![]()

The Indian insurance industry and climate change: exposure, opportunities and strategies ahead

Ulka Kelkar1*, Catherine Rose James2, Ritu Kumar3

1The Energy and Resources Institute, 4th Main, Domlur 2nd Stage, Bangalore 560071, India

2The Energy and Resources Institute, Habitat Place, Lodhi Road, New Delhi 110003, India

3The Energy and Resources Institute-UK, 27 Albert Grove, Wimbledon, London SW20 8PZ, UK

Abstract

What is the preparedness of the Indian insurance industry to deal with the growing frequency and severity of natural disasters? We examine this question and argue that the continuation of present practices is not sufficient to address the challenges posed by climate change. The potential impact of climate change on the Indian economy can be severe, given the country’s history of disaster losses, which is compounded by growth in population concentrations and burgeoning development in coastal and flood-prone areas. Targeted strategies are needed to deal with the rising costs of claims caused by climate change in a fledging Indian insurance market. The key challenges are to improve penetration of the available insurance products and to develop innovative delivery mechanisms to improve the access of the most vulnerable communities. Insurance is only a part of the solution, and must be combined with other measures that foster genuine preparedness and adaptation.

Keywords: Insurance; Climate change; India

1. Introduction

1.1. Climate change and India

India, with its large and growing population, densely populated and low-lying coastline, and an economy that has been closely tied to its natural resource base, is highly vulnerable to climate change. Two-thirds of the total sown area of the country is drought-prone, with monsoon rains showing high inter-annual, intra-seasonal and spatial variability. About 40 million hectares of land is liable to floods, with 8 million hectares and 30 million people affected each year on average (NCDM and NDMD, 1999). In the pre-monsoon and post-monsoon seasons, the coastline, particularly the east coast, is vulnerable to tropical cyclones. Over the period 1971–2000, India was among the top four countries in terms of number of people killed in natural disasters (Brooks and Adger, 2003).

India’s first national communication on climate change impacts and measures, which was submitted to the United Nations Framework Convention on Climate Change (UNFCCC) in 2004, describes the potential impacts of climate change (Government of India, 2004). Climate projections indicate a marked increase in air temperature in the 21st century, which would become even more pronounced after the 2040s.1 Models predict little change in total monsoon rainfall for India as a whole, but project an overall decrease in the number of rainfall days and an increase in rainfall intensity over a major part of the country. Preliminary assessments reveal a general reduction in the quantity of precipitation, and increase in severity of droughts and intensity of floods in various parts of India. Sea-level rise and higher storm surges may adversely affect coastal ecosystems and structures, leading to losses of settlements, property, recreation beaches and tourism infrastructure. Extreme events such as droughts, floods and cyclones may become more frequent, leading to widespread damage to life, property, crops and livelihoods.

1.2. Natural disasters in India

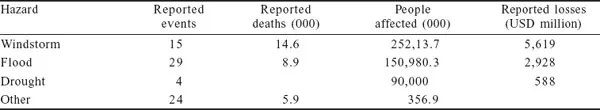

The potential impact of climate change on the Indian economy can be severe, given the country’s history of disaster losses (Table 1), which is compounded by the growth in population concentrations and burgeoning development in coastal and flood-prone areas.

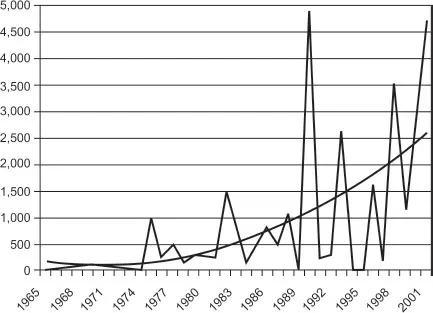

The World Bank estimates that direct annual economic losses from natural disasters, most of which are climate-related, amount to 2% of India’s GDP (Gurenko and Lester, 2003). It also observed a rising volatility in reported monetary losses from natural disasters (Figure 1).

These findings were driven home by the July 2005 floods in Mumbai, India’s commercial capital, caused by a record level of precipitation within 24 hours unprecedented in the country’s recorded weather history. The floods resulted in the record economic loss of $5,000 million of which insured loss was about $770 million or about 15% (Munich Re, 2006). While this unusually high percentage of insured losses compares favourably with the small insurance loss observed in the Gujarat earthquake, we must point out that in the case of the recent Mumbai floods most of the insurance payments went to large businesses rather than home-owners, as the level of insurance penetration for the industry is many times that of residential uptake.

In the case of natural disasters in India, typically attention has been focused on relief and reconstruction in the aftermath of a disaster rather than on prevention and preparedness. The affected state government manages relief work and reconstruction efforts with financial support from the central government through the Calamity Relief Fund (CRF), with additional assistance from the National Calamity Contingency Fund (NCCF) in the case of severe calamities. However, financial discipline is an issue, which is obvious from frequently inflated demands for post-disaster financial assistance from the state governments, late contributions from states to the CRF, and delays in transferring funds to the district level. Declaring districts drought-prone is a politically sensitive issue because of the implications for financial assistance, and the possibility of receiving various waivers and concessions (including food-for-work schemes and rescheduling of short-term agricultural loans). In addition, the World Bank has pointed out that the current approach lacks institutional incentives and underplays the role of risk financing through ex-ante mechanisms (such as catastrophe reinsurance and contingent credit facilities) that could provide financial liquidity in the aftermath of natural disasters and kick-start economic recovery (Gurenko and Lester, 2003).

Table 1. Disaster history by major climate hazard in India during 1996–2001

Source: Gurenko and Lester (2003).

Figure 1. Reported direct losses from natural disasters in India during 1965–2001 in nominal US$ million at then applying exchange rates. Direct losses refer to stock losses including destruction of public and private economic infrastructure, productive capital, and housing.

Source: Gurenko and Lester (2003), based on data from OFDA/CRED (2003).

2. Role of insurance in disaster loss financing in India

Despite the fact that India is the second most disaster-prone country in terms of the frequency of these events, the level of non-life insurance penetration is abysmally low, under 1%, even when compared to countries with a similar level of GDP. While insurance plays a major role in compensation for disaster-related losses in developed countries, accounting on average for over 40% of economic losses, it is only a minor source of disaster risk financing in India. Government by and large remains the main financier of disaster relief, rescue, rehabilitation and reconstruction efforts. However, in the aftermath of the Gujarat earthquake in 2001,2 the Indian psyche has shown a slight but discernible shift from a reactive to a more proactive management of disasters, in which insurance has an important role to play, as reflected in government policy and legislation such as that aimed at revisions in building codes for risk mitigation (MoHA, 2005). In the context of the increasing volatility of weather patterns due to climate change, insurance can smooth out the adverse financial consequences on households, businesses and the government. Insurance can also prove to be an important adaptation tool, which, over time, can help reduce India’s vulnerability to natural disasters.

2.1. Present status of the Indian insurance industry

Although the Indian insurance industry remains underdeveloped, as can be seen from the low levels of insurance penetration and insurance consumption per capita, it has shown signs of improvement since its partial deregulation in 1999 (Infrastructure Regulatory and Development Authority Act, 1999). Besides lifting the ban on private players and opening the industry to foreign players in a limited manner, the Act also established the IRDA to oversee and regulate the insurance industry and named the General Insurance Company (GIC) as the national reinsurer to which all the country’s direct insurers must cede 20% of their business. In the aftermath of these partial liberalization measures, insurance penetration has been on the rise, although it is still extremely low. In 2003, total insurance premium was US$9.9 billion, or 2.3% of GDP or US$16.40 per capita, and holds a very large growth potential (Table 2). Yet, the market for insurance, even after 4 years of liberalization, comprises only 29 companies, including one reinsurance company, as compared with 61 in China at the end of 2003. This may be taken as an indication of the inadequate competition in the Indian insurance sector in the light of the huge market potential. The current 26% restriction on foreign ownership in local insurance companies has limited the involvement of global insurance companies in the Indian insurance industry. It is hoped that recent talks on increasing the cap on FDI to 49% will attract more global players to invest in India and also encourage the growth of existing players by enhancing product innovation and service levels.

2.2. Coverage of natural perils in life, property and vehicle insurance

Except for personal accident policies, which cover accidents triggered by natural hazards, traditional insurance products do not cover property damages/loss or injury/death arising out of natural perils. Although both motor and property insurance provide the insured with an option of adding a natural-hazards coverage (which includes storm, tempest, flood and inundation) for an extra premium, most insurance buyers decline this extra coverage in an effort to reduce the premium.

2.3. Reasons for low insurance penetration

An underdeveloped insurance market makes it extremely difficult to diversify the risks arising out of large disasters, such as a tsunami, or a series of small disasters. The low insurance penetration in the country can be traced to a number of factors.

Table 2. Indian insurance industry: trends

| 2000 | 2003 |

Insurance penetration (% households) | 2.32% | 2.88 % |

Insurance consumption (USD per capita) | 9.90 | 16.40 |

World rankings in premium volumes | 23 | 19 |

Share in world market | 0.25% | 0.29% |

Source: Rao (2004).

On the demand side, the biggest hurdles are the very low income of the population and the common perception of insurance products. Insurance in India has been traditionally sold more as a savings instrument rather than a risk protection vehicle, with tax incentives offered on a life policy to the individual assessee. Coupled with this is a low awareness among the public about insurance products in general. As a result, personal risk management is usually reactive and, in case of catastrophes, episodic. The experience of major insurance companies shows that following a major catastrophe, there is a rush for insurance cover, particularly for life and assets such as property, motors, etc. But this interest is short-lived and in the majority of cases these policies are not renewed (Banerjee, 2001).3

Another major factor is that large sections of the Indian economy operate outside the formal economy – not just small businesses, but also housing (slums). All insurers are required to provide some coverage for the rural sector. In addition, each comp...