eBook - ePub

Fixed or Flexible? Getting the Exchange Rate Right in the 1990s

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Fixed or Flexible? Getting the Exchange Rate Right in the 1990s

About this book

NONE

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Fixed or Flexible? Getting the Exchange Rate Right in the 1990s by Jahangir Aziz, and Francesco Caramazza in PDF and/or ePUB format. We have over one million books available in our catalogue for you to explore.

Information

Publisher

INTERNATIONAL MONETARY FUNDYear

1998eBook ISBN

9781455220038Summary

Until recently, most evidence suggested that developing countries with pegged exchange rates enjoyed relatively lower and more stable rates of inflation. In recent years, however, many developing countries have moved toward flexible exchange rate arrangements—at the same time as inflation has come down generally across the developing world. Indeed, the average inflation rate for countries with flexible exchange rates has fallen steadily— to where it is no longer significantly different from that of countries with fixed rates. The perceived need for greater flexibility has probably resulted from the increasing globalization of financial markets—which has integrated developing economies more closely into the global financial system. This in turn imposes an often strict discipline on their macroeconomic policies.

Trade-offs exist between fixed and more flexible regimes. If economic policy is based on the “anchor” of a currency peg, monetary policy must be subordinated to the needs of maintaining the peg. As a result the burden of adjustment to shocks falls largely on fiscal policy (government spending and tax policies). For a peg to last, it must be credible. In practice, this often means that fiscal policy must be flexible enough to respond to shocks. Under a more flexible arrangement, monetary policy may be more independent but inflation can be somewhat higher and more variable.

Considerations affecting the choice of regime may change over time. When inflation is very high, a pegged exchange rate may be the key to a successful short-run stabilization program. Later, perhaps in response to surging capital inflows and the risk of overheating, more flexibility is likely to be required to help relieve pressures and to signal the possible need for adjustments to contain an external imbalance. To move toward full capital account convertibility, especially in a world of volatile capital flows, flexibility may become inescapable.

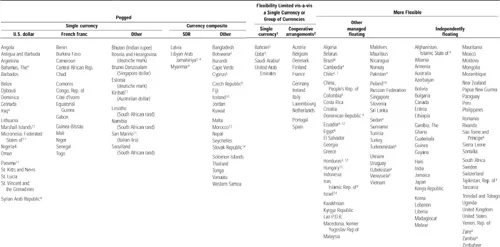

Exchange Rate Arrangements as of December 31, 1997

1 In all countries listed in this column, the U.S. dollar was the currency against which exchange rates showed limited flexibility.

2 This category consists of countries participating in the exchange rate mechanism (ERM) of the European Monetary System (EMS). In each case, the exchange rate is maintained within a margin of ±15 percent around the bilateral central rates against other participating currencies, with the exception of Germany and the Netherlands, in which case the exchange rate is maintained within a margin of ±2.25 percent.

3 The exchange rate is maintained within margins of ±47 percent.

4 Member maintained exchange arrangement involving more than one market. The arrangement shown is that maintained in the major market. For Zaire, note that the official name was changed to Democratic Republic of the Congo on May 17, 1997.

5 Exchange rates are determined on the basis of a fixed relationship to the SDR, within margins of up to ±7.25 percent. However, because of the maintenance of a relatively stable relationship with the U.S. dollar, these margins are not always observed.

6 The ex...

Table of contents

- Cover Page

- Title Page

- Copyright Page

- Fixed or Flexible? Getting the Exchange Rate Right in the 1990s

- Analysts agree that “getting the exchange rate right”

- From Fixed to Flexible

- Macroeconomic Performance Under Different Regimes

- Choosing a Regime

- Challenges Posed by Fast Growth and Capital Inflows

- Capital Account Convertibility

- Summary

- The Economic Issues Series