- 206 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Economic Growth, Efficiency and Inequality

About this book

This volume deals with a range of contemporary issues in Indian and other world economies, with a focus on economic theory and policy and their longstanding implications. It analyses and predicts the mechanisms that can come into play to determine the function of institutions and the impact of public policy.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Economic Growth, Efficiency and Inequality by Satish K. Jain,Anjan Mukherji in PDF and/or ePUB format, as well as other popular books in Economics & Development Economics. We have over one million books available in our catalogue for you to explore.

Information

CHAPTER 1

Intersectoral Disparities and Growth

Amitava Bose*

Development is associated with changes in the sectoral composition of output. Such changes are driven by disparities in sectoral rates of growth. The dynamics of growth disparities raise a number of analytical questions that can be dealt with in different ways using alternative frameworks. This essay is confined to a particular framework—the framework of dual economy models of development. The objective of the essay is to find out what these models have to say on intersectoral disparities in rates of growth. In particular, it engages with the following issues:

- What is the variable that holds the key to explaining the dynamics of growth disparities in dual economy models?

- Do sectoral growth rates converge over time or do disparities persist?

- A widely debated question in development economics is whether growth in the ‘advanced’ sector pulls up the ‘backward’ sector. If it does, growth is said to ‘trickle down’. Does the answer depend on whether growth rates converge over time or diverge?

The recent growth experience of the Indian economy has brought these questions to the fore. Two facts stand out. First, the composition of India’s gross domestic product (GDP) has changed significantly and continues to do so. In the course of the last two decades, the share of agriculture has fallen from around 35 per cent to almost 15 per cent, while the share of the services sector has gone up from around 40 per cent to 55 per cent. Second, news on the growth front has been both exciting and disappointing. The Indian economy has been registering high rates of GDP growth in recent years—India is one of the fastest-growing economies of the world—yet employment growth has been low, sometimes negative, especially of unskilled labour. Clearly, growth has not been ‘inclusive’. What structural features could be responsible for this? If the different sectors are interlinked, why do disparities persist?

Classical development models yield balanced growth in the long run (convergence), but they can be used to shed some light on intersectoral disparity as well (as part of transitional dynamics). Most macro-models of development are dual economy models characterized by dynamism in one part of the economy and stagnation in the other. The central question—whether dualism will persist or not—depends on the manner in which the two parts are linked to each other. Some linkages are related to resource flows, such as the flow of surplus unskilled labour from the stagnant part to the dynamic part. Other linkages belong to the product side—the flow of food from the rural to the urban sector and the flow of industrial goods in the reverse direction. While recognizing the existence of surplus unskilled labour, demand-side linkages on the product side are emphasized here.

Resources and goods are moved from one part of the economy to the other to take advantage of opportunities for exchange. An exchange equilibrium can be brought about in different ways. This essay focuses on models in which the equilibrating variable is the intersectoral terms of trade (or relative price) between goods of the agriculture sector and goods of the industry-cum-services sector.1

Examples of flexible price dual economy models abound in the literature. These models are brought under one umbrella here, using a reduced form model with a very spare frame. This reduced form model can be fitted up to yield either convergence (to the balanced growth equilibrium) or persistent disparity. In the second section, the model is used to generate convergence to balanced growth. There are several elaborate models that can be reduced to this convergent version of the reduced form model, characterized here as the Lewis—Ricardo model.2 On the other hand, the third section emphasizes various contrary possibilities that lead to perpetual uneven growth. In the fourth section, the basic model and its variants are used to comment on the issue of ‘trickle-down’ and its relation to the existence of perpetual disparity. The fifth section works out an example of a parametric form that covers all possibilities.

The exposition is heuristic and relies entirely on a pair of cross diagrams. We know of no existing model that fits the depiction of persistent growth disparity that is provided in the third and fourth sections, though the issue is of some contemporary relevance.3

Disparity and Convergence in the Benchmark L—R Model4

There are two sectors: (a) agriculture and (b) non-agriculture (including manufacturing and services).The relative price of agricultural products in terms of non-agricultural products is denoted as p. The two growth rates are x for agriculture and g for non-agriculture. There is one market for exchange of products. The focus will be on the supply and demand for the agricultural surplus. The supply is denoted X and the demand denoted D. The former is the net exports of agriculture and the latter the net imports of the non-agriculture sector.

Growth Gap

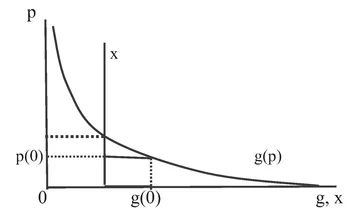

The analysis begins by isolating the variable responsible for differences between the growth rates of the two sectors. Here the variable is taken to be the terms of trade p. Two simple relations are postulated:

- 1. An increase in p reduces the growth rate g of the non-agriculture capital stock K. This postulate is expressed in terms of a function g = g(p) that yields a downward sloping curve.

- 2. The agricultural growth rate x is given: x =x̅. (This can be changed to x being an increasing function of p without affecting anything of significance.) Here x is the rate of growth of the marketable surplus (net exports) of the agricultural sector X.

FIGURE 1.1 Determination of Growth Rates

It follows that the growth gap [g–x] depends on p. The dependence can be characterized by referring to the ‘balanced growth terms of trade’ p̅ that equalizes the growth rates.5 The size of the gap is then related to the difference between p and p̅.

There is p̅ such that

Figure 1.1, showing sectoral growth rates as functions of p, is referred to as the Kaldor diagram. It is important to emphasize that Figure 1.1 is not about how the market clearing price p(t) is determined at a particular date t. Given p(t), Figure 1.1 tells us how sectoral growth rates and the size of the growth gap are determined at that t.

Figure 1.1 also helps identify the balanced growth point. But there is no presumption that p(t) = p̅. Moreover, nothing so far suggests that p(t) converges to p̅ and there is balanced growth g (p̅) = x̅in the long-run (that is, steady s...

Table of contents

- Cover

- Title

- Copyright

- Contents

- List of figures

- List of tables

- List of contributors

- Introduction

- 1 Intersectoral Disparities and Growth

- 2 Cycles and Crises in a Model of Debt-Financed Investment-Led Growth

- 3 Policy-Induced Changes in Income Distribution and Profit-Led Growth in a Developing Economy

- 4 A Simple Dynamic Bargaining Model

- 5 Increasing Returns, Non-traded Goods and Wage Inequality

- 6 Equality, Priority and Distributional Judgements

- 7 Contest under Interdependent Valuations

- 8 Auctions with Synergy

- 9 Negligence as Existence of a Cost-Justified Untaken Precaution and the Efficiency of Liability Rules

- 10 The 11-20 Money Request Game and the Level-k Model: Some Experimental Results