eBook - ePub

The Case Approach to Financial Planning: Bridging the Gap between Theory and Practice, Fourth Edition (Revised)

John E. Grable, Ronald A Sages, Michelle E Kruger

This is a test

Share book

- 640 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

The Case Approach to Financial Planning: Bridging the Gap between Theory and Practice, Fourth Edition (Revised)

John E. Grable, Ronald A Sages, Michelle E Kruger

Book details

Book preview

Table of contents

Citations

About This Book

The Case Approach to Financial Planning: Bridging the Gap between Theory and Practice, Fourth Edition (Revised), fosters sound financial planning logic and decision-making using the CFP Board of Standards, Inc. newly-revised 7-step systematic financial planning process.

This textbook provides the tools and foundation for helping aspiring financial planners learn by doing. The material in this book provides students with real-world scenarios that can provide insights into the financial planning process as they put their financial planning skills to the test.

This title features:

- A content review of the major subject areas typically taught in a college-level financial planning curriculum

- A comprehensive review of important financial planning mathematical formulas and procedures

- A variety of 16 case studies, including an ethics review case

- Chapter-based case examples that illustrate how financial planning strategies can be used to develop client-specific recommendations

- End-of-chapter mini-cases with exercises that challenge students to apply chapter content

- Instructions on how to do calculations essential to creating a financial plan

New in the revised 4thEdition:

- Newly updated materials that reflect current financial planning trends

- Updated information regarding recent tax changes, including the SECURE Act

Topics Covered:

- Financial Planning

- Tax Planning

- Insurance Planning

- Estate Planning

- Assessing Client Risk Tolerance

- Client Communication

- Financial Planning Ethics

- And More! See the "Table of Contents" section for a full list of topics

Frequently asked questions

How do I cancel my subscription?

Can/how do I download books?

At the moment all of our mobile-responsive ePub books are available to download via the app. Most of our PDFs are also available to download and we're working on making the final remaining ones downloadable now. Learn more here.

What is the difference between the pricing plans?

Both plans give you full access to the library and all of Perlego’s features. The only differences are the price and subscription period: With the annual plan you’ll save around 30% compared to 12 months on the monthly plan.

What is Perlego?

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Do you support text-to-speech?

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Is The Case Approach to Financial Planning: Bridging the Gap between Theory and Practice, Fourth Edition (Revised) an online PDF/ePUB?

Yes, you can access The Case Approach to Financial Planning: Bridging the Gap between Theory and Practice, Fourth Edition (Revised) by John E. Grable, Ronald A Sages, Michelle E Kruger in PDF and/or ePUB format, as well as other popular books in Law & Antitrust. We have over one million books available in our catalogue for you to explore.

Chapter 1

The Financial Planning Process

Learning Objectives

•Learning Objective 1: Summarize and explain the steps of the financial planning process.

•Learning Objective 2: Describe how the financial planning process, as established by the Certified Financial Planner Board of Standards, Inc. (CFP Board), serves as a framework for guiding financial planners when working with clients.

•Learning Objective 3: Understand the role of case studies when preparing for financial planning certification.

CFP® Principal Knowledge Topics

•CFP Topic: A.1. CFP Board’s Code of Ethics and Professional Responsibility and Rules of Conduct.

•CFP Topic: A.2. CFP Board’s Financial Planning Practice Standards.

•CFP Topic: A.3. CFP Board’s Disciplinary Rules and Procedures.

•CFP Topic: A.7. Fiduciary.

•CFP Topic: B.8. Financial Planning Process.

•CFP Topic: B.14. Client and Planner Attitudes, Values, Biases, and Behavioral Finance.

Chapter Equations

There are no equations in this chapter.

THE CASE STUDY APPROACH

The profession of financial planning has expanded quickly since its inception in 1969. During the 1960s and 1970s, financial planning consisted of little more than a small consortium of financial service professionals interested in offering clients a value-added service, in addition to insurance and mutual fund products. Since its inception, financial planning has grown into a dynamic, growing, and respected profession.

The growth of financial planning, both as a recognized profession and as an important behavioral change force in the lives of individuals and families, has been remarkable. Starting with fewer than fifty Certified Financial Planner (CFP®) professionals in the early 1970s, the number of CFP® certificants has grown to more than eighty thousand today. Worldwide growth in financial planning, particularly among CFP® professionals, is even more stunning. As the profession has expanded in recent years, the number of students studying financial planning has also grown, which has prompted the need for tools students and aspiring financial planners can use to enhance their knowledge, skill set, and confidence. Thus, the purpose of this textbook.

This book has been designed to help students synthesize knowledge obtained in multiple classes into practical techniques that can be used to solve theoretical and practical financial planning case studies. The tools, techniques, and strategies presented here are intended to serve as a manual to help students and aspiring financial planners piece together divergent concepts into strategic recommendations. Before describing each element of the book, it is worthwhile to take a step back and review two important concepts. First, what exactly is meant by the phrase ‘financial planning’? And second, what is the relationship between financial planning and the process of financial planning?

FINANCIAL PLANNING DEFINED

Professional organizations and leading members of the financial planning community have defined financial planning in a variety of ways. The most recognized definition, offered by the Certified Financial Planner Board of Standards, Inc. (CFP Board), defines financial planning as a process. According to CFP Board,1 financial planning denotes:

“The collaborative process that helps maximize a client’s potential for meeting life goals through financial advice that integrates relevant elements of the client’s personal and financial circumstances.”2

Financial planning can be thought of as a humanistic science focused on helping individuals and families manage and improve their financial situation. The term humanistic, as used here, means that a financial planner focuses on individuals and families and the values, capabilities, and capacities clients bring with them when dealing with complex financial questions and issues. Financial planning is a science because financial planning professionals rely on critical thinking, data, and evidence-based practices, rather than generalized rules or dogmas, when formulating client-centered strategies.3

THE FINANCIAL PLANNING PROCESS

Traditionally, the practice of financial planning has followed what is generally referred to as the financial planning process. In its Standards of Professional Conduct, CFP Board describes the financial planning process as the following seven steps:

1.Understanding the client’s personal and financial circumstances

2.Identifying and selecting goals

3.Analyzing the client’s current course of action and potential alternative course(s) of action

4.Developing the financial planning recommendation(s)

5.Presenting the financial planning recommendation(s)

6.Implementing the financial planning recommendation(s)

7.Monitoring progress and updating

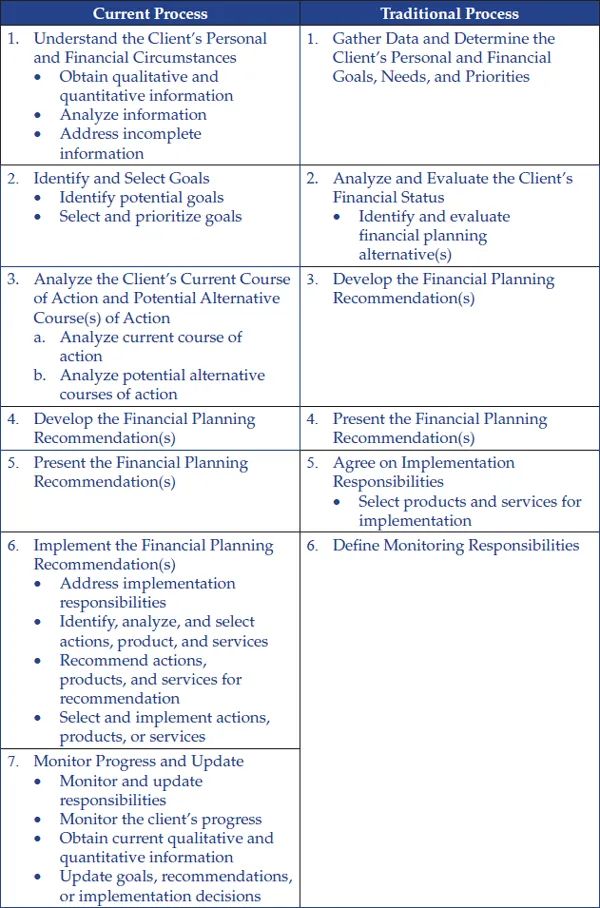

The financial planning process has been revised over the years. The current seven-step financial planning process represents the latest revision as of 2018. Prior to the revision, the process consisted of six steps. Figure 1.1 compares the current financial planning process with the way nearly all financial planners have traditionally conceptualized the process of financial planning.

Figure 1.1. The Current Financial Planning Process Compared to the Traditional Process

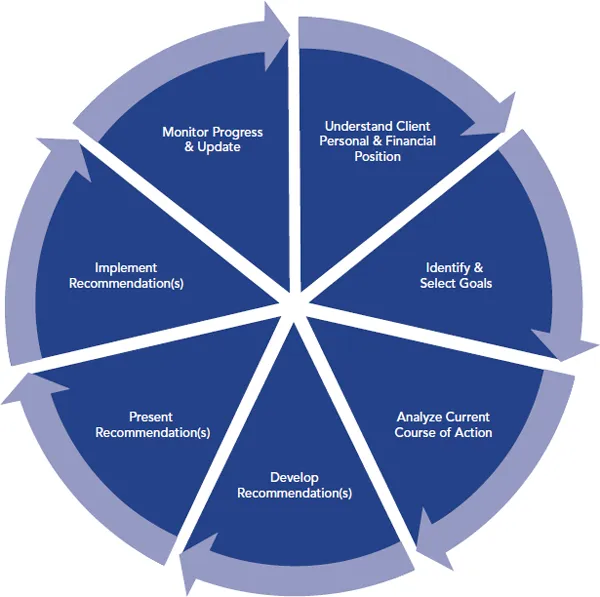

Figure 1.2 illustrates how the financial planning is circular in nature, with ongoing monitoring continually informing the type of information a financial planner must obtain to continually ensure that a client is moving toward goal achievement.

THE ROLE OF FINANCIAL PLANNERS

Figure 1.2. The Circular Nature of the Financial Planning Process

According to the Bureau of Labor Statistics,4 a financial planner is a professional who provides advice on investments, insurance, mortgages, college savings, estate planning, taxes, and retirement to help individuals manage their finances. Financial planners tend to look at a client’s financial situation holistically. Unlike a financial advisor who may provide advice and council on investment or insurance topics, or an accountant who may only prepare a client’s tax or perform auditing services, a financial planner, by definition, is generally tasked with evaluating a client’s overall financial situation and then using professional judgment to make integrated recommendations with the intent of improving a client’s financial situation. Subject areas typically reviewed by a financial planner include, but are not limited to, the following:

•Financial statement preparation and analysis (including cash flow and net worth management and budgeting)

•Insurance planning and risk management

•Employee benefits planning

•Investment planning

•Income tax planning

•Education planning

•Retirement planning

•Estate Planning

Essentially, a financial planner is expected to use the financial planning process to guide their client generally and specifically within—and across—each subject area.

Financial Planning Practice Standards and Ethics

Financial planning professionals who are CFP® certificants must also follow practice standards developed and promulgated by CFP Board. These standards are described CFP Board’s Standards of Professional Conduct—all of which have evolved within the profession to gu...