- 272 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

About this book

Due to the countless variables that affect revenue and cost, the hospital reimbursement process is by far the most complex of any industry. Requiring only a basic financial background and a working knowledge of accounting, Hospital Reimbursement: Concepts and Principles supplies a clear understanding of the concepts and principles that drive the re

Tools to learn more effectively

Saving Books

Keyword Search

Annotating Text

Listen to it instead

Information

Chapter 1

Fundamentals of Accounting

Introduction

Before any discussion of hospital reimbursement can be given, a broad overview of the fiscal concepts that drive the accounting field needs to be addressed. The accounting profession has been in existence for hundreds of years, and there are numerous services an accountant can perform. These services range from those that are limited in scope to ones that are highly analytical. The rules and guidelines that accountants follow are formulated by regulatory bodies that have a responsibility to the public interest. Healthcare accountants are responsible not only for formulating the annual budget but also for creating financial statements. In addition, accountants who work within hospital systems are responsible for providing financial advice and direction when clinical initiatives are researched and developed.

Often referred to as the “language of business,” the accounting field is a vast composition of subject matter that spans numerous industries. A majority of colleges and universities have some type of accounting program that prepares students to take either the certified management accountant (CMA) or certified public accountant (CPA) exam. The undergraduate curriculum begins with understanding the debit and credits that formulate the financial statements and advances into intermediate courses that detail the principles of taxation and auditing. The accounting field is historically separated into either financial or managerial accounting; financial accounting is the preparation of financial statements for external decision makers, while managerial accounting is designed to assist internal users within an organization. Historically, accountants have been categorized as either “tax” or “audit”; however, this classification has evolved due to the increased responsibilities of accountants and the expansion of the certification exams. An accounting professional need not obtain either a CMA or CPA to work in healthcare, but certification could increase compensation.

Many accountants find it difficult to describe their profession to those without financial experience because of the technical nature of the accounting field. It can be a challenge to describe the purpose of an audit or the significance of financial reporting. A broad definition is that accounting is creating structure where there was once disorder so a decision can be made. The disorder can be the various amounts of revenue and expense figures that need to be classified and analyzed. The structure is the numerous financial reports and statements that are formulated, while management represents the decision-making body.

History and Framework

The history of double-entry accounting can be traced to the 15th century; a Franciscan friar named Luca Pacioli published his theory of debit and credit rules in a mathematics text. Pacioli is often called the “father of accounting” because his research detailed the use of journals, ledgers, and a correlating trial balance. The theories and mathematical proofs that Pacioli created have been modified over the years, but the same accounting principles exist today. The basic accounting equation that “assets equal liabilities plus equity” is still in practice.

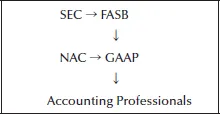

The Financial Accounting Standards Board (FASB) is the highest authority in establishing accounting standards and principles. It is a nongovernmental organization that develops and interprets accounting standards, and the SEC (Securities and Exchange Commission) has delegated this authority to the FASB. There are currently seven full-time FASB members, and they each serve five-year terms. Accountants adhere to generally accepted accounting principles (GAAP) developed and interpreted by the FASB. These GAAP regulations are used to prepare, present, and report financial statements for numerous entities, including not-for-profit organizations. In 2009, the FASB created a Not-for-Profit Advisory Committee (NAC) to obtain input from the various not-for-profit entities regarding how GAAP affects their job duties and financial reporting. This committee also assists the FASB in communicating these matters to the appropriate not-for-profit businesses. The NAC has developed three working groups whose purpose is to develop initiatives and recommendations that can improve the fiscal accountability of not-for-profit operations. The rules and regulations formulated by this committee will most likely have a significant impact on healthcare accounting. Table 1.1 lists the hierarchy of accounting standard setting (1).

Other countries do not have to adhere to either GAAP or FASB regulations because they have their own internally created standards. An increasing trend within the accounting profession is how to handle accounting issues with the increase of globalization.

The rules and regulations that are contained within GAAP are guided by specific assumptions, principles, and constraints. Unfortunately, it is not feasible to describe all the rules of double-entry accounting; however, an underlying conceptual framework can be discussed. The four primary assumptions of accounting are economic entity, going concern, monetary unit, and periodicity. The economic entity assumption states that the affairs of the officers and managers are separate from those of an entity such as a hospital. The going-concern assumption states that unless otherwise stated each business will continue operating indefinitely, which means that the liquidation values of assets is not important. The monetary unit assumption states that accounting records are best examined when they are reported in terms of money. The final assumption is periodicity, which states that financial information is best reviewed on a periodic basis, such as monthly or quarterly.

Table 1.1 Hierarchy of Accounting Standard Setting

In addition to assumptions, there are several principles that are referenced when reporting financial information. The revenue recognition principle determines when sales or gains should be recorded in financial statements. Revenues are recorded when they are realized, realizable, or earned. Realized means that cash has been given, while realizable translates to a receivable being created. Earned occurs when the goods or services have been rendered, which is usually at the time of delivery or sale. The matching principle is a second principle that requires a company to match expenses with related revenues to report a company’s profitability during a specified time interval (2). This principle is a critical aspect of accounting because it symbolizes the cause and effect of revenue and expenses. Basically, the expenses that are incurred in one time period must correlate with the revenue that is formulated within that same time period. In other words, the expenses recorded in March must be from the sales made in March. This principle is associated with the periodicity assumption.

Constraints are used within accounting to limit the process of recognition in financial statements. Two constraints that are used in all industries would be the cost-benefit and materiality constraints. The cost-benefit restraint of accounting basically states that the cost of any project or initiative should not exceed its benefits. Materiality is another constraint that is consistently used in accounting, and the basic premise is that something is material if its omission or misstatement could influence a decision maker. The concept of materiality is often used as a threshold within variance analysis and auditing.

Accounting Services

Accountants have historically performed four types of services or engagements, classified as compilations, reviews, agreed-upon procedures, or audits.

1. Compilation: Formulation and presentation of financial data without assurance

2. Review: A service that provides some assurance about the reliability of financial data

3. Agreed-upon procedure: An engagement to report on the procedures and findings relating to financial data

4. Audit: An examination of accounting records to formulate an opinion

Compilations and reviews are usually not completed within a hospital setting since most facilities employ their own accounting departments. Agreed-upon procedures are occasionally completed when compliance issues are in question; however, audit engagements are commonly used in the healthcare industry. A significant aspect of accounting services is understanding the difference between an attestation and an assurance service. An attestation engagement is a process in which an accountant reports on subject matter that is the responsibility of another party. The objective of attestation services is to create reliable information. In contrast, assurance services aim to improve the quality of information for decision makers. Auditing is a type of assurance service used by healthcare facilities to ascertain the validity and reliability of information. Assurance services are broader in scope than attestation services, and they focus on providing information rather than advice. Assurance engagements are also independent services that can be of a nonfinancial mature.

Auditing

Audits are used extensively throughout hospital reimbursement in that both Medicare and Medicaid will often employ the contract services of an audit firm to ensure that what a hospital is reporting is valid. Auditing is a type of accounting service that is performed to determine the credibility of data, whether financial or nonfinancial. The goal of an audit is to express an opinion on the subject matter in question. The audit does not guarantee that the information is free from mistakes but rather provides reasonable assurance that the statements are free from material error. Audit reports can be classified as qualified, unqualified, adverse, or a disclaimer of opinion (Table 1.2).

Some larger healthcare organizations employ both internal and external auditors to review both financial and nonfinancial subject matter. In comparison, the internal auditor’s work is usually more detailed than the external auditor’s work. The external auditor’s primary purpose is to express an opinion on the fairness of the statements; the internal auditor attempts to improve the effectiveness and efficiency of the hospital’s operations.

CRITICAL ISSUE

Audits do not guarantee that data are free from all errors. An audit is designed to provide reasonable assurance that the information is free from material error.

Another aspect of auditing is to provide an assessment of a hospital’s internal control mechanisms. Internal control is the process designed to ensure reliable financial reporting and compliance with applicable laws and regulations. Safeguarding assets against theft and unauthorized use of equipment also falls within internal control. A hospital can achieve effective internal control through the proper segregation of job duties. The three principle job responsibilities that must be segregated are authorization, recording, and custody. These functions must be performed independently by separate hospital personnel, or an internal control weakness might exist. An example would be that only human resources should have access to changing pay rates, while the t...

Table of contents

- Cover

- Title Page

- Copyright

- Dedication

- Contents

- Preface

- About the Author

- 1: Fundamentals of Accounting

- 2: Types of Hospitals/Conceptual Framework

- 3: Hospital Revenue Cycle

- 4: Hospital Services

- 5: Medicare

- 6: Medicaid

- 7: Other Insurance Providers

- 8: Governmental Cost Reporting

- 9: Statement of Operations (Income Statement)

- 10: Statement of Financial Position (Balance Sheet)

- 11: Coding

- 12: Managing the Month-End Close Process

- 13: Calculating the Financial Impact of Hospital Length of Stay

- 14: The Future of Healthcare Accounting

- 15: Epilogue

- Appendix A

- Appendix B

- Index

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn how to download books offline

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 990+ topics, we’ve got you covered! Learn about our mission

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more about Read Aloud

Yes! You can use the Perlego app on both iOS and Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app

Yes, you can access Hospital Reimbursement by Kyle Herbert in PDF and/or ePUB format, as well as other popular books in Business & Management. We have over one million books available in our catalogue for you to explore.