![]()

Peter Kennedy and David Kennedy

School of Business for Society, Glasgow Caledonian University, Glasgow, Scotland

European football market finances appear to be in very good health and impervious to the current Euro-wide financial crises. Yet beneath the apparent financial buoyancy a different story emerges, one of fan exploitation, spiraling debt and the threat of bankruptcy hanging over many clubs. In this introduction to the special issue we chart what is effectively a political economy of debt underpinning the European football market and threatening to bring professional football in Europe into disrepute. Against this backdrop the paper considers the impact financial exuberance and systemic debt has had on fans’ identification with clubs. It is argued that whilst football fans have borne the social and economic costs of weak governance and lack of financial regulation, which have become the hallmark of European football, they have also shown themselves to be highly resistant to the commercialisation of football and innovative in their responses to this commercialisation.

Writing in his organisation’s Annual Review of Football Finance in June 2010, Dan Jones, partner in the Sports Business Group at Deloitte, commented:

European football’s continued revenue growth demonstrates an impressive resilience to the extremely challenging economic times – underlying the continued loyalty of its fans and the continued attractiveness of football to sponsors and broadcasters.1

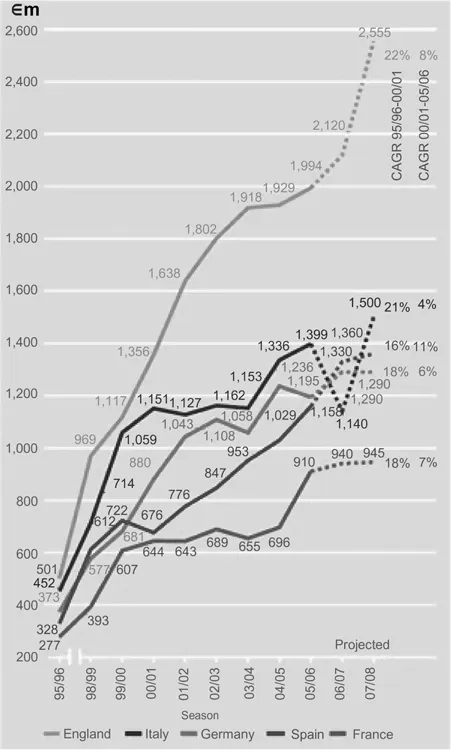

With economic performance in the European Union running at a negative-to-stagnant growth rate, the continued expansion of the European football market at 8% per annum meant that Jones’ boast was not without substance. The first decade of the twenty-first century has witnessed market growth from €8 billion per annum in revenue to almost €16 billion per annum, powered by the so-called ‘big five’ leagues in England, Germany, Spain, Italy and France (Figure 1).2 The English Premier League, Germany’s Bundesliga, Spain’s La Liga, Italy’s Serie A and the French Ligue 1 are five of the six most highly supported leagues in world football (only Mexico’s Primera Division is able to compete with Europe’s elite leagues). In terms of the whole of world sport, only the US National Football League and Indian cricket’s Premier League can boast higher average attendances than the best attended European foot-ball league, the Bundesliga.3 The big five together attracted almost €12 billion in television rights deals in their last round of negotiations with media groups. Their commercial revenue, boosted by corporate sponsorship, amounts to €2–3 billion annually,4 and Europe’s flagship tournament, the UEFA Champions League, is now confirmed as the ultimate competition in global club competition. With a worldwide audience of more than four billion viewers per season, the viewing figures for the Champions League final now surpass that of the NFL’s Superbowl. The European football governing body, UEFA, receives over €500 million in broadcasting and sponsorship deals for the Champions League.5

Figure 1. Revenue growth of the ‘big five’ European leagues – 1995/1996 to 2007/2008

Source: Deloitte Annual Review of Football Finance 2007.

While such headline figures point toward a sector in rude health, some commentators take the view that focusing on them is ‘akin to complementing a man in intensive care for having a full head of hair’.6 A more forensic examination of the state of European top-flight football reveals another, very different picture: one of debt, bankruptcy, a loss of competitive balance, and a barely concealed resentment of fan exploitation. The enormous riches pouring into European football may have produced an unrivalled spectacle of top-class players from around the globe producing football of the highest standard, played out in state-of-the-art stadiums, but this has been accompanied by instability in the game. Top-division clubs in Europe have run up bank debt and commercial loans of €5.5 billion; 32% of clubs are in negative net equity (that is, their debts are larger than their reported assets); costs consistently outstrip income; and competitive balance has been diminished both between leagues (88% of the all-important revenue generated from European-wide broadcasting goes to the big-five leagues) and within leagues (the four largest teams in each top European division have on average four times the income of their domestic opponents).7 Though the financial spoils resulting from success are immense, the cost of failing to achieve success – realistically the only outcome for the vast majority of clubs – can be catastrophic. As one commentator puts it:

… the face of European football is contorted by the strain experienced by clubs attempting to remain on a financial tightrope which is constantly being yanked by their competitors. It’s as simple as this. Clubs need to be successful if they are to prosper. But to be competitive they have to invest in player transfers and wages which, all too often, they are unable to afford. For all but the biggest clubs, every season represents a gamble. For those whose gambles do not pay off the result is relegation, reduced income and the prospect of severe financial difficulty. It’s a kind of financial Russian roulette.8

Casting an eye around the various European leagues hammers the point home. In the first decade of the twenty-first century unsustainable debts drove a number of clubs to financial ruin or the brink of it. Italian clubs AC Fiorentina (2002), AC Parma (2003) and SSC Napoli (2004) were declared bankrupt, later to re-emerge under slightly different identities after spells in the lower Italian leagues. In Holland, bankrupt HFC Haarlem had their 121-year existence terminated in 2010, and BV Veendam were declared bankrupt in the same year. The case of Alkmaar Zaanstreek (‘AZ’) underlines the seriousness of the situation in Holland: Eredivisie Champions in season 2008/2009, the club was being run by administrators by 2009 as a result of its main sponsor, DSB Bank, being declared bankrupt.9 The seriousness of financial woes in the Eredivisie prompted the Dutch Football Association, the KNVB, to seek a pledge from each participating Eredivisie club before the 2010/2011 season declaring that they had enough cash to reach the end of the season. In Spain, clubs in La Liga are saddled with enormous levels of debt. Between them, Barcelona and Real Madrid have debts totalling almost €1 billion (a level of debt anchored by the two clubs’ ability to generate enormous commercial deals), while Valencia CF’s debt is more than €600 million and Atlético Madrid has debts in excess of €300m. Traditionally, Spanish clubs’ debts have been underwritten by the local state or by regional banks. When Sporting Gijón went into administration their ‘brand image’ was bought by the municipal authority in order to rescue the club. As one Sporting Gijon insider put it: ‘The council could not let us disappear; Gijón without Sporting is not Gijón.’10 However, this is a system coming under increasing pressure as the global recession continues to bite. More recently, RC Celta Vigo filed for voluntary insolvency, and Real Sociedad and Levante have also gone into administration. Unable to find a backer to take on its debts, RCD Mallorca went into voluntary administration in 2010, and the Spanish FA have threatened RC Deportivo La Coruña with demotion from La Liga because of their financial conduct. The English Premier League generates both the greatest amount of revenue in European football and its greatest levels of debt. The total debts of its member clubs stood at just under €4 billion in 2010, anchored by huge television broadcasting deals and the fact that – unlike in most other European leagues – clubs own their own stadiums and are able to borrow against this asset. This has not, however, prevented high-profile cases of financial failure when clubs have taken on unsustainable levels of debt in their attempt to fulfil competitive ambitions: Leeds United FC – Champions League semi-finalists in 2001 – went into voluntary administration in 2007; West Ham United FC narrowly avoided bankruptcy in 2009 when their holding company, Hansa Holdings, went into administration; and most recently Portsmouth FC filed for administration after running up €160 million in debt. The problem of debt is not confined to the continent’s premier leagues. Further down the pyramid, lower league clubs, attempting to make the breakthrough into more financially lucrative divisions, are equally susceptible to insolvency. In the summer of 2010, for example, 20 Italian clubs from Serie B, Prima Divisione and Seconda Divisione were declared bankrupt and prevented from competing in their respective divisions.11

The loosely regulated path that football has taken has brought with it socioeconomic consequences for football fandom. The massive expansion in football finances is driven, directly and indirectly, by the commercial exploitation of a ‘brand loyalty’ that generates money from fan allegiance to football clubs nurtured over generations. The emphasis is upon the consumption of football, through expertly targeted merchandising that exploits communal identity and the adoption of an exorbitant pricing policy for watching football, both in terms of matchday tickets and of pay-per-view broadcasting. And, of course, through such participation fans help to create the spectacle that attracts commercial sponsorship. Fan allegiance is seen as elastic. If existing stadia cannot churn out the required revenue, supporters can be shunted to new locations and new stadia which can improve the club’s finances; if a club is not considered to be viable from a commercial perspective, it can be merged with local rivals. Even in the teeth of an economic recession fan identity is a rich seam that revenue-hungry clubs are eager to mine. For instance, the traditional moderately priced ticket to watch matches in the German Bundesliga – a reasonably well regulated league in comparison with others across Europe – has come under threat from successive price hikes and the introduction of premium-game surcharges. German supporter groups fear a situation will develop in which young and lower-income fans will be squeezed out of match attendance and a process of ‘gentrifica-tion’ of German football, similar to the process witnessed in the English Premier League in the past years, will be set in motion.12

As the commercial ethic penetrates further into the game, a sense that the social value of football is beginning to be ground down by financial imperatives has caused alarm. UEFA’s president, Michel Platini, has spoken of an

explosion of sectoral and corporate interests at both league and club levels in all team sports that are played professionally. These initiatives, which often attract enormous media coverage, are designed to benefit one element, particularly if it is powerful and rich, rather than the masses. Attempts are made to reduce a discipline into a show, to demean a sport in order to convert it into a product. It is becoming more important to make a profit than to win trophies.13

An institutional response to this ‘reductionism’ – with the European Union and UEFA at the vanguard – has been forthcoming. In 2005, under the auspices of the United Kingdom’s presidency of the European Union, sports ministers from Britain, France, Germany, Italy and Spain set up a working group to provide the European Union with a sports model which enshrines in European law the principles contained in the Nice Declaration (2000), which underlines ‘the social, educational and cultural functions inherent in sport’. For their part, the sports ministers concentrated attention on the issue of fair competition and, with respect to this, on professional football; this was reflected in the addition to the steering group of Sepp Blatter, the general secretary of world football’s governing body, FIFA, and Lennart Johansson, then chief executive of European football’s governing body, UEFA. The outcome of that meeting was the setting in motion of an Independent European Sport Review (IESR), which the ministers commissioned Portugal’s former deputy prime minister, José Luis Arnaut, to carry out. In May 2006 Arnuat produced his report, The Independent European Sports Review (IESR). Arnuat concluded:

Sports in general and football in particular are not in good health. Only the direct involvement of political leaders, working together with the football authorities, can put it back on the road to recovery… there is a real risk that the ownership of football clubs will pass into the wrong hands, the true values of the sport will be eroded, and the public will become increasingly disaffected with the ‘beautiful game’.14

He presented a series of recommendations aimed at curbing and controlling the commercial excesses that have been viewed as bringing professional football in Europe into disrepute. Arnaut recommended a fit and proper persons test for all potential owners of football clubs – principally as a means to deter the use of European clubs as money-laundering operations. He also suggested the need for a salary cap for players as an important step toward securing a competitive balance between clubs. The Report also called for the issue of player-trafficking to be addressed, with Arnaut in favour of stricter controls on the licensing of football agents. A more even distribution of wealth generated by the game was also a key element of the report. To this end it was argued that ‘central marketing’ of the game (that is, national leagues collectively bargaining with TV companies over the sale of image rights to televise matches) is the most suitable vehicle through which to begin to bridge the gap in income between top clubs and others. The ultimate objective...