eBook - ePub

The Pure Theory of International Trade and Distortions (Routledge Revivals)

- 206 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

The Pure Theory of International Trade and Distortions (Routledge Revivals)

About this book

First published in 1978. This book provides a simple, systematic, yet rigorous treatment of the key aspects of the pure theory of international trade and distortions. The opening chapter presents the standard two-factor, two-commodity barter model of international trade and a comprehensive treatment of the important properties and relationships. The rest of the book consists of four sections: parts One and Two are devoted to an analysis of factor market imperfections, and Parts Three and Four consider the trade-theoretical consequences of product market imperfections. A concluding chapter presents some generalised theorems. This book would be of interest to students of economics.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access The Pure Theory of International Trade and Distortions (Routledge Revivals) by Bharat Hazari in PDF and/or ePUB format, as well as other popular books in Business & Business General. We have over one million books available in our catalogue for you to explore.

Information

1 | A MODEL OF A TRADING WORLD |

This chapter presents the standard two-commodity, two-factor barter model of international trade that will be used throughout the present book.1 In this part we shall be mainly engaged in the construction of a formal model of a trading economy and discussing its relatively more important properties. Since the pure theory of international trade makes heavy use of several concepts of micro-economics, a brief treatment of the more frequently used micro-economics concepts is also provided. The closed economy model can easily be derived as a subset of the open economy model presented in this chapter.2

1.1 The Formal Model

We consider a country which produces two commodities, X1 and X2. The utility function for the country as a whole is given by:

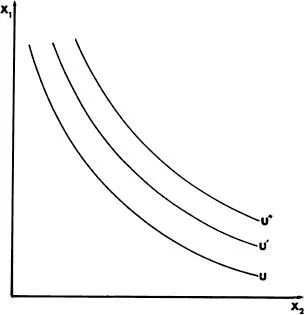

where U indicates utility and D1 and D2 the domestic consumption of commodities X1 and X2. The utility function is assumed to be strictly concave. The social indifference curves associated with the utility function equation (1.1) are presented in Figure 1.1. These curves are assumed to be convex to the origin and non-intersecting.

At this point it is important to remind the reader that the assumption of the existence of a well behaved aggregate utility function is indeed a strong one. This is so because of the problems associated in going from individual indifference maps to social indifference maps. Undoubtedly, under a set of very restrictive assumptions this can be done. For example, if all individuals have identical tastes and endowments, then the aggregation of individual indifference curves generates social indifference curves which possess the same properties as the individual indifference curves. The assumption of identical tastes need not be regarded as outrageous, since the aggregation is performed over the set of individuals that belong to a particular nation, and hence involves cultural similarities. However, there is no denying the fact that the assumption of identical endowment for each consumer is indeed a very strong one.

Given the rather stringent assumptions under which an aggregate utility function can be generated, one may legitimately ask the question, why use a utility function at all? If one’s interest is only in positive economics (more specifically positive propositions in trade theory), then one need not use a utility function that possesses both behavioural and welfare significance. However, if one is interested in making welfare judgements about society as a whole, one immediately needs a well behaved utility function. If the economist is interested in comparing the welfare effects of a lower tariff with a higher tariff, then a utility function is needed. Economists do like making policy judgements and policy recommendations, and hence, in spite of difficulties associated with the aggregate utility function, this concept is used very widely. In the present book an aggregate utility function will be used to establish normative results.

Figure 1.1

Given utility maximisation, the following condition can be easily derived:

where Ui = ∂U/∂Di (i = 1, 2). This condition states that in equilibrium the marginal rate of substitution in consumption equals the ratio of commodity prices. This condition is the national counterpart of the condition of individual maximisation in the theory of consumer behaviour.

It is assumed that part of X1 is exported and part of X2 is imported, so that:

where Xi (i = 1,2) indicates the level of output, E1 represents the exports of commodity X1 and M2 represent the imports of commodity X2. In a closed economy model the import–export terms equal zero. In economic terms this implies that all markets must clear locally. However, in an open model local excess supply or demand can be met in the international markets.

The balance of payments equilibrium requires that the following condition always be satisfied:

where p = p2/p1, i.e. the relative price of commodity 2 in terms of commodity 1. This condition states that in equilibrium the value of exports must equal the value of imports.3

We now specify the production functions. The ith production relationship is written as:

where Ki denotes the amount of capital employed in the ith industry and Li the amount of labour employed in the ith industry.4 Note that we have assumed absence of externalities in specifying (1.6).

Both the factors of production are assumed to be indispensable in the production process in the following sense:

The economic meaning of the above restriction is that both factors must be used in positive quantity to obtain a positive output.

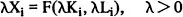

We also assume that Fi is homogeneous of degree one in Ki and Li, which implies that if both factors are changed in the same proportion, output also changes by the same proportion. The assumption can be stated mathematically in the following way:

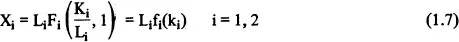

Given the assumption of homogeneity, it follows that the average product of labour depends only on the capital–labour ratio, ki = Ki/Li. Moreover, the production function can be written in its intensive form, i.e. output can be expressed as the product of a scale factor (Li) and a function fi of the capital-labour ratio ki:

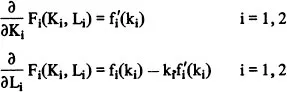

The marginal products of capital and labour in terms of the ith commodity respectively are given below:

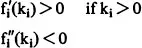

Note that all marginal products depend on the capital–labour ratio. All marginal products are assumed to be positive but diminishing, hence:

It will be assumed further that:...

Table of contents

- Cover

- Half Title

- Title Page

- Copyright Page

- Original Copyright Page

- Dedication

- Table of Contents

- Acknowledgements

- Introduction

- 1. A Model of a Trading World

- Part One: The Theory of Factor Price Differentials and the Pure Theory of International Trade

- Part Two: Minimum Wage Rates and the Pure Theory of International Trade

- Part Three: Externalities and the Pure Theory of International Trade

- Part Four: Tariffs, Illegal Trade and Immiserising Growth

- Appendix: The Derivation of the Offer Curve and Stability Conditions

- Index