![]()

1 Opening Laos

The Nam Theun 2 hydropower project

Introduction

In early 2010, the Nam Theun 2 (NT2) project – the largest hydropower plant in Lao PDR – went into operation after a five-year construction period. Touted as a “world class project” according to Patchimuthu Ilangovan, the Country Manager of the World Bank in Laos, the Nam Theun 2 is expected to generate approximately US$2 billion in revenues through taxes, dividends, and royalties for the Lao government over a 25-year operating period. This constitutes about 7–9 percent of the country’s annual budget and will be a key resource that will finance the development programs of Laos, specifically its drive to reduce poverty.

As per update from the World Bank, the first revenue stream amounting to US$600,000 revenues from electricity sales to Thailand was already received by the Lao government in June 2010.1 An additional US$6.5 million was expected to bring in revenues in late 2010. To ensure that revenues are utilized to fund development programs, the World Bank assisted in the creation of the Poverty Reduction Fund, while the Asian Development Bank is working closely with the Lao government on streamlining reporting systems to ensure effective revenue management and accountability mechanisms.

Despite this early economic success, the NT2 hydroproject has not been without controversy. Since the idea of the project began in the early 90s, various groups sought to oppose the project on the basis of environmental and social concerns. The World Bank, one of the project’s major financiers, agreed to postpone the project while putting together a comprehensive package of compliance measures that consisted of (i) an Environmental Impact Assessment and mitigation measures to address environmental degradation, (ii) a Social Impact Assessment, addressing in particular the sensitive issues of relocation of affected communities and a corresponding compensation policy, and (iii) an extensive multi-stakeholder process that involved consultations among a diverse set of stakeholders including the communities who were directly affected by the project.

Further, the NT2’s massive financial requirements required private sector financing due to the limited financing capacity of international financial institutions. The result of extensive negotiations yielded a complex web of partnerships that involved the Government of Laos, the World Bank, the Asian Development Bank, and seven international private sector partners to provide technical and financial expertise. The Nam Theun 2 Power Company spearheaded by a French contractor was established as the implementing unit to oversee the construction, implementation, and eventual turn-over of the project after 25 years under a Build–Operate–Transfer agreement with the Lao government.

The energy sector in Laos: a brief background

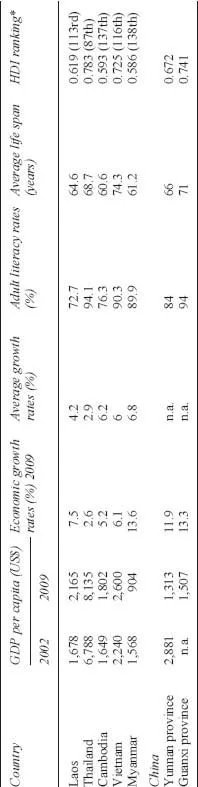

Energy development in Laos should be viewed within the wider context of national development. Laos is one of the poorest countries in Southeast Asia. Compared to its immediate neighbors, particularly Thailand, China, and Vietnam, it has certainly lagged behind in most development indicators (see Table 1.1). Deprived of natural resources unlike its bigger and wealthier neighbors, Laos regards the exploitation of its hydropower potential for energy exchange to Thailand and Vietnam as the strongest logic for national development. Its recent adoption of market reforms primarily through liberalization measures in the power sector and current legislation to allow foreign investment in the country provide the framework for a market-led development strategy.

Interestingly, Laos has enjoyed positive annual growth rates over a 15-year period, positive increases in GDP per capita incomes, and progress in HDI rankings. This is accounted for by electricity exports mostly to Thailand which contribute 30 percent of total export earnings, thus strengthening the argument for a development strategy anchored on the exploitation of the country’s hydropower potential. Also, the strategy is based on increased energy demand from Thailand. For the period 2000–2002, Thailand’s demand for energy grew annually at 20 percent, outpacing its GDP growth rate of 11.7 percent during the same period. The need to diversify Thailand’s energy sources and reduce its dependence on natural gas prompted both governments to enter into an energy exchange agreement over a long-term period.2

Energy development in Laos is still relatively at a very early stage. Only 41 percent of households in Laos are electrified and almost all the current energy use in the country is dominated by household consumption of traditional fuels, that is, mainly wood and charcoal. The government has committed itself to increasing electricity access to 90 percent of households by 2020, based primarily on grid extension and hydropower development.3

Thus, the government mandate to develop the energy sector for Laos is anchored on a twin set of requirements: (i) to provide for the domestic energy needs of Lao citizens away from traditional fuel consumption; and (ii) to tap the country’s energy potential through exploitation of the country’s hydropower resources. In turn, the lucrative sale of electricity to its neighbors will generate the necessary revenues to finance its development programs.

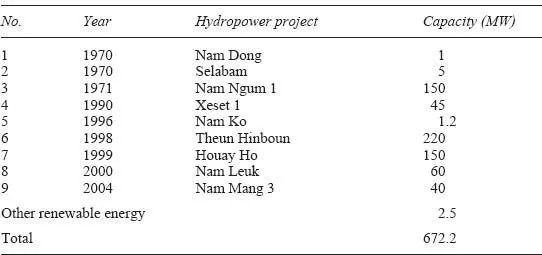

Hydropower development in Laos dates back to 1970 through the construction of the Nam Dong plant with an installed capacity of 1 MW (megawatt). This small hydroplant provided electricity to the town of Luangprabang in northern Laos. The same year, the Selabam plant in southern Laos was constructed with an installed capacity of 5 MW and supplied electricity to the town of Pakse in Champasak province. In 1971, following the successful completion of the Nam Dong and Selabam hydropower plants, the government undertook the construction of the first large hydropower plant, the Nam Ngum 1 with an installed capacity of 155 MW. The Nam Ngum 1 dam was originally constructed with two 15 MW generators in 1971. Two 40 MW generators were added in 1978 and the last 40 MW generator in 1984. It was from this project that the export of electricity to Thailand began. Over the past three decades, Laos embarked on a gradual build-up of hydropower development with a total capacity of 670 MW of energy. Other sources from renewable energy contributed about 2.5 MW (see Table 1.2).

Table 1.1 Selected development indicators: Greater Mekong countries, 2009

Source: compiled from UNDP HDR 2009 and the China Human Development Report 2007/2008 for data on Yunnan and Guanxi Provinces. Economic growth rates for Yunnan and Guanxi provinces were obtained from the National Bureau of Statistics in China 2006 and the China Daily Newspaper, online available at: www.chinadaily.com.cn/cndy/2009-06/10/content_8266027.htm (accessed 25 February 2010).

Note

* 182 countries measured.

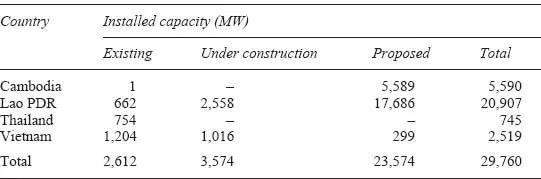

The hydropower potential of Laos is best appreciated in contrast to that of its neighbors. Table 1.3 shows hydropower capacity among the different Lower Mekong Basin (LMB) countries at various stages. Existing capacity of 2,612 MW is already in operation in the LMB, while projects with an additional 3,574 MW are provided by ongoing hydropower projects. All of these projects are located on the tributaries of the Mekong River. On the drawing board are projects that will scale up an additional capacity to 20,000 MW, with Laos contributing the lion’s share of 17,686 MW, approximately 75 percent of total capacity.

Table 1.2 Present electricity installation in Lao PDR

Source: Ministry of Energy and Mining of the Lao PDR (2008).

Table 1.3 Installed capacity of existing, under construction, and planned hydropower projects in the LMB

Source: “Mekong River Commission Initiative on Sustainable Hydropower Work Plan,” March 2009.

The history of the Nam Theun 2

According to the Nam Theun 2 Power Company (NTPC), the hydropower potential of the Nam Theun River was identified as early as 1927 in the French bulletin L’Eveil Économique de l’Indochine. However, preparations for the Nam Theun 2 project only began in earnest in the early 1980s when the Mekong Secretariat, the forerunner of the present-day Mekong River Commission, engaged the services of Motor Columbus, a Swiss engineering firm, to investigate the hydropower possibili...