eBook - ePub

Caribbean Renewal : Tackling Fiscal and Debt Challenges

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Caribbean Renewal : Tackling Fiscal and Debt Challenges

About this book

NONE

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Caribbean Renewal : Tackling Fiscal and Debt Challenges by Charles Amo Yartey, and Therese Turner-Jones in PDF and/or ePUB format. We have over one million books available in our catalogue for you to explore.

Information

Publisher

INTERNATIONAL MONETARY FUNDYear

2014eBook ISBN

9781484369142Chapter 1. Fiscal Consolidation and Debt Reduction in the Caribbean: An Overview

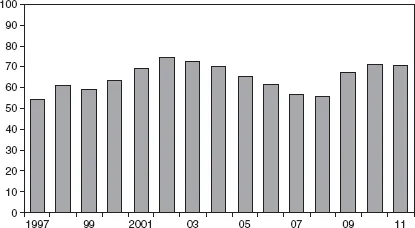

Caribbean economies face high and rising debt-to-GDP ratios that jeopardize prospects for medium-term debt sustainability and growth. In 2011, the region’s overall public sector debt was estimated at about 70 percent of regional GDP (Figure 1.1). Interest payments on the existing debt stock in the most highly indebted countries with rising debt ratios are already in the range of 16 percent to 42 percent of total revenues. In addition, high amortization exposes some countries to considerable roll-over risk that could trigger a fiscal crisis.

Figure 1.1 The Caribbean: Total Government Debt, 1997–2011

(weighted average; percent of GDP)

Source: Author’s calculations.

Structural fiscal problems have resulted in a sizable accumulation of debt. Between 1997 and 2004, the average debt-to-GDP ratio in the region increased from 54 percent to 84 percent, driven mainly by deteriorating primary balances. Successive years of fiscal deficit, public enterprise borrowing, and off-balance-sheet spending, including financial sector bailouts, all contributed to high debt levels. Prior to the onset of the global crisis, moderate growth rates helped some countries to broadly stabilize and reduce their debt ratios, albeit at high levels.

The global financial crisis worsened the already high debt burdens in the Caribbean. The crisis and the subsequent slow recovery in advanced countries had a significant adverse effect on the Caribbean, undermining growth in the largely tourism-dependent economies and exposing balance sheet vulnerabilities built up over many years. These vulnerabilities originated from a strategy of increasing public spending to counteract declining trade performance, partly due to the erosion of trade preferences, and rebuilding costs after frequent natural disasters. As a result, the ratio of public debt to GDP increased by about 15 percentage points between 2008 and 2010 in tourism-dependent economies. By contrast, Caribbean commodity exporters rebounded rapidly after the crisis, buoyed by high commodity prices, and their debt ratios have stabilized at relatively low levels.

Past attempts at tackling high debt in the region have not yielded lasting gains. Several countries have made attempts at reducing debt, mainly through ad hoc restructuring or fiscal consolidation. Since most countries have not adopted comprehensive economic reforms to complement these adjustment efforts, the initial gains have not been sustained. Further, because of their middle-income status, the majority of the region’s nations have not been able to benefit from international debt relief. Moreover, only a few Caribbean countries still qualify for concessional borrowing at the World Bank. At the same time, their small size and geographical location makes them highly vulnerable to a host of frequent shocks, against which it is costly to insure. As a result, Caribbean economies have had a silent debt crisis for the past two decades, contributing to a high debt–low growth trap.

This book examines the challenges of fiscal consolidation and debt reduction in the Caribbean. It looks at the problem of high debt in the region, examines the reasons for this debt, and discusses policy options for improving debt sustainability, including fiscal consolidation. The book examines empirically the factors underlying global large debt reduction episodes to draw important policy lessons for the Caribbean. It also reviews the literature on successful fiscal consolidation experiences and provides an overview of past and current consolidation efforts in the Caribbean region.

More specifically, the book attempts to address the following questions:

- What are the impacts of the global financial crisis on fiscal performance and debt levels in the Caribbean?

- How large are fiscal multipliers in the region?

- Has there been fiscal consolidation?

- What policies are the region’s countries currently pursuing to reduce debt?

- What are the challenges to fiscal consolidation?

- Is there an optimal level of debt for the region?

- What is the impact of fiscal consolidation on the current account in the region?

- What lessons can these countries draw from successful fiscal consolidation and large debt reduction experiences around the world?

- What is the impact of fiscal policy rules on fiscal performance in the region?

- Is fiscal consolidation enough to significantly reduce the debt levels? What other policy options may be available?

In an environment where the level of public debt remains high, reducing public debt is crucial to reduce vulnerabilities. How then can the Caribbean countries lower their debt-to-GDP ratio? What factors explain the success of public debt reduction, and why are some countries able to reduce public debt to prudent levels faster than others? To answer these questions, this book analyzes past global large debt reduction episodes in order to yield relevant policy lessons for the Caribbean. The analyses show that major debt reductions are mainly driven by decisive and lasting fiscal consolidation efforts focused on reducing government expenditure. In addition, robust real GDP growth increases the likelihood of a major debt reduction because it helps countries grow their way out of indebtedness.

Since growth in the current environment is virtually nonexistent, significant fiscal consolidation is inevitable. Based on a survey of country experiences, fiscal consolidation based on expenditure reductions tends to be more effective than tax-based consolidations. However, for countries with large adjustment needs, fiscal consolidation may need to be a balanced combination of spending cuts and revenue increases (Baldacci, Gupta, Mulas-Granados, 2010). Given the already sizable public sector in Caribbean countries, most of the fiscal consolidation would have to be done by restraining spending while implementing measures to boost revenues. Fiscal consolidation needs to be complemented by a comprehensive strategy to reduce public debt, including tax policy reforms, improvements in the efficiency of government spending, containment of contingent liabilities, rationalization of the public sector, active debt management and debt restructuring, and growth-enhancing structural reforms.

The Social, Economic, and Political Context

This section briefly discusses the social, economic, and political setting of the Caribbean to identify the main constraints to macroeconomic policy making in the region. Knowledge of the setting within which macroeconomic policies will take place is essential in order to design and implement successful fiscal consolidation and debt reduction strategies.

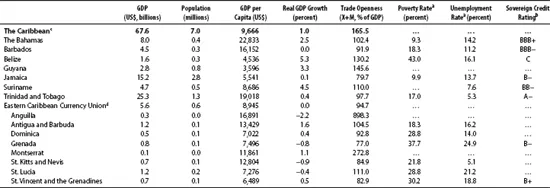

The Caribbean enjoys a relatively high GDP per capita, well-developed social indicators, and a long history of political stability (see Table 1.1). The region performs relatively well on most social development indicators, even though unemployment and poverty levels are rising. Life expectancy, for instance, averages more than 75 years, higher than the average for middle-income countries. Significant progress has been made in reaching the objectives of the millennium development goals. Primary school enrollment is close to 100 percent, and the average tuberculosis detection rate has increased to close to 99 percent in the Eastern Caribbean Currency Union (ECCU). Additionally, the proportion of seats held by women in national parliaments in the Caribbean has increased significantly (Jack and Wendell, 2013).

Table 1.1 The Caribbean: Selected Social and Economic Indicators, 2012

Sources: Bloomberg, L.P.; Caribbean Development Bank Country Poverty Assessments; IMF, World Economic Outlook database; International Labour Organization; World Bank, World Development Indicators; and authors’ calculations.

a Latest available data.

b Median ratings published by Moody’s, Standard and Poor’s, and Fitch Ratings.

c The Caribbean includes The Bahamas, Barbados, Belize, Guyana, Jamaica, Suriname, Trinidad and Tobago, and the Eastern Caribbean Currency Union (ECCU). GDP and population are sums of individual countries. Real GDP growth and trade openness are simple averages.

d ECCU includes Anguilla, Antigua and Barbuda, Dominica, Grenada, Montserrat, St. Kitts and Nevis, St. Lucia, and St. Vincent and the Grenadines.

Despite this progress, poverty levels and unemployment, which are likely to have been exacerbated by the global financial crisis, remain stubbornly high. Country poverty assessment studies conducted by the Caribbean Development Bank show that the collapse of the sugar and banana industries has worsened poverty levels in rural communities even though the levels are not as high as in some urban communities (Jack and Wendell, 2013). Labor force survey data are limited in the Caribbean, but anecdotal evidence suggests that the unemployment rates increased during the global financial crisis.

Policy decision making in most Caribbean countries is guided by social partnership arrangements, under which the government, the private sector, and labor unions meet to discuss and agree on policies of national concern. As a result, the implementation of macroeconomic programs needs the support of all the major stakeholders in the economy. There are also other elements of the social fabric of the Caribbean that could help improve economic performance. Generally, greater social homogeneity and cohesion in a country lead to greater flexibility and decision-making efficiency and greater openness to change, resulting in greater gains for the country as a whole (Streeten, 1993). For instance, greater social homogeneity should enable adjustment to shocks to be more promptly handled because the shifting of adjustment onto other social groups is less feasible (Alesina and Drazen, 1991).

On the economic front, domestic markets in the Caribbean are small, so the level of domestic demand lies below the minimum efficient scale of output (Armstrong and others, 1993). Due to their small size, these countries are usually disadvantageous as locations for extensive industrial activities, especially those that could substantially raise growth. The small domestic market is less conducive for the development of indigenous technologies, limiting the growth of research and development, technical progress, and technology acquisition. In addition, a small domestic market does not allow competitive firms to emerge within the Caribbean because of the limited number of participants involved in any economic activity. As a result, prices of goods are generally higher in the Caribbean than in other regions (Armstrong and others, 1993). The relatively small population tends to make labor very scarce in the Caribbean. As a result, output in the region is usually enhanced through the accumulation of human or physical capital rather than through employment (Bhaduri, Mukherji, and Sengupta, 1982). The small size of domestic markets and the scarcity of labor tend to narrow the structure of domestic output, making these countries dependent on a small number of activities and hampering the potential to implement import substitution industrialization strategies. This leaves them exposed to exogenous shocks.

Exports and export markets are also narrow, due in part to the narrowness of their domestic production structures. The need for specialization tends to limit export-oriented domestic output to just a few products. Tourism and financial services are the main service sectors, normally complemented by an uncompetitive agricultural sector. Offshore financial services have become an important sector in the Caribbean due to their strategic location and enabling local laws. Highly liberalized financial systems based on lax regulatory standards or strong supervisory frameworks have been a major attraction in the emergence of the Caribbean as an offshore financial center. The export specialization of Caribbean countries renders them vulnerable to external shocks, and this vulnerability is worsened by the fact that reliance is on export markets in just a few countries (Armstrong and others, 1998).

The Caribbean continues to gain from its proximity to the U.S. market and historical ties to the United Kingdom in the areas of tourism and financial services. At the same time, this trade openness and these strong ties imply that global economic crises are easily transmitted to the Caribbean. The importance of tradable goods to these economies necessitates their pursuit of highly open trading regimes. Consequently, import barriers are less important in the Caribbean than in other regions (Selwyn, 1975). There is a substantial asymmetry between domestic production patterns and consumption in the Caribbean, making the proportion of imports in domestic consumption very high. This feature has led some resear...

Table of contents

- Cover Page

- Title Page

- Copyright Page

- Contents

- Acronyms

- Foreword

- Acknowledgments

- About the Authors

- 1 | Fiscal Consolidation and Debt Reduction in the Caribbean: An Overview

- 2 | Fiscal Performance in the Caribbean Before and After the Global Financial Crisis

- 3 | Public Debt Profile and Public Debt Management in the Caribbean

- 4 | Global Large Debt Reduction: Lessons for the Caribbean

- 5 | Fiscal Consolidation: Country Experiences and Lessons from the Empirical Literature

- 6 | Fiscal Sustainability and Public Debt Limits in the Caribbean: An Illustrative Analysis

- 7 | Fiscal Consolidation in the Caribbean: Past and Current Experiences

- 8 | Fiscal Multipliers in the Caribbean

- 9 | Selected Debt Restructuring Experiences in the Caribbean

- 10 | Fiscal Policy and the Current Account in Microstates

- 11 | Fiscal Policy Rules and Fiscal Performance: Evidence from Microstates

- 12 | Fiscal and Debt Sustainability in the Caribbean: A New Agenda

- Index

- Footnotes