![]()

1

CASH FLOW AND BUSINESS

Cash flows are normally reported in a Cash Flow Statement. In the United Kingdom this is prepared in accordance with Financial Reporting Standard (FRS) No. 1 - Cash Flow Statements. In countries that have adopted international accounting standards it is prepared in accordance with International Accounting Standard (IAS) No. 7 - Cash flow Statements. The Cash Flow Statement is a relatively recent phenomenon. FRS 1 was issued in the United Kingdom in September 1991. IAS 7, having originally been called Statement of Changes in Financial Position, was revised in 1992 and retitled Cash Flow Statements. Prior to this the UK and many other countries required a Statement of Source and Application of Funds in the annual accounts which, while being a document that assisted in the analysis of cash flows, was not a cash flow statement and proved difficult to interpret.

Ever since the joint stock company was invented in the 1800s it has been customary to offer shareholders an annual Profit and Loss Account and Balance Sheet. However, professional analysts have realized that cash flows are essentially a matter of fact and are therefore much less prone to accounting interpretation by managers and directors of companies. Consequently we are now seeing much more emphasis being placed on the identification and analysis of cash flows as opposed to the traditional approach of data derived from the Profit and Loss Account and Balance Sheet

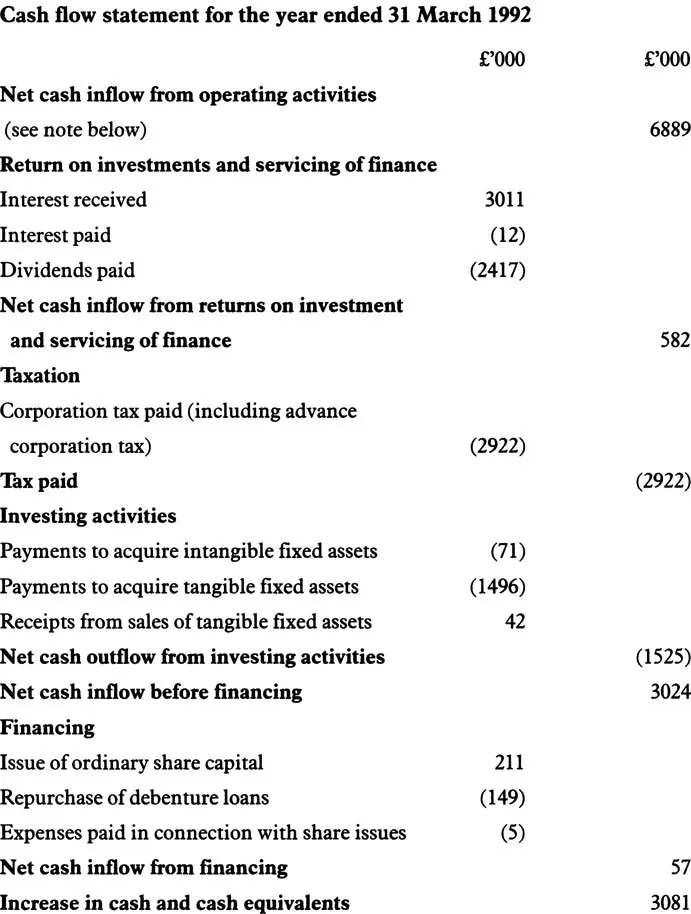

See overleaf for extract from FRS 1 - Illustrative example

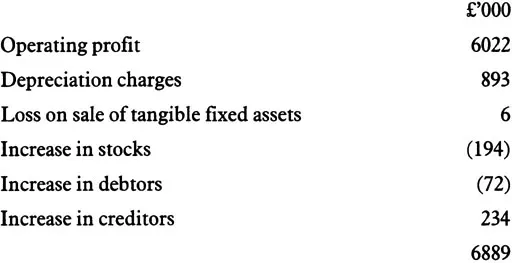

Note to the cash flow statement

Reconciliation of operating profit to net cash inflow from operating activities:

1. Net cash inflow from operating activities

The identification starts with operating profit, and the next two items are depreciation and the (profit)/loss on sale of fixed assets, which are added back. The objective is to identify the cash generated from operations. This is normally achieved by adding back to operating profit all non-cash items in the Profit and Loss Account before the operating profit value is struck. Additional items in this class include loss and trade provisions, unrealized gains and losses on foreign exchange and provisions in respect of acquisitions and reorganizations.

The second three items, the increase or decrease in stocks, debtors and creditors, gives us the movement in the investment in net working assets. Most businesses are constantly increasing their investment in stock and debtors to allow for the effects of inflation and growth in turnover of the business. This is usually partly offset by the increase in creditors each year, which arises for the same reasons.

So the cash generated from operations less the amount invested in net working assets every period gives us the Net cash inflow from operating activities.

2. Returns on investments and servicing of finance

The cash flow statement of XYZ Limited shows interest received and the interest and dividends paid.

Interest received is the cash earned from surplus cash. We would also find any dividends received from investments in this section, because these are earnings from investments. Where the business owns less than 50% of the shares and therefore does not enjoy control, it makes sense where these items are material to separate this cash flow item for analysis purposes. This is because the future flow of dividends from investments may be less certain than the business’s own core-operating cash flow.

Indeed we also need to separate interest and dividends paid in order to properly evaluate the performance of the business, because these payments are driven by quite different factors:

• The payment of interest is contractual and may vary significantly depending on the inflation and interest rate outlook for the business concerned and the amount of interest which is at fixed rather then at variable rates.

• The timing and amount of dividends paid by the business, in contrast, is at the discretion of the directors.

3. Taxation

This item is the amount paid in the financial period. In the United Kingdom this represents the tax due in respect of profits earned in the previous accounting period. In other countries the grace period for payment of taxes due varies from monthly on account to nine months after the year end, as it is in the United Kingdom.

Note that there is no reference to deferred tax in the cash flow statement. This is because any charge or release for deferred tax in the Profit and Loss Account tax charge is a movement in the deferred tax provision and is therefore a non-cash item. Non-cash items have no effect on the cash flow statement.

4. Investing activities

This is the section where we find the value of capital expenditure made during the period under examination. The term “capital expenditure” is often abbreviated to “capex”. Where it is netted off against any proceeds of disposal it is often known as “net capex”. Do not confuse the profit or loss on the sale of fixed assets (which actually represents an adjustment to the depreciation charge) with the proceeds of sale of fixed assets (which represents the cash received on the sale of fixed assets). A cash flow statement shows any proceeds of sale as a cash inflow in this section.

5. Net cash inflow before financing

This is the key cash flow figure. Items 1 to 4 above represent the cash generation and cash absorbed in reinvestment in the fixed and working assets of the business, paying taxes and compensating providers of finance. The cash flow generated (or cash flow absorbed) is what remains after carrying out these essential activities.

6. Financing

This final section shows how the cash surplus has been used (and, if it is cash absorbed, how it has been financed). The sum of the movements on equity, debt and cash when totalled should equal the net cash inflow/(outflow) before financing.

Presentations of the financing section vary. In this case the cash has been shown separately as the final figure. Sometimes all the movements are shown, with a total which equals the net cash inflow before financing.

The FRSl document or its international equivalent will therefore provide a useful template for us to examine and monitor the essential constituent cash flow dynamics of any business, whatever its size or sector.

Cash Flow and Business Cycles

We will begin our cash flow topic by restating from my first book Cash is King, a diagrammatic approach to the capital cycle. (See overleaf.)

See Capital Cycle diagram overleaf.

Cash can be seen, in the illustration opposite, as the central hub of the capital cycle. Cash is needed to continually finance the asset conversion cycle, to enable payments to the bank, to pay dividends to the shareholders, to pay taxes due, to purchase further fixed assets, and to undertake research and development, etc.

Cash flow is essentially uncertain and difficult to predict in that it is based to begin with on the projections of future operating income, and this is dependent on a number of important environmental factors, such as:

• The fundamental nature of the differing business sectors and the key risks to be managed within the sector both locally and globally.

• The current trends, both adverse and favourable, in the legal and regulatory environment surrounding the sector.

• The current competitive trends and changes within the sector

When we have considered the effects of these influences on a macro basis, we are then in an improved position to examine the more specific factors relating to the effect on the cash flows, such as the market position of the company and the business strategy that the management propose to follow.

Business Sector Fundamentals

A Corporate Manager in his assessment of corporate cash flow will inevitably, as part of the overall analysis, need to understand the company’s competitive position, its strategy, and its resultant business risk effect on cash flow needs.

Every company has a strategy, be it express or implied. Express strategy is normally well defined and the result of a structured planning process. Implied strategy on the other hand is the result of different business units pursuing different (and sometimes conflicting) strategies. The combined result is very often unclear and can cause severe cash flow distortions.

A good starting point in the assessment of corporate risk is to undertake a general review on how the corporate’s strategy has been formulated.

The Wheel of Competitive Strategy

The Wheel of Competitive Strategy is a device for expressing the main aspects of a corporate’s competitive strategy in summary format. The centre illustrates the corporate objectives and then goes on to state how the corporate is going to compete. The spokes of the wheel are operational factors by which the corporate intends to achieve the “centre” objectives. Within each spoke a summarized statement of intent is required. The designer of this wheel concept states that “for the corporate to progress effectively, not only must the policies radiate from the centre, but also each of the spokes must link smoothly together”.

The next step is ask what considerations are needed in formulating the centre statements for the wheel?

The most frequently used model is to undertake a SWOT analysis.

SWOT stands for Strengths, Weaknesses, Opportunities and Threats. In carrying out this type of assessment of strengths and weaknesses, we are undertaking an internal audit of the corporate and in evaluating opportunities and threats we are then carrying out an external review of the market place in which the corporate is currently operating.

Industry Identification

As part of this review of the company’s individual strategies the Manager must analyse in depth the industry within which the company operates to identify its particular characteristics, features and peculiar risk profiles. The industry structure has a strong influence in determining the competitive rules of the game - as well as the strategies potentially available to the corporate. Outside forces usually affect all corporates in the industry, and therefore another key is the corporate’s ability to deal with external factors. The intensity of competition within the industry is determined by industry economics as well as the strategies of current competitors.

A well-known model for looking at industry competition is Porter’s Five Forces Model, which is a framework for identifying the collective strength or weaknesses of the factors driving industry competition. The intensity of the forces then in turn drive the rates of return on capital employed. For example, in industries such as tyres, paper and steel there is high intensity of competition and therefore economics dictate a low return on capital employed. Examples of relatively mild intensity are oil field equipment, cosmetics and toiletries, which generate high returns.

Porters Five Forces Model

The five forces to be considered are the external aspects of the bargaining power of buyers, the bargaining power of suppliers, the threat of new entrants, the threat of substitute products or services, and the internal forces (consistin...