- 224 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Legal Aspects of Trade Finance

About this book

Trade finance is of great importance in the commercial world, for both students (undergraduate and postgraduate) and practitioners. The choice of countries in export trade is often perception-based: trade with government departments or public institutions is seen as much safer than with private entities and the choice of countries is often based on that perception of risk.

This book:

- addresses issues and topics which are relevant to all jurisdictions in the world

- explains the various types of trade finance, how they may be raised and the legal issues pertaining to them

Value for those wanting to understand the legal issues of sources of trade finance in both the developed and developing countries, this book will interest students studying the interaction between law and commerce.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Legal Aspects of Trade Finance by Charles Chatterjee in PDF and/or ePUB format, as well as other popular books in Derecho & Teoría y práctica del derecho. We have over one million books available in our catalogue for you to explore.

Information

CHAPTER 1

Methods of Payment in Export Trade

1.1 INTRODUCTION

Over the years the international commercial world has developed a variety of methods of payment in export trade. It is for the parties concerned to choose their method of payment bearing in mind the nature of the trade, the risks involved in particular method(s) of payment; foreign exchange regulations etc. Where a country is subject to rigid foreign exchange regulations, the seller (exporter) should ensure that the buyer (importer) does have the licence to import the goods against payment in the chosen hard currency. A prudent seller should consider this issue and discuss this matter with the importer. Often an exporter may come to the aid of an importer in importing goods by providing information and documents which might facilitate the importer’s obtaining the required foreign exchange licence from its Central Bank. Of course, in a Customs Union or a Political Union, such as the European Union, a trade within the European Economic Area is not subject to any hindrances, including hindrances that might be prevented by foreign exchange regulations. Although most of the EU Members still operate foreign exchange regulations (except Germany, the Netherlands and the United Kingdom) trade within the European Economic Area is not subject to any foreign exchange regulations. Prior to its negotiating any method of payment, an exporter in the case of initiating business with a new importer, should carry out a status enquiry by means of bank references and/or by studying its business track record. What applies to the European Economic Area does not apply to other similar areas, namely, Association of South East Asian Nations (ASEAN)1 or Andean Pact2. These latter economic arrangements usually apply Preferential Trading Arrangement (PTA) primarily in terms of import-export and absence of quantitative restrictions.

Foreign exchange issues do not usually hamper trade between rich countries however (that is, the countries which are not members of the European Union) and trade between the richer members of the European Union and other rich countries, namely, Australia, Canada, Japan and the United States.

It is interesting to note that payment by hard currencies still seems to be the most popular method of payment in export trade.

1.2 METHODS OF PAYMENT

The following methods of payment are common in import-export trade:

(a) Advance Payment

(b) Open Account

(c) Goods on Consignment

(d) Payment by Letters of Credit

(e) Deferred Payment

(f) Contratrade

(g) Buy back

(h) Switch Trading

(i) Offset

(j) Evidence Account

1.2.1 Advance Payment

Under this method, the importer is required to make payment, in advance, in a chosen currency, for the goods and services provided by the exporter. This method of payment is preferred by an exporter when it is not familiar with the business conduct or records of the importer, or when it has doubts about the financial stability and economic conditions of the country to which the importer belongs. Advance payment may also be chosen by an exporter when it is short of funds, so that with advance payment it can obtain or manufacture products for supply to the importer. “Payment” in this context usually includes the price of the goods, probably foreign and the cost of taking out an insurance policy.

There are certain foreseeable risks for the importer and the exporter which are associated with this method of payment. These are now explained in the following sub-sections:

1.2.2 Risks for the Exporter

If an exporter starts obtaining or manufacturing the product for the importer, prior to his receiving the advance payment, and the advance payment is not effected by the importer for whatever reason, the exporter will predictably sustain financial losses. It is to be emphasised however that if a country is subject to stringent foreign exchange regulations, any agreement to make advance payment by the importer may not materialise. Of course, an exporter may stipulate that if the advance payment is not effected by a certain date, the contract will come to an end. On the other hand, an exporter may stipulate that the advance payment must be made by a certain date in order to enable it to procure or manufacture the contract goods for shipment.

1.2.3 Risks for the Importer

In the event of the exporter being a rogue, the contract goods will not be manufactured, or shipped. Even if the exporter is an honest person, the importer may not be assured of delivery or shipment of goods on time. Thus, it would be advisable for an importer to obtain a performance guarantee from the exporter from a first class bank in the exporter’s country, otherwise, if the importer fails to supply the contract goods to its customers or sub-buyers, the importer will be involved in litigation for breach of contract.

In any event, advance payment may prove to be onerous for an importer particularly when the importer’s country operates a stringent foreign exchange policy.

1.2.4 Open Account

As the title suggests, under Open Account the account is left open for the importer at various times. This is a method under which the seller supplies goods to the importer without receiving any immediate payment of any form, cash, or letter of credit, but on the clear understanding that the importer will settle the account periodically or at the end of a specified period. An open account is usually used by a seller on the basis of the business relationship that it has developed with a particular importer. A high level of trust between the exporter and importer forms the basis for operating export trade on an “open account” basis. Obviously, this method of payment cannot usually be operated if the importer’s country is subject to stringent foreign exchange regulations. Whether by Customs Union or Free Trade Areas, such as the European Union or the North Atlantic Free Trade Area (NAFTA) payment by Open Account should not present much difficulty. As to the mechanism of payment, the exporter provides an invoice, and the importer pays periodically, and at the end of the accounting period, the invoice amount is settled, and if any surplus accrues it is rolled over to the next accounting period; similarly, if there is any deficit, the importer will be required to settle it.

The obvious advantages of this method of payment are: (i) it minimises administrative work; and (ii) it allows the importer and the exporter to do business speedily. However, this method of payment is not entirely risk-free, as for argument’s sake, if the importer fails to pay for any consignment for whatever reason, the exporter will suffer losses. One can only hope that the importer and the exporter will not be subject to any jeopardy under this method of payment.

1.2.5 Goods on Consignment

This method of payment requires an importer to make payment after the goods dispatched to him / it by the exporter have been sold. Under this method the exporter deals with the importer on the basis of “trust”. The importer agrees to pay for the goods as soon as they are sold or to return them to the exporter in the event of his / it being unable to sell them. This method of payment may be accepted by an exporter if the importer or its country is not subject to import restrictions or that he / it has been denied the privilege of having foreign exchange for the payment of the goods. This method should not be accepted by any exporter if it is not certain that the importer will not have any difficulty in making payment either because of import restrictions and / or because of restrictions as to remittances in foreign currencies. Of course, if payment is not made by an importer, it is important to ensure that the goods are returned to the exporter intact in their original condition. This should be a term of the contract in order to protect the interest of the exporter.

1.2.6 Payment by Letters of Credit

The basic features and the principal issues pertaining to the use of letters of credit as a method of making payment for export trade have already been explained in Chapter 4 of this work. In this section only the mechanics of using letters of credit are explained. Incidentally, the instrument is known as a letter of credit as it is a letter / confirmation by a bank (the Issuing Bank) acting on behalf of the buyer that credit will be allowed by it in order to enable the buyer to purchase the goods. This instrument is based on the commercial practice developed by the world of trade. The International Chamber of Commerce (ICC) developed rules governing letters of credit in the form of UCP, which are largely recognised by the banking world. These rules have also standardised the mechanism for the use of letters of credit through the participation of commercial banks. (For details of the new UCP 600 refer to the author’s book Law of International Business, Routledge, 2007.)

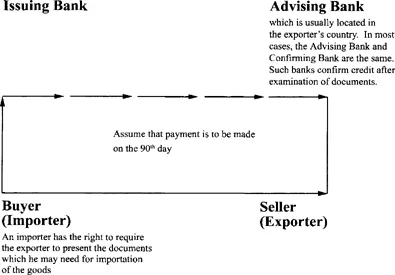

Under the letter of credit mechanism, the buyer (importer) requests a bank (which eventually becomes the Issuing Bank) to make payment in the chosen currency to or to the order of a third party (the beneficiary) or to accept and pay bills of exchange drawn by the beneficiary. Another bank may be authorised by the same bank to make such payment or to accept and pay such bills of exchange; or it may authorise another bank to negotiate the bill against stipulated document(s). The mechanism of the operation of letters of credit may be explained by means of a diagram.

An importer has the right to require the exporter to present the documents which he may need for importation of the goods The period fixed for payment is crucially important in that the exporter must submit all documents stipulated by the importer (usually, these documents are: a full set of clear on-board marine bills of lading marked “freight paid”; a commercial invoice in triplicate, a certificate of origin, an insurance policy or a certificate in duplicate covering marine and war risks; the importer may also require other, namely, inspection certificates). These documents must conform to the specifications given by the buyer, and it has been explained in Chapter 5 of...

Table of contents

- Cover

- Half Title

- Title Page

- Copyright Page

- Table of Contents

- List of Cases

- Introduction

- Chapter 1 Methods of Payment in Export Trade

- Chapter 2 Types of Bills

- Chapter 3 Types of Credit

- Chapter 4 Letters of Credit

- Chapter 5 Liabilities of Parties Involved in the Documentary Credit Mechanism

- Chapter 6 Legal Aspects of Short-term Finance for Exports

- Chapter 7 Bills of Exchange

- Chapter 8 ICC Uniform Rules for Collection1 These Rules have been published in ICC publication No. 522, 1995 Revision

- Chapter 9 Bonds and Guarantees

- Conclusions

- Table of Statutes

- Table of International Conventions

- Other Primary Sources

- Other Sources

- Index