eBook - ePub

Collapse and Revival : Understanding Global Recessions and Recoveries

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Collapse and Revival : Understanding Global Recessions and Recoveries

About this book

NONE

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Collapse and Revival : Understanding Global Recessions and Recoveries by Ayhan Kose, and Marco Terrones in PDF and/or ePUB format. We have over one million books available in our catalogue for you to explore.

Information

Publisher

INTERNATIONAL MONETARY FUNDYear

2015eBook ISBN

9781513570020CHAPTER 1

Overview

The beginning of a long nightmare…

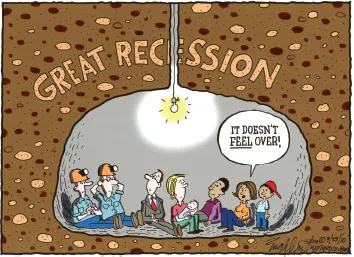

Recessions are devastating events that can wreak havoc on people’s lives and cause lingering damage to national economies. The world is still recovering from the most recent global recession—dubbed the Great Recession because of its scale and reach—and the possibility of another downturn persists as the world economy struggles to regain lost ground.

The 2008 bankruptcy of Lehman Brothers, one of the largest U.S. investment banks, sparked turmoil in the world economy and financial system, and the resulting global recession had dire and extreme consequences. What began as loan defaults in the U.S. subprime mortgage market spiraled into a series of events that cut through the international financial system, leading to corporate defaults, slashed stock values, and diminished household wealth. The downturn put millions of people out of work and triggered a huge rise in the debt of nations.

The effects are still with us. Despite tentative signs of a pickup in 2010–11, stimulated by aggressive central bank interventions, the world has since been battered by a series of setbacks that have slowed the recovery. In 2012, the euro area financial crisis frustrated hopes for a rapid rebound. After the turbulence in Europe appeared to be under control, the recovery continued to lag behind expectations in 2014, despite a pickup in growth in advanced economies, as emerging market and developing country economies slowed.

The Turning Point: The collapse of Lehman Brothers was a critical turning point during the last global financial crisis.

In early 2015, signs of durable growth in the United States stirred optimism about global growth prospects, but significant risks continue to cloud the outlook. The impending normalization of monetary policies in advanced economies poses challenges for the developing world. The fragility of growth in the euro area and Japan causes concern. A synchronized and protracted slowdown in emerging market economies is troubling. Daily headlines bring fresh reminders of worrisome geopolitical risks.

Thus, the possibility of another global recession lingers in light of the persistently weak recovery, even though damage from the previous one has yet to be fully repaired. Economists generally expect economies to bounce back to trend growth after a recession; this time, the pace and strength of the recovery have repeatedly disappointed. Add to that the side effect of continued increases in income inequality, particularly in some advanced economies, where the wealthiest have moved ahead while the fortunes of the middle classes have stagnated since the recession.

…that we don’t fully understand

What is increasingly clear is that we do not fully understand what causes global recessions and what drives global recoveries. Moreover, despite ubiquitous discussion in the media and in policy circles about recessions on a national and global scale, there are, surprisingly, no commonly accepted definitions of global recession and global recovery.

This book attempts to define the terms “global recession” and “global recovery” and to delve into their causes and consequences. We document their main features and describe the events that take place around these episodes. In light of our findings, we put the latest global recession and ongoing recovery in perspective. In addition, we analyze the interactions between global and national business cycles.

What is a global recession? A recession can be called global when there is a contraction in world real output per capita accompanied by a broad, synchronized decline in various other measures of global economic activity. This has happened four times over the past half century: in 1975, 1982, 1991, and 2009. Although each episode had its own unique features, there are many similarities.

What is a global recession?

The world economy also experienced two periods—in 1998 and 2001—when growth slowed significantly without tipping into outright recession. The four global recessions and two slowdowns we identify during 1960–2014 together imply that the world economy comes to the verge of a recession or a near-stall every nine years, with a 7 percent chance of a global recession in any given year.

A global recession corresponds to a contraction in world real output per capita accompanied by a broad, synchronized decline in various other measures of global economic activity.

What is a global recovery? A recovery can be defined as global when there is a broad rebound in worldwide activity one to three years following a global recession. Historically, the world economy has been able to return to its prerecession level of output within a year after a recession.

What is a global recovery?

What happens during global recessions and recoveries? During a global recession, the average annual decline in world output per capita is about 0.7 percent—roughly 3 percentage points lower than the global average rate of growth. In addition, a wide range of macroeconomic and financial variables decline across the board during global recessions. Global recoveries are characterized by a synchronized pickup in worldwide consumption, investment, and trade. The average growth of world output per capita is 2.3 percent during a global recovery. Credit and asset prices fluctuate sharply around the occurrence of global recessions and recoveries.

A global recovery is a broad rebound in worldwide activity in one to three years following a global recession.

What is unique about the latest recession and subsequent recovery? The 2009 episode was the most severe of the four global recessions of the past half century and the only one during which world output contracted outright—truly deserving of the “Great Recession” label. The recovery, on the other hand, has played out along significantly different trajectories for advanced versus emerging market economies. For advanced economies, it has been the weakest recovery among the four episodes; for emerging market economies—at least until 2014—it has been the strongest.

What explains the depth of the 2009 global recession and the weakness of the recovery in advanced economies? Four principal factors appear to be at work: the highly synchronized nature of the recession, the severity of financial disruption preceding the recession, unusually high levels of macroeconomic and policy uncertainty during the recovery, and the divergent paths of fiscal and monetary policies and the unevenness of their relative effectiveness after 2010. While each of these factors has played a special role, their unfortunate coincidence appears to have led to an unusually damaging episode.

The 2009 global recession was the most synchronized of the four episodes, with almost all advanced economies and a large number of emerging market and developing economies simultaneously experiencing recessions. This is important because historical evidence suggests that highly synchronized recessions tend to be deeper and longer. Moreover, recoveries that follow synchronized recessions are often slower.

Former U.K. Prime Minister Gordon Brown recalls the aftermath of the Lehman Brothers failure.

The recent global recession also coincided with the most severe financial crisis since the Great Depression. Recessions accompanied by serious financial market turmoil often lead to larger contractions in output and last longer than other downturns. Recoveries following such recessions tend to be weaker and more protracted. For advanced economies, the 2009 global recession was a textbook example of these effects.

Furthermore, macroeconomic and policy uncertainty have remained unusually high during the latest recovery. This has contributed to the dismal performance of labor markets—in the form of persistently high unemployment and flat wages—and stagnant investment growth in advanced economies. Indeed, evidence suggests that periods of elevated uncertainty coincide with lower growth. Recessions accompanied by high uncertainty are often deeper, and recoveries coinciding with excessive macroeconomic and policy uncertainty are generally weaker.

In addition, fiscal and monetary policies in advanced economies appear to play a major role in explaining the dynamics of recession and recovery. Sizable and internationally coordinated fiscal and monetary stimulus programs were instrumental in supporting aggregate demand during the worst of the global financial crisis in 2008–09. However, market pressures and political constraints forced some advanced economies to withdraw fiscal support in 2010 and others to actively pursue fiscal austerity. Some, notably the United States, also introduced extraordinarily loose monetary policies to boost demand and reduce unemployment.

The cutoff of fiscal stimulus made the paths of government spending in these economies quite different than during past recoveries, when fiscal policy was decisively expansionary. Monetary policy has stayed highly accommodative since 2008, but its effectiveness has been hampered by the zero lower bound in interest rates and the severity of the disruption to financial markets. The divergence between fiscal and monetary policies during the recent recovery has become increasingly pronounced and has led to a difference in the effectiveness of policies as well, reflected by divergent growth paths among recovering economies. Notably, growth in the United States—where monetary policy was aggressively loose—began to improve in 2014, whereas growth has remained weak in Europe, where the central bank was more cautious and policymakers in many countries stayed committed to fiscal austerity for an extended period.

How does global growth interact with domestic growth during global recessions and recoveries? In a highly integrated world economy, national business cycles have become more tightly linked to the global business cycle. The link is even stronger during global recessions. Worldwide downturns tend to have a larger impact on advanced economies than on developing economies. Moreover, countries are often more sensitive to the global cycle the more integrated they are into the global economy.

“Collapse and Revival”

The title of our book aims to describe the evolution of global activity during periods of global recession and recovery. In each of the four global recession episodes we examine, the average world citizen’s income declined. Moreover, these episodes led to enormous and long-lasting human and social costs—millions of people lost their jobs, their homes, or both; businesses closed; financial markets plunged; and income inequality widened. In other words, the world economy experienced a period of collapse during each global recession, stoking fears of economic apocalypse. After each global recession, however, the world economy was able to go through a period of revival.

Collapse and revival are unavoidable features of the global business cycle.

Accepting the endurance of the global cycle

Despite persistent declarations to the contrary, history shows that the global business cycle is alive and well. Therein lies the simple message of our book: collapses and revivals are regular features of the global business cycle. Any prediction that there will be no “next” collapse should thus be met with extreme caution. At the same time, we must be ambitious in our search for better policy prescriptions to mitigate the massive costs associated with collapses while seeking ways to accelerate revivals.

PART I

Setting the Stage

CHAPTER 2

Global Cycles: Toward a Better Understanding

The U.S. baseball season culminates in a championship called the World Series, reflecting a time when the United States was the world when it came to baseball. Likewise, in the 1960s, a recession in the United States could just as well have been called a global recession. The United States accounted for a large share of world output, and cyclical activity in much of the rest of the world was dependent on U.S. ...

Table of contents

- Cover

- Contents

- Title

- Copyright

- Acknowledgments

- About the Authors

- Introduction

- Icons Used in This Book

- 1 Overview

- PART I: SETTING THE STAGE

- PART II: LEARNING ABOUT THE FOUR EPISODES

- PART III: THE GREAT RECESSION UNDER A MICROSCOPE

- PART IV: LIVING WITH THE GLOBAL CYCLE

- Notes

- Appendices

- Bibliography

- Credits

- Index

- Advance Praise for Collapse and Revival