- 274 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Facilities Management and the Business of Space

About this book

Essential reading for building owners, facilities managers, architects and surveyors, this book will also prove useful on business management and facilities management courses, and for those studying architecture, surveying and real estate management.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Facilities Management and the Business of Space by Wes McGregor in PDF and/or ePUB format, as well as other popular books in Architecture & Architecture General. We have over one million books available in our catalogue for you to explore.

Information

Topic

ArchitectureSubtopic

Architecture General1

Introduction

‘Corporate real estate – the land and buildings owned by companies not primarily in the real estate business – is an aspect of corporate affairs largely ignored in boardrooms across the USA.’ So said Sally Zeckhauser and Robert Silverman, writing in the Harvard Business Review in 1981. A survey conducted by Zeckhauser and Silverman, president and vice president respectively of Harvard Real Estate Inc, who manage Harvard University’s properties, found that only 40% of American companies clearly and consistently evaluated the performance of their real estate, ‘most treated property as an overhead cost like stationery and paper clips.’

Almost two decades on, the acceptance by senior management of property assets (real estate) as a vital business resource is still by no means obvious. In many organizations the role of operational property is still considered to be no more than a cost to business, an overhead that does not warrant serious management considerations. This view persisted when the world economy was buoyant and business optimism was bright. The prolonged depression in world trade in the 1970s, and from the mid-1980s onwards, has brought about a renewed awareness in controlling the costs of doing business. For many large corporations, the revelation of the fact that after staff costs (salaries), the next highest category of costs are facilities-related, has reinforced the strategic importance of property (or real estate) as a business resource, and the need to manage the resource as effectively and efficiently as possible.

This new awareness has brought about a much needed management focus on measures to ensure the corporate real estate (CRE) portfolio is matched as closely as possible to operational requirements, and that asset occupancy costs are managed and controlled. The perceived role of real estate assets in business and their effective management is increasingly seen as a strategic dimension in business planning.

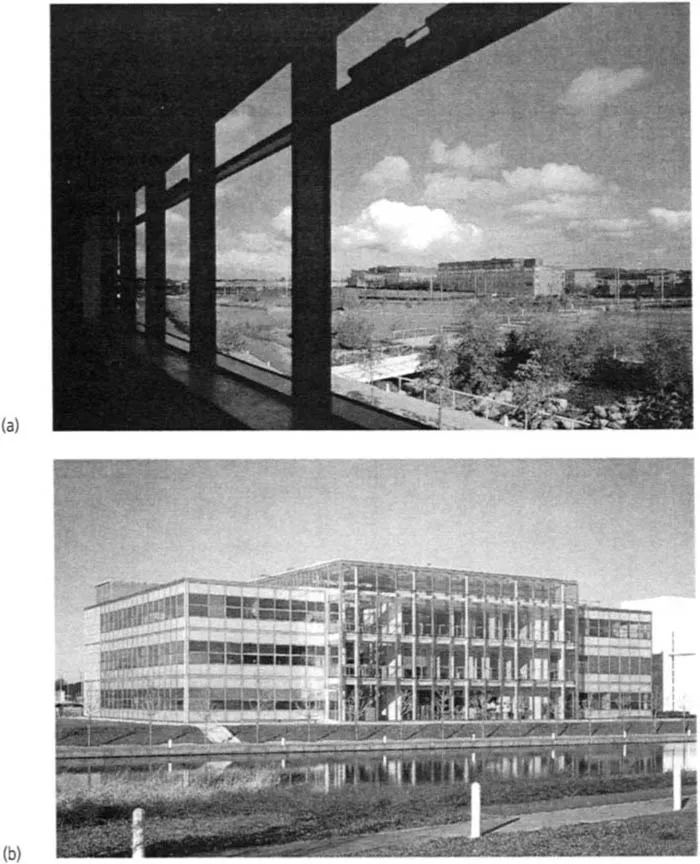

The desired outcome in any organization, from the perspective of business operations, is to maintain strategic relevance by attempting continuously to match the demand by business units for workspace, with the existing real estate portfolio (i.e. the supply) through the provision of appropriate enabling work environments that satisfy the needs of the people in the business and their work processes (Fig. 1.1).

Fig. 1.1 The business park has become a focus for investment in workspace: (a) Edinburgh Park, South Gyle, Edinburgh; (b) John Menzies plc, Wholesale Division Headquarters, Edinburgh Park, South Gyle, Edinburgh.

The pace of change brought on by intense global competition and rapid technological developments has in recent years meant that the past assumptions of stability and steady growth are no longer true. These changes have particular significance for the ongoing management of operational property, and premises occupancy costs. A key feature within any organization is the ability to respond to shifts in the strategic direction of the business and, while so doing, control the likely impact upon the existing real estate portfolio, in terms of the amount of space, i.e. the scale of the assets, as well as the financial consequences of its ownership and occupation. Essential prerequisites for this to be achieved are appropriate strategies for both facilities and support services that are continuously aligned with the strategic intentions of the business. This book is an attempt to provide routes to possible solutions, through consideration of conceptual models and the application of practical processes. The aim is to clarify the crucial role played by operational buildings – what we call workspace – in supporting the fulfilment of business objectives, which is achieved through the prudent management of their provision and servicing – the business of space.

1.1 Buildings and the business of space

During the period up to the mid-1970s, work buildings were seen very much as a necessary, but relatively ‘static’ factor of production, required to accommodate the production processes of business. Expenditure on these buildings was generally regarded as a ‘sunk’ business cost that could not be avoided. The prevailing view at that time was that the costs associated with building occupancy were part of the business production process and were therefore necessary business expenses. The level of management associated with controlling this group of facilities-related costs was not regarded as sufficiently demanding nor sophisticated enough to necessitate specialist skills or the attention of the business’s senior executives.

The oil crisis of the mid-1970s had the immediate impact of raising awareness of the need to manage the costs of occupancy, particularly those relating to energy. The focus on monitoring energy consumption in occupied buildings had the effect of bringing the ‘space’ dimension of business premises to the fore. Up till then, the capital costs of building construction had been the major concern in any evaluation of building investments. The energy crisis, therefore, can be said to be largely responsible for creating a climate in which the general focus amongst building owners, business managers and occupiers, was of the need to consider the economics of occupancy in terms of the elements of recurring costs associated with sustaining the operation of business premises, such as energy, repairs and maintenance.

The boom and bust cycle of the property market in the 1970s and mid-1980s caught many companies off-guard. The combination of over-commitments in long-term leases made at a time of optimistic expectations for high growth, followed by a prolonged period of general economic recession and stagnation, resulted in a situation of surplus capacity in real estate provision for many organizations. For many large corporations, the coincidence of a fall in revenue with a consistent rising trend in occupancy costs, resulted in a dramatic shift in the focus of senior management in their efforts to contain business operating costs – getting rid of space surplus to current requirements.

The rapid pace of technological development, particularly in information technology, has, and continues to have, a considerable impact on the design and subsequent use of buildings. Far from being regarded as a necessary evil, as had been thought by many, for an increasing number of organizations there is a growing acceptance that buildings (being operational assets) must now be managed as a valuable business resource, just like people and technology. Further, there is a growing consensus that investment decisions associated with the provision and subsequent management of operational assets, must consider the interplay between:

• Property – the physical resource.

• Technology – the supporting infrastructure in terms of essential building services, as well as the technology that directly supports work processes.

• People – the users of the facilities and services, in the conduct of their value-adding activities.

This acknowledgement of operational property as a business resource has resulted in a growing appreciation of the need to manage the business’s operational asset base over time.

The 1980s and 1990s have also seen an enormous growth of service industries. One of the ramifications of this growth, the development of a service culture, has had a direct impact on the property management industry, through the emergence of facilities management as a professional discipline, in North America initially, then in the UK and Europe, and most recently in Australia and the Pacific Rim. As part of an emerging service industry, the facilities management market has grown considerably within the property services sector, which by 1991 was estimated to be worth £16 billion per annum (Centre for Facilities Management, UK FM Survey), providing facilities-related support services and management expertise to organizations with large operational real estate portfolios. The growing trend of contracting out (or outsourcing) of non-core support services, far from diminishing the role of management of the organization’s real estate asset base, has reinforced the strategic importance of aligning the physical operational asset base to the organization’s business plans.

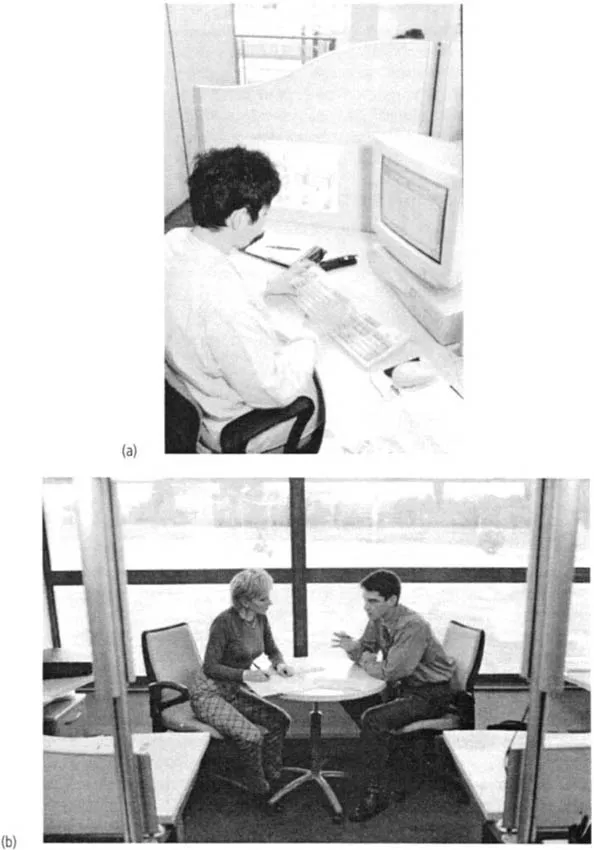

At the same time, there is also a growing acceptance that the workplace environment is becoming a crucial component in the drive to improve productivity of the organization’s most expensive resource – its employees. Together with information technology, the management of the operational asset base is increasingly regarded as an important leverage in the strategic management of the workplace environment, aimed at improving overall organizational effectiveness (see Fig. 1.2).

Fig. 1.2 (a) and (b) The importance of the work environment on business effectiveness and hence profitability, is gradually being recognized.

It is within the context of the above developments and their implications for the management of business operations, that the focus of attention is increasingly being aimed at seeking solutions to one key question: how do organizations manage their inherently fixed, operational real estate asset base in a business environment that is increasingly competitive and constantly changing?

In seeking appropriate facilities solutions to business challenges it is important to understand clearly the nature of the product we are dealing with. In terms of buildings as an operational resource, the unit of measure and hence the language of discussion, is the functional space or workspace. It is the variables that define the mix of workspace requirements, which must be aligned with the outputs of the business, whether they are tangible products or intangible services. It is in this context that the language of ‘the business of space’ must be defined, and that the space itself is assessed, procured, serviced and disposed of, as a supporting resource of business.

1.2 Linking real estate and facilities decisions to business strategy

The significance of the strategic role of real estate assets to corporate performance, can be seen in the influential research report by The Industrial Development Research Foundation (Joroff et al., 1993), where corporate real estate assets are termed as the fifth resource, after the traditional resources of people, technology, information and capital.

There is clear evidence (Zeckhauser and Silverman, 1981; Veale, 1989; Gale and Case, 1989; Avis et al., 1989; Arthur Andersen, 1993) that supports the view that an assured strategic direction is needed from senior business managers, in their consideration of the management of corporate real estate (i.e. the land and buildings used for workspace, infrastructure and investment) as an integral part of business resource management. This view was aptly expressed in the Corporate Real Estate 2000 Report (Joroff et al., 1993, p.7) which called for a rethinking in the way this resource is managed:

In the past, corporate management often did not consider the corporate real estate function to be as important as the four corporate resources of capital, people, technology and information. Senior managers had not learned to ask how the function could create value for the company and help to meet the overall corporate mission. Today that goal is being pursued aggressively. Senior managers now are beginning to recognise that real estate is a critical strategic asset, one that supports the financial, work environment and operational needs of the total corporation.

The reference to ‘financial, work environment and operational needs’ as an integrated task of resource management to provide for the ‘total corporation’ is significant. It acknowledges that land, buildings and the work environment are essential parts of every corporation’s strategic planning, and must therefore be managed accordingly, to ensure that the financial and operational goals of the company are met.

There are many examples where the strategic dimensions of real estate decisions are being demonstrated through the actions taken by real estate or facilities managers in order to add value to the organization, improve economic performance at a time of frequent corporate restructuring, and in so doing, strengthen the company’s compe...

Table of contents

- Cover Page

- Half Title Page

- Title Page

- Copyright Page

- Table of Contents

- Preface

- Acknowledgements

- Glossary of terms

- Acronyms and abbreviations

- List of figures

- List of tables

- 1. Introduction

- 2. The context of space planning

- 3. The space planning process

- 4. Assessing demand – the organization's needs

- 5. Assessing supply – the premises audit

- 6. Matching demand and supply – the outcome

- 7. Managing space demand over time

- 8. The future of workspace management

- Bibliography

- Index