eBook - ePub

Negative Euro Area Interest Rates and Spillovers on Western Balkan Central Bank Policies and Instruments

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Negative Euro Area Interest Rates and Spillovers on Western Balkan Central Bank Policies and Instruments

About this book

NONE

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

At the moment all of our mobile-responsive ePub books are available to download via the app. Most of our PDFs are also available to download and we're working on making the final remaining ones downloadable now. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Negative Euro Area Interest Rates and Spillovers on Western Balkan Central Bank Policies and Instruments by International Monetary Fund in PDF and/or ePUB format. We have over one million books available in our catalogue for you to explore.

Information

Publisher

INTERNATIONAL MONETARY FUNDYear

2017eBook ISBN

9789928445391Fifth Session: Negative Euro Area Interest Rates and Monetary Policy in the Proximity of the Euro Area

Introductory Remarks On Panel “negative Euro Area Interest Rates and Monetary Policy in the Proximity of the Euro Area”

After a very interesting first day of the conference, I am honored to start the second day and introduce a panel of highly distinguished central banks’ senior policymakers and economists.

Yesterday we focused on the repercussions of negative euro area policy rates on financial stability and reserve management of the countries in the region and beyond. Today’s focus is on monetary policy. In the first session, we will hear the experience of the ECB itself and from a few countries in the euro area proximity that also braced with the spillover from the euro area and had to make recourse to a different set of standard and non-standard monetary policy tools.

We start with a keynote address from Ryan Banjeree, Senior Economist in the Monetary and Economic Department at BIS and formerly Senior Economist at the Bank of England. I think most of you may have come across Ryan’s research papers, which span a wide array of topics. Inter alia, he has published papers on the effects of unconventional monetary policy and monetary policy spillovers. I think Ryan’s keynote speech will ideally set the scene for the entire day since he will provide a broad but very insightful overview of the consequences of negative euro area policy rates on the conduct of monetary policy in the proximity of the euro area.

We will then have four panelists. Ulrich Bindseil, Director General of the ECB’s Directorate General Market Operations, architect of the ECB monetary policy implementation framework, and leading contributor to the design of the recent ECB monetary policy actions during the crisis, will give us unique insight into the rationale of accommodating ECB monetary policy, and ECB’s own experience and current outlook.

We have then Thomas Moser from Swiss National Bank (SNB). Thomas is Alternate Member of the Governing Board of SNB, with experience at the IMF as Executive Director of the IMF constituency in Washington headed by Switzerland. We will hear from Thomas the SNB’s unique experience. Bracing with safe haven currency inflows from the euro area during the sovereign bond crisis, SNB first lowered the interest rate to zero and announced a floor to the CHF/EUR exchange rate to prevent a destabilizing exchange rate appreciation. Later on, it reconsidered the lower policy rate bound, abandoned the floor, and lowered interest rates where nobody had dared before. At the same time, via the tiered remuneration of reserves it shielded at least in part banks from a negative profitability impact. I am looking forward to hearing from Thomas also because he will touch upon several themes from the time varying lower bound, the combination of standard and non-standard tools, and the use of tools to mitigate some of the negative consequences of negative interest rates, thereby lowering the effective lower bound, which will be the focus of my presentation later on.

We have then Dana Hajkova, Advisor to the Bank Board of Czech National Bank,(CNB), and Daniel Felcser, of Magyar Nemzeti Bank (MNB). The Czech Republic and Hungary are two countries in the EU proximity in Central and Eastern Europe that have also coped with the consequences of low euro area interest rates but, interestingly, have taken different approaches. Czech National Bank lowered policy rates practically to zero and then reverted to non-standard monetary policy tools in the form of a koruna/euro exchange rate floor, which they successfully defended and recently decided to discontinue as an additional instrument for easing the monetary conditions. By taking this step, the CNB returned to the conventional monetary policy regime, in which interest rates are the main policy instrument. MNB also returned to a mix of standard and non-standard tools, but was likely driven by a context in which vulnerabilities to exchange rate movements were higher due to the high share of FX loans and some impairment in the bank lending channel due to the consequences of past NPLs, implemented non-standard monetary policy prevalently via the funding for growth scheme.

Therefore a very interesting panel, with different countries reacting to the same context in different manners, with different considerations on the effective lower policy rate bound, and the most appropriate non-standard tools to provide additional accommodation at the lower bound.

Monetary Policy in the Proximity of the Euro Area: What Changes with Negative Euro Area Rates?

The title of my presentation is not very catchy. Catchy titles should fit on one line. I think my research papers tend to have un-catchy titles, which is probably why I am in central banking and not politics. But I think it conveys what I want to say. Has something changed with negative euro area rates? Are the spillovers that we see in countries around the euro area the same as before or are they different? I’ll try to highlight what I consider to be normal spillovers. I will then discuss some channels through which one may experience deviations from normal spillovers with negative rates based on some of my research. In my remarks, I am going to try to address three points, that were raised by Governor Sejko in his opening address.

The first is the effect of the change in relative yields across countries due to negative euro area interest rates. The second point I’d like to discuss is how low inflation in the euro area may be spilling over to other countries in the region. The third point is the effect of negative interest rates on capital flows, especially given the high concentration of euro area banks in the region.

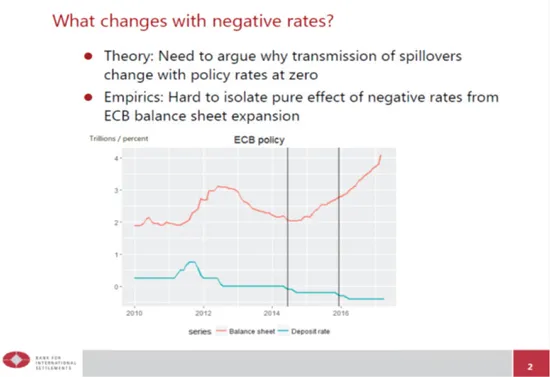

With that, I am going to start with this slide (Figure 1), which shows the ECB policy actions since 2010. If we want to understand what has changed with negative euro area rates, from a theoretical perspective, we need to argue why the transmission of spillovers changes with negative interest rates. A potential mechanism runs through the effective lower bound on nominal interest rates. There is also an empirical challenge. In the figure above, the blue line shows the ECB deposit rate, the red line shows the size of the ECB balance sheet, and the two black vertical lines pick out the two points when ECB interest rates were decreased first into negative territory and then cut again. What you see is that it is pretty hard to empirically isolate the pure effect of negative rates from ECB balance sheet expansion. So, I am not going to do that here. However, I will try to illustrate how spillovers may change with negative interest rates.

Figure 1. What changes with negative rates?

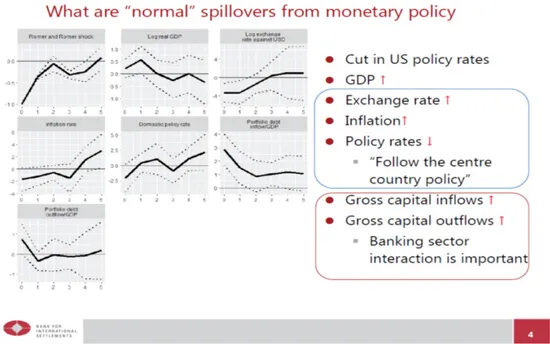

I am going to base part of my talk on a paper I have written with Mick Devereux from the University of British Colombia and my colleague Giovanni Lombardo, mentioned in Figure 2. As you see, another paper with a not very catchy title, but basically what we do in this paper is to first establish some empirical facts about monetary policy spillovers. In this case, we looked at US monetary policy spillovers to emerging economies, principally in Asia or Latin America. We then explain these facts by adding certain types of financial frictions to a standard two-country Dynamic Stochastic General Equilibrium (DSGE) model. In our model there are two frictions that seem to be important in explaining how US interest rate changes affect emerging economies.

Figure 2. Normal spillovers from monetary policy

First, there is something that we call a double banking friction. That is, the banks in the center country, for example, the euro area, face a collateral constraint. When interest rates are cut, this raises the net worth of the banks, which in turn raises not only their domestic lending, but also cross-border lending to banks in emerging economies for example, Southeastern Europe. The second aspect of this spillover is that many emerging economies have foreign currency debt, and so movements in the exchange rate caused by interest rate changes affects the relative value of assets and liabilities, which amplifies the cross-border lending spillover.

In our model, we show that with these frictions there is little advantage from following an inflation targeting rule over a fixed exchange rate rule. So, it is interesting given the talks we heard yesterday that although countries in the region have quite different monetary arrangements: some have floating exchange rates, such as Serbia or Albania, others have currency boards – Bosnia – and some are completely euroized, the outcomes do not seem so different. This may be partly due to the effect of these financial frictions, so that there is little to be gained from one monetary arrangement over the other, at least in terms of short-term macroeconomic stabilization and spillovers.

Let me turn to characterizing normal spillovers from monetary policy. In Figure 2 above, we estimate the effect of a cut in US policy rates using narrative monetary policy shocks from Romer and Romer before interest rates hit the effective lower bound. Overall, a reduction in US policy rates generates an expansion in emerging economies. But where is this coming from?

First, the exchange rate in the emerging economy appreciates. Associated with the appreciation is a fall in the inflation rate of the emerging economy, potentially driven by the exchange rate appreciation. There is also an emerging economy policy response. When the US cuts the policy rate, other countries also cut rates and so they seem to follow the policy of the center country. That is the first block on the right there, where following the center country policy seems to be the standard response.

The second par...

Table of contents

- Cover Page

- Title Page

- Copyright Page

- Contents

- INTRODUCTION

- CONFERENCE AGENDA

- WELCOME ADDRESSES

- FIRST SESSION: NEGATIVE EURO AREA INTEREST RATES AND FINANCIAL STABILITY: A FIRST LOOK BEYOND THE WESTERN BALKANS AND GENERAL TRENDS

- SECOND SESSION: NEGATIVE EURO AREA INTEREST RATES AND FINANCIAL STABILITY IN WESTERN BALKAN ECONOMIES

- THIRD SESSION: NEGATIVE EURO AREA INTEREST RATES AND RESERVE MANAGEMENT

- FOURTH SESSION: NEGATIVE EURO AREA INTEREST RATES AND RESERVE MANAGEMENT (CONTINUED)

- FIFTH SESSION: NEGATIVE EURO AREA INTEREST RATES AND MONETARY POLICY IN THE PROXIMITY OF THE EURO AREA

- SIXTH SESSION: NEGATIVE EURO AREA INTEREST RATES AND MONETARY POLICY IN THE WESTERN BALKANS

- CONCLUDING REMARKS

- SPEAKERS’ BIOS

- Footnotes