![]()

1

Overview

Since the 1960s, natural gas use in many countries has become an important part of economic life, and today it provides between 20 and 25 per cent of the world’s primary energy demand. Yet despite the contemporary importance of natural gas for maintaining a good quality of life for many people, as well as providing a substantial export income for many countries, it should be remembered that the industry did not exist in many countries until comparatively recently. Excluding countries like Canada and the United States, both of which experienced substantial growth of the industry prior to World War II, the development of natural gas is a relatively recent occurrence in many places. This is because the establishment of the industry involves a considerable effort on the part of mining and petroleum companies to first locate the natural gas reserves, in either offshore reserves or in particularly isolated and inhospitable parts of the world, to extract and treat it, and then undertake substantial additional investments in transmission pipelines, which are needed to deliver the gas to urban centers. This has meant that despite knowledge of natural gas being common in many places, the development of it as a viable fuel source has often been delayed.

Once natural gas has been extracted, treated and transported to urban centers it is then delivered to end-users through low pressure, distribution pipes, which in many cases were originally constructed in the nineteenth century to deliver manufactured gas (also known as town or coal gas). Government intervention was extensive in this process, whether in assisting with exploration and the construction and operation of pipelines, or as an industry regulator. Gradually the nature of this intervention changed and during the 1980s, 1990s and 2000s there was a substantial shift in the manner in which many governments around the world approached intervention in the industry.

The natural gas industry is a network industry (similar to electricity and telecommunications). The fundamental characteristics of network industries are the presence of the network infrastructure – the pipelines in the gas industry (wires in telecommunications and electricity). This infrastructure is the essential link in the chain of activities that make up the gas industry, which is also linked to the natural resources sector of the industry, which possesses the resource characteristic of scarcity. In addition, gas as a commodity has two major dimensions: quality and time. Network industries like the gas industry are the subject of significant economies of scale, due to the high level of fixed costs and the low marginal costs of extending the network to additional customers. These investments are mainly sunk costs – that is, these costs cannot be recovered, which often makes it uneconomic to duplicate facilities (i.e. the size of the market is often too small to enable competing networks to operate on an efficient scale).

This is in contrast with most of the other network industries, with natural gas also being a natural resources industry, like oil or coal, which exploits non-renewable natural resources. This means that in the industry, resource scarcity exists, which in turn relates to the opportunity costs of exploiting natural resources. That is, the current production of natural gas limits future production, the foregone benefits of future production is a cost of current production.

The creation of resource rents has a significant influence on the production decisions of natural gas producers (i.e. the higher the opportunity costs of using a resource, the more suppliers will conserve for future use). In addition to influencing production decisions, the creation of resource rents can also give rise to the issue of rent allocation. That is, the value of the products produced by a natural resources industry, such as natural gas, is only partly influenced by the direct costs involved in exploration, extraction and treatment – instead, it mainly derives from the product’s scarcity. Natural resource rents arise from the specific characteristics of gas fields, such as geology, field size and economies of scale and location. These specific characteristics often mean that there are vastly different underlying costs across different gas reserves. Rent accrues as the difference between the costs of intra-marginal production and selling costs, and is normally accrued to the resource owner, most often (outside of the United States) to the government. In practice, much of the history of gas and oil markets has involved disputes over the claiming of rents, which can be captured in a variety of ways. Government and regulators have therefore often played an important role in the pricing of gas. One additional response of governments has been the use of government-owned companies to organize the supply, distribution and pricing of gas. Even without state ownership, private companies have been subjected to an array of regulated resource pricing and taxation arrangements. Typically where governments own the resource, they wish to capture some of the resource rents of extraction. However if the company is privately owned, this might involve some principal agent problem further complicating the challenge to governments of capturing resource rents (Bindemann 1999).

In terms of time and quality, end-users of gas do not usually store gas on their premises (except where they make use of bottled gas), but take it from a distribution network company when they require it. Since the pipeline grids can only operate safely if the pressure remains within a certain bandwidth, this implies gas injections into the distribution grids should more or less follow the consumption patterns of end-users. The natural gas market therefore has a temporal dimension to it, which means that demand for gas on different days, or even times of the day, may not be similarly priced. Gas quality is also important to end-users in that in its natural state it has a varied quality, which means that it must be treated to make it of use to consumers.

Apart from transporting gas, an operator of a gas pipeline grid must be able to guarantee supply integrity. The operator of the grid is responsible for ensuring that both the gas pressure and quality is of a required standard. In practice, this is ensured by assigning a short-term balancing responsibility to the operator, which may then reserve part of the available line-pack capacity (i.e. the storage capacity of the pipeline network) to balance supply and demand in the short term.

Due to the network characteristics of the transportation segment of the natural gas industry, the various players in the industry are interrelated in ways that do not exist in other natural resources industries like oil and coal. The combination of relevant resource and network economics means that the industry is unique, which makes it of particular interest to economists. Historically, it has also meant that there has been considerable government intervention in the industry; although the more recent changes in relation to government involvement have often led to a substantial restructuring of the industry. Such restructuring includes the lowering of barriers to entry protecting public sector gas utilities, the breaking up and privatization of public sector gas utilities, and the concentration of pricing regulations on the transportation functions of the transmission and distribution segments of the industry (ABARE/Asia-Pacific Economic Cooperation Energy Working Group 2002; International Energy Agency 2000; NaturalGas 2015; Tussing and Tippee 1995). The basic aim of this restructuring process has been to increase competition in the industry and promote private investment, which, it is hoped by policy reformers, will improve efficiency and reduce the prices of natural gas.

In addition to the vertical separation and privatization of government-owned assets, such reform has also involved the creation of formal price regulatory regimes, designed to set the price of gas distribution services, and to open access and pricing regimes imposed on transmission pricing. A similar process has occurred in many other utility industries around the world, such as railways, electricity supply and telecommunications. However in the case of reform, the natural gas industry has been characterized as having more private ownership in many countries before reform than other industries like electricity, and less vertical integration, mainly because of the different origins of the various components of the industry.

The purpose of this study is to examine the economics of the natural gas industry over the longer term, to provide a better understanding of the impact of this industry in modern economic life and the changes that have occurred to it. This study will review the nature of the industry both before and after the successful development of the natural gas reserves. In particular the industry’s structure has been influenced by long-term developments, which is why it is appropriate to examine the nature of the industry over the longer term. Government regulation of the industry always had a very strong presence for a variety of reasons, which will also be explored. The study has used a range of examples from different countries to illustrate the various aspects of the economics of the natural gas industry. However, despite the attempt to incorporate as many global examples of natural gas development as possible, it has used potentially a disproportionate number of examples from Australia in terms of the history of the industry, and from East and South-East Asia in relation to contemporary trade in natural gas. The reason for this is two-fold, as discussed below.

First, the Australian natural gas industry historically displays many of the typical characteristics of the gas industry across the globe. Over the years it has evolved from being a largely localized, manufactured gas industry, to one of exploration and development of natural gas reserves, construction of a national gas transmission grid, and then establishment as a substantial exporter of gas. Likewise, the more recent developments of the natural gas industry in East and South-East Asia display many of the common characteristics of contemporary global developments. Second, quite simply, the author of this study mainly has a background working in the Australian and South-East Asian natural gas industries, and so is more comfortable with using examples of this origin. Although other examples have also been drawn from Europe and North America, especially where they are more relevant to broader changes in the industry internationally.

References

ABARE/Asia-Pacific Economic Cooperation Energy Working Group 2002, Deregulating Energy Markets in APEC: Economic and Sectoral Impacts, APEC Secretariat: Canberra.

Bindemann, K 1999, Production-Sharing Agreements: An Economic Analys is, WPM25, June, Oxford Institute for Energy Studies: Oxford.

International Energy Agency 2000, Regulatory Reform: European Gas, IEA: Paris.

NaturalGas 2015, viewed 28 September 2015, <www.naturalgas.org>.

Tussing, A and Tippee, B (eds) 1995, The Natural Gas Industry: Evolution, Structure and Economics, 2nd edn, Pennwell Books: Tulsa, OK.

![]()

2

The economics of the industry

Natural gas

To be able to study the characteristics of the gas industry, it is necessary to understand a bit about the physical characteristics of natural gas, such as why it is important to modern economies and what special features it has that makes it different from other commodities. Because natural gas and oil are normally found in close proximity to each other, trapped in the earth’s crust, the two industries have a close association at the extraction stage. Natural gas, crude oil and a number of other substances are all known jointly as petroleum, which is the general term used to denote hydrocarbons that are found in the earth’s crust. Crude oil is found in pools – or so - called reservoirs – in the earth’s crust, made up of naturally occurring deposits containing substantial amounts of hydrocarbons that are liquid at certain atmospheric pressures and temperatures. In contrast, natural gas reservoirs are deposits containing hydrocarbons that are gaseous under the same conditions. The close proximity of the two means that in most countries, much of the exploration and development of natural gas reserves has been undertaken by oil companies. The two industries only become genuinely separate after both substances have been extracted from the ground and then sent either via long-distance transmission pipelines or transported in ships or tanker trucks (NaturalGas 2015a).

Natural gas is a fossil fuel and is created from the remains of plants and animals that lived millions of years ago. Layers of rock, sand and ice cover these remains, and over time heat and pressure eventually change them into fossils, with various gaseous and liquid substances created in the process. Natural gas becomes trapped in pockets under the layers of rock in sedimentary basins, both onshore and offshore. In order to extract the natural gas from these pockets, earth wells are drilled deep into the ground. As there is a finite amount of natural gas trapped in the ground, natural gas (as well as oil and coal) is often described as a non-renewable resource, as it cannot be replenished within a foreseeable timeframe.

Natural gas is made up of a mixture of hydrocarbons; the main one being methane, which is a substance that is comprised of one atom of carbon and four of hydrogen (CH4). Hydrocarbon compounds vary in molecular size and configuration, but every hydrocarbon compound can exist as a liquid, solid or gas, depending on the surrounding pressure and temperature. Before natural gas can be sold to end-users the raw gas extracted needs to be processed to remove any liquid hydrocarbons and poisonous impurities such as hydrogen, sulphide, water and carbon dioxide. The residue gas is a mixture of methane, plus heavier hydrocarbon gases such as ethane (C2 H6) and propane (C3 H8), with inert gases such as nitrogen. For instance, in Melbourne, Australia, in 2015 the natural gas supplied to that city consisted of 90.1 per cent methane, 5.8 per cent ethane, 1.9 per cent carbon dioxide, 1.1 per cent propane and 0.2 per cent nitrogen and oxygen (Energy Supply Association of Australia 2015).

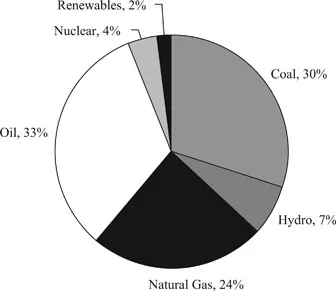

Figure 2.1 Composition of primary energy consumption by fuel type (world, 2014), percentage

Table 2.1 Primary energy consumption by fuel type (various countries, 2014), percentage

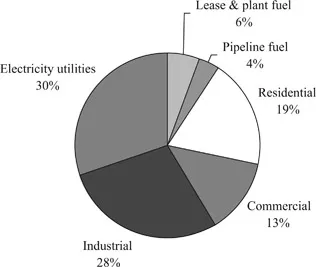

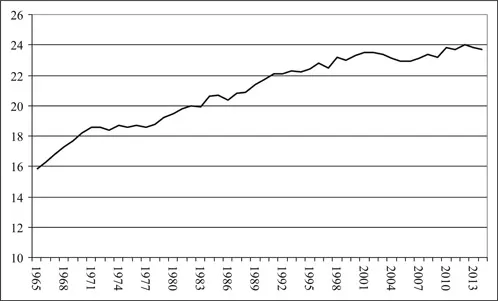

During the second half of the twentieth century, natural gas became an increasingly popular fuel in many countries, and today provides approximately one-quarter of the world’s primary energy consumption (see Figure 2.1). However, this level of consumption is not universal across all countries, as can be seen in Table 2.1 below. For instance, it is a more of a primary energy source in the United States and Europe than in countries like India and China. That said, its consumption is rising in nearly all countries around the world; overall since the mid-1960s, world consumption of natural gas has risen from around 600 billion cubic meters (Bcm) to around 3,000 Bcm (see Figure 2.3), with its usage growing from

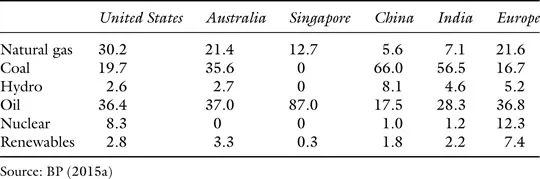

Figure 2.2 Composition of natural gas consumption by end-user (United States, 2014), percentage

Figure 2.3 Natural gas production (world, 1965 to 2014), million tonnes of oil equivalent

around 15 per cent as a proportion of all energy use to around 25 per cent in 2014 (see Figure 2.4). In recent years, growth in demand for natural gas has been driven by global economic factors such as the significant escalation of energy needs within large developing economies such as China and India.

Figure 2.4 Natural gas share of total energy use (world, 1965 to 2014), percentage

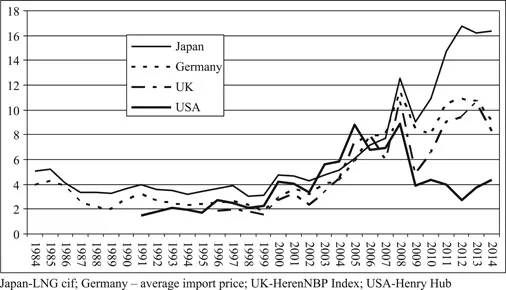

Figure 2.5 Prices of natural gas (various countries, 1984 to 2014), $US per million Btu

The general rising prices of energy has meant that the price of natural gas has also often increased, as evidenced by the rise in gas prices in the United Kingdom, Japan and Germany (see Figure 2.5). The United States is an exception to this trend, where gas prices have been falling since 2008, partly because of the lower growth of the United States economy since the global financial crisis (GFC) (and subsequently lower demand growth for gas), and also because of the growth in production and proved reserves of shale gas in that country.

While growth of demand for natural gas has been affected by the availability of reserves, it is has also been influenced by other factors such as the building of infrastructure and gas prices, and the price of substitute products. Natural gas is only one of a number of potential sources of energy. During the twentieth century, developed societies mainly relied on fossil fuels for energy such as oil, coal and natural gas, along with other sources such as nuclear, geo-thermal and hydro energy; and in more recent years, renewable sources of energy such as solar, wind a...