking models to data for development

- Section I Cross-section data and the determinants of incomes

- Section II Time-series data, growth and development

- Section III Panel data

- Section IV An introduction to programme evaluation

- Part II Modelling development

- Section V Modelling choice

- Section VI Structural modelling

- Section VII Selection, heterogeneity and programme evaluation

- Section VIII Dynamic models for micro and macro data

- Section IX Dynamics and long panels

- Section X An overview

- Bibliography

- Index

Frequently asked questions

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app